Investing in mutual funds can be a powerful tool for building long-term wealth. But just like any journey, there can be hidden obstacles. One such obstacle is the expense ratio, a fee that can silently diminish your potential returns. We'll explain what is expense ratio, why it matters, and how to make informed decisions when choosing mutual funds.

By the end, you'll be equipped with the knowledge to navigate the world of mutual funds confidently and maximise your investment returns.

The expense ratio is a fee associated with mutual funds and ETFs. It's a percentage of the fund's total assets that covers the costs of managing the fund, like fees paid to the fund manager and administrative expenses. It's like a service charge for managing your investment basket within the mutual fund.

This might sound complicated, but it's a simple concept. Imagine you invest ₹10,000 in a mutual fund. The expense ratio is a percentage of that ₹10,000 that covers the costs of managing the fund.

Here's a breakdown:

Imagine two mutual funds, A and B, investing in similar companies and aiming for similar returns. However, Fund A has a lower ratio of 1%, while Fund B has a higher ratio of 2%.

While the difference might seem small initially, the impact of a lower expense ratio can be significant over time, especially when considering compounding interest.

We'll delve deeper into this concept in later sections.

The expense ratio is calculated using a formula, but fear not; investors don't need to be math wizards! Most mutual fund houses and stock brokers like lakshmishree display the expense ratio online.

However, if you're curious, here's a quick peek at the formula:

Expense Ratio = Total Annual Expenses / Average Net Assets

Let's break it down with an example:

Imagine you and your friends decide to pool money for a monthly grocery basket. You hire a friend (like a fund manager) to handle the shopping and ensure you get the best deals. Throughout the month, your friend incurs transportation costs (administrative fees) and a small service charge (management fees).

To calculate the expense ratio for your grocery basket investment:

Expense Ratio = Total Annual Expenses / Average Net Assets

Example: If the total annual expenses for your friend are ₹2,000 and the average net assets are ₹30,000, the expense ratio would be:

Expense Ratio = ₹2,000 / ₹30,000 = 0.066 ≈ 6.6%

While it's good to be curious, most mutual fund houses will readily display the expense ratio for their funds. You can focus on comparing the ratios of different funds you're considering and choose the one with a lower percentage.

Think of the expense ratio as a pie, with each slice representing a different cost associated with managing your mutual fund investment. Here are the key ingredients in this pie:

1. Management Fees: This is the salary paid to the fund manager, the expert chef overseeing your investment basket. Their job is to research, select, and manage the fund's various investments to grow your money potentially. (Consider the salary for the cook in our grocery basket example.)

2. Administrative Expenses: Just like maintaining a kitchen requires utensils, recordkeeping, and maybe even security, these expenses cover the day-to-day operations of the fund. This includes costs like recordkeeping of your investment, shareholder communication, legal and audit fees, etc. (Think: Costs of maintaining utensils and electricity in the kitchen.)

3. Marketing and Distribution Costs: This could include advertising campaigns, commissions paid to advisors who sell the fund, etc. Similar to how a grocery store might advertise fresh produce, mutual funds incur costs to promote themselves and make them available to investors.

Note: Exit loads and fees charged if you redeem your investment within a specific period are not typically included in the expense ratio. However, it's important to consider when choosing a mutual fund. We'll discuss exit loads in a later section.

Remember, a lower expense translates to a larger slice of the pie remaining invested and potentially growing for you in the long run.

| Best Lowest Expense Ratio Mutual Funds | Expense Ratio (%) | 3 Year Returns (%) |

|---|---|---|

| 1. Nippon India Nifty Next 50 Junior BeES FoF Direct Growth | 0.09% | 21.9% |

| 2. Bandhan Nifty 50 Index Fund Direct Plan-Growth | 0.10% | 15.97% |

| 3. ICICI Prudential S&P BSE Sensex Index Fund Direct-Growth | 0.18% | 15.34% |

| 4. HDFC Index S&P BSE Sensex Direct Plan-Growth | 0.20% | 15.38% |

| 5. UTI Nifty 50 Index Fund Direct-Growth | 0.21% | 15.90% |

We've established that the expense ratio is a fee for managing your mutual fund. But how exactly does it impact your investment? Let's explore the mechanics behind the scenes.

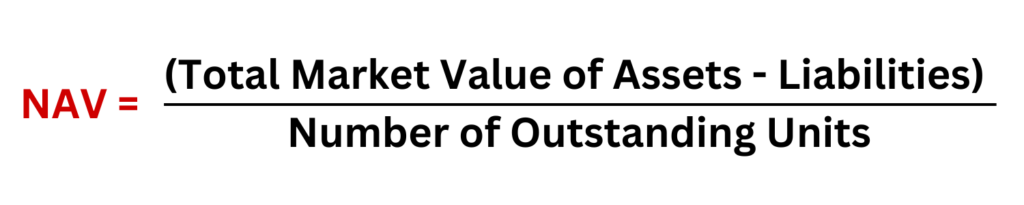

This isn't a separate charge you pay upfront. Instead, it's deducted directly from the fund's total assets before calculating the Net Asset Value (NAV), which represents the price per unit of the mutual fund.

