Investing in the best ETFs in India for 2026 can be a smart way to grow your wealth with lower risk and better diversification. In recent years, Exchange-Traded Funds (ETFs) have gained popularity for offering stock-like flexibility with mutual fund-style diversification. In this article, we share the top 10 ETF funds in India, based on past performance, risk levels, and exposure to popular sectors like PSU banks, gold, midcaps, and global tech. Whether you're a beginner or a seasoned investor, these best-performing ETFs could be a valuable addition to your portfolio in 2026.

Here is a list of the top 10 best ETFs in India for 2026, selected based on their 3-year returns and expense ratios. These Exchange Traded Funds (ETFs) offer a simple and low-cost way to invest in sectors like PSU banks, gold, tech, and midcaps.

| Best ETFs in India for 2026 | 3yr Return |

| 1. Mirae Asset NYSE FANG+ ETF | 354.35% |

| 2. Nippon India Silver ETF | 237.03% |

| 3. Nippon India ETF Gold BeES | 138.19% |

| 4. Invesco India Gold ETF | 123.69% |

| 5. BHARAT 22 ETF | 114.07% |

| 6. Nippon India ETF PSU Bank BeES | 106.16% |

| 7. Kotak Nifty PSU Bank ETF | 106.06% |

| 8. ICICI Prudential Nifty Midcap 150 ETF | 91.91% |

| 9. HDFC Nifty100 Low Volatility 30 ETF | 64.05% |

| 10. HDFC Nifty50 Value 20 ETF | 54.97% |

NAV as of 07/01/26

Note: Rankings have shifted significantly in 2026. Silver and Gold ETFs have surged to the top spots due to a massive rally in precious metals.

These best-performing ETFs in India provide diverse investment opportunities across various sectors, from banking to bonds, gold, and silver, making them suitable for different risk profiles and financial goals in 2026.

