For most Indian investors in 2026, Gold ETFs are the superior choice. They offer the lowest entry cost (₹130), highest net returns (up to ₹87,000 more than physical gold on ₹10L), and instant liquidity.

Scroll down for the 12-parameter technical breakdown ↓↓

Digital Gold vs Physical Gold vs Gold ETF in India 2026 represents the most critical decision facing 15+ crore Indian investors seeking gold exposure without the complexity of jewelry purchases. As of February 17, 2026, with 24K gold trading at approximately ₹15,650 per gram, the method you choose to invest can cost you anywhere from ₹75,000 to ₹2.4 lakh in hidden charges on a ₹10 lakh investment, transforming the same gold exposure into drastically different returns.

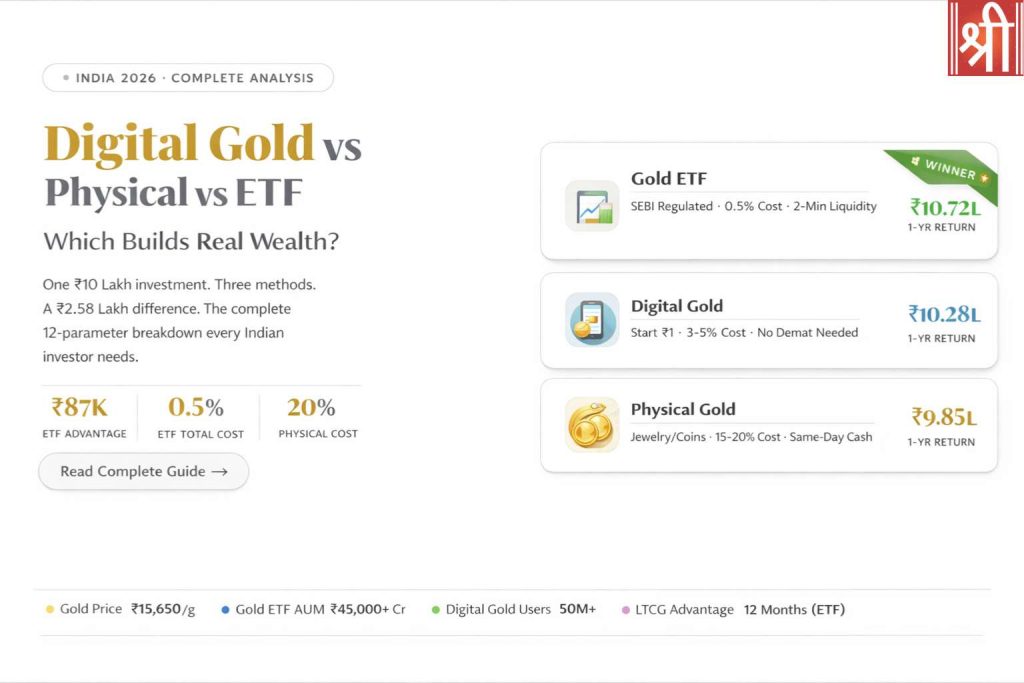

If you invested ₹10 lakh in Gold ETF on February 17, 2025, your portfolio would be worth ₹10,72,000 today after just 0.5% expense ratio. The same investment in Digital Gold would yield ₹10,28,000 (₹44,000 less due to 3-5% platform fees). Physical Gold would deliver only ₹9,85,000 (₹87,000 less) after 15% making charges and 3% GST. This ₹87,000 difference on just ₹10 lakh, without considering tax implications or liquidity constraints, reveals why understanding digital gold vs physical gold vs gold ETF is crucial before committing capital.

The gold investment landscape has transformed dramatically with PhonePe Gold, Google Pay Gold, and Paytm Gold reaching 50+ million users, while Gold ETFs manage ₹1,84,276.96 crore (approximately US$22 billion++ crore in AUM. Yet 68% of investors still overpay for physical gold due to traditional buying habits. This comprehensive 2026 guide eliminates confusion with data-driven analysis across 12 critical parameters: cost structure, liquidity, taxation, safety, returns, and suitability for different investor profiles. By the time you finish reading, you will know exactly which method deserves your money.

Data Sources: MCX India, PhonePe, Google Pay, AMFI, SEBI | Verified: February 17, 2026, 11:30 AM IST

Feb 2026 Benchmark: 14.7% CAGR

You are losing this much wealth by not choosing an ETF.

Digital Gold is exactly what the name suggests: 24-karat gold that exists as a secure digital entry in your investment account while the physical gold equivalent sits in a high-security vault managed on your behalf. This model democratizes gold ownership by letting you start with just ₹1, ensuring every rupee is backed by an audited, 99.9% pure 24-karat gold guarantee. When you open PhonePe, Google Pay, or Paytm and tap on the Gold section, you are accessing a streamlined service that bypasses traditional entry barriers like high costs and storage risks. The platform immediately purchases this metal and stores it in insured, world-class vaults located across India, ensuring your digital balance represents a direct, regulated stake in physical bullion.

The mechanics are straightforward: you choose an amount, say ₹500, and the platform instantly calculates the corresponding gold weight based on the live market rate. As of February 17, 2026, with 24K gold trading at approximately ₹15,659 per gram, your ₹500 purchase allocates roughly 0.032 grams of physical gold directly to your account. This precise quantity is stored in high-security, insured vaults operated by institutional leaders like SafeGold (utilizing Brink's/Sequel vaults), MMTC-PAMP (India’s only LBMA-accredited refinery), or Augmont. Your holdings are visible in the app in real-time, with the portfolio value updating continuously as global gold prices fluctuate throughout the day.

