If you’re searching for the best SWP for monthly income in India, 2026 has brought many top-performing options that can help you earn a steady payout without fully touching your capital. A Systematic Withdrawal Plan (SWP) lets you withdraw a fixed amount at regular intervals, while the rest of your money stays invested and continues to grow.

Many investors also use an SWP calculator to estimate their monthly income, but the key is to choose the top-performing SWP mutual funds in India that have shown consistent returns. In this article, we’ll explain how SWPs work, their benefits, risks, and share the best SWP mutual funds for 2026 to help you make smarter investment decisions.

SWP in mutual funds means Systematic Withdrawal Plan, where investors withdraw a fixed amount at regular intervals—monthly, quarterly, or annually—from their mutual fund investment. It helps create a regular income without liquidating the full investment, making it ideal for retirees and passive income seekers.

A Systematic Withdrawal Plan is designed for those who want a steady cash flow while keeping their money invested in the market. Instead of redeeming the full corpus, investors sell a few units periodically, ensuring that the remaining amount continues to grow. Unlike a lump sum withdrawal (where you redeem all at once) or a Systematic Investment Plan (SIP) (where you invest small amounts regularly), SWP works in reverse by providing structured payouts.

For example, let’s say you invest ₹50 lakh in one of India’s best SWP mutual funds with an average annual return of 15%. If you set a plan to withdraw ₹50,000 every month, you’ll receive a total of ₹90,00,000 over a period of 15 years. Despite these regular withdrawals, thanks to the power of compounding and market growth, your remaining investment would still be worth approximately ₹1,02,23,882 at the end of 15 years.

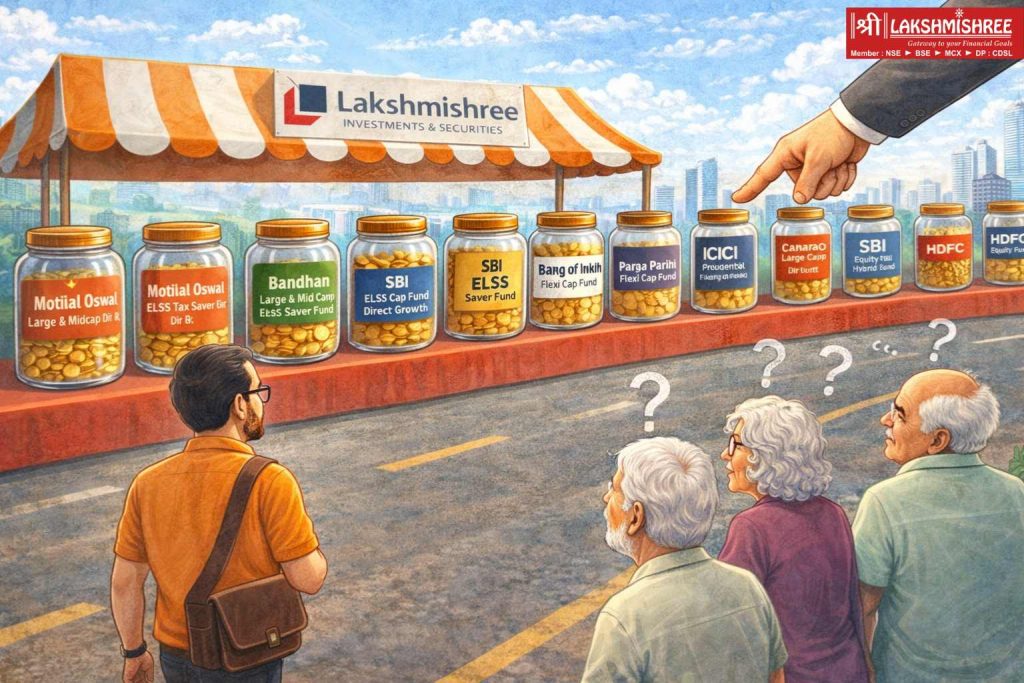

When choosing the Top SWP mutual fund in India, it’s important to consider funds with a history of delivering consistent returns over time. Below, we’ve compiled a list of top-performing mutual funds that are ideal for setting up a withdrawal plan based on their fund type and 3-year returns.

