Finding the right price to buy or sell in the stock market can be tricky. Many traders struggle to understand if they're making the right decision at the right time. This is where the VWAP indicator comes in handy. It helps traders know the average price of a stock throughout the day by factoring in both price and volume.

In this blog, we'll explain the VWAP indicator, how to use it effectively, and why it’s important for making smart trading decisions. If you want to improve your trading strategy, this guide is the perfect place to start.

The VWAP indicator, or Volume Weighted Average Price, is a technical tool that traders use to understand the average price of a stock, adjusted for its trading volume, throughout the day. Unlike traditional price averages, the VWAP indicator reflects price movement and considers how much volume is traded at each price level. This makes it more accurate for identifying fair entry and exit points.

It’s especially useful for intraday traders and portfolio managers who want to make informed decisions. In simple terms, the VWAP indicator shows whether a stock is trading above or below its average price for the day, helping traders identify overvalued or undervalued positions. Stocks trading below the indicator are often considered cheap, while those above the indicator are seen as more expensive.

The VWAP indicator is typically used on intraday charts, meaning it resets at the start of each new trading day. Most traders use VWAP on short time frames like 1-minute or 5-minute charts, but it can be applied to any timeframe depending on your trading style.

Some key settings to keep in mind:

The VWAP indicator doesn’t require complex settings to be useful, but knowing how to apply it to different timeframes and charts can enhance your trading decisions.

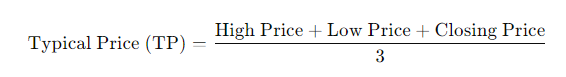

The VWAP indicator (Volume Weighted Average Price) is calculated using intraday data, starting from the opening of the market and ending with its close. It tracks the typical price of a stock throughout the trading day, factoring in both the stock’s price and the volume of shares traded. This allows traders to see whether a stock is trading above or below its daily average price.

Its calculation may sound complicated, but it follows a simple step-by-step process that combines price and volume to give a more accurate picture of market activity. Though most trading platforms calculate VWAP automatically, understanding how it’s computed can give traders an edge in making better trading decisions.

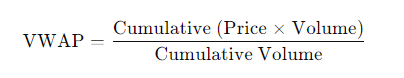

The VWAP formula is straightforward:

Here’s how it breaks down:

This section will give a clear picture of how traders use VWAP to determine the average price based on both price and trading volume.

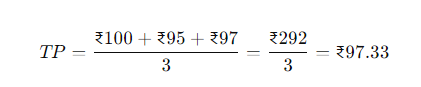

Let’s assume the following data for a stock during a specific time period:

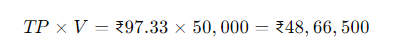

Next, multiply the Typical Price by the volume of shares traded in that period:

Let’s assume that the cumulative volume at this point is 78,000 shares.

Thus, the VWAP for this period is ₹62.24. Traders would use this value to assess whether the stock is currently trading at a fair price. The stock might be undervalued if the current price is below ₹62.24. If it's trading above this, it could be considered overvalued

The Volume Weighted Average Price is a powerful tool that traders use to improve their trading strategies in various ways. While the VWAP helps you gauge whether a stock is overvalued or undervalued based on price and volume, combining it with other indicators like the MACD or stochastic can enhance its effectiveness. Let's explore some practical methods to trade using Volume Weighted Average Price effectively.

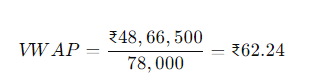

One of the most common ways traders use the VWAP indicator is to identify key support and resistance levels. The VWAP line acts as a simple visual guide:

Additionally, the direction of the VWAP line helps determine the current trend:

The indicator is incredibly helpful for finding entry and exit levels. Here’s how it works:

Some traders use VWAP envelopes (upper and lower bands) to help identify when to buy or sell. For instance, when the price returns towards the VWAP after touching the envelope lines, it signals a potential entry or exit point.