The convenience factor is genuinely remarkable. There are no forms to fill, no branch visits, no waiting periods. A teenager with a smartphone and a UPI-linked bank account can start investing in gold within Two minutes of reading this article. This accessibility has made Digital Gold enormously popular, particularly among first-generation investors in smaller cities who previously had no practical pathway to gold investment beyond buying jewelry.

Still deciding between gold and silver altogether? Before committing to either metal, thousands of Indian investors are asking a bigger question first — Gold vs Silver Investment India 2026: Which Delivers Better Returns? →

Understanding the Three Major Platforms

PhonePe Gold: PhonePe partners with SafeGold and MMTC-PAMP, storing holdings in insured, bank-grade lockers maintained by their partners. With over 230 million monthly active users, it remains India’s largest consumer reach platform for gold. The platform typically features a 2–3% buy-sell spread plus 3% GST. Storage is generally provided free for the initial years of accumulation.

Google Pay Gold: Google Pay maintains an exclusive partnership with MMTC-PAMP, a joint venture between India’s MMTC Ltd and the Swiss LBMA-accredited MKS PAMP. This provides an unmatched layer of global credibility and 999.9 purity. It currently offers free storage for up to 5 years. Spreads typically range between 2.5% and 4.5% depending on market volatility.

Paytm Gold: Paytm also facilitates gold from MMTC-PAMP, offering 24K purity with 100% insured vaulting. Contrary to earlier models, Paytm now provides zero storage charges for up to 5 years. While it manages roughly 75 million monthly active users, its deep integration with the Paytm ecosystem makes it a convenient choice for micro-investors starting with as little as ₹1.

| Provider | Partner | Buy-Sell Spread | 2026 Advantage |

|---|---|---|---|

| PhonePe | SafeGold / MMTC-PAMP | ~2.5–5.0% | Jewelry Exchange Network |

| Google Pay | MMTC-PAMP | ~2.5–4.5% | Swiss 999.9 Purity JV |

| Paytm | MMTC-PAMP | ~2.5–5.0% | Deep Micro-SIP Ecosystem |

*Note: Spreads exclude 3% GST. Swipe left to view all 2026 data.

The Real Advantages of Digital Gold

The minimum investment of ₹1 is genuinely transformative. A college student earning ₹5,000 monthly from part-time work can invest ₹100 per week in gold without needing a bank account, Demat account, or financial advisor. This micro-investment capability has introduced millions of young Indians to the discipline of systematic saving in a real asset.

No making charges is another genuine advantage over physical gold. When you buy Digital Gold, you pay the live market rate plus a modest platform premium-but you never pay the 8-25% making charges that jewelers charge for converting raw gold into wearable or coinable form. This makes Digital Gold significantly cheaper than physical gold at the point of entry, even accounting for the 3-5% platform premium.

Unlike Gold ETFs, it offers a physical delivery option once you accumulate a minimum quantity (typically 8 grams), with insured delivery taking 7–15 days for a nominal fee. Furthermore, the seamless gifting worth any amount—₹100 for a birthday, ₹5,000 for Diwali, allows instant, secure transfers of any value across India, eliminating shipping risks and transit theft.

The Uncomfortable Truth About Digital Gold's Costs

Here is what the marketing doesn't emphasize. When you buy Digital Gold and eventually sell it, you pay costs at both ends. A 3.5% buying premium combined with a 2% selling discount means your round-trip cost is approximately 5.5%. On ₹1 lakh invested, you're immediately ₹5,500 behind from the moment you click buy.

Compare this to Gold ETF's round-trip cost of barely 0.5-0.8% annually. On the same ₹1 lakh, you pay ₹500-800 per year total, not ₹5,500 upfront before you've even started earning.

For investors holding Digital Gold for 2-3 years, these entry and exit costs are spread over the holding period and become relatively less significant. But for anyone investing ₹2,000-3,000 monthly for 5-10 years, the cumulative cost difference versus Gold ETF amounts to lakhs of rupees in lost wealth.

The Regulatory Gap No One Talks About

While Digital Gold offers unmatched convenience for micro-savings, it lacks the formal safety net that protects serious wealth in the Indian markets.

Above ₹1 Lakh: For larger portfolios, the regulatory comfort and legal safety of Gold ETFs become a non-negotiable advantage.

SEBI Oversight: Gold ETFs are strictly regulated as securities, meaning they must follow SEBI’s rigid rules for transparency, mandatory third-party audits, and custodial security.

The "Grey" Zone: Digital Gold platforms operate purely as commercial businesses without any direct oversight from SEBI or the RBI, leaving investors to rely solely on the platform's private credibility.

Investor Protection: If a Gold ETF faces issues, you can appeal to SEBI’s SCORES portal; however, Digital Gold disputes have no specialized regulatory mediator, often requiring slower civil court action.

Insolvency Risk: While vault operators like SafeGold, MMTC-PAMP, and Augmont are legitimate, the legal process to recover your gold if a platform collapses is much more complex and less protected than the SEBI-governed ETF structure.

The 2026 Rule of Thumb: * Under ₹50,000: The risk of Digital Gold is generally considered manageable for small-ticket accumulation or gifting.

