Investing in Exchange-Traded Funds (ETFs) has become increasingly popular among stock market investors in India. With many options available, choosing the ETF can be overwhelming. This article delves into the 15 Best ETFs in India, providing a detailed overview, advantages, comparison with mutual funds, investment strategies, and tax implications to help you make informed investment decisions.

Exchange-traded funds (ETFs) are investment funds traded on stock exchanges like individual stocks. These funds typically hold a diversified portfolio of assets such as stocks, bonds, gold commodities, or a combination thereof. They are designed to track the performance of a specific index, sector, commodity, or asset class.

One of the key features of ETFs is their structure, which allows investors to buy and sell shares throughout the trading day at market prices. This provides liquidity and flexibility to investors, allowing them to enter and exit positions easily. It also known for their low expense ratios compared to traditional mutual funds, making them a cost-effective investment option.

Here is the list of 15 Best ETFs in India. Click respectively to know more about them:

| List of 15 Best ETFs in India | NAV |

|---|---|

| 1.Nippon India ETF Nifty 50 BeES | ₹ 241.63 |

| 2.Nippon India ETF PSU Bank BeES | ₹ 76.03 |

| 3.BHARAT 22 ETF | ₹ 96.10 |

| 4.Mirae Asset NYSE FANG+ ETF | ₹ 84.5 |

| 5.UTI S&P BSE Sensex ETF | ₹ 781 |

| 6.Nippon India ETF Gold BeES | ₹ 55.5 |

| 7.Nippon India Etf Nifty Bank Bees | ₹ 471.9 |

| 8.HDFC Nifty50 Value 20 ETF | ₹ 123.2 |

| 9.Invesco India Gold ETF | ₹ 6.51 |

| 10.Nippon India Silver ETF | ₹ 72.5 |

| 11.Kotak Nifty PSU Bank ETF | ₹ 663.7 |

| 12.HDFC Nifty100 Low Volatility 30 ETF | ₹ 17.81 |

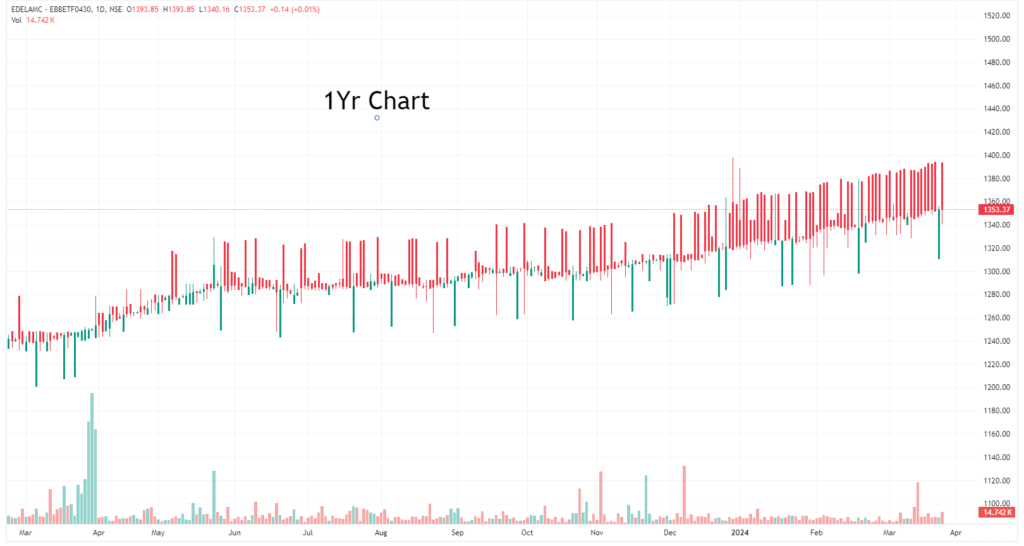

| 13.Bharat Bond ETF - April 2030 | ₹ 1351 |

| 14.Bharat Bond ETF - April 2031 | ₹ 1209.2 |

| 15.ICICI Prudential Nifty Midcap 150 Etf | ₹ 174.04 |

Here, a complete overview of 15 best ETF to invest, along with there Expense ratio, AUM, Market Cap, Risk, and Trend chart

Nippon India ETF Nifty 50 BeES is one of the best etf to invest because it tracks the Nifty 50 index, which comprises the top 50 companies listed on the National Stock Exchange (NSE). By investing in NIFTYBEES, investors gain exposure to a diversified portfolio of blue-chip companies across various sectors of the Indian economy, making it a popular choice for broad market exposure.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 12.1 | 44.25 | 101.17 |