| 10 Best SWP Plans in India 2026 | Fund Type | 3-Year Returns (%) |

|---|---|---|

| 1. Motilal Oswal Large & Midcap Dir Gr | Large & Midcap | 97.6 |

| 2. Motilal Oswal ELSS Tax Saver Dir Gr | ELSS | 91.6 |

| 3. Bandhan Large & Mid Cap Fund Direct Growth | Large & Midcap | 90.5 |

| 4. SBI ELSS Tax Saver Fund Direct Growth | ELSS | 90.5 |

| 5. Bank of India Flexi Cap Fund | Flexi Cap | 82.0 |

| 6. Parag Parikh Flexi Cap Fund | Flexi Cap | 81.8 |

| 7. ICICI Prudential Large Cap Fund Direct Growth | Bluechip Equity | 66.6 |

| 8. Canara Robeco Large Cap Fund Direct Growth | Bluechip Equity | 59.5 |

| 9. SBI Equity Hybrid Fund | Hybrid Equity | 52.6 |

| 10. HDFC Hybrid Equity Fund | Hybrid Equity | 41.0 |

Don't rely solely on equity. Learn how a simple 70-30 Gold-Silver split could have saved portfolios during the Jan '26 market dip.

View 10-Year Wealth Matrix →In this section, we’ll walk you through the 10 Best SWP mutual funds in India that investors can consider for a reliable source of income. We'll give detailed information for each fund, such as expense ratios, market caps, NAV and returns.

Motilal Oswal Large & Midcap Fund invests in both large-cap and mid-cap stocks. This dual approach gives the fund stability of large-cap stocks and growth of mid-cap stocks. A good option for SWP investors looking for a balance between risk and return.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 0.9 | 97.6 | 180.2 |

Note: Based on Absolute Return

Motilal Oswal ELSS Tax Saver Fund offers wealth creation and tax savings under Section 80C. This ELSS invests in high-quality stocks across sectors, a good option for long-term investors.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 0.9 | 91.6 | 152.3 |

Note: Based on Absolute ReturnNote: Based on Absolute Return

The Bandhan Core Equity Fund aims for steady growth through a diversified portfolio that invests across large-cap, mid-cap, and small-cap companies. Its flexible investment strategy allows it to adapt to changing market conditions, making it suitable for SWP investors who prioritize consistent performance over the long term.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 8.9 | 90.5 | 169.0 |

Note: Based on Absolute Return

SBI Long Term Equity Fund is a tax-saving ELSS with a focus on long-term wealth creation. With 3-year lock-in, it invests in high-quality stocks with strong fundamentals. A good option for investors looking to combine long-term growth with SWP.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 7.8 | 90.6 | 158.0 |

Note: Based on Absolute Return

Bank of India Flexi Cap Fund offers flexible investment strategies, allowing exposure to large, mid, and small-cap stocks. It is an all-weather option that provides good potential for capital appreciation along with regular SWP income.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 1.6 | 82.0 | 163.0 |

Note: Based on Absolute Return

Parag Parikh Flexi Cap Fund is a flexible mutual fund that invests across market caps and international equities. This diversification ensures that it balances risk and return, making it an excellent choice for SWP mutual fund investors seeking long-term growth.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 9.1 | 81.8 | 147.6 |

Note: Based on Absolute Return

ICICI Prudential Bluechip Fund is a large-cap fund with a good performance record. It invests in blue-chip companies with strong financials and consistent performance. So, it’s a low-risk option for SWP investors who want stability and regular income over growth.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 11.2 | 66.6 | 121.5 |

Note: Based on Absolute Return

Canara Robeco Bluechip Equity Fund invests in high-quality large cap stocks. The portfolio is designed to give stability with moderate growth and is a popular choice for conservative investors. The fund’s diversified portfolio and risk-averse strategy make it a good option for SWP investors who want consistent payouts without too much volatility.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 8.0 | 59.5 | 98.7 |

Note: Based on Absolute Return

One of India's most popular hybrid funds, SBI Equity Hybrid Fund invests in a mix of equity and debt. This balanced approach gives growth potential and income stability. This fund gives regular payouts for systematic withdrawal plan investors and minimises the risk associated with market volatility.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 13.0 | 52.6 | 87.6 |