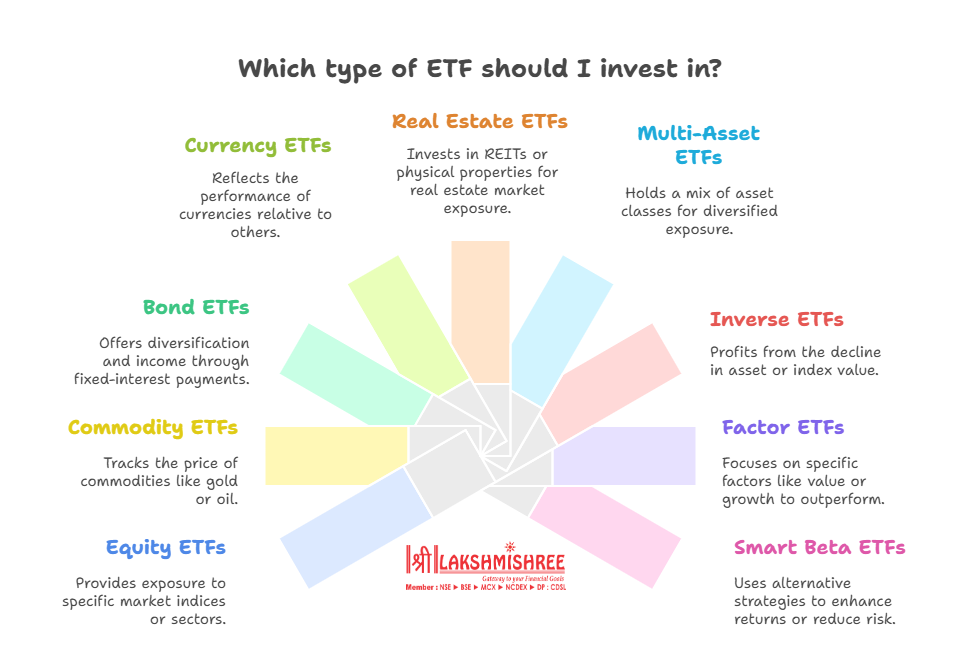

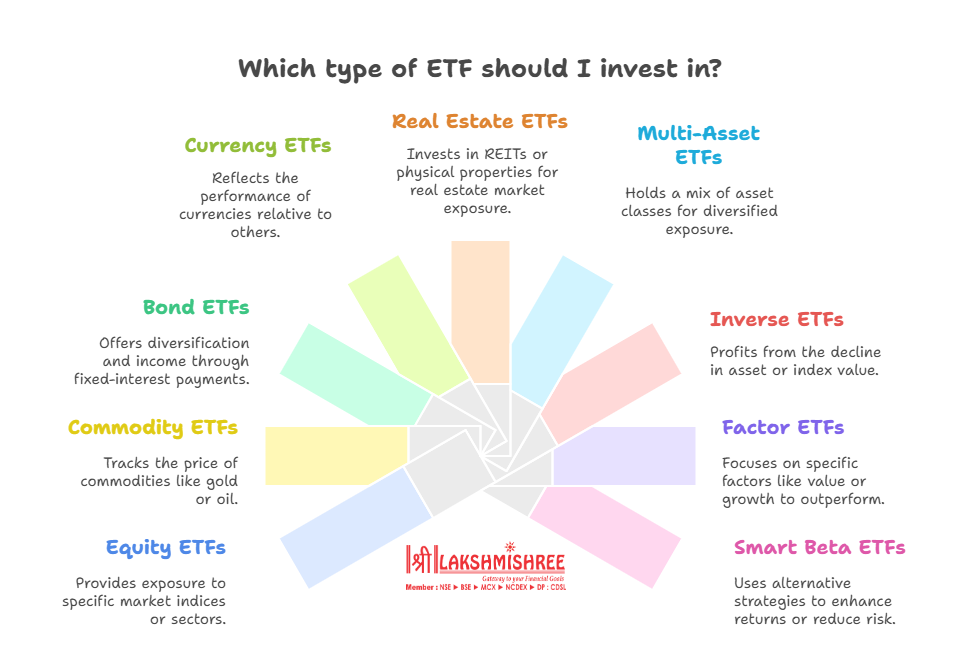

ETF stands for Exchange-Traded Fund. It is a type of investment fund that is traded on stock exchanges, just like regular shares. The ETF's meaning is simple: it pools money from many investors and invests in a basket of assets like stocks, bonds, or commodities.

Imagine an ETF like a fruit basket — instead of buying individual fruits (stocks), you buy a basket that holds different types of fruits. This gives you diversification in a single trade. So, when you invest in one ETF, you get exposure to multiple companies or sectors, reducing risk while keeping costs low.

ETFs are ideal for beginners and smart investors who want long-term returns with the liquidity of shares. They can track indices like Nifty, Bank Nifty, or even global markets.

In this section, we provide a detailed overview of the top 10 ETFs in India, including their latest returns, expense ratios, AUM, market capitalisation, risk levels, and trend charts, giving you a clear picture of each ETF’s performance and potential.

Overview of India’s Top 10 ETFs in 2026

In this section, we provide a detailed overview of the top 10 ETFs in India, including their latest returns, expense ratios, AUM, market capitalisation, risk levels, and trend charts, giving you a clear picture of each ETF’s performance and potential.

Mirae Asset NYSE FANG+ ETF tracks the NYSE® FANG+™ Index, which includes innovative technology and technology-enabled companies at the forefront: Facebook, Apple, Amazon, Netflix, and Google. This will enable investors to catch up with leading global tech giants and unlock their future growth potential.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 23.80 | 354.35 | 232.02 |

Note: Based on Cumulative Return

Nippon’s SILVERBEES has climbed the ranks to become one of the top-performing ETFs in 2026, backed by physical silver. By being exposed to this investment through SILVERBEES, the investor attains the return represented in price changes of the underlying instrument, such as the highly valued industrial metal or a very valuable precious metal in silver bullion.

