Want your money to work for you? If you are looking for a steady source of passive income, monthly dividend stocks in India might be the answer. These stocks give you monthly payouts, so you don’t have to wait for annual returns. Whether you save for the future or need extra money for monthly expenses, dividend stocks can be a good option.

In this post, we will cover everything you need to know about stocks that give monthly dividends—how they work, which ones to consider and the benefits and risks of investing in them.

Below, we’ve listed India's top monthly dividend-paying stocks, ranked by their Dividend Yield and market capitalisation, to help you make a smart investment decision.

| Best Monthly Dividend Stocks | Market Cap (₹ Cr) | Dividend Yield (%) |

|---|---|---|

| Xchanging Solutions | 1,204 | 17.59 |

| Chennai Petroleum | 8,956 | 9.15 |

| Bharat Petroleum Corporation Ltd. | 1,25,426 | 7.15 |

| Coal India Ltd. | 2,36,002 | 6.66 |

| Vedanta Ltd. | 1,85,040 | 5.93 |

Note: Dividend yields are approximate and subject to market conditions.

It refers to shares of companies that distribute dividends to their shareholders every month. These dividends are a part of the company’s profit shared with the investors, a steady income and potential long term capital appreciation.

In India, most companies don’t offer monthly dividends. However, some regular dividend stocks do reward investors with frequent payouts. They may not guarantee monthly dividends but their track record of distributing profits makes them good for income investors.

These companies have a history of paying the highest dividends or a predictable dividend schedule. Real estate (REITs), utilities and mutual funds are such industries.

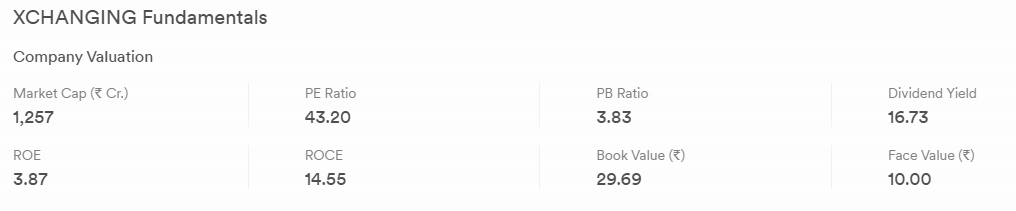

This section provides an overview of the top dividend-paying stocks in India, focusing on their market cap, current market price (CMP), dividend yield, and other key metrics like PE Ratio. These insights will help you better understand the performance and potential of these stocks for steady income generation.

Xchanging Solutions Ltd offers information technology services and business process outsourcing. ITO is one of the products. Its offerings include software development and implementation services, strategic consulting and application support.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -2.07 | 6.34 | 95.34 |

AMOCO, National Iranian Oil Company (NIOC) and Government of India (GOI) came together to form Chennai Petroleum Corporation Ltd. The company’s products are LPG, motor spirit, superior kerosene, aviation turbine fuel, high-speed diesel, naphtha, bitumen, lubricant base stocks, paraffin wax, fuel oil, hexane and petrochemicals.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -12.6 | 493.87 | 432.57 |

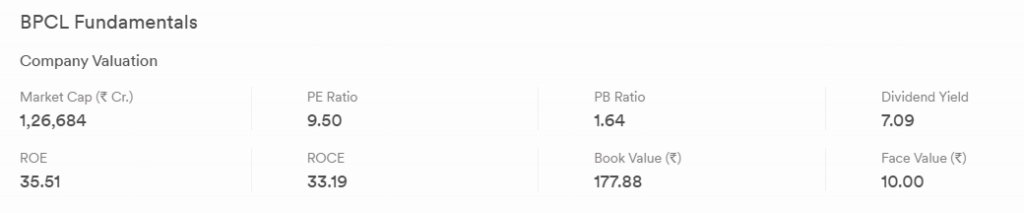

Bharat Petroleum Corp. Ltd is one of the top companies in India’s petroleum industry. The company explores, produces and sells petroleum and related products. BPCL’s retail business unit sells kerosene, diesel and petrol.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| 29.43 | 57.06 | 22.33 |

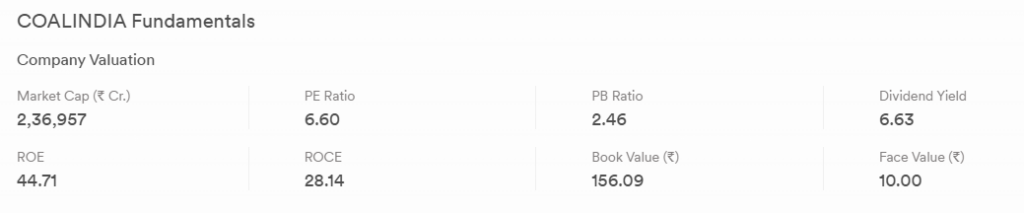

The largest coal producer in the world is Coal India Ltd. The company produces coking and non-coking coal in various grades for different uses. Its clients are large thermal power generation companies, steel and cement companies, and other industrial companies in the public and private sectors.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| 5.08 | 163.64 | 93.34 |

Founded in 1965, Vedanta Ltd is a large-cap company with a market cap of Rs 1,85,039.56 crore and operates in various segments. Some of Vedanta Ltd’s main products and revenue segments are Aluminium, Copper Cathodes, Oils, Iron Ore, Pig Iron, Others, Other Operating Revenue, Power, Metallurgical Coke and Export Incentives.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| 77.03 | 33.98 | 212.93 |

Most Indian companies don’t pay monthly dividends but some regular dividend-paying stocks come close, so here’s why you should consider them:

Investing in such high dividend paying stocks is income and wealth creation, so it’s a good option for Indian investors.

