Equity Broking or Stockbroking is one of the services provided by a broking firm by which the retail and institutional investors get the opportunity to buy and sell equities. Equity trading is basically the purchase and sale of the securities of the company, which is also known as equities. In common terms, equity trading is nothing but the purchase and sale of securities or the shares of the companies through a registered stock exchange. One of the benefits of trading in the stock or equity market is that investors can become partial owners of a company. These shares, which are offered by companies in return for money, are called equities. In the Indian stock market, equities are traded in the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE).

Lakshmishree Investments & Securities Ltd (LISL) is one of the quickest growing Stock Broking companies in India. Further, providing you with the appropriate guidance in this exciting world of the Stock Market, LISL ensures to aid you with the ideal trading solutions. With the decades of our existence and the membership with BSE, NSE, MCX, and Depository Participant with CDSL, Lakshmishree Investment & Securities Ltd is on the urge of providing people with the Stock Trading services throughout Pan India by encouraging and facilitating every Indian to decide for their Investment structure and educating them to self-trade. Subsequently, having the in-house core Research team who dedicatedly works to assist our clients to guide them to invest in the selected stocks based on their risk and returns, LISL renders quality research outcomes to different classes of clients as per their preferences and requirements.

We know the value of your investments and hence help you up with the ongoing updates through our Telegram group throughout the trading hours.

With a team of experts to drive profits to your investments, LISL ranges an extensive knack for your investments.

To let you stay upgraded with all the activities going on around your invested stock and to predict your future investments, LISL has a wide range of research reports for you.

To guide you with any of your Demat & Trading account-related queries, our enthusiast team of Relationship Managers is always on the other side of your telephone.

Providing everything at your fingertips, you being a part of LISL get to access the most convenient way to have customized market watches through our Shree Varahi App.

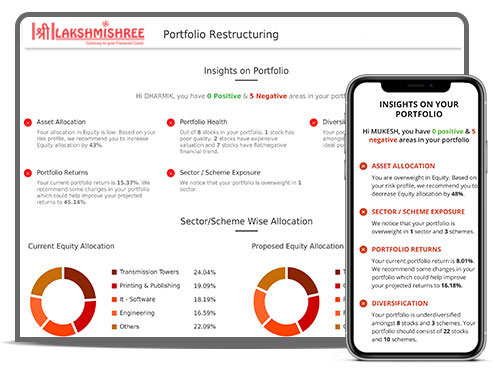

Managing your portfolio by yourself when you are busy building your future or having less knowledge at times lacks to get a positive portfolio. Therefore, here at LISL, we care for your time and investments.

Here is LISL we ensure to serve you with the best back-end support services round the clock to let you trade smoothly.

To deliver you quick services with regard to trade understanding or on the technical side, the team at LISL is always available to get you through.

You can also opt for live chat support with our team that is basically set to resolve any of your queries.

Open today Free trading and demat account

With the decades of our presence in the Stock Market, we admire the trust you keep with us. Whereas, Investments are not just the capital for your returns but they are the stability of your future times. Therefore, maintaining your portfolio appropriately will robustly help you gain utmost stability for your profit bookings.