Like any other investment alternative, this one, too has its share of risks and, therefore should be considered with due caution but not without consulting a financial adviser or stockbroker such as lakshmishree, prior to making an investment decision.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 162.47 | 237.03 | NA |

Note: Based on Cumulative Return

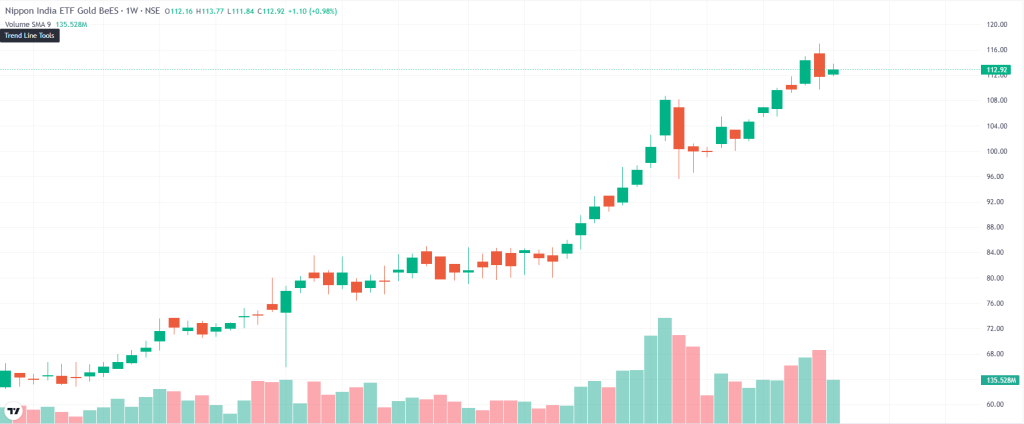

Nippon India ETF Gold BeES (GOLDBEES) is one of the best Gold ETFs to invest in that is backed by physical gold. It allows investors to take exposure in the movements in gold prices without physically holding gold. In such a case, the investment in GOLDBEES would provide returns linked to gold bullion, a safe-haven asset and a hedge against inflation and currency depreciation.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 75.11 | 138.19 | 150.53 |

Note: Based on Cumulative Return

Invesco India Gold ETF is another best Gold ETFs, which is an investment fund intended to shadow the gold price in India. By investing in these Exchange-traded funds, investors get exposure to the performance of gold without necessarily having to own or store the precious metal physically.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 71.99 | 123.69 | 119.91 |

Note: Based on Cumulative Return

BHARAT 22 ETF is considered one of the best ETFs to invest in due to its diversified portfolio of blue-chip stocks from key sectors of the Indian economy. It offers investors exposure to well-established companies with strong growth potential and the benefits of diversification and liquidity that Exchange-traded funds provide.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 8.88 | 114.07 | 361.69 |

Note: Based on Cumulative Return

This scheme aims to track the Nifty PSU Bank Index returns through investment in securities constituting the Nifty PSU Bank Index. The scheme would, therefore, be attractive to an individual investor with objectives and risk appetite concerning diversification in the PSU banking segment.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 38.57 | 106.16 | 389.73 |

Note: Based on Cumulative Return

The KotakPSUBK is one of the best ETFs in India, and it is targeted at investing in public sector banks. Therefore, it exposes this banking industry segment to the investing community. Because the banking sector has played a major role in India's economy, this index fund can be a very good avenue for investors to reap benefits from the performance of PSU banks listed on NSE.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 38.71 | 106.06 | 391.46 |

Note: Based on Cumulative Return

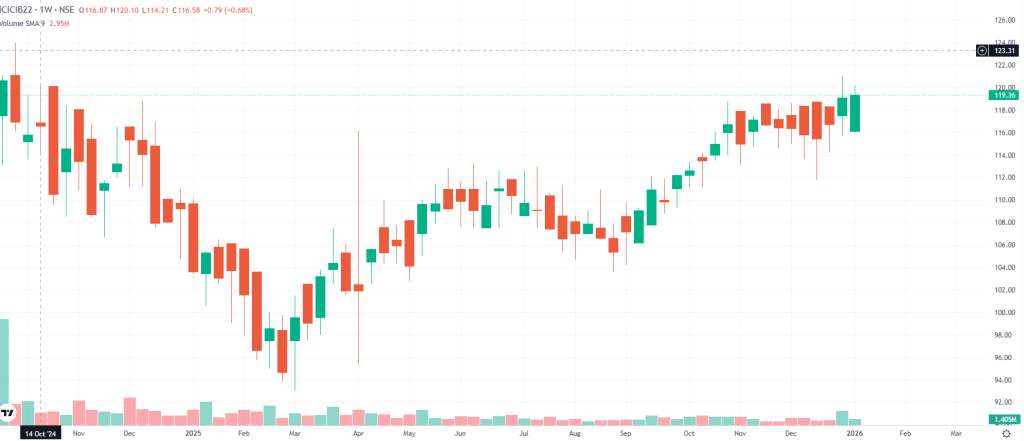

ICICI Prudential Nifty Midcap 150 Etf would fall into one of the newer ETFs focusing on mid-cap companies. One will note herein the opportunity of getting exposure in a market that usually has higher growth opportunities than large cap, while pretty low compared with small cap investment stocks.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 7.20 | 91.91 | 183.41 |