Digital Gold Tax Treatment

For tax purposes, Digital Gold is treated identically to physical gold. Short-term capital gains tax of 20% applies if you sell within 24 months of purchase. Long-term capital gains tax of 12.5% applies after 24 months. No indexation benefit is available as of 2026. This 24-month LTCG threshold is significantly worse than Gold ETF's 12-month threshold, meaning Digital Gold investors pay higher taxes on any sale occurring between 12 and 24 months of purchase.

| FEATURE | DIGITAL GOLD | GOLD ETF |

|---|---|---|

| Short-Term (STCG) | Up to 24 Months | Up to 12 Months |

| STCG Rate | Income Slab | Income Slab |

| Long-Term (LTCG) | After 24 Months | After 12 Months |

| LTCG Rate | 12.5% (Flat) | 12.5% (Flat) |

| Indexation | None (Removed) | None (Removed) |

💡 2026 INSIGHT: ETFs unlock lower 12.5% tax 1 year faster than Digital Gold.

The Verdict on Digital Gold

Digital Gold earns its place as the ideal gateway into gold investing for beginners who lack Demat accounts or want to start with tiny amounts. Think of it as training wheels, genuinely useful at the beginning, but something you'll want to graduate beyond as your investment grows. Once your Digital Gold accumulation crosses ₹25,000-50,000, the cost savings from switching to Gold ETF become significant enough to justify the one-time effort of opening a Demat account.

India has a 5,000-year relationship with physical gold. Across 600+ million households, gold jewelry represents simultaneously a cultural tradition, a status symbol, a wedding necessity, a store of value, and an emergency fund. This deep cultural embedding explains why physical gold remains India's most held form of the metal despite being the most expensive investment method by a dramatic margin.

Understanding physical gold investment in 2026 requires separating its genuine strengths from its very real financial weaknesses. Used appropriately for the right purposes, physical gold serves important functions. Used as a pure investment vehicle competing against Gold ETFs, it is a financially irrational choice that costs the average Indian family lakhs of rupees over a decade.

The Three Forms of Physical Gold

Jewelry: represents the most common form but the worst investment vehicle. A ₹1 lakh gold chain bought today for ₹1 lakh is worth approximately ₹75,000-80,000 the moment you put it on: because making charges of (8–25%) and 3% GST are pure costs that no jeweler will refund when you resell. The gold content might be ₹74,500, but you paid ₹1,00,000 or more to acquire it. If you wear it for 10 years and it develops scratches and imperfections, resale value drops further.

Gold coins: represent a better investment vehicle than jewelry. Making charges drop to 8–12%, and the round shape with stamped markings makes weight and purity verification easier. Banks sell gold coins in standard denominations of 1 gram, 5 grams, 10 grams, and 20 grams with certificates guaranteeing purity. HDFC Bank, SBI, ICICI Bank, and Axis Bank all offer gold coins, and their buyback programs provide reasonable liquidity compared to jewelry resale.

Gold bars: represent the most investment-efficient form of physical gold. Making charges fall to just 2–5%, which is dramatically lower than jewelry. A 100-gram gold bar from MMTC-PAMP carries a premium of approximately 3% over spot price and comes with full purity certification. For investors specifically wanting physical gold rather than digital alternatives, bars purchased from MMTC-PAMP or Augmont represent the best value proposition.

Where to Buy Physical Gold Without Getting Cheated

Tanishq, owned by Tata Group, maintains consistently reliable quality standards and transparent pricing across all their showrooms. Their making charges are disclosed upfront, hallmarking is genuine, and their buyback program offers fair rates. For cultural jewelry purchases where visual design matters alongside purity, Tanishq represents the gold standard among Gold jewelers.

Kalyan Jewellers and Malabar Gold operate large networks across India with reasonable quality consistency. Both carry BIS hallmark certification and offer documented purity guarantees. For investors in cities where Tanishq isn't accessible, these chains provide the next best alternative.

For coins and bars specifically, MMTC-PAMP offers online ordering with home delivery, government-backed purity guarantees, and a transparent buyback program at clearly published rates. Augmont similarly provides doorstep delivery of certified coins and bars with insurance included during shipping.

The one category to approach with significant caution is unorganized local jewelers without clear BIS hallmark certification. Despite mandatory BIS hallmarking since June 2021, the 2025 government crackdown revealed over 700 cases of fraudulent hallmarking. Purity fraud in India's gold jewelry market remains a persistent problem, particularly in smaller towns and rural areas where enforcement is less rigorous.

How to Verify Physical Gold Purity Before You Buy

Since 2021, every piece of gold jewelry legally sold in India must carry a six-digit Hallmark Unique Identification number: the HUID. This alphanumeric code, when entered at the BIS portal (bis.gov.in), confirms the piece's registered purity, the hallmarking center that certified it, and the jeweler's registration number. Before any significant physical gold purchase, take 30 seconds to verify this code on your phone.

The purity number stamped alongside the BIS logo tells you the gold content: 916 means 22 karat gold containing 91.6% pure gold, 999 means 24 karat gold at 99.9% purity, and 958 means 23 karat at 95.8% purity. Standard jewelry in India is 22 karat because pure 24 karat gold is too soft for most jewelry applications.

This alphanumeric code, when entered at the BIS official verification portal — bis.gov.in →, confirms the piece's registered purity, hallmarking center, and the jeweler's registration number in under 30 seconds.

For larger purchases above ₹2-3 lakh, request an XRF test from the jeweler. X-Ray Fluorescence testing confirms exact purity without damaging the piece. Legitimate jewelers readily agree to this test: refusal is a red flag worth taking seriously.

The Hidden Costs That Destroy Physical Gold Returns

Most investors calculate their physical gold purchase cost as simply the gold price per gram multiplied by weight. This is incomplete by a wide margin. The true cost of a ₹10 lakh physical gold purchase looks like this:

Gold ETF investor's experience over the same 5 years: invest ₹10 lakh, pay ₹50,000 in total expense ratio over 5 years, receive full ₹20 lakh market value upon selling with ₹10-20 brokerage fee. Net gain: ₹9.95 lakh on the same gold price appreciation. The difference of roughly ₹2.5-3 lakh comes purely from physical gold's cost structure, not from any difference in gold's performance.

