What if you could turn a single investment into a step toward financial freedom? Sounds exciting, right? In 2025, finding the best mutual funds for lumpsum investment is your golden ticket to achieving that dream. With countless options out there, this guide simplifies your journey, highlighting top-performing funds designed to grow your wealth while aligning with your goals.

Ready to unlock your investment potential? Let’s dive in!

Lump sum investments in mutual funds mean putting a large amount of money into a fund at once instead of spreading it out over several smaller payments. This type of investment is suitable for those who have a significant amount of money ready to invest and are looking for a way to grow this money over time. When you invest a lump sum, your money starts working for you all at once, potentially growing through the fund’s activities and the overall movements of the market.

For example, consider Priya, who got ₹10 lakh from a relative. After consulting with a stock broker like lakshmishree, she decides to invest the entire lump sum in a well-performing mutual fund that aligns with her goal of long-term capital growth. A mutual fund invests in a diversified portfolio to grow the lump sum investment over time, offering benefits like professional management and liquidity. Over the years, the market has had its ups and downs, but because Priya’s investment horizon is over 10 years, she stays invested. Over time, her initial investment grows significantly, showing the potential benefits of lump sum investing in mutual funds for those who can afford to wait out the market’s volatility.

Discover the top-performing mutual funds for lump-sum investment in 2025, selected based on their impressive 5-year returns. Our curated list features funds that offer a balance of growth potential and stability, helping you make informed decisions to maximize your wealth this year.

| 10 Best Mutual Funds(Lumpsum Investment) | 5Yr Return |

|---|---|

| 1. Invesco India Infrastructure Regular Fund | 261.9% |

| 2. Aditya Birla Sun Life PSU Equity Fund DG | 233.9% |

| 3. Parag Parikh Flexi Cap Fund DG | 201.2% |

| 4. SBI PSU Direct Plan-Growth | 198.4% |

| 5. JM Flexicap Fund Direct Plan Growth | 192.8% |

| 6. HDFC Flexi Cap Direct Plan-Growth | 174.2% |

| 7. HDFC Flexi Cap Direct Plan-Growth | 163.7% |

| 8. Nippon India Large Cap Fund DG | 142.4% |

| 9. Canara Robeco Bluechip Equity Fund DG | 125.7% |

| 10. Edelweiss Large Cap Fund DG | 121.4% |

Explore a detailed overview of the best mutual funds for lump-sum investment in 2025, including key metrics like expense ratios, NAV, and past returns. This guide will help you evaluate the top funds to make smart, data-driven investment decisions for sustained growth in the coming year.

Invesco India Infrastructure fund is one of the best mutual funds for lumpsum investment; targeted at capital growth, this fund invests primarily in stocks related to infrastructure. It is designed for investors looking to capitalize on the growth potential of India's infrastructure development.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 26.7 | 92.6 | 261.9 |

This mutual fund is designed to invest predominantly in Public Sector Undertakings (PSUs) across India. The fund seeks to capitalize on these entities' stability and growth potential by focusing on government-backed companies.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 9.6 | 121.6 | 233.9 |

This Flexi cap fund invests across market capitalizations and sectors, including a portion in international stocks. It is known for its value investing approach and aims for high-risk-adjusted returns.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 21.8 | 56.8 | 201.2 |

The SBI PSU Fund Direct Plan-Growth is the best SBI mutual fund for lumpsum investment; this mutual fund primarily invests in public sector undertakings (PSUs) across India. It focuses on companies that the government either partially or fully owns. Here are some key features of this fund:

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 20 | 130.1 | 198.4 |

Aiming to provide capital appreciation, this fund invests in a dynamically balanced portfolio across large, mid, and small-cap stocks. It's suitable for investors looking for diversified exposure within the equity market.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 28 | 86.2 | 192.8 |

This diversified fund invests across various market caps and sectors, aiming to offer flexibility and capital appreciation. It adjusts its portfolio based on market conditions and growth prospects.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 20.4 | 77 | 174.2 |

