A Depository Participant is a registered Stockbroker of a Depository, e.g. CDSL Or NSDL. It is through a Depository Participant (DP) that an investor can open a Demat account and the same is maintained by DP. A Depository Participant can either be a Brokerage House, Bank, Financial Institution, or a similar entity. In simple words, the Depository Participant (DP) is the link between the depository (NSDL, CDSL) and the investors. An agreement between the Dp and the Depository regulates their relationship. It is important that the Depository Participant (DP) is registered SEBI (Securities and Exchange Board of India) and complies with all the norms and guidelines prescribed by it. The Depository is mainly concerned with the objective of reducing the settlement risk by ensuring the seamless operations involved in trading, settlement, and transfer of the Securities.

Lakshmishree Investments & Securities Ltd (LISL) is one of the quickest growing Stock Broking companies in India. Further, providing you with the appropriate guidance in this exciting world of the Stock Market, LISL ensures to aid you with the ideal trading solutions. With the decades of our existence and the membership with BSE, NSE, MCX, and Depository Participant with CDSL, Lakshmishree Investment & Securities Ltd is on the urge of providing people with the Stock Trading services throughout Pan India by encouraging and facilitating every Indian to decide for their Investment structure and educating them to self-trade. Subsequently, having the in-house core Research team who dedicatedly works to assist our clients to guide them to invest in the selected stocks based on their risk and returns, LISL renders quality research outcomes to different classes of clients as per their preferences and requirements.

Safety & Records are the priorities for Depository Participants and so are for LISL too. Our team maintains all the transactions with connection to beneficial holdings and presents them on your account registered with us for your reference.

You can log in through your account registered with us to look for your pledge/unpledged shares. Or you can also speak with our team if you land on any confusion regarding your stocks.

Whenever any corporate actions like stock splits, dividend, rights issues happen with regard to the securities held in your account, Lakshmishree will be there to facilitate the Electronic Credit of the benefits into your accounts.

You can easily convert your shares either through rematerialization or dematerialization from your Demat account to lock it safe as per your preferences.

Transfer of shares is no more a hectic task for an investor, with the access of Shree Varahi App and the dedicated team, you can now easily transfer your shares wherever or whomever you seek to.

If you come up with the thought of having a break from investments, here you can freeze your Demat account and you do not need to pay any charges until you are back.

With the Shree Varahi App, you get to keep a watch on all your transactions or trades together for 24x7 and track your investments.

With the voice of VocalForLocal, LISL is fully digitalized, from account opening to trading and settling your investments, you can access them at any time with zero paperwork.

No worries if you have stuck in your Stock Market journey, we have a dedicated personal advisor to guide you through.

Open today Free trading and demat account

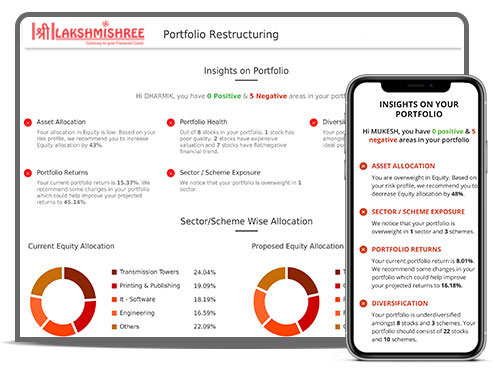

With the decades of our presence in the Stock Market, we admire the trust you keep with us. Whereas, Investments are not just the capital for your returns but they are the stability of your future times. Therefore, maintaining your portfolio appropriately will robustly help you gain utmost stability for your profit bookings.