Note: Based on Cumulative Return

Investment in relatively low volatile scripts would provide stability to the investors and, at the same time, will reduce the downside risk. The scheme will invest in companies showing lower price volatility compared to the overall market which is beneficial for the investors following a more defense-oriented investment approach.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 10.07 | 64.05 | 72.87 |

Note: Based on Cumulative Return

HDFC Nifty50 Value 20 ETF (HDFCVALUE) is the best nifty 50 ETF, a value-oriented Exchange-traded fund that aims to create wealth by predominantly investing in stocks trading at a discount to intrinsic value. Value investing focuses on identifying undervalued stocks with the potential for long-term capital appreciation.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 1.31 | 54.97 | 67.22 |

Note: Based on Cumulative Return

The best-performing ETFs in India over the last 10 years include Invesco India Gold ETF, UTI S&P BSE Sensex ETF, and Nippon India ETF Gold BeES. These funds have delivered over 150%+ returns in 10 years, making them strong long-term performers.

| Best Performing ETFs last 10 years in India | 5Yr Return | 10Yr Return |

| Motilal Oswal Nasdaq 100 ETF | 153.42 | 642.82% |

| Invesco India Gold ETF | 119.91% | 314.70% |

| Nippon India ETF Gold BeES | 150.53% | 307.97% |

| Nippon India ETF Nifty 50 BeES | 125.87% | 275% |

| UTI S&P BSE Sensex ETF | 124.90% | 270% |

NAV: 07/01/2026

Here’s a look at the Best ETFs in India for January 2026, showcasing the 5 ETFs that have delivered the best returns in 1 year and have good potential to grow.

| Best ETFs in India for August 2026 | 1 Yr Return |

| Nippon India Silver ETF | 162.47% |

| Nippon India ETF Gold BeES | 75.11% |

| Nippon India ETF PSUs Bank BeES | 38.57% |

| Motilal Oswal Nasdaq 100 ETF | 26.39% |

| Mirae Asset NYSE FANG+ ETF | 23.80% |

Data as of 06/08/2026

ETFs and mutual funds are both popular investment options that offer diversification. However, they work differently in terms of how you buy, sell, and manage them. Mutual funds are managed by fund houses and priced once a day, while ETFs trade like stocks on the stock exchange with real-time pricing.

Here's a quick comparison of ETFs vs. mutual funds in India:

| Feature | ETFs (Exchange Traded Funds) | Mutual Funds |

| Trading | Traded on stock exchanges like shares | Bought/sold through AMC at NAV |

| Pricing | Real-time market price during trading hours | Priced once a day based on NAV |

| Liquidity | High liquidity, can be bought/sold anytime during market hours | Limited to AMC redemption timelines |

| Costs | Lower expense ratio, brokerage charges apply | Slightly higher expense ratios, no brokerage |

| Taxation | Taxed like equity shares (STCG, LTCG) | Similar equity taxation rules apply |

You can invest in the Best ETFs in India without any hassle in easy steps using the below instructions:

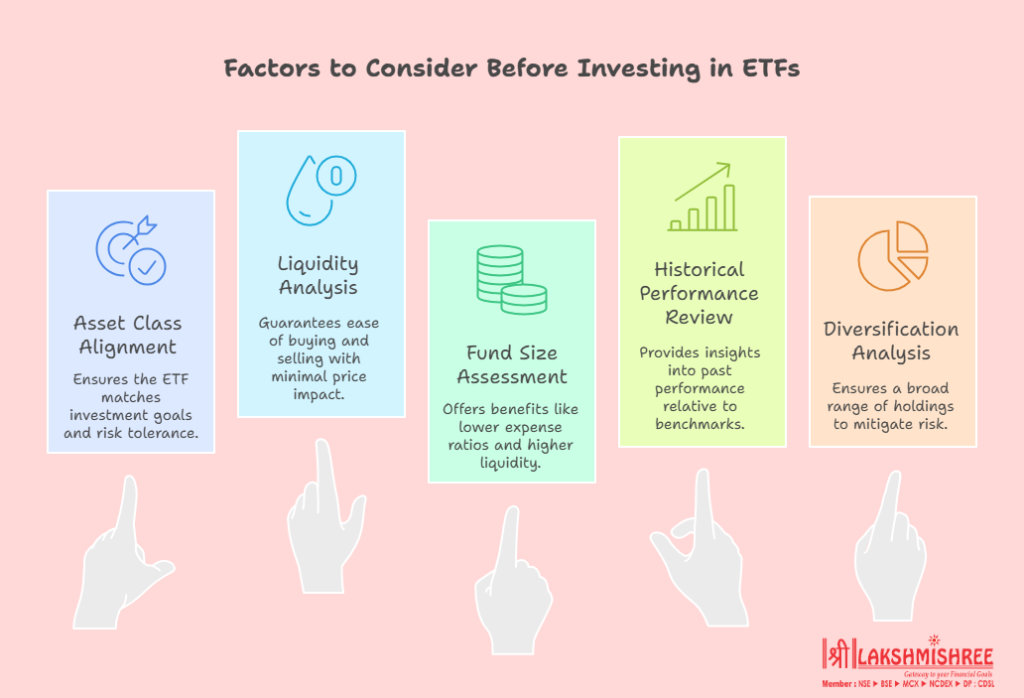

When considering investing in ETFs, it's crucial to assess various factors to make informed decisions:

While ETFs offer numerous advantages, they also come with certain risks that investors should consider before diving in. Understanding these risks will help you make informed decisions:

Also Check:

In 2026, Exchange Traded Funds (ETFs) have become a popular choice for Indian investors who want returns like mutual funds but with the flexibility of stocks. Among the top-performing ETFs this year are Kotak Nifty PSU Bank ETF, BHARAT 22 ETF, and Gold ETFs from Invesco India and Nippon India.

These funds have delivered strong 1-year and 3-year returns, and also provide sector-wise diversification. Whether you are looking for the best PSU ETF, the best silver ETF, or the best midcap ETF, the Indian ETF market now offers good options with lower cost and better liquidity.

The Best ETF in India 2026 includes Nippon India Silver ETF, Nippon India ETF Gold BeES, Mirae Asset NYSE FANG+ ETF, Kotak Nifty PSU Bank ETF, and ICICI Prudential Nifty Midcap 150 Etf for growth potential. However, it depends on your financial goals and risk tolerance.

The best-performing ETFs in the last 10 years include Motilal Oswal Nasdaq 100 ETF, Invesco India Gold ETF, Nippon India ETF Gold BeES, Nippon India ETF Nifty 50 BeES, and UTI S&P BSE Sensex ETF, which have given the best returns with stability.

Check the complete list of Best Gold ETFs to invest. Nippon India ETF Gold BeES and Invesco India Gold ETF remain top choices in 2026.

Nippon India Silver ETF is the best silver ETF in India, providing a massive return of 162.47% in the last 1 year. This fund aims to replicate the performance of silver prices, offering investors an opportunity to gain exposure to this precious metal without holding physical silver.

HDFC NIFTY Smallcap 250 ETF is the smallcap ETF in India. It tracks the NIFTY Smallcap 250 Index, providing investors with exposure to a diversified range of small-cap stocks.

To invest in ETFs in India, you need a demat and trading account with lakshmishree. You can then buy and sell ETFs directly through the stock exchange, just like regular stocks.

ETF investments are subject to capital gains tax upon sale or redemption. Short-term gains are taxed at the investor's income tax rate.

ETFs carry market risks, liquidity risks, tracking errors, and sector concentration risks. It can further result in volatility in prices, inability to buy or sell shares, or tracking error versus the Index.

Disclaimer: This article is intended for educational purposes only. Please note that the data related to the mentioned companies may change over time. The securities referenced are provided as examples and should not be considered as recommendations.