It is one of the best mutual funds for lumpsum investment; aiming to generate long-term capital growth, this fund primarily invests in large-cap stocks across various sectors. It's known for a robust portfolio that targets leading companies with a stable performance record.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 16.5 | 54.9 | 163.7 |

Aiming to generate long-term capital growth, this fund primarily invests in large-cap stocks across various sectors. It's known for a robust portfolio that targets leading companies with a stable performance record.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 16.1 | 65.2 | 142.4 |

This fund focuses on equity and equity-related securities of large-cap companies. With a strategy to invest in quality blue chip stocks, it seeks to offer investors sustainable returns over the long run.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 15.8 | 39.8 | 125.7 |

Managed by Edelweiss, this fund invests predominantly in large-cap stocks aiming for capital appreciation. It targets stable and well-established companies, making it suitable for risk-averse equity investors.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 14 | 45.5 | 121.4 |

Focusing on the top tier, the Top 5 mutual funds for lumpsum investment in 2025 offer a blend of dynamism and stability with 1 yr Highest Growth.

The top investment options for 2025 are:

| Top 5 Mutual Funds (lumpsum investment) 2025 | 1Yr Return |

|---|---|

| 1. Invesco India Infrastructure Regular Fund | 26.7% |

| 2. JM Flexicap Fund Direct Plan-Growth | 28% |

| 3. Parag Parikh Flexi Cap Fund Direct-Growth | 21.8% |

| 4. HDFC Flexi Cap Direct Plan-Growth | 20.4% |

| 5. SBI PSU Direct Plan-Growth | 20% |

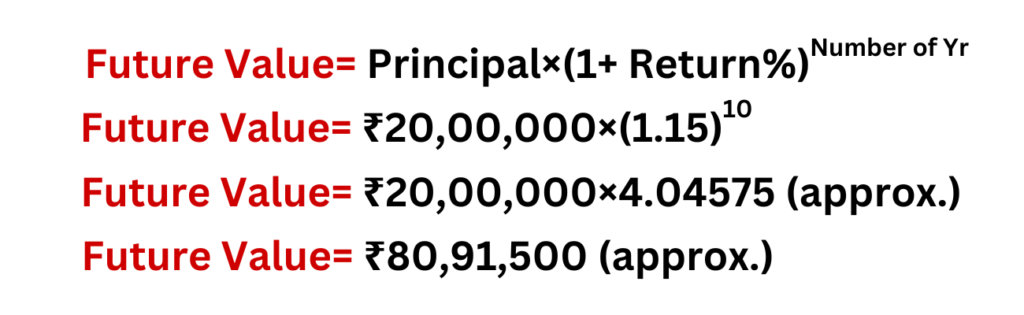

Suresh, a 50-year-old marketing consultant, invested ₹20 lakh in a high-growth mutual fund with an aggressive growth strategy, targeting an annual return of 15%. He planned to start his consulting firm in 10 years using the proceeds from this investment.

To calculate the future value of Suresh’s investment at a 15% annual return over 10 years, we use the formula for compound interest:

For Suresh, the calculation would be:

Future Value= ₹20,00,000×(1+0.15)10

Breaking down the calculation:

This calculation shows that Suresh’s initial investment of ₹20 lakh could grow to about ₹80.91 lakh in 10 years with a 15% annual return, approximately 4 times the original amount. The growth factor of approximately 4.04575 confirms that a 15% annual return effectively quadruples the investment in a decade due to the power of compounding. This clarifies how such returns over a decade can substantially increase the initial capital.

| Feature | Lump Sum Investment | SIP (Systematic Investment Plan) |

|---|---|---|

| Definition | A one-time investment of a large sum of money. | Lower initial capital is suitable for investors who prefer or need to invest gradually. |

| Investment Timing | Requires significant capital upfront and carefully selecting the best mutual funds for lumpsum investment. | It allows for the spread of investment over time, reducing the financial burden in one go. |

| Market Timing | More sensitive to market timing; risks and rewards can be higher depending on the market entry point. | Reduces the risk of poor timing through dollar-cost averaging, potentially lowering the impact of market volatility. |

| Capital Requirement | Investors with a lump sum available and a higher risk tolerance are looking for direct exposure to market timing. | Investors who wish to build their investment gradually are suitable for regular income earners. |

| Risk | Higher market risk exposure at a single point in time. | Potentially lower risk due to spreading out the investment entry points. |

| Returns | A high initial capital is required. | Returns are averaged over time; individual investments may have varying rates of return. |

| Ideal For | Each instalment has its compounding period; earlier instalments have more time to grow, benefiting from compounding. | Each installment has its compounding period; earlier installments have more time to grow, benefiting from compounding. |

