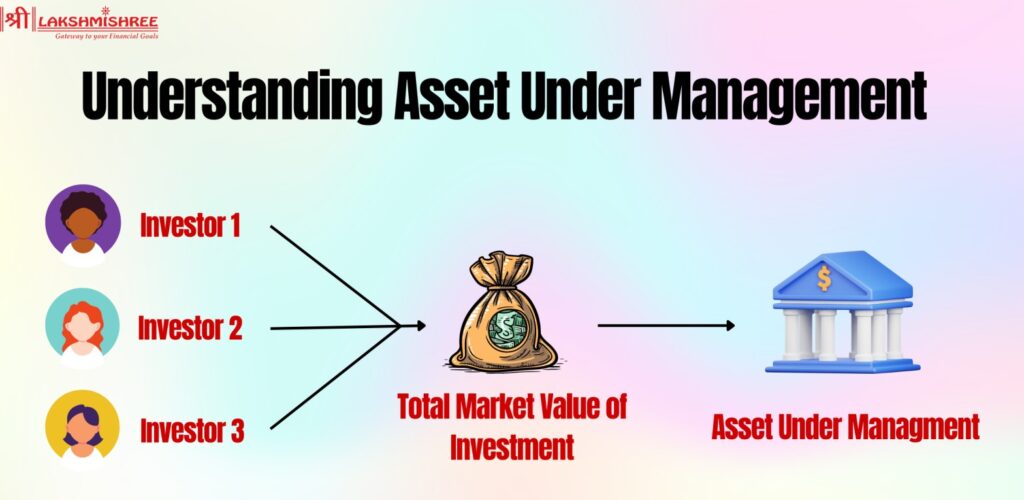

When investors ask about ‘asset under management’ (AUM), they seek to understand the total market value of the assets that a financial institution or mutual fund manages and, importantly, why it matters. A higher AUM may indicate a fund’s growth potential and stability, influencing investment decisions. In this guide you will learn about What is AUM in Mutual Funds, their components, and their fluctuating nature, expounding why a thorough grasp of AUM is instrumental for anyone navigating the complex world of investments.

[ez-toc]

Assets under management(AUM) represent the total market value of a mutual fund company's assets, including the mutual fund’s portfolio. This encompasses everything from investments in stocks and bonds to cash reserves and other financial assets.

A larger AUM often signifies a more established and potentially trustworthy mutual fund, which can attract further investor interest. It reflects a fund's ability to pool a significant amount of capital from various investors, which can then be utilized to secure a more diversified portfolio, potentially leading to reduced risks and improved returns. Moreover, a sizable asset can indicate the fund's market success and capacity to sustain operational efficiencies.

With a broad base of assets, these funds can negotiate lower transaction fees and better access to high-quality investment opportunities. Additionally, a large asset management can imply investor confidence in the fund's management team and investment strategies, often supported by a track record of strong performance and robust risk management practices.

Therefore, while AUM in Mutual funds should not be the sole factor in making investment decisions, it is a significant indicator of a mutual fund's scale and the trust placed in it by the investing community.

It isn’t just a single number; it’s a composite of several components. One is a financial institution's various investments, such as stocks, bonds, and other financial assets. These investments are integral to a fund’s AUM, contributing to its total market value.

Another key component of AUM is the cash reserves held by the financial institution. Additionally, the market value of securities is a dynamic component that reflects current market conditions, valuations, and the performance of underlying investments.

Market movements directly affect assets, with positive market performances leading to an increase and negative performances causing a decrease in Assets under management.

But market movements aren’t the only factor at play. Investor inflows and outflows are primary drivers of AUM changes. Investor inflows refer to the new capital coming into the fund from investors, and outflows, indicating the withdrawal of capital by investors, are primary drivers of changes. These cash movements and market performance issues directly influence whether a fund may experience growth through higher inflows or shrinkage due to greater outflows.

Managing these fluctuations is critical, and strategies such as diversifying investments and regular portfolio rebalancing can help achieve a more stable management. Financial advisors often recommend these approaches to their clients.