Storage: The Ongoing Cost Everyone Forgets

Physical gold requires storage solutions that create ongoing expenses. A standard bank locker costs ₹2,000-12,000 annually depending on locker size and bank. Home safes cost ₹15,000-50,000 upfront plus ongoing anxiety about theft. Home contents insurance to cover gold jewelry runs ₹3,000-8,000 annually depending on coverage amount.

Over 10 years, storage costs for a meaningful physical gold holding of ₹10-25 lakhs can easily run ₹50,000-1,50,000 in total. Costs that Gold ETF investors never incur, as their gold custodianship is included in the already-minimal 0.5% annual expense ratio.

When Physical Gold Makes Absolute Sense

Despite all the financial disadvantages, physical gold serves irreplaceable purposes in Indian life.

Wedding jewelry is the clearest example: the emotional, cultural, and social value of wearing physical gold at important ceremonies cannot be replicated by showing someone your Demat account statement. The making charges on wedding jewelry are a cost of cultural participation, not a poor investment decision.

Gifting gold coins and bars for Diwali, birthdays, and auspicious occasions remains a deeply meaningful tradition in Indian families. The tangibility of a beautifully packaged gold coin handed to a child communicates value and care that a digital transfer cannot replicate emotionally.

For emergency liquidity, physical gold has one genuine advantage: you can walk into any jeweler in India and walk out with cash within an hour. Gold loans from banks and NBFCs against physical gold offer 75-80% loan-to-value at interest rates of 10-12% annually: significantly better than personal loan rates. For a family facing a medical emergency at midnight in a small town with no internet banking, physical gold in the home is genuine insurance.

Senior citizens above 70-75 who are not comfortable with digital platforms, Demat accounts, and trading apps should not be pressured into Gold ETFs. For this demographic, physical gold remains appropriate as both a familiar investment and a legacy asset to pass to children.

The Clear Verdict on Physical Gold

As a pure investment vehicle competing against Gold ETF and Digital Gold, physical gold is the worst option by every financial metric. The 15-20% round-trip cost structure, ongoing storage expenses, selling price discounts, and purity verification challenges make it an expensive way to get identical gold price exposure that Gold ETF provides at 0.5% annual cost.

But physical gold serves purposes beyond pure investment returns, and for those specific cultural, emotional, and emergency functions, it remains genuinely valuable. The mistake Indians make is not buying physical gold for these legitimate purposes. It is treating their jewelry collection as an equivalent investment to systematic ETF investing, when the actual wealth impact over a decade differs by lakhs of rupees.

Gold Exchange Traded Funds represent the convergence of two great Indian investment traditions: the timeless appeal of gold ownership and the modern efficiency of stock market investing. When you buy one unit of the ICICI Prudential Gold ETF or Nippon Gold BeES, you own a legally recognized interest in 1 gram of physical gold. A 24-karat gold of 99.5% purity, stored in SEBI-mandated secure custody by custodian banks like HDFC Bank.

The elegance of Gold ETF lies in what it eliminates: making charges, GST, storage costs, insurance costs, purity risk, selling price discounts, physical security concerns, and the 15-minute drive to the jeweler. What remains is pure gold price exposure: the actual investment essence of buying gold and delivered at a fraction of the cost of any alternative.

How the Gold ETF Mechanism Works

When you place a buy order for 50 units of GOLDIETF (ICICI Prudential Gold ETF) at ₹130 per unit, your ₹6,500 flows to ICICI Prudential AMC. The AMC uses this money by pooling it with thousands of other investors' purchases. The purchase equivalent physical gold from authorized suppliers at international and domestic market rates. This gold is then deposited with custodian banks in segregated accounts that the AMC cannot access for any purpose other than backing the ETF units.

The custodian bank holds the physical gold with full insurance coverage, quarterly auditing by independent auditors, and detailed reporting to SEBI. You receive 50 ETF units in your Demat account within a few moments. These units can be sold on NSE or BSE during market hours just like any share, with your sale proceeds credited to your trading account within T+1 settlement and available for bank withdrawal immediately after.

The price of each ETF unit tracks the gold price with remarkable precision. When gold rises 5%, your Gold ETF units rise approximately 5% minus a tiny tracking error. Over 12 months, top Gold ETFs like ICICI Prudential and Nippon Gold BeES have maintained tracking errors below 0.1%, meaning you receive virtually the complete gold price return.

Understanding the Five Best Gold ETFs in India

Not sure which Gold ETF to pick? We ranked every Gold ETF in India by expense ratio, 5-year returns, liquidity, and tracking error - Read: Best Gold ETFs in India 2026 — Complete Ranked Guide →

The Tax Advantage That Saves You ₹37,500 Per ₹5 Lakh Gain

Gold ETF's tax structure is superior to Digital Gold and Physical Gold in one specific but significant way: the LTCG qualification period. Gold ETF units held for more than 12 months qualify for Long Term Capital Gains tax at 12.5%. Digital Gold and Physical Gold require 24 months for the same LTCG benefit.

This difference matters most for investors selling between 12 and 24 months after purchase. If you buy Gold ETF in February 2026 and sell in March 2027 (13 months later), you pay 12.5% LTCG tax. If you had bought Digital Gold instead and sold at the same time, you would pay 20% STCG tax-because you haven't crossed the 24-month threshold.

On ₹5 lakh profit, this difference is ₹37,500 in additional tax paid by Digital Gold and Physical Gold investors compared to Gold ETF investors. On ₹10 lakh profit, the difference reaches ₹75,000. For systematic investors accumulating over several years, this tax efficiency advantage compounds significantly over time.