Choosing between a lump sum investment and a Systematic Investment Plan (SIP) largely depends on your financial circumstances, investment goals, and risk tolerance. Here’s a breakdown to help you decide which might be better suited to your needs:

Lump Sum Investment:

Systematic Investment Plan (SIP):

Eager to get started? Investing your lump sum in the top mutual funds is straightforward. Here’s how:

1. Lump sum investments in mutual funds involve investing a significant capital amount all at once, offering immediate market exposure and leveraging compounding for wealth accumulation.

2. The top 10 mutual funds for lump sum investments in 2025 cater to various investor profiles with strategies ranging from aggressive growth in niche segments to balanced income generation across small-cap equities and medium-term debt securities.

When you have a lump sum to invest, you need to consider the various mutual fund categories, each with its own characteristics and investment objectives. From high-growth equity funds to debt funds and balanced hybrid funds, your choice should be based on your financial goals, risk appetite and investment horizon.

Also, Exchange-Traded Funds (ETFs) are gaining popularity as a flexible and cost effective option. With its ability to give diversified exposure on stock exchanges, ETFs are a good choice for lump sum investments in India, with liquidity and low management charges.

Equity mutual funds primarily invest in stocks of various companies with the aim of capital growth. These funds offer the potential for substantial returns as the value of the underlying stocks increases over time.

These funds are ideal for investors with a higher risk appetite, looking to achieve significant growth. While they come with market volatility, they are an attractive option for those who can weather short-term fluctuations for long-term gains.

Investors also enjoy tax advantages, including tax-exempt capital gains up to a certain limit, making equity mutual funds a compelling choice for lump-sum investments.

Debt funds invest in fixed income securities like bonds, government securities and other money market instruments. These funds are lower risk and for those who want a steady income.

Conservative investors look for stability and regular returns and relatively low volatility.

Hybrid funds combine equities and fixed income in one portfolio to get growth and stability. They allow you to balance the high potential of equities with the security of debt investments.

Hybrid funds are for medium-term investors and those who want a more moderate risk profile. They can adjust to market changes and adjust their asset allocation to get the best returns while managing risk. Plus the tax treatment of hybrid funds mirrors their equity exposure, another thing to consider.

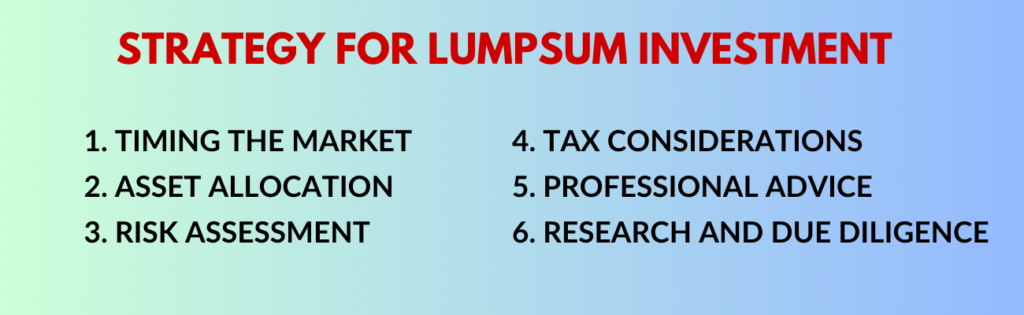

When considering a lump sum investment, strategic planning is crucial for balancing potential returns with risks. Here are streamlined strategic considerations for investors thinking about lump sum investments:

When investing in mutual funds through a lump sum investment, it's important to consider the taxes and expenses involved, as they can significantly affect the returns on your investment. Here’s a brief overview:

1. Expense Ratio: This is the fee mutual funds charge yearly for managing your money. It includes administrative costs, management fees and other operational expenses. The expense ratio is expressed as a percentage of the fund’s average assets under management (AUM) and is deducted from the fund’s assets, thus impacting overall returns. If you invest lumpsum in top mutual funds, a higher expense ratio can eat into the profits if the fund doesn’t outperform significantly.