Calculating Assets Under Management involves considering three key components: investor inflows, outflows, and the market price of the fund's assets. To begin, the number of shares or units held by investors is multiplied by the current market price of each share or unit. This multiplication yields the total value of assets under management.

For instance, if a mutual fund scheme has 10,000 shares outstanding and the current market price per share is ₹50, the AUM would be ₹500,000 (₹50 * 10,000 shares).

This method helps determine the total value of assets the fund manages. It's essential to note that its calculations can be conducted on various timeframes, such as daily, monthly, or annually, depending on the requirements and practices of the managing institution.

Formula: AUM = Number of Shares or Units * NAV

Example: Consider a mutual fund with 20,000 units outstanding and a current market price per unit of ₹75. To calculate the AUM: AUM = 20,000 units * ₹75 per unit = ₹1,500,000

Example 2: Let's say another mutual fund has 15,000 shares outstanding and a current market price per share of ₹100. The AUM would be ₹1,500,000 (₹100 * 15,000 shares).

Asset under management is a critical metric for mutual funds, influencing their strategy, performance, and investor appeal. However, the impact of it varies among different types of mutual funds, with equity funds, debt funds, and small-cap funds each responding differently to changes in mutual fund schemes.

Equity funds invest in stocks and other equity securities, with their AUM affecting operational efficiency and potential investor returns.

Regarding equity funds, AUM isn’t as important as performance consistency. These funds rely less on AUM and more on the asset manager’s expertise to improve returns.

The success of an equity fund isn’t determined by its AUM alone but by its consistency of returns and compliance with its investment aim. The performance of large-cap funds doesn’t primarily depend on asset management, as market yields more influence them.

Debt funds primarily invest in fixed-income securities such as bonds and treasury bills, with larger assets often leading to lower expense ratios and potentially higher returns for investors.

In contrast to equity funds, a larger AUM can be advantageous for debt funds managed by a reputable fund house. With a larger pool of assets, the total expense ratio, the cost to manage and operate the fund, is distributed across a wider base of investors. This leads to a lower per-investor expense ratio.

In simpler terms, the fixed costs of running the fund are spread out over more investors when the AUM is substantial, which can improve the individual returns for each investor. Thus, the larger the assets, the more benefit each investor potentially gains regarding reduced costs and enhanced returns.

Small-cap funds focus on investing in companies with small market capitalizations, with their AUM impacting their ability to navigate market volatility and potentially influencing company decisions and market dynamics.

Small-cap funds, including hedge fund investments, present a unique case for Assets under management. When the assets of these funds grow significantly, they can be negatively impacted, especially if the mutual fund company or fund houses become major shareholders of a specific company. This can lead to potential conflicts of interest and influence over the company’s decisions.

On the other hand, funds with smaller assets to manage may have greater flexibility to pursue diverse investment opportunities and potentially higher returns in a mutual fund scheme. During market uncertainty, small-cap funds prefer investing through Systematic Investment Plans (SIPs) to avoid restrictions on cash inflows and difficulty trading shares if they become significant stakeholders in a company.

While Asset Under Management and Net Asset Value (NAV) are both crucial to understanding mutual funds, they represent different aspects of fund valuation. NAV reflects the per-unit value of a fund’s assets minus its liabilities, while AUM signifies the total market value of all assets managed by mutual fund houses, including cash.

Despite common misconceptions, these two metrics are not the same. NAV is essentially the unit price for purchasing shares within a mutual fund which depends on the performance of the fund's underlying assets. In contrast, assets under management reflect the overall size and market influence of the fund.

| Aspect | Assets Under Management | Net Asset Value |

|---|---|---|

| Definition | The total value of the fund's assets minus liabilities, divided by the total number of outstanding shares | The total value of the fund's assets minus liabilities, divided by total number of outstanding shares |

| Calculation | The total market value of assets managed by a fund | The per-share value of a mutual fund's assets |

| Scope | The sum of all market values of the fund's investments | Indicates the value of a single share |

| Frequency | Periodically updated | Calculated daily |

| Importance | Reflects the overall size and growth of the fund | Reflects the fund's market presence and investor base |

| Use | Useful for comparing fund sizes and industry trends | Determines the value of an investor's holdings in the fund |

In India, the size of a mutual fund's Assets Under Management (AUM) plays a big role in determining the fees investors pay. Let's break it down:

Understanding the significance of Assets Under Management is pivotal when selecting mutual funds. However, Investors must grasp that a higher AUM doesn't always guarantee superior returns.

