Have you ever dreamt of turning your savings into big bucks in the Indian stock market? Sounds exciting. But before you dive in, there are a few details to understand: Security Transaction tax is a kind of tax that goes hand-in-hand with buying and selling shares, mutual funds, and other market stuff.

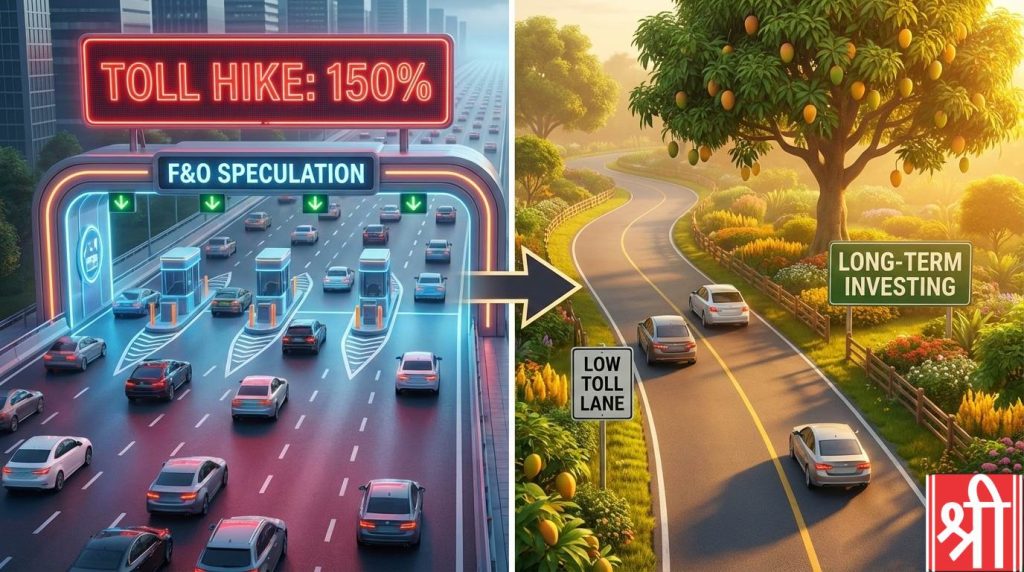

Think of STT as a toll booth on the stock market highway. The government collects a small fee whenever you buy or sell something. Following the Union Budget 2026-27, the "toll" for derivative traders has increased significantly. This move is a "course correction" intended to address the explosion in retail speculation. This guide will help you understand the new rates and how they impact your trading ledger.

Securities Transaction Tax (STT) is a direct tax levied on every purchase and sale of security traded on recognised Indian stock exchanges. Before 2004, the Indian government faced a significant challenge: tax evasion on capital gains from stock market transactions. Investors underreport their profits, leading to revenue loss for the government. The Finance Act of 2004 introduced the Securities Transaction Tax to address this issue.

This innovative tax approach aimed to streamline tax collection and maintain tax evasion. The government ensured a more efficient and transparent system by levying a small tax directly during the transaction. This simplified tax administration and provided a level playing field for honest investors.

This encompasses a broad spectrum of instruments, including:

This act defines taxable securities, identifies the party responsible for payment (buyer or seller), and empowers the government to determine the Tax rate. This rate can change based on economic considerations and budgetary needs.

It offers several advantages that make it a valuable tool for tax collection & payment:

Investment is comparable to planting a mango tree. You water it, wait for years, and eventually reap the fruit. It is a long-term commitment that adds value to the economy. Speculation, particularly in derivatives, is often compared to betting on whether it will rain tomorrow. It is short-term, high-risk, and often a "zero-sum game" where one person's gain is another's loss.

The government's analysis indicates that the volume of speculative trading in India has grown disproportionately large. The Revenue Secretary recently noted that trading volumes in derivatives are 500 times India's GDP, suggesting a market overheated with speculative fervor rather than productive capital allocation.

A central theme of the 2026 Budget is the distinction between investment and speculation. By increasing the STT, the government aims to gently discourage this excessive speculation often described as "satta" (gambling) and nudge citizens towards long-term, productive investing.

To comprehend the impact of the STT hike, one must first understand the instruments being taxed. Futures and Options (F&O) are financial contracts that derive their value from an underlying asset, like a stock or an index.

A Futures Contract is essentially a promise to buy or sell something at a fixed price on a specific future date.

An Option is like buying a ticket or a coupon. It gives you the right to buy or sell, but not the obligation.

In recent years, millions of retail investors have flocked to F&O, seeking quick riches. However, SEBI data (FY 2025-26) reveals a stark reality: 9 out of 10 individual traders lose money in F&O. Collectively, individuals lost over ₹1.06 lakh crore in the last fiscal year alone. The government views this as financial gambling that erodes household savings, making this STT hike a necessary "Course Correction."

