In 2025, as gold prices hit new highs and market volatility keeps rising, more Indian investors are choosing Gold ETFs as a smart and secure option. These funds let you invest in digital gold through the stock market, without worrying about lockers or making charges. But with so many choices, finding the best Gold ETFs in India can be confusing. In this guide, we simplify your decision by comparing top-performing ETFs based on returns, cost, and reliability.

Here are the top-performing gold ETFs in India for 2025, offering a blend of stability and strong returns. Factors such as asset under management (AUM), performance over the last years, and expense ratios are crucial when selecting gold ETFs in India.

| Best Gold ETFs in India | Market Cap | 5 Yr Return |

|---|---|---|

| 1. Birla Sun Life Gold ETF | ₹1204.99 Cr | 72.67% |

| 2. HDFC Gold ETF | ₹10,011.25 Cr | 71.56% |

| 3. Kotak Gold ETF | ₹6840.22 Cr | 71.11% |

| 4. Nippon India ETF Gold BeES | ₹22969.69 Cr | 70.47% |

| 5. Axis Gold ETF | ₹2030.13 Cr | 69.58% |

These 5 Best Gold ETFs in India provide solid returns while offering liquidity, making them excellent choices for those looking to diversify with gold.

A Gold ETF (Exchange-Traded Fund) in India is a type of mutual fund that invests in physical gold of high purity (usually 99.5%) and is traded on stock exchanges like NSE and BSE. Instead of buying physical gold, you buy units of a Gold ETF—each unit usually represents 1 gram of gold. These ETFs are backed by actual gold held securely by a custodian, ensuring transparency and credibility.

Regulated by the Securities and Exchange Board of India (SEBI), Gold ETFs in India are offered by leading mutual fund companies, providing investors with a secure and efficient way to gain exposure to gold without the challenges of storing or securing physical bullion. Unlike traditional gold investments such as jewellery or bars, Gold ETFs eliminate concerns about purity, making charges, and storage risks.

Below is a detailed list of the top-performing Gold ETFs in India based on their returns, costs, liquidity, and ease of investing, so you can choose what fits your goal best.

The Birla Sun Life Gold ETF is one of the best gold ETFs in India, commonly called BSLGOLDETF, it is managed by Birla Sun Life Mutual Fund and is recognised for its expert management and well-thought-out investment strategies. Backed by Birla Sun Life's strong reputation in the financial sector, BSLGOLDETF is managed by experienced professionals who carefully monitor market movements to optimise returns.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| 43.83 | 88.34 | 72.67 |

HDFCGOLD, managed by HDFC Mutual Fund, is one of the largest gold ETFs in India in terms of assets under management (AUM). This ETF gives investors direct exposure to gold, making it ideal for those seeking a safe haven during market volatility.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| 43.26 | 66.06 | 71.56 |

Managed by Kotak Mutual Fund, KOTAKGOLD is one of the most trusted gold ETFs in India. Known for its consistent returns and performance, it aims to deliver capital appreciation by tracking gold prices effectively. Over the years, it has outperformed many of its benchmarks, making it a popular choice among investors. Its disciplined investment approach and long-term wealth creation focus have helped it build a strong position in the Indian Gold ETF market.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| 43.92 | 90.55 | 71.11 |

GOLDBEES, managed by Nippon India Mutual Fund (earlier known as Reliance Mutual Fund), holds the distinction of being India's first gold ETF. It is also the largest in terms of assets under management. GOLDBEES offers a reliable and stable option for investors who want to gain exposure to gold. Its long-standing market presence and high liquidity make it ideal for investors looking for both safety and convenience in gold investments.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| 43.05 | 87.07 | 70.47 |

AXISGOLD, offered by Axis Mutual Fund, stands out as another best Gold ETFs in India due to its professional management and strategic investment approach. Managed by a team of seasoned professionals, AXISGOLD focuses on maximizing returns while minimizing risk. This ETF has gained popularity among investors seeking reliable gold exposure as part of a diversified portfolio.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| 43.94 | 89.94 | 69.58 |

Investors need a Demat account with a registered stockbroker to invest in Best Gold ETFs. Get your FREE Demat account from Lakshmishree Investments today.

Check out the tables below showcasing the top-performing Gold ETFs in India, ranked by their 1-year and 5-year returns, to help you make informed investment decisions.

| Top 10 Gold ETFs in India | 1 Year Return | 5 Year Return |

|---|---|---|

| LIC MF Gold ETF | 45.40 | 68.59 |

| Invesco India Gold ETF | 45.23 | 70.48 |

| BNP Paribas Gold ETF | 44.88 | 58.68 |

| Aditya Birla SL Gold ETF | 44.47 | 73.80 |

| Axis Gold ETF | 44.38 | 72.99 |

| Kotak Gold ETF | 44.32 | 71.57 |

| Quantum Gold Fund ETF | 44.18 | 71.05 |

| Nippon India ETF Gold BeES | 44.07 | 70.53 |

| Zerodha Gold ETF | 44.03 | 57.72 |

| Mirae Asset Gold ETF | 44.02 | 66.08 |

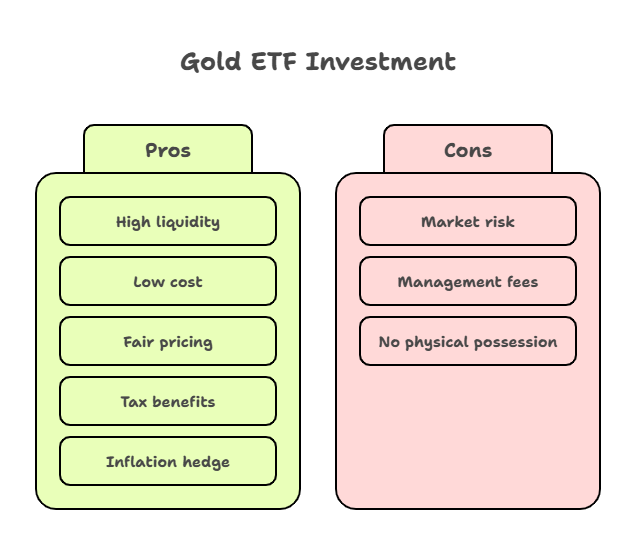

Gold ETFs offer high liquidity, better tax benefits, and easy access to digital gold, making them a smarter choice than physical gold in 2025.