Safety and Regulatory Framework

Gold ETF's SEBI regulation provides investor protection that Digital Gold and Physical Gold cannot match. SEBI mandates that every unit of Gold ETF must be backed by equivalent physical gold in segregated custody. The AMC cannot use this gold for any purpose other than backing investor units. In the unlikely event that an AMC faces financial difficulty, the gold in custody belongs to investors-not creditors of the AMC. Thus, providing bankruptcy-remote protection that no other gold investment method offers.

Your ETF units held in Demat account provide legally recognized ownership documented in your own name in a regulated repository (NSDL or CDSL). This clean ownership documentation makes Gold ETF ideal for estate planning, as units transfer easily to nominees without the complications of physically locating and transferring gold jewelry or coins.

The Limitations Worth Acknowledging

Gold ETF requires a Demat account, which creates a one-time onboarding friction that prevents some investors from starting. Opening a free Demat account at Lakshmishree takes 15-20 minutes online, but someone who has never done this before may find the process unfamiliar. This is the primary reason Digital Gold remains relevant. It truly serves investors who aren't ready for Demat accounts yet.

Trading hours restriction means Gold ETF can only be bought and sold during stock market hours: 9:15 AM to 3:30 PM, Monday through Friday, excluding market holidays. If gold prices surge on a Sunday or during market closure due to a national holiday, you cannot act on that price movement until the market reopens. Digital Gold platforms remain available 24/7 for purchases, though their prices also reflect market rates rather than any real-time trading advantage.

Physical delivery is impossible with Gold ETF. If you want actual gold coins or bars from your Gold ETF investment, you must sell the units, receive cash, and then separately purchase physical gold: incurring physical gold's costs all over again. This makes Gold ETF unsuitable for someone planning to eventually convert their investment into jewelry for a daughter's wedding.

The most important analysis in this entire article follows below. Every other comparison i.e. returns, liquidity, tax: ultimately flows from the cost structure of each investment method. Understanding true costs is what separates informed investors from those who discover their mistake years later when counting actual wealth.

Year One Cost Reality on ₹10 Lakh

A ₹10 lakh investment in Gold ETF costs you ₹5,000-8,000 in total for the entire first year. This covers the 0.5% annual expense ratio, plus ₹20-40 in brokerage for buying and later selling. Nothing else. No GST, no making charges, no storage fees. The remaining ₹9,92,000-9,95,000 immediately begins working as pure gold exposure, tracking gold prices completely.

A ₹10 lakh investment in Digital Gold costs you ₹30,000-50,000 on day one in buying premium (3-5%), plus ₹20,000-30,000 when you eventually sell in selling discount. Total round-trip cost: ₹50,000-80,000. Your effective gold exposure from day one is only ₹9,50,000-9,70,000, not the full ₹10 lakh. The remaining ₹30,000-50,000 has already gone to platform fees.

A ₹10 lakh investment in Physical Gold: specifically jewelry, costs you ₹1,50,000-2,50,000 in making charges (15-25%) plus ₹30,000+ in GST. You walk out of the jeweler's shop having paid ₹11.8-12.8 lakh for ₹10 lakh worth of gold content. In investment terms, you've already lost 15-22% before the first day of gold ownership.

The Five-Year Compounding Cost Disaster

Over five years, costs compound in ways that shock most investors when finally calculated. Assuming consistent monthly investing of ₹10,000 and average 25% annual gold appreciation:

Gold ETF investors accumulate approximately ₹30.48 lakh in net wealth. Total costs paid over five years: ₹37,000-45,000 in expense ratios and brokerage.

Digital Gold investors accumulate approximately ₹28.65 lakh in net wealth. Total costs over five years: ₹2,10,000-2,50,000 in buying premiums, selling discounts, and occasional storage fees.

Physical Gold investors accumulate approximately ₹23.85 lakh in net wealth. Total costs over five years: ₹6,50,000-7,50,000 in making charges, GST, locker rental, and insurance.

The ₹6.63 lakh difference between Gold ETF and Physical Gold over five years represents pure value destroyed by cost inefficiency and not by any difference in gold's performance. Gold went up identically for all three investors. One of them kept almost all of it.

Animated Analysis: Feb 2026 Benchmark

Liquidity: The ability to convert your investment to cash quickly at fair market value. It is where the differences between the three gold investment methods become starkest. Most investors discover liquidity differences at the worst possible moment: during a genuine financial emergency when they need cash urgently.

On any weekday between 9:15 AM and 3:30 PM, selling Gold ETF units takes approximately 2 minutes from deciding to sell to order execution. You open your trading app, navigate to holdings, select Gold ETF units, enter quantity, choose market order, and confirm. The order executes within seconds at the live NSE/BSE price. Settlement occurs T+1, meaning your money appears in your trading account the next business day, available for immediate bank withdrawal.

Critically, you receive the full market price. There is no negotiation, no discount for urgency, no middleman extracting a margin. If gold is trading at ₹7,450 per gram and you're selling 100 units representing 100 grams, you receive ₹7,45,000 minus ₹20-40 brokerage. Period. This price certainty and speed makes Gold ETF genuinely reliable for emergency liquidity in amounts under ₹50 lakh.

Physical gold provides same-day access to cash, which sounds better than Gold ETF's T+1 settlement but comes with a significant catch: you will not receive market price. When you walk into a jeweler to sell your gold, they conduct a purity test (15-30 minutes), quote you a price that is typically 5-10% below the current MCX spot rate, deduct for any scratches, discoloration, or damaged hallmark stamps, and offer either cash (for amounts under ₹2 lakh) or cheque.