Under the Union Budget 2026, STT Hike (April 1, 2026): Futures @ 0.05% (from 0.02%) | Options @ 0.15% (from 0.10%). STT on derivatives has effectively doubled starting April 1, 2026, to curb retail speculation.

| Instrument | Old Rate | New Rate (Budget 2026) |

| Equity Delivery | 0.1% | 0.1% (No Change) |

| Equity Intraday | 0.025% | 0.025% (No Change) |

| Equity Futures (Sell) | 0.02% | 0.05% (150% Hike) |

| Options Premium (Sell) | 0.1% | 0.15% (50% Hike) |

| Options Exercise (Buy) | 0.125% | 0.15% (20% Hike) |

To understand the Budget 2026 STT hike, consider trading 1 lot of Nifty Futures (Contract Value: ₹13 Lakhs):

Why the hike? With 9 out of 10 retail traders losing money in F&O, the government introduced this speed breaker to protect household savings and redirect capital toward long-term, productive equity delivery.

The introduction of STT in 2004 was a landmark shift. Following the Union Budget 2026, understanding this interplay is critical, as you remain liable for Income Tax on capital gains despite the upfront STT "toll."

Lakshmishree Insight: With the Budget 2026 STT hike in F&O and the 12.5% LTCG rate, "Tax Harvesting" to utilize the ₹1.25 lakh exemption is now a vital strategy for long-term wealth creation.

Calculating Tax is a straightforward process. Here's how to determine the Tax amount for different scenarios:

Tax = (Transaction Value x STT Rate) x 2 (for both buyer and seller)

Example: You purchase 100 company shares at ₹100 per share for a total transaction value of ₹10,000.

The Budget 2026 STT hike has seen the tax on the sale of futures jump by 150%. This is where the impact is most visible for active traders.

For options, STT is calculated on the Premium value, not the total strike value. The 2026 Budget increased this rate by 50%.

Intraday trades (bought and sold on the same day) remain a cost-effective way to trade the cash market as their rates were not affected by the recent budget.

Tax: (₹12,000 × 0.025%) = ₹3 (Applicable only on the selling side)

Formula: Tax = (Selling Transaction Value × STT Rate)

Example: You buy 100 shares at ₹100 each and sell them later the same day at ₹120 each.

Tax: (₹12,000 × 0.025%) = ₹3 (Applicable only on the selling side)

The responsibility for paying Tax varies depending on the type of market participant:

The Budget 2026 STT hike has fundamentally shifted the unit economics for active traders. What was once a "small cost" has now become a significant strategic barrier, particularly for the derivatives segment.

The Budget 2026 STT hike which saw tax on futures surge by 150% and options by 50% has turned STT from a minor fee into a major "Impact Cost." For high-volume traders, these changes necessitate a complete recalibration of their trading playbook.

Frequent trading now requires a much higher win rate or larger price moves just to cover the tax "toll."

The "churn" strategy (doing 20–30 trades a day) is now penalized by the tax structure.

One of the clearest signals from the Budget 2026 is the government's push toward "Productive Capital."

The recent hike in the Union Budget 2026 has intensified the debate around STT. While the tax rates for long-term delivery remain stable, the significant increase in the derivatives segment has shifted the pros and cons for many investors.

Understanding Securities Transaction Tax (STT) has always been essential, but in 2026, it has become a defining factor for your trading profitability. The Budget 2026 STT hike is a historic "course correction" by the government, aimed at cooling an overheated derivatives market that had reached 500 times India's GDP.

While this tax adds a significant cost for high-frequency F&O traders doubling the toll on the futures highway it plays a vital role in protecting household savings. By making impulsive speculation more expensive, the government is nudging investors toward the stable, wealth-generating path of long-term equity delivery.

The revised Securities Transaction Tax (STT) rates for the derivatives (F&O) segment announced in the Union Budget 2026 will come into effect from April 1, 2026. Traders have until the end of the current fiscal year to adjust their strategies to the old rates.

No. In a move to encourage long-term "Viksit Bharat" style investing, the government has kept STT on Equity Delivery unchanged at 0.1%. The hike is strictly targeted at the derivatives segment to curb excessive speculation.

For Options traders, the Budget 2026 STT hike has increased the tax on the sale of options from 0.1% to 0.15% of the premium value. Additionally, if an option is exercised, the STT has been hiked to 0.15% of the intrinsic value

The primary objective is to handle systemic risk and protect retail investors. With SEBI data showing that 9 out of 10 retail traders lose money, the government introduced this hike as a "speed breaker" to reduce speculative "betting-style" activity that has surged to 500 times India's GDP.

Yes, it is a mandatory tax applicable to most stock market transactions in India. As mentioned earlier, it's a way for the government to streamline tax collection and ensure transparency in the market.

No, Securities Transaction Tax is non-refundable and cannot be claimed as a credit or set-off against your final Income Tax liability. However, for professional traders, it can be treated as a business expense to reduce taxable business income.

It is charged to both the buyer and seller for delivery-based equity transactions. However, for intraday equity trades where shares are bought and sold on the same day, Tax applies only to the selling side.

No, the Securities Transaction Tax is non-refundable. It's not a deduction you can claim against your income tax liability. This Tax is a separate levy collected upfront on your stock market transactions. However, you might still be liable for capital gains tax depending on your holding period for the securities and the type of investment.