Here’s why they’re gaining popularity among Indian investors:

As of 2025, gold continues to be one of the most trusted investment choices for Indian investors — especially during uncertain global and domestic conditions. With rising inflation, geopolitical risks, and a weakening rupee, the demand for gold as a safe-haven asset is on the rise.

According to SEBI filings and AMFI data, retail participation in Gold ETFs in India grew by over 20% year-on-year in Q1 2025 — showing a clear shift from physical to digital gold investing.

Financial experts, including Nippon India and HDFC Mutual Fund analysts, forecast that gold prices could rise by 10–15% in 2025, supported by high central bank demand and low-interest-rate expectations globally.

Gold Exchange-Traded Funds (ETFs) function similarly to mutual funds but exclusively track the price of gold. When you invest in a Gold ETF in India, your funds are pooled with those of other investors and used to purchase gold bullion, which the ETF's custodian securely stores.

The value of your investment fluctuates in sync with the gold market price, allowing you to benefit from price movements without physically owning gold.

Gold ETFs are traded on stock exchanges just like shares, offering high liquidity and flexibility. Investors can buy or sell units during market hours, making them a cost-effective and convenient way to diversify into gold without the hassle of storage or safety concerns.

Both Gold ETFs and Gold BeES aim to track the price of gold, but there are a few differences to consider. Gold ETFs are a broad category of exchange-traded funds backed by physical gold, while Gold BeES is a specific Gold ETF launched by Nippon India Mutual Fund and is notable for being one of the first Gold ETFs introduced in India. Known for its strong liquidity and established track record, Gold BeES has slightly higher expense ratios than other Gold ETFs.

Investing in Best Gold ETFs can be an intelligent decision, but it's essential to consider a few factors before diving in:

Investing in Gold ETFs is straightforward and hassle-free. Follow these simple steps:

Here's a table highlighting the differences between Gold ETFs and physical gold:

| Aspect | Gold ETF | Physical Gold |

|---|---|---|

| Ownership | Represents ownership of gold in electronic form. | Ownership of physical gold in the form of bars or coins. |

| Storage | Gold is stored securely by the fund's custodian. | Requires safe storage at home or in a bank vault, incurring storage costs. |

| Liquidity | Easily tradable on stock exchanges, providing liquidity. | Selling physical gold may take time and involve additional costs. |

| Cost | Generally lower expenses compared to physical gold. | Involves additional costs such as making charges, storage fees, and insurance. |

| Tax Treatment | Taxed as capital assets, subject to capital gains tax. | Tax implications vary based on the holding period and jurisdiction. |

| Transparency | Transparent pricing and holdings information are available. | The value may be subject to appraisal and verification. |

| Risk Management | Acts as a hedge against inflation and currency devaluation. | Provides tangible asset protection but may be susceptible to theft or loss. |

Also Check:

Gold ETFs provide a seamless and cost-efficient way for investors to gain exposure to gold while avoiding the challenges of physical ownership. They combine the benefits of liquidity, transparency, and diversification, making them an ideal choice for modern investors. Investors can make informed decisions that align with their financial goals by carefully analyzing top-performing Gold ETFs in India and considering factors such as returns, expense ratios, and fund management.

The best gold ETFs in India for 2025 include Birla Sun Life Gold ETF, HDFC Gold ETF, Kotak Gold ETF, Axis Gold ETF and Nippon India ETF Gold BeES. These options are popular for their performance, liquidity, and trustworthiness, making them great choices for gold investment.

The top 5 best Gold ETFs in India, based on 1-year returns, are UTI Gold Exchange Traded Fund, SBI-ETF Gold, Aditya Birla Sun Life Gold ETF, HDFC Gold Exchange Traded Fund, and IDBI Gold ETF. These ETFs provide strong returns, efficient management, and an easy way to invest in gold without the need for physical storage.

Yes, intraday trading is possible with gold ETFs. Investors can buy and sell these ETFs on the stock exchange throughout the trading day, just like stocks.

When selecting an ETF for investment, the investor should consider factors like the fund's expense ratio, tracking error, liquidity, underlying assets, and historical performance. Additionally, investors should assess the fund's management team, investment strategy, and risk profile to ensure alignment with their investment objectives and risk tolerance.

You are subject to capital gains tax when you sell your Gold ETF units at a profit. If you hold the units for less than three years, the gains are considered short-term and taxed according to your income tax slab rate. To know more, check the in-depth information on the Tax Implications of ETF Investments

To save tax on Gold ETFs, hold them for at least 12 months to qualify for Long-Term Capital Gains (LTCG), which is taxed at 12.5% without indexation. If sold before 12 months, gains are taxed as Short-Term Capital Gains (STCG) at 20% tax rates.

Disclaimer: This article is intended for educational purposes only. Please note that the data related to the mentioned companies may change over time. The securities referenced are provided as examples and should not be considered as recommendations.