Mutual Funds are the companies that attract a pool of money from the investors and further invest their part of the money in diversified stocks. When you purchase a mutual fund, each share represents an investor’s part of ownership in the fund. Additionally, Mutual Fund is a company where it invests in the combined holdings, a few named assets, stocks, or bor bonds, which is further known as a portfolio of every individual. Many mutual funds fall into four categories - money market funds, stock funds, target-date funds, bond funds. The major advantage that an investor can benefit post choosing to invest in mutual funds is that he/she has a professional investment manager to handle the investments. Plus, they get to invest in a diversified portfolio which automatically decreases the risk too.

Shree MF is an online web app based mutual funds platform which allow users to open their account easily with paperless signup process with insightful research and goal tracker which will make your investment journey easy!

Lakshmishree Investments & Securities Ltd (LISL) is one of the quickest growing Stock Broking companies in India. Further, providing you with the appropriate guidance in this exciting world of the Stock Market, LISL ensures to aid you with the ideal trading solutions. With the decades of our existence and the membership with BSE, NSE, MCX, and Depository Participant with CDSL, Lakshmishree Investment & Securities Ltd is on the urge of providing people with the Stock Trading services throughout Pan India by encouraging and facilitating every Indian to decide for their Investment structure and educating them to self-trade. Subsequently, having the in-house core Research team who dedicatedly works to assist our clients to guide them to invest in the selected stocks based on their risk and returns, LISL renders quality research outcomes to different classes of clients as per their preferences and requirements.

Now booking your IPO is no more a hassle for you. With the times going more digitalized, you can now book IPO through the online process.

LISL has permitted access to quality companies from PSU that can help you with better investment opportunities.

With the commitment-driven team of dealers, you get to access the stocks at the lowest possible price for your better investments.

We do not charge any brokerage fees from the public while applying for the new IPOs hitting the market. Therefore, you can give a try to your investments.

To ensure safety and keep continue to earn your interest on the application money, here at LISL you are covered under the ASBA Process that eliminates the hassle of blocked funds.

If you are a short-term investor and seek to book your profit at the lowest risk, still you have a list of those stocks displayed on LISL's digital platforms.

With the Shree Varahi App, you get to keep a watch on all your transactions or trades together for 24x7 and track your investments.

With the voice of VocalForLocal, LISL is fully digitalized, from account opening to trading and settling your investments, you can access them at any time with zero paperwork.

No worries if you have stuck in your Stock Market journey, we have a dedicated personal advisor to guide you through

Open today Free trading and demat account

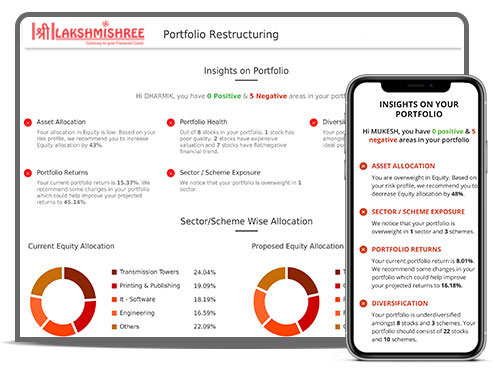

With the decades of our presence in the Stock Market, we admire the trust you keep with us. Whereas, Investments are not just the capital for your returns but they are the stability of your future times. Therefore, maintaining your portfolio appropriately will robustly help you gain utmost stability for your profit bookings.