Offering our customers in the Insurance sector too, here at LISL we have got you all covered. Whether it be term insurance or life insurance, with this pandemic going on around, you get to pick the ideal safety for your future life. Standing with you, your family, and your business, we at LISL protect your financial dreams for your long-running life. Moreover, joining the team of Insurance in LISL is no more difficult and confusing. We have an experienced staff that is eligible to guide you with the appropriate knacks which will surely aid you in your further walks of Insurance coverage. Bringing up with the best insurance plans for you, we are concerned for your safety in this phase of an unpredictable life. And so for your loved ones too. Furthermore, having insurance as a part of your investment can be undoubtedly one open and bright door in front of you for your help throughout your lifespan.

Lakshmishree Investments & Securities Ltd (LISL) is one of the quickest growing Stock Broking companies in India. Further, providing you with the appropriate guidance in this exciting world of the Stock Market, LISL ensures to aid you with the ideal trading solutions. With the decades of our existence and the membership with BSE, NSE, MCX, and Depository Participant with CDSL, Lakshmishree Investment & Securities Ltd is on the urge of providing people with the Stock Trading services throughout Pan India by encouraging and facilitating every Indian to decide for their Investment structure and educating them to self-trade. Subsequently, having the in-house core Research team who dedicatedly works to assist our clients to guide them to invest in the selected stocks based on their risk and returns, LISL renders quality research outcomes to different classes of clients as per their preferences and requirements.

Our dedicated team guides you to find optimal policy options since Insurance is been tagged as the fundamental part of every individual's life to access Economic Freedom.

Health is much more crucial these days, but subsequently, it is expensive too. So why not punch in for Health Insurance ?? LISL has got you covered for that too.

Designing a tailored insurance policy for your coverage, you can speak with us the moment you have thought of getting insurance. LISL is available to guide you.

Whether it be a vehicle or your family, Insurance can help you by chipping in your bad times any day.

Long-term capital gain is the profit that is booked from the investments that are owned for longer than 12 months at a scale.

For more encouragement and enjoy the benefit of having insurance for free, LISL offers every individual with Insurance cover to pay SIP.

With the Shree Varahi App, you get to keep a watch on all your transactions or trades together for 24x7 and track your investments.

With the voice of VocalForLocal, LISL is fully digitalized, from account opening to trading and settling your investments, you can access them at any time with zero paperwork

No worries if you have stuck in your Stock Market journey, we have a dedicated personal advisor to guide you through.

Open today Free trading and demat account

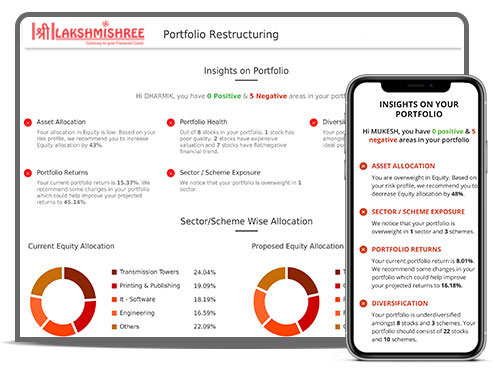

With the decades of our presence in the Stock Market, we admire the trust you keep with us. Whereas, Investments are not just the capital for your returns but they are the stability of your future times. Therefore, maintaining your portfolio appropriately will robustly help you gain utmost stability for your profit bookings.