Note: Based on Absolute Return

This hybrid fund provides a mix of equity and debt exposure. It is designed to give investors a balance of growth and steady income, making it an ideal fund for those looking for regular SWP withdrawals while benefiting from market growth.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 6.3 | 41.0 | 91.2 |

Note: Based on Absolute Return

When choosing a Plan, understanding India's top and best-performing SWP mutual funds in the last 10 years can give investors valuable insight into long-term reliability and returns. These funds have consistently demonstrated strong performance, making them ideal choices for investors

| Top 5 SWP Mutual Funds (Monthly) | Fund Type | 10-Year Returns (%) |

| 1. Parag Parikh Flexi Cap Fund | Flexi Cap | 464.00% |

| 2. ICICI Pru Bluechip Dir Gr | Bluechip Equity | 352.00% |

| 3. Canara Robeco Large Cap Fund | Bluechip Equity | 304.00% |

| 5. SBI Equity Hybrid Fund | Hybrid Fund | 246.00% |

| 4. UTI NIFTY 50 Index Mutual Fund | Index Fund | 233.00% |

Data as of 19/10/2026

Whether you’re planning for retirement or managing recurring expenses, here are the key benefits of Whether you’re planning for retirement or managing recurring expenses, SWP mutual funds in India provide multiple advantages:

While SWP is a tool for withdrawal, it is often confused with SIP, which is a tool for investment. To understand which phase you are in, read our detailed comparison on:

SIP vs SWP: Which Is Better for You?

While SWP mutual funds offer steady income, it’s crucial to understand the potential risks. Knowing these SWP investment risks helps you plan better and choose the best SWP plan for long-term stability.

Before diving into a SWP mutual fund, it's important to consider several factors to ensure your investment aligns with your financial goals and risk tolerance. Here are a few key points to keep in mind:

Systematic withdrawal plan (SWP) mutual funds are ideal for investors seeking a reliable income stream while keeping their capital invested. Here's who can benefit most:

In short, systematic withdrawal plan mutual funds are for anyone who wants to withdraw regularly from their investments and still focus on long term capital appreciation.for anyone who wants to withdraw regularly from their investments and still focus on long term capital appreciation.

Eager to get started? Investing in the top SWP mutual funds is straightforward. Here’s how:

Choosing the best SWP mutual fund involves evaluating performance, cost, and stability. Here's what you should consider when selecting a systematic withdrawal plan:

If you are searching for the best SWP mutual funds for monthly income in India (2026), options like Parag Parikh Flexi Cap, ICICI Prudential Bluechip, and SBI Equity Hybrid Fund stand out for their long-term consistency and reliable payouts. By using an SWP calculator, investors can estimate monthly withdrawals and plan better for retirement or recurring expenses. Remember, the right SWP plan balances steady income with capital growth, making it more tax-efficient than traditional options like FDs.

The best SWP mutual funds include HDFC Hybrid Equity Fund, ICICI Prudential Bluechip Fund, and SBI Equity Hybrid Fund. However, it depends on your financial goals and risk appetite.

SWP stands for Systematic Withdrawal Plan, which allows investors to withdraw a fixed amount from their mutual fund investments at regular intervals, providing a steady income while the rest of the investment continues to grow.

Withdrawals from SWP mutual funds are treated as capital gains. Short-term gains (under 12 months) are taxed at 20%, while long-term gains (over 12 months) are taxed at 12.5%. Debt funds have different tax rules, so consulting with a tax advisor is important.

While you can start an SWP immediately, letting your investment grow for a few years is often recommended before beginning withdrawals. This allows your capital to appreciate, making the plan more tax-efficient and potentially preserving your principal longer.

Yes, SWP is an excellent option for retirees seeking a steady income stream. Retirees can ensure regular payouts by choosing top-performing SWP mutual funds while still growing their investments over time.

Capital erosion can occur if your withdrawal amount is higher than the fund's growth rate. Over time, this can reduce your investment's value, especially if market performance is poor. Choosing funds with strong long-term performance and managing withdrawal rates carefully can help mitigate this risk.

Disclaimer: This article is for educational purposes only and should not be considered financial advice. Always conduct your research and consider consulting with a financial advisor before making any investment decisions.