Here's a breakdown of the process:

Example:

Let's take a more specific example. Imagine you invest ₹10,000 in a mutual fund with a NAV of ₹10 per unit. This means you purchase 1000 units (₹10,000 / ₹10 per unit).

As you can see, even a small difference in expense ratio (0.5% vs 1.5%) can slightly reduce the NAV and, ultimately, the value of your investment.

Here's the key takeaway: A lower ratio means more of your money stays invested and has the potential to grow through compounding. Choosing funds with lower ratios can maximise your returns in the long run.

Imagine filling your grocery basket with fresh ingredients for a delicious meal. You want to maximise the amount of money going towards the actual food, not on delivery charges or service fees. The concept of expense in mutual funds is similar.

A mutual fund incurs various costs for management, administration, and marketing. These costs are reflected in the expense ratio. The lower the ratio, the less money is deducted for fees, leaving more of your investment working for you in the market.

Expense Ratio Benchmarks for Indian Investors

There's no single "perfect" expense ratio, but here's a general guideline for the Indian mutual fund market:

Important Note: These are just benchmarks, and the ideal ratio can vary depending on several factors:

While a lower ratio is desirable, choosing a mutual fund shouldn't be the sole deciding factor. Consider the fund's past performance, investment strategy, and risk tolerance. However, keeping an eye on the ratio can help you compare similar funds and maximise your returns over the long run.

When choosing mutual funds, you'll encounter two main management styles: active and passive. Understanding these styles and their connection to expense is crucial for making informed investment decisions.

Active Management: Imagine a captain steering a ship through unpredictable waters, constantly making decisions and adjustments. Actively managed funds function similarly. Fund managers research, select, and trade investments aiming to outperform the market. This hands-on approach requires a skilled team, leading to higher costs. As a result, actively managed funds typically have higher expense ratios (often exceeding 1% for equity funds) due to:

Passive Management: They passively track a specific market index, like the Nifty 50, and invest in the same proportions as the index. There's minimal intervention from a fund manager. This "set-and-forget" approach translates to lower costs. Passively managed funds (like Index Funds and ETFs) typically boast lower expense ratios (often below 0.80%) because:

The choice between active and passive management depends on your investment goals and risk tolerance. Actively managed funds might offer higher returns but come with a higher expense ratio. Passively managed funds offer a more low-cost, diversified approach, but returns are typically tied to the market performance of the tracked index.

Imagine you're growing a vegetable patch in your backyard. You invest time and resources to boost your plants, hoping for a bountiful harvest. But what if there was a hidden fee – a portion of your vegetables taken each season for maintenance? The expense in mutual funds acts similarly, silently affecting your potential returns.

Lower Expense Ratio = More Money Compounding Over Time

The ratio might seem like a small fee, but it can significantly impact your returns, especially when considering the magic of compound interest. Compound interest allows your earnings to grow on your initial investment and the accumulated returns from previous periods. Even a small difference in ratio can translate to a substantial difference in your wealth over the long term.

Let's see this in action with a real-life example:

In our example, even a 1% difference in expense ratio resulted in a ₹1,166 lesser return in just five years. This gap widens further over extended investment horizons due to compounding.

The Takeaway: Choosing Funds with Lower Expense Ratios

Keeping ratios low allows more of your money to stay invested and benefit from compounding over time. This can significantly impact your investment goals, especially for long-term investments like retirement planning.

There might be some confusion between the expense ratio and management fees. Let's clear things up:

Think of it like this: The expense ratio is the total bill for managing your investment basket in a mutual fund. It has various components, and the management fee is one of the key ingredients.

Here's a table summarising the key differences:

| Feature | Expense Ratio | Management Fees |

| Management Fees | Total percentage of a mutual fund's assets used for operational costs | Fees paid to the fund manager for managing the investments |

| What it Covers | Management fees, administrative expenses, marketing & distribution costs | Expertise in selecting and managing investments |

| Analogy | Total bill for managing your investment basket | Salary paid to the cook in a community kitchen investment example |

The Role of Management Fees:

Management fees are crucial because they compensate the fund manager for their expertise in researching, selecting, and overseeing the investments within the fund. Ideally, the fund manager's skills can help the fund outperform the overall market and potentially generate higher returns for investors. However, it's important to remember that a higher management fee doesn't guarantee better performance.

TER stands for Total Expense Ratio, the same concept as the expense ratio discussed earlier. It signifies the overall cost, expressed as a percentage of a fund's assets, associated with managing the fund. Think of it as the fees you pay for professional management of your investment basket within the mutual fund.