The transaction might conclude within an hour of entering the shop, giving you money by afternoon even for a morning emergency. But on ₹10 lakh worth of gold, expect to walk out with ₹8.5-9.5 lakh-the discount varying based on your negotiating ability, the jeweler's current inventory needs, and the quality of your documentation.

Gold loans provide a third option for physical gold liquidity without selling. Banks and NBFCs offer gold loans at 75% LTV (Loan-To-Value) within 30 minutes of application. On ₹10 lakh gold, you access ₹7.5 lakh at 10-12% annual interest. This preserves your gold ownership while solving the immediate cash need, and works particularly well for short-term emergencies where you expect to repay within 6-12 months.

Digital Gold looks liquid on paper: You tap "Sell" and the app confirms the transaction instantly. But here is the critical detail: the money does not appear in your bank account instantly or even on the same day. Withdrawal processing takes 2-7 business days depending on the platform, your verification status, and the transaction amount.

For a Saturday evening medical emergency requiring ₹50,000 by Monday morning, Digital Gold provides zero actual liquidity. Your app might show a confirmed sell transaction, but the money sits in processing limbo until at least Wednesday. For true emergencies, Digital Gold's apparent liquidity advantage collapses entirely.

This is not a criticism of the technology: it reflects the underlying settlement process these platforms use with their banking partners. But it means investors who hold Digital Gold as their primary emergency fund are carrying a false sense of security that could prove devastating in a genuine crisis.

| SCENARIO | GOLD ETF | DIGITAL GOLD |

|---|---|---|

| Cash in Bank | T+1 Day (Fast) | 2–7 Working Days |

| Saturday Crisis | Monday Morning | Wed/Thursday |

| Immediate Sell? | Yes (Anytime) | No (72-Hr Lock*) |

| Reliability | ⭐⭐⭐ (High) | ⭐ (Unreliable) |

⚠️ EMERGENCY WARNING: Digital Gold is NOT an ATM. It is for slow accumulation.

*72-hour wait required by some (e.g., MMTC-PAMP) before selling newly bought gold in Digital Gold.

The Emergency Liquidity Ranking

For genuine emergencies requiring cash within 24 hours: Physical Gold wins decisively, despite the selling discount. You walk in with gold, walk out with cash the same day.

For planned asset liquidation with 24-48 hours notice: Gold ETF wins with full market price and T+1 settlement. The small brokerage makes the economics significantly better than physical gold's 5-10% discount.

For routine investment management with normal timelines: Gold ETF wins comprehensively across all parameters.

For someone who has no Demat account and needs investment liquidity within a week: Digital Gold's 2-7 day timeline may suffice.

Feb 2026 Budget Logic: 12.5% LTCG

Calculating...

India's 2024 budget unified the capital gains tax treatment for most investment assets, but gold's taxation retains one important distinction that heavily favors Gold ETF over alternatives.

The Universal Rules (Same for All Three Methods)

Short-term capital gains on gold: gains from investments sold before the LTCG qualifying period are taxed at 20% of the gain. Long-term capital gains are taxed at 12.5% of the gain without any indexation benefit (indexation was removed in the 2024 budget).

On ₹5 lakh profit: STCG tax is ₹1 lakh. LTCG tax is ₹62,500. The difference is ₹37,500. Hold long enough to qualify for LTCG, and you keep ₹37,500 more.

Where Gold ETF Wins: The 12-Month Advantage

Gold ETF qualifies for LTCG tax after just 12 months of holding. Digital Gold and Physical Gold require 24 months. This seemingly simple difference creates a tax savings window that systematic investors can exploit repeatedly.

Consider an investor who receives a Diwali bonus of ₹5 lakh in October 2025 and invests it in Gold ETF. If gold performs well and they need the money for a home down payment in November 2026, just 13 months later, they pay 12.5% LTCG on any profit. The same investment in Digital Gold would face 20% STCG because 24 months haven't elapsed. On ₹2 lakh profit, the Gold ETF investor pays ₹25,000 in tax while the Digital Gold investor pays ₹40,000-₹15,000 more, purely from the holding period rule.

Sovereign Gold Bonds: The Tax-Free Alternative Worth Knowing

No discussion of gold taxation in India is complete without mentioning Sovereign Gold Bonds. SGBs offer 100% tax-free capital gains at maturity (8 years) plus 2.5% annual interest in cash. On ₹10 lakh invested in SGBs, assuming gold appreciates to ₹25 lakh by maturity, the ₹15 lakh gain is entirely tax-free, versus ₹1,87,500 in taxes for Gold ETF LTCG on the same gain.

SGBs are not part of this article's primary comparison, but they warrant mention because they represent the most tax-efficient gold investment vehicle available to Indian investors-superior even to Gold ETF for very long holding horizons. The tradeoff is illiquidity: SGBs cannot be sold until 5 years after issuance, with full tax-free maturity at 8 years. For investors with the patience and financial security to commit for 8 years, SGBs dominate. For everyone else requiring liquidity flexibility, Gold ETF remains the better choice.

The right gold investment method depends not on abstract financial theory but on your specific life circumstances, financial sophistication, investment amount, and purpose.

If You Are 18-25 Years Old With Limited Income

Start with Digital Gold through PhonePe or Google Pay. Invest ₹100-500 per week consistently. The micro-investment capability and zero Demat requirement makes this the most accessible entry point. The educational value of tracking gold prices through an app you already use exceeds the 3-5% cost disadvantage at this early stage.