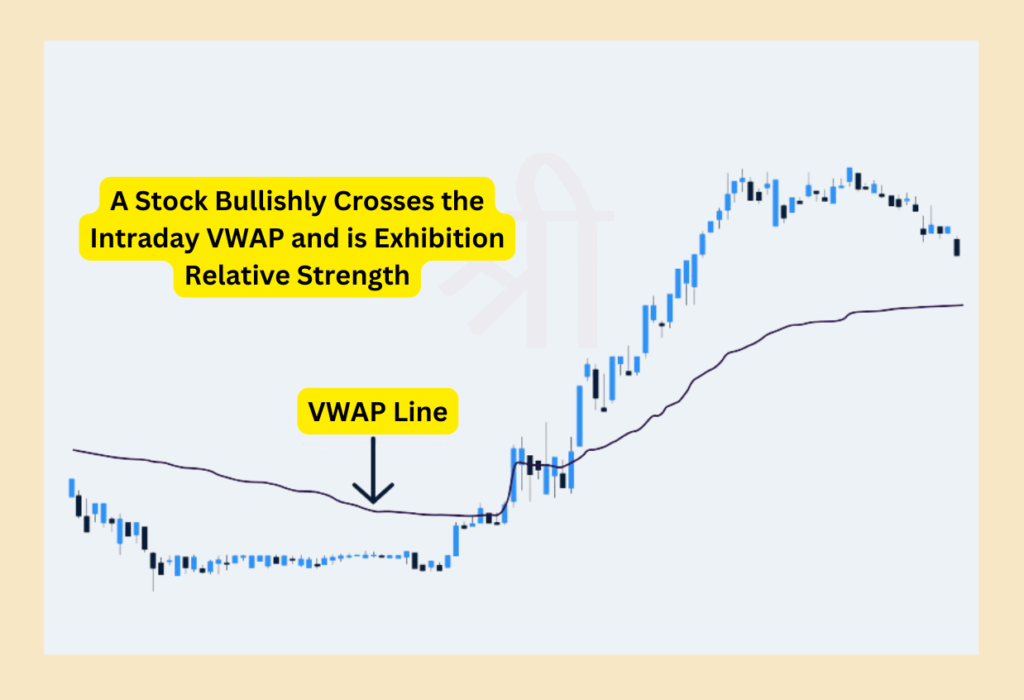

The VWAP indicator can also be used to gauge a stock's relative strength or weakness.

By comparing the VWAP of a stock to the VWAP of its benchmark index or peer stocks, traders can quickly understand whether the stock is stronger or weaker than the market. This is particularly useful for traders looking to short-sell or buy stocks based on their relative performance.

For instance, shorting a stock that’s trading above the indicator line could be risky, as it may experience a short squeeze—a rapid upward movement in price. However, shorting a stock that’s trading below VWAP aligns your trade with the existing trend, minimizing risk.