Choosing good dividend stocks is a combination of research and analysis. Here are the key metrics and factors to look out for when you’re looking for dividend income

You should look beyond the dividend yield when looking at regular dividend-paying stocks for your portfolio. Several factors can impact the sustainability of those dividends and your overall investment. Here are things to consider:

1. Dividend Sustainability

Dividend sustainability is key. Look at the dividend payout ratio which shows what percentage of earnings are distributed as dividends. A lower payout ratio (typically under 70%) means the company retains enough earnings for growth and can pay dividends even in tough times.

2. Yield vs. Risk

High dividend yields may look attractive but often come with more risk. Companies offering unusually high yields may be under financial stress or over-leveraged. Balance yield and stability by examining whether the company’s financials can support consistent payouts without sacrificing growth.

3. Company Fundamentals

Strong company fundamentals are the foundation of any dividend-paying stock. Look at key metrics like revenue growth, profit margins, debt-to-equity ratio and return on capital employed (ROCE).

4. Market Sector Stability

The sector in which the company operates plays a vital role in the reliability of its dividend payouts. Industries like utilities, real estate (e.g., REITs), and consumer staples are generally more stable and resilient to economic downturns.

5. Dividend Reinvestment Opportunities

Some companies offer Dividend Reinvestment Plans (DRIPs) where you can reinvest your dividend payouts into more shares. This can help compound your returns over time and is especially good for long-term investors who want to grow without incurring transaction costs.

Investing in regular dividend stocks is a straightforward process. Here’s how you can get started:

The taxation of dividend income in India is governed by the Finance Act of 2020, which abolished the Dividend Distribution Tax (DDT). Now, shareholders tax dividends based on their applicable income tax slab.

Dividend stocks do better than other investments in volatile markets. While stock prices increase and decrease, dividend payouts buffer against market uncertainty. That’s why they’re the go-to for conservative investors looking for steady income even when the equity markets are rough.

Utilities, consumer staples and real estate are the most resilient, and they have dividends because of their steady cash flows and demand. However, not all dividend stocks are immune to volatility. Stocks with high payout ratios or those in cyclical industries may struggle to keep dividends during downturns.

Diversify across sectors and focus on fundamentally strong companies with a history of payouts and you’ll reduce the risks and have a steady income stream even in tough markets.

Dividend mutual funds can be a good alternative to monthly dividend-paying stocks, especially for those who want diversified exposure and professional fund management. These funds invest in a basket of high dividend-yielding stocks and distribute regular income to unit holders. For beginners or those who don’t have time to research individual stocks, dividend mutual funds are a simple and hands-off way to earn passive income.

But there are downsides. Mutual funds charge expense ratios that will eat into your returns. Dividends from mutual funds are not guaranteed. They depend on the fund’s performance and the companies in the portfolio. Direct investment in good dividend stocks might be better for those who want control over their investments and fixed payouts.

Anyway, it’s up to you, your risk tolerance, income needs and level of involvement in managing your portfolio.

Monthly dividend-paying stocks are a great way to create a passive income stream. Although no Indian company pays monthly dividends, you can consider regular dividend stocks with consistent payouts. These stocks stabilise market volatility and help you achieve your long-term goals.

You can create a portfolio that balances income and growth by selecting stocks with good track records and analyzing dividend yield, ROCE and payout ratio.

India's best monthly dividend-paying stocks include companies like Xchanging Solutions, Chennai Petroleum, Bharat Petroleum Corporation Ltd., Coal India Ltd., and Vedanta Ltd. These stocks are known for their regular dividend payouts and strong financial performance, making them suitable for investors seeking consistent income.

To select good dividend-paying stocks, analyze factors like dividend yield, payout ratio, company earnings, and financial stability. Look for companies with a strong history of consistent dividend payments and low debt levels.

Yes, dividends are taxable in India. As per the current tax regulations, dividends are added to the investor's income and taxed according to their income tax slab.

The risks include dividend cuts during economic downturns, market volatility affecting stock prices, and potential tax liabilities. Always research thoroughly before investing.

While dividend stocks can provide regular income, it’s not advisable to rely on them entirely. Diversify your portfolio with a mix of growth and income stocks to manage risks effectively.

Disclaimer: This article is for educational purposes only and should not be considered financial advice. Always conduct your research and consider consulting with a financial advisor before making any investment decisions.