Nippon India ETF PSU Bank BeES tracks the Nifty PSU Bank Index, offering exposure to stocks of public sector banks in India. Its appeal depends on individual investment goals and risk tolerance, with potential benefits of diversification across the PSU banking sector. However, like any investment, it carries risks, requiring careful consideration and consultation with a financial advisor before investing.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 86.17 | 210.69 | 120.81 |

BHARAT 22 ETF is considered one of the best etf to invest due to its diversified portfolio of blue-chip stocks from key sectors of the Indian economy. It offers investors exposure to well-established companies with strong growth potential and the benefits of diversification and liquidity that Exchange-traded funds provide.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 67.72 | 167.61 | 163.31 |

Mirae Asset NYSE FANG+ ETF aims to mirror the NYSE® FANG+™ Index, encompassing top technology and tech-enabled firms like Facebook, Apple, Amazon, Netflix, and Google. It presents an opportunity for investors to tap into the growth potential of leading global tech giants. However, it's essential to note the associated risks, including market volatility and regulatory uncertainties, before investing.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 78.87 | 83.87 | NA |

UTI S&P BSE Sensex ETF aims to mirror the performance of the S&P BSE Sensex Index, comprising India's top 30 listed companies. This Exchange-traded funds offers investors a convenient way to gain exposure to the Indian equity market's blue-chip segment. While it provides diversification and potential for long-term capital growth, investors should assess market risks before investing.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 25.59 | 50.93 | 96.76 |

Nippon India ETF Gold BeES (GOLDBEES) is a one of the best gold ETF to invest backed by physical gold, offering investors exposure to the price movements of gold without the need for physical ownership. By investing in GOLDBEES, investors can access the returns of gold bullion, considered a safe-haven asset and a hedge against inflation and currency depreciation.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 12.38 | 44.61 | 101.67 |

Nippon India Etf Nifty Bank Bees (BANKBEES) tracks the Bank Nifty index, which comprises the most liquid and large-cap banking stocks listed on the NSE. This ETF offers investors exposure to India's banking sector, which is crucial to the country's economic growth. Investing in BANKBEES allows investors to capitalize on the performance of leading banks in India.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 17.94 | 30.97 | 56.87 |

HDFC Nifty50 Value 20 ETF (HDFCVALUE) is a value-oriented Exchange-traded funds that aims to invest in stocks trading at a discount to their intrinsic value. Value investing focuses on identifying undervalued stocks with the potential for long-term capital appreciation. HDFCVALUE allows investors to benefit from the investment strategy of buying quality stocks at discounted prices.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 34.58 | 47 | 48.08 |

Invesco India Gold ETF is one of the best Gold ETF, it is an investment fund that aims to track the price of gold in India. By investing in this Exchange-traded funds, investors gain exposure to the performance of gold without the need to physically own or store the precious metal. While it offers liquidity and potential for capital appreciation, investors should consider market risks and fluctuations in gold prices before investing.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 12.37 | 43.74 | 104.88 |

Similar to GOLDBEES, SILVERBEES is a silver ETF backed by physical silver. By investing in SILVERBEES, investors can gain exposure to the price movements of silver bullion, which is considered a valuable industrial and precious metal. SILVERBEES offers investors a convenient way to invest in silver without needing physical storage.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 9.53 | N/A | N/A |

KOTAKPSUBK is one of the best ETFs in india which focuses on investing in public sector banks, providing investors with exposure to this banking industry segment. With the banking sector significantly contributing to India's economy, KOTAKPSUBK offers investors an opportunity to capitalize on the performance of PSU banks listed on the NSE.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 84.79 | 217.22 | 113.29 |

HDFC Nifty100 Low Volatility 30 ETF aims to invest in stocks with lower volatility, offering investors stability and potentially reducing downside risk. HDFCLOWVOL focuses on companies that exhibit lower price volatility than the broader market, making it suitable for investors seeking a defensive investment strategy.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 38.71 | N/A | N/A |

Bharat Bond ETF - April 2030 offers similar benefits as its 2031 counterpart, providing investors with exposure to a diversified portfolio of high-quality bonds with a fixed maturity date. It is cost-effective and tax-efficient, making it an attractive option for investors seeking stability and income generation. However, investors should evaluate their investment objectives and risk tolerance before investing.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 8.52 | 21.97 | N/A |

Bharat Bond ETF - April 2031 is considered as one of the best ETFs in india to invest due to its fixed maturity date, diversification benefits from investing in high-quality bonds, cost-effectiveness, and tax efficiency. However, investors should assess their goals and risk tolerance before investing.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 9.25 | 22.04 | N/A |

ICICI Prudential Nifty Midcap 150 Etf (MIDCAPIETF) focuses on mid-cap companies, offering investors exposure to this market segment with growth potential higher than large-cap stocks but lower than small-cap stocks. Mid-cap stocks are known for delivering attractive returns over the long term, making MIDCAPIETF a suitable choice for investors seeking growth opportunities in the mid-cap segment.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 54.28 | 99.7 | N/A |