While it is a vital metric for assessing a fund's performance, Investors should also consider other critical factors such as investment objectives, historical performance, and the fund manager's expertise. These aspects collectively contribute to the fund's overall success and align with the investor's financial goals.

Moreover, although a larger AUM may signal stability and credibility in the fund, Indian investors should be mindful of potential drawbacks. For instance, as the fund's size increases, the fund manager may encounter challenges in efficiently deploying capital, potentially affecting the fund's ability to outperform the market. Indian investors must carefully weigh these factors when evaluating mutual funds for their investment portfolios.

Investors should also recognize that a larger asset can offer certain advantages. For example, funds with substantial AUM may benefit from economies of scale, allowing them to negotiate better deals and access exclusive investment opportunities. Additionally, a larger asset to manage can enhance the fund's visibility and attract more institutional investors, further bolstering its market presence and potentially leading to improved performance over time.

AUM volatility means the it goes up and down a lot. When this happens, it can be tough for fund managers to deal with certain types of investments. Some assets, like ones that can't be easily turned into cash without losing value, become tricky to manage during these times.

But here's the thing: when a fund has a lot of assets under management, it's better prepared to handle big withdrawals from investors. This means the fund can stay stable even when investors want to take out a lot of money.

Having a bigger asset to manage also gives fund managers more flexibility. They can make smarter decisions about when to enter or exit the market, which helps them deal better with ups and downs in the market. So, while AUM volatility can be tricky, having a large assets to manage can be an advantage for fund managers.

As an investor, Look for funds with a track record of effectively managing AUM volatility. Additionally, consider the fund's investment strategy and whether it aligns with your risk tolerance and investment goals. Finally, keep an eye on the fund's performance relative to its peers and benchmark indices to gauge its ability to generate returns consistently over time.

Active investing involves actively managing a portfolio to outperform the market through frequent buying and selling based on market analysis. Passive investing aims to replicate market index performance by investing in index funds or ETFs, minimizing costs with a buy-and-hold strategy.

Passive and active investing strategies impact AUM in different ways. Passive funds, known for their straightforward investment approaches and lower fees, have seen significant growth, with a 31% increase in AUM over the previous year. The growing popularity of passive funds is due to their simpler investment structures and lower costs, which have positively impacted their assets.

Active investing has the potential to generate higher returns, which can attract more clients. As a result, this can lead to an increase in assets under management.

For more clarification, consult financial advisors or a popular stock brokerage firm like Lakshmishree to make an informed decision.

In conclusion, understanding the role of AUM in mutual funds is essential for investors looking to make informed investment decisions. AUM is a crucial metric for evaluating a mutual fund's size, stability, and market presence. While a higher assetmanagement can indicate trust and confidence in a fund, investors should consider other factors such as performance consistency, investment objectives, and fund manager expertise.

AUM stands for Assets Under Management, which refers to the total market value of a mutual fund's assets, including stocks, bonds, cash reserves, and other financial assets.

The AUM fluctuates due to market movements, investor inflows and outflows of funds, and portfolio management strategies.

The difference between AUM and NAV is that AUM represents the market value of all assets managed by mutual fund houses. At the same time, NAV reflects the per-unit value of a fund's assets minus its liabilities. Therefore, AUM provides an overall view of a fund's size, while NAV indicates the value per unit.

AUM impacts mutual fund fees by influencing the expense ratio, calculated as a percentage of asset under management. As a mutual fund gathers more assets, it can spread its fixed costs across a larger investor base, potentially lowering individual expenses.

When selecting a mutual fund scheme, it's important to consider AUM, investment objectives, past performance, and the fund manager's expertise, as it provides insight into the fund's size and popularity. A larger assets to manage may reflect a fund's ability to leverage economies of scale, potentially offering lower operating costs per investor and more significant bargaining power with service providers.