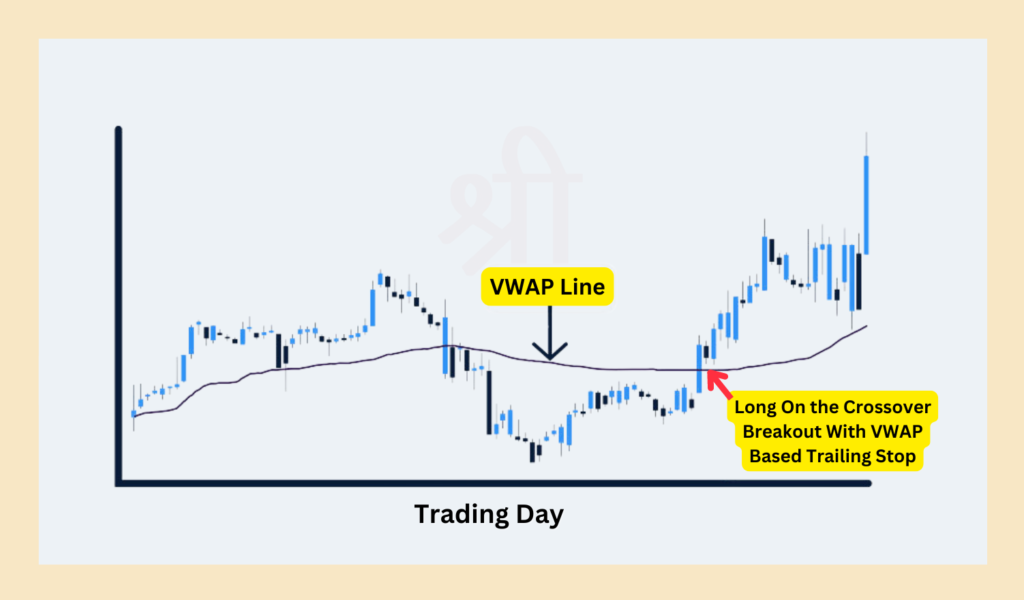

Another popular strategy is to trade when the price crosses the VWAP line.

Traders often use this indicator as a stop-loss level. For example, if you enter a long trade after a breakout above VWAP, you might set a stop-loss just below the indicator line to limit potential losses if the trade goes against you.

While the standard Volume Weighted Average Price indicator resets every day, Anchored VWAP is a more flexible version that allows traders to set a custom starting point for the calculation. This starting point can be any significant event in the stock's price history, such as earnings reports, market news, or major announcements.

Key Features of Anchored VWAP:

Example of Anchored VWAP:

Imagine a stock announces a new product launch, and you want to track its price performance since that announcement. You can "anchor" the VWAP to the day of the announcement. This will give you a custom price line that shows how the stock has been valued (taking volume into account) since that key date, helping you make more informed trading decisions.

Trading volume plays a key role in technical analysis because it shows the strength behind price movements. Volume tells you how many shares are being traded, helping traders confirm whether price trends are solid or weak.

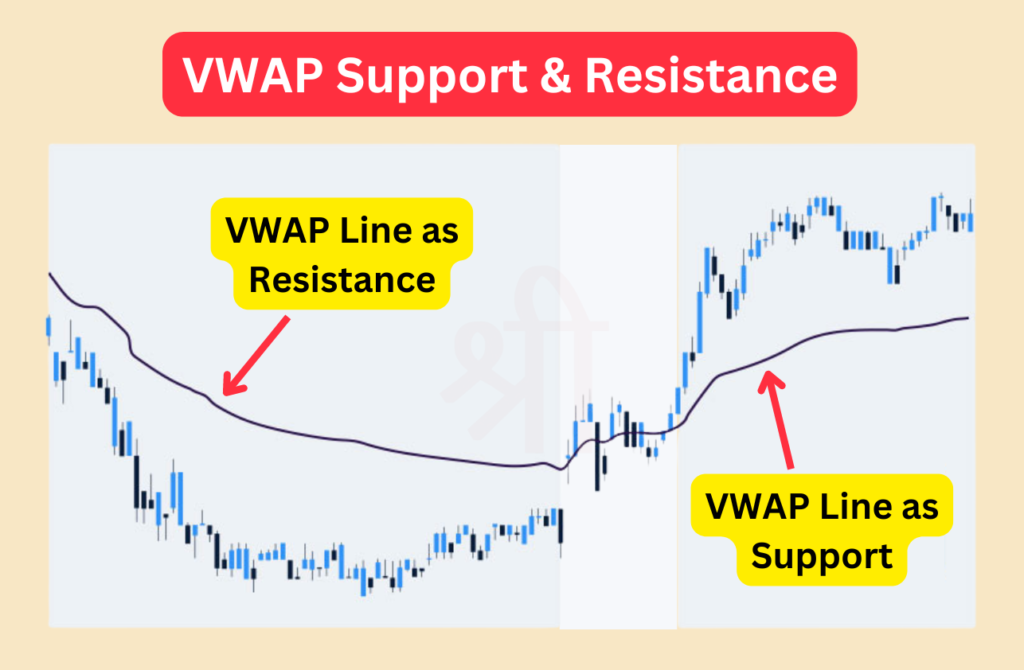

The Volume Weighted Average Price is a versatile tool for intraday trading. Let’s go over three common VWAP trading strategies:

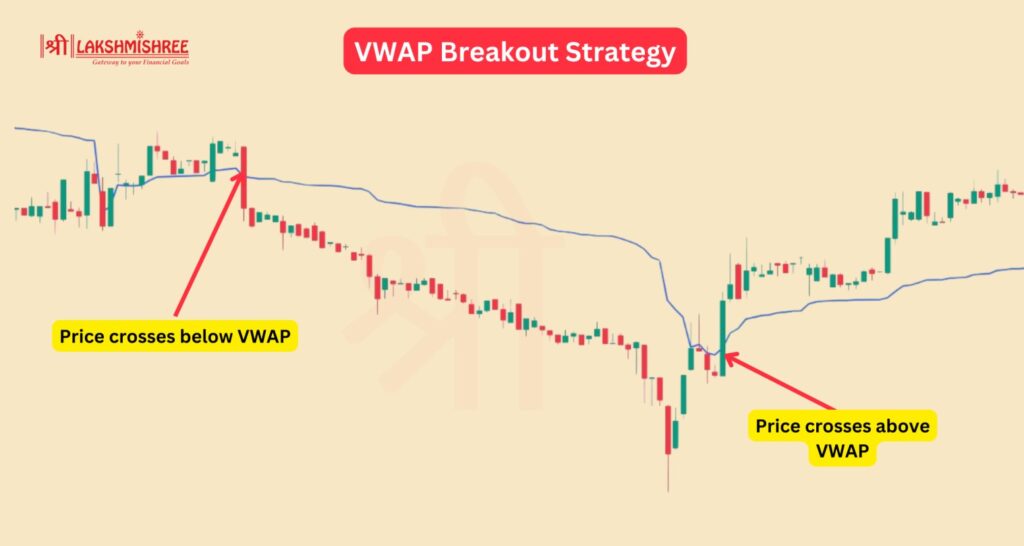

This strategy involves buying or selling when the price breaks above or below the Volume Weighted Average Price line.

Traders often combine this strategy with other momentum indicators, like the MACD, to confirm the strength of the breakout.

Here, traders use the Indicator line as a dynamic support or resistance level.

This strategy is especially useful in range-bound markets.

Volume Weighted Average Price crossovers can indicate potential entry or exit points when combined with moving averages.

Benefits

Limitations

To get the most out of the Volume Weighted Average Price indicator, it’s useful to combine it with other technical indicators:

The VWAP indicator is a highly valuable tool for intraday traders, providing a clear view of a stock’s average price while taking volume into account. It helps identify key support and resistance levels, make better entry and exit decisions, and confirm market trends. While It is best suited for short-term trading, combining it with other indicators like the MACD, RSI, or moving averages can make it even more powerful and reliable.

VWAP stands for Volume Weighted Average Price. It shows the average price a stock has traded at throughout the day, adjusted for trading volume.

The Volume-Weighted Average Price is calculated by multiplying the typical price by the volume and then dividing by the total volume. The formula is: VWAP = (Cumulative (Price * Volume) ÷ (Cumulative Volume)

No, VWAP is primarily an intraday indicator. It resets at the beginning of each trading session and is best used for short-term or day trading.

VWAP considers both price and volume, while moving averages only consider the price. This makes it more effective at reflecting a stock’s true average price for the day.

Yes! VWAP indicator works best when combined with other technical indicators like MACD, RSI, or moving averages to confirm trade signals and improve decision-making.

Disclaimer: This article is intended for educational purposes only. Please note that the data related to the mentioned companies may change over time. The securities referenced are provided as examples and should not be considered as recommendations.