What's Included in TER?

The TER encompasses various expenses incurred by the mutual fund house to operate the fund. These expenses are identical to what we saw with the expense ratio:

SEBI Regulations on Expense Ratio Caps

The Securities and Exchange Board of India (SEBI) plays a vital role in regulating expense ratios (also referred to as TER) in the Indian mutual fund industry. SEBI has set specific ratio caps for different categories of mutual funds. These caps help ensure transparency and prevent excessive charges for investors.

The table below shows the maximum limit of the Total Expense Ratio (TER) a fund can charge.

| AUM | Equity Funds | Debt Funds |

|---|---|---|

| Up to ₹ 500 crore: | 2.25% | 1.50% |

| Up to ₹ 750 crore: | 2.00% | 1.25% |

| Above ₹ 5000 crore: | 1.35% | 1.00% |

| Index Funds & ETFs | Generally lower expense ratios due to their passively managed nature |

Why TER Matters for Indian Investors?

A lower TER (expense ratio) translates to a larger portion of your investment staying invested and potentially growing over time. This is because lower fees mean less money is deducted for operational costs. When comparing mutual funds, keeping an eye on the TER can help you choose a cost-effective option that maximises your returns in the long run.

While the expense ratio is a key cost in mutual funds, other fees can chip away at your returns. Here's a breakdown of some additional costs to be aware of:

Many investors utilise Systematic Investment Plans (SIPs) to grow their wealth gradually. However, a common question arises: How does the expense ratio impact SIP investments?

The ratio applies to SIP investments as well. It's not a one-time fee you pay upfront. Instead, a proportionate amount is deducted from each SIP instalment. With every SIP contribution, a small percentage covers the fund's operational costs, and the remaining amount is invested in the fund's underlying assets.

For example, if you invest ₹1,000 in a mutual fund with an expense ratio of 1%, around ₹10 will be deducted for expenses, and ₹990 will be invested in the fund. This deduction happens proportionally for every SIP instalment.

While SIPs are a fantastic way to inculcate discipline and benefit from rupee-cost averaging, keeping expense ratios low adds another advantage for long-term investors. By choosing funds with lower expenses, you can maximise the returns on your SIP investments and reach your financial goals faster.

What is Expense Ratio? Simply, it's a percentage of a mutual fund's assets used to cover operational costs like management fees, administrative expenses, and marketing.

Investing for the future? Don't let expense ratios be the silent thief of your returns! Research these fees, choose cost-effective funds, and watch your money grow to its full potential. Remember, a smart investor is an informed investor!

The Mutual Fund Expense Ratio refers to the percentage of a mutual fund's assets used to cover the operating expenses of the fund. These expenses typically include management fees, administrative costs, marketing expenses, and other operational charges. The expense ratio is deducted from the fund's returns, impacting investors' overall returns.

An expense ratio calculator is a tool used to determine the total expenses associated with owning a mutual fund or exchange-traded fund (ETF). The calculator then computes the expense ratio, representing the percentage of the fund's assets used to cover these expenses. This helps investors understand the cost of owning the fund and assess its impact on their investment returns.

The Total Expense Ratio (TER) in a mutual fund refers to the comprehensive measure of all costs incurred by the fund in managing and operating its portfolio over a specific period, typically expressed as a percentage of the fund's average net assets.

The expense ratio isn't a one-time fee. The expense ratio is a percentage of the fund's assets taken out daily to cover operational costs. This means a small amount is deducted each day, resulting in a slightly lower amount invested that grows over time. The expense ratio in a mutual fund is deducted before calculating the net asset value (NAV).

Lowest Expense Ratio Mutual Funds #1. Nippon India Nifty Next 50 Junior BeES FoF Direct Growth

Lowest Expense Ratio Mutual Funds #2. Bandhan Nifty 50 Index Fund Direct Plan-Growth

Lowest Expense Ratio Mutual Funds #3. ICICI Prudential S&P BSE Sensex Index Fund Direct-Growth

Lowest Expense Ratio Mutual Funds #4. HDFC Index S&P BSE Sensex Direct Plan-Growth

Lowest Expense Ratio Mutual Funds #5. UTI Nifty 50 Index Fund Direct-Growth

Yes, generally, a lower expense ratio is considered better for investors. A lower expense ratio means that a smaller portion of the fund's assets is used to cover operating expenses, leaving more of the fund's returns to investors. Over time, lower expenses can contribute to higher overall returns for investors.

The expense ratio is deducted from the fund's assets daily, but it's calculated as an annual fee based on the fund's average net assets over the year. However, investors do not see this deduction directly from their accounts on a monthly basis; instead, it's reflected in the fund's net asset value (NAV), which is calculated daily.