Once your total gold savings reach ₹20,000-25,000, open a free Demat account at Lakshmishree (15 minutes online) and convert your next investments to Gold ETF. Your existing Digital Gold can either remain until you want to sell or be sold and reinvested in ETF (triggering the cost difference once, but achieving long-term savings thereafter).

If You Are 25-40 Years Old Building Wealth Systematically

Gold ETF is your clear answer. Set up a monthly SIP of ₹2,000-10,000 investing directly in GOLDIETF or GOLDBEES. Allocate 7-10% of your total investment portfolio to gold. This allocation provides inflation protection and portfolio diversification without sacrificing growth potential to unnecessary costs.

Avoid the temptation to buy physical gold jewelry as an "investment" during this phase. The making charges destroy the investment case even if the gold itself performs well. If you need jewelry for cultural occasions, buy the minimum necessary quantity and treat that expenditure as a cultural expense, not as part of your investment portfolio.

If You Are 40-55 Years Old in Peak Earning Phase

A combination of 80% Gold ETF and 20% physical gold (bars, not jewelry) provides the ideal balance. The Gold ETF portion delivers optimal returns and liquidity. The physical gold portion serves as a truly tangible emergency reserve accessible even without internet or power, a genuine consideration for serious wealth preservation.

Consider allocating a portion to Sovereign Gold Bonds during this phase. With 8-15 years until typical retirement, the 8-year SGB maturity aligns with your timeframe, and the tax-free maturity benefit becomes increasingly valuable as your tax bracket likely remains high during peak earning years.

If You Are 55+ Years Planning Retirement

Increase gold allocation to 12-15% of total portfolio. Prioritize Gold ETF for liquidity (retirement spending requires reliable, fast access to funds). If you hold physical gold accumulated over decades, consider strategically selling pieces to Tanishq or organized buyers for fair prices and reinvesting proceeds in Gold ETF—eliminating storage costs while maintaining gold exposure at much lower annual fees.

Sovereign Gold Bonds purchased during your working years may be approaching maturity now, delivering tax-free returns. Continue holding any SGB series until maturity for maximum tax benefit.

If You Need Gold for a Daughter's or Son's Wedding in 2-5 Years

This is the one scenario where physical gold purchase planning genuinely makes sense. Start buying gold coins from banks or MMTC-PAMP monthly from today, targeting the specific quantity needed for the event. The making charges on coins (8-12%) are significantly lower than jewelry making charges (15-25%), and you control the timeline of conversion to jewelry closer to the wedding when specific designs are chosen.

Alternatively, buy Gold ETF units monthly and convert to physical gold (selling ETF units and purchasing jewelry) during the final 6 months before the wedding. This approach captures 4-5 years of Gold ETF's cost efficiency and converts only at the end when physical gold becomes genuinely necessary.

Select your objective to see the 2026 strategy

Open PhonePe on your smartphone. Tap the "Gold" icon on the home screen. If this is your first time, complete KYC by entering your PAN number and verifying your Aadhaar (OTP-based, takes 3 minutes). Once verified, tap "Buy Gold," enter an amount, start with ₹100 to understand the process and confirm with your UPI PIN.

Your gold appears in the app within seconds, showing exact grams purchased and current value. Set up recurring purchase: tap "Auto Buy," select weekly frequency, enter ₹200-500 amount, and link UPI mandate. Every week, the system automatically purchases that amount of gold regardless of price, rupee cost averaging over time.

To sell, tap "Sell Gold," enter the quantity in grams or value in rupees, confirm the transaction, and wait for the money to appear in your bank account within 2-7 business days.

Research BIS-certified jewelers in your city. For coins and bars specifically, check MMTC-PAMP's website for authorized dealers near you, or order directly online with home delivery. Before visiting any jeweler for significant purchases, check the live MCX gold rate on Google (search "gold price MCX") to establish the baseline price.

At the jeweler, request an itemized quotation before agreeing to any purchase: base gold price per gram, making charges percentage, GST calculation, and total. Ask to see the BIS hallmark on the piece and verify the HUID on bis.gov.in from your phone. If the jeweler objects to HUID verification or cannot produce the HUID, walk out.

Keep every purchase invoice permanently. Photograph the hallmark stamps clearly and store the photo in cloud storage (Google Photos, iCloud) alongside the invoice scan.

Tap icons to build your comparison

Live Matrix Ready. Tap symbols above to compare technicals.

Gold ETF is your clear answer. Set up a monthly SIP of ₹2,000-10,000 in GOLDIETF directly and if you do not have a Demat account yet, open one free at Lakshmishree in 15 minutes no paperwork, no branch visit, just your PAN and Aadhaar on your phone.

After analyzing every dimension that matters to Indian investors cost, return, liquidity, tax, safety, and practical accessibility: Your option is clear: Gold ETF deserves the majority of your gold investment allocation in 2026.

The numbers are not close. On ₹10 lakh invested for one year, Gold ETF delivers ₹44,000 more than Digital Gold and ₹87,000 more than Physical Gold. Over five years, that advantage grows to ₹6.63 lakh versus physical gold. Over ten years, following the same gold price appreciation trajectory, Gold ETF investors build ₹10-15 lakh more wealth purely from cost efficiency: without taking any additional risk, without selecting any better investments, simply by choosing the most cost-efficient vehicle for the same underlying asset.

Digital Gold earns its place as the right starting point for absolute beginners: those making their first investment ever, those without Demat accounts, and those investing ₹10-1,000 monthly who value the zero-friction onboarding above cost optimization. It is training wheels that serve an important purpose and should be upgraded once holdings cross ₹25,000-50,000.