These are the 6 Best performing ETFs in the last 10 years in India, as per their 5year and 15year comparison which include 2 Best Gold ETFs and 4 Other sector ETFs

| Best Performing ETFs in Last 10Yr in India | 5Yr Return | 15Yr Return |

|---|---|---|

| 1.Nippon India ETF Nifty 50 BeES | 102.38% | 707.9% |

| 2.Nippon India ETF Gold BeES | 99.57% | 467.4% |

| 3.Invesco India Gold ETF | 107.00% | 288.0% |

| 4.UTI S&P BSE Sensex ETF | 95.56% | 200.8% |

| 5.BHARAT 22 ETF | 161.65% | 172.2% |

| 6.Nippon India ETF PSU Bank BeES | 120.24% | 144.3% |

| Best ETFs in India for April 2024 | 1Yr Return |

|---|---|

| 1.CPSE ETF | 96.76% |

| 2.BHARAT 22 ETF | 68.87% |

| 3.Nippon India ETF Nifty Next 50 Junior BeES | 54.76% |

| 4.SBI Nifty 50 ETF | 30.57% |

Here's a difference between ETFs and Mutual Funds

Here's a comparison between ETFs and Equity Stocks

You can invest in Best ETFs in India without any hassle in easy steps using the below instructions:

When considering investing in ETFs, it's crucial to assess various factors to make informed decisions:

When it comes to investing in Exchange Traded Funds (ETFs), understanding the tax implications is essential for maximizing returns and managing overall tax liability.

Here's an overview of the tax treatment of income and capital gains from ETF investments:

For ETFs that primarily invest in equity-oriented instruments, the tax treatment is akin to that of equity shares:

For ETFs where less than 35% of the funds are invested in domestic equity shares, the tax treatment varies based on the acquisition date:

The recent budget introduced amendments affecting the tax treatment of certain ETFs. Specified ETFs no longer receive indexation benefits for LTCG computation. Consequently, ETFs with less than 35% investment in domestic equity shares are now subject to taxation at applicable slab rates.

Long-Term Capital Gain (LTCG): Gains from selling other ETF units held for more than 36 months qualify as LTCG. These LTCGs are taxed at a rate of 20% with indexation benefits.

Short-Term Capital Gain (STCG): Profit from selling other ETF units held for less than 36 months is treated as STCG and taxed according to the applicable slab rates.

Understanding the tax implications of ETF investments empowers investors to make informed decisions and optimise their tax strategy. It's advisable to consult with a stock broker like Lakshmishree Investment for personalised advice tailored to individual financial circumstances.

Investing in Exchange Traded Funds (ETFs) offers various benefits, but it's crucial to be aware of the potential risks involved. Here are some key risks associated with ETF investments:

ETF prices are subject to market fluctuations. If the underlying assets in which the ETF invests experience a decline in value, the ETF's price may also decrease, leading to potential losses for investors.

ETFs traded on stock exchanges may face liquidity challenges, especially for less actively traded funds. Limited liquidity can impact the ability to buy or sell ETF shares at desired prices, potentially resulting in increased transaction costs or difficulty exiting positions.

Despite ETFs' goal to replicate the performance of their underlying index, tracking errors may occur. Portfolio rebalancing and imperfect replication techniques can lead to deviations between ETF and index returns.

Certain ETFs may focus on specific sectors or industries, resulting in concentration risk. If the sector experiences adverse events or underperforms, it can disproportionately impact the ETF's returns and expose investors to heightened risk.

ETFs represent a valuable investment vehicle that aligns with various investment objectives, whether seeking long-term growth, income generation, or capital preservation. With careful consideration of the factors discussed in this article about best ETFs in India, investors can harness the potential of ETFs to achieve their financial goals and navigate the ever-changing landscape of the investment market.

The best ETF depends on individual investment objectives and risk tolerance. Conduct thorough research before making a decision. However, investors can check the overview of the best ETFs in India to invest.

Check the complete list of Best Gold ETFs to invest.

Kotak Silver ETF FoF is the best silver etf in India which has provided an average return of 36.56% in the last 3year.

HDFC NIFTY Smallcap 250 ETF is one of the best performing smallcap index fund in india.

You can invest in ETFs through a brokerage account. Choose suitable ETFs based on your investment goals and risk appetite. To get your Free Demat account, check here.

ETF investments are subject to capital gains tax upon sale or redemption. Short-term gains are taxed at the investor's income tax rate.

Risks include market volatility, liquidity issues, and tracking errors. It's essential to assess these risks before investing.