2. Exit Load: Some mutual funds have an exit load—a fee for withdrawing your money within a certain period, usually within a year from the investment date. This fee is a percentage of the amount you’re withdrawing and is meant to discourage short term withdrawals and can impact your lump sum returns.

3. Capital Gains Tax: The profits you make from your mutual fund investments are subject to capital gains tax which varies based on the tenure of your investment. For equity funds, if you sell your investment after more than 1 year, you’ll be taxed 12% on gains above ₹1 lakh annually without indexation. If you sell within a year, the gains are short term and taxed at 20%. For debt funds, the LTCG tax in short-term gains are added to your income and taxed according to your income tax slab.

4. Securities Transaction Tax (STT): STT is levied on every purchase or sale of equity-oriented mutual funds in India. The current rate is 0.001% on the sell-side for equity mutual funds.

Savvy investors can leverage tax-saving strategies to enhance the efficiency of their lump-sum investments in mutual funds. One prime option is the equity-linked saving scheme (ELSS), offering tax deductions under Section 80C. By wisely investing in ELSS, one can reduce the taxable income by up to ₹1,50,000 annually. However, it’s important to note that the lock-in period and tax on long-term capital gains exceeding ₹1,00,000 per year must be considered.

Each investment portion in ELSS through SIPs or lump sums carries its tax implications, emphasizing the need for strategic investment planning.

Investing in the best lumpsum mutual funds requires strategic planning, market intelligence, and an eye for detail. Much like identifying the best performers to understanding the tax implications of your investments and the costs involved, an informed investor is all set to make the most of the year 2025. As success stories illustrate and preparatory steps lead the way, investing your money is less about the actual investment than the whole approach enveloping it.

If you're looking for the top 5 mutual funds for lump sum investment in 2025, consider the Invesco India Infrastructure, Aditya Birla Sun Life PSU Equity Fund, Franklin India Flexi Cap Fund and HDFC Flexi Cap Direct Plan-Growth. These funds offer a mix of growth potential and sector diversification for a successful lump-sum investment strategy.

The Invesco India Infrastructure is a top choice for lump sum investment due to its focus on infrastructure. The JM Flexicap Fund Direct Plan offers flexibility with diverse sector exposure, while the Parag Parikh Flexi Cap Fund DG provides a mix of growth and stability for a balanced approach.

A lump sum investment in mutual funds means investing significant money into a fund at once rather than making regular interval investments through SIP. Often used with the best mutual funds for lumpsum investment, this strategy allows for potential capital appreciation and eliminates the need for regular investment decisions.

Investing in an Equity Linked Savings Scheme (ELSS) can help you save on taxes by allowing deductions under Section 80C of the Income Tax Act. This means you can deduct investments up to ₹1,50,000 per year in ELSS from your taxable income, potentially reducing your tax liability.

Yes, the tax implications for a lump sum and SIP investments in mutual funds are generally similar. Still, the holding period of the investments can affect the calculation of capital gains and applicable taxes.

When selecting a mutual fund for a lump sum investment, consider its performance history, expense ratio, fund manager track record, asset allocation, and risk profile to ensure it aligns with your investment goals and risk tolerance. This is particularly important when choosing the best mutual funds for lumpsum investment.

Yes, diversifying your lump sum investment across different mutual fund categories, such as equity, debt, and hybrid funds, can help balance risk and optimize potential returns based on your financial goals and risk appetite. This approach is often recommended when investing a lump sum in the best mutual funds.

Disclaimer: This article is intended for educational purposes only. Please note that the data related to the mentioned companies may change over time. The securities referenced are provided as examples and should not be considered as recommendations.