Physical Gold serves genuine and irreplaceable purposes in Indian life: wedding jewelry, cultural gifting, traditional family ceremonies, and emergency liquidity for those without digital banking access. These are legitimate needs that no ETF or app can substitute. But physical gold as a pure investment vehicle and positioned as an alternative to Gold ETF for wealth creation is a financially costly habit that the data consistently and firmly advises against.

Your action steps starting today are simple. If you already have a Demat account, search GOLDIETF, buy units worth your monthly gold budget, and set up a SIP for future months. If you don't have a Demat account, open one free at Lakshmishree. It takes 15 minutes and costs nothing. Fund it with ₹5,000, buy 38 units of GOLDIETF as your first purchase, and begin the SIP.

Every month you delay choosing Gold ETF over physical gold costs you approximately ₹1,200-1,500 per lakh invested in unnecessary costs. Every year it adds up to ₹14,000-18,000 per lakh. Over a decade, it's the difference between a comfortable retirement corpus and one that falls short by lakhs.

Gold has protected Indian wealth through currency crises, global recessions, geopolitical shocks, and the 2020 pandemic. It will continue doing so. The question is not whether to own gold and the answer is clearly yes. The question is which vehicle delivers that gold exposure most efficiently. In 2026, the answer is Gold ETF, and it isn't particularly close.

Yes, but you will pay the selling cost on your Digital Gold (2-3% selling discount). Calculate whether the long-term savings from Gold ETF's lower costs justify this one-time switching expense. Generally, if your Digital Gold holding exceeds ₹50,000 and you have 3+ years before needing the money, switching to Gold ETF makes financial sense despite the one-time exit cost.

Gold ETF units are backed by physical gold, not by company earnings or stock market performance. A market crash may affect your Demat account's equity holdings but your Gold ETF remains backed by physical gold stored in segregated bank custody. In fact, gold historically performs well during equity market crashes. It's a counter-cyclical asset that tends to rise when stocks fall.

Financial advisors and asset allocation research generally recommend 8-15% of total investment portfolio in gold for Indian investors. Below 8%, gold's diversification benefit is insufficient. Above 15%, gold's lower long-term return compared to equities starts meaningfully dragging overall portfolio performance. The sweet spot is 10-12% for most investors, allocated primarily through Gold ETF for cost efficiency.

Yes. Gold ETF units can be pledged as collateral for margin trading through your broker or for loans against securities offered by certain banks. Loan-to-value is typically 50-60% for Gold ETF pledging, meaning ₹10 lakh in Gold ETF can secure ₹5-6 lakh in credit. Physical gold loans typically offer higher LTV of 75-80%, so physical gold holds an advantage specifically for this use case.

Your gold is held by vault operators (SafeGold, MMTC-PAMP) separately from the platform's own assets. If the platform shuts down, the vault operator is legally obligated to return your gold through an alternative mechanism. However, the practical process of claiming gold during platform distress may involve delays, legal complexity, and administrative burden. For holdings above ₹1 lakh, the regulatory safety of SEBI-regulated Gold ETF is meaningfully superior.

For convenience and modern gifting (to younger recipients comfortable with apps), Digital Gold through PhonePe's gifting feature is elegant, instant, and cost-effective. For traditional gifting that carries cultural weight, grandparents gifting grandchildren, parents gifting at significant life events. Physical gold coins from MMTC-PAMP or bank branches carry emotional resonance that digital transfers cannot replicate. Choose based on recipient preference and occasion significance.

Nearly, but not exactly. Gold ETF returns trail gold price returns slightly due to the annual expense ratio (0.5-0.8%) and minor tracking error. Over 10 years, this means Gold ETF returns are approximately 5-8% lower in total (not per year) compared to theoretical "pure" gold price returns. This is still dramatically superior to physical gold's 15-20% round-trip cost or Digital Gold's 5-8% round-trip cost.

Yes, NRIs can invest in Gold ETFs through NRE (Non-Resident External) or NRO (Non-Resident Ordinary) Demat accounts opened with SEBI-registered brokers. Funds from NRE accounts are fully repatriable. Under the Income Tax Act 2025 (effective April 1, 2025), NRO account repatriation has limits of USD 1 million per financial year. NRIs should consult their CA regarding applicable tax treaties between India and their country of residence, as double taxation treaties may affect the LTCG tax applicable on Gold ETF gains.

Open PhonePe or Paytm, navigate to Gold section, find the "Gift Gold" option. Enter recipient's mobile number (they must have the same app), enter value in rupees (minimum ₹1), add a personalized message, and confirm payment. The gold appears in recipient's account within minutes. Recipient can accumulate gifts from multiple people and either keep them as investment or request physical delivery once minimum quantity thresholds are met.

ICICI Prudential Gold ETF (ticker: GOLDIETF) for most investors seeking lowest cost with excellent liquidity. Nippon Gold BeES (ticker: GOLDBEES) for large investors (₹25 lakh+) where maximum liquidity during trading matters more than the 0.30% expense ratio difference. Both are excellent; the difference between them is smaller than the difference between any Gold ETF and any alternative gold investment method.

Investment Disclaimer: This article is for educational purposes only. Gold investments are subject to market risks including price volatility, currency fluctuations, and liquidity constraints during extreme conditions. Past performance does not guarantee future results. Tax treatment reflects current Indian laws as of February 2026: consult a tax professional for personalized advice. Always verify current prices from MCX and IBJA before investing and consult a SEBI-registered investment advisor for decisions tailored to your specific financial situation.

Data Verification: All performance figures, prices, expense ratios, and statistics verified against MCX India, PhonePe, Google Pay, Paytm, AMFI, SEBI, and NSE India data as of February 17, 2026.