Investing in mutual funds, shares, and property is a common way to build wealth, but it's important to understand the tax implications associated with these investments. One such tax is the Short Term Capital Gain Tax, which applies when you sell an asset within a short period after acquisition. This guide will help you understand what STCG is, how it is calculated, and how it affects your mutual funds, shares, and property investments.

Short-term capital gains are taxed differently than long-term gains, and the rates can vary significantly based on the type of asset and holding period. Knowing the rules and rates for STCG can help you make more informed investment decisions and plan your finances better.

1. Short Term Capital Gain Tax applies if assets like equity shares are sold within 12 months and for debt mutual funds or property within 36 months.

2. Equity mutual funds and shares are taxed at 15% for STCG, while debt mutual funds and property are taxed as per income tax slab rates.

3. Offset short-term capital gains with losses to reduce tax liability effectively.

4. Holding assets beyond the short-term period can qualify for lower tax rates under Long Term Capital Gain Tax.

Short-Term Capital Gain (STCG) refers to the profit earned from the sale of a capital asset that is held for a short duration before being sold. According to Indian tax laws, if you sell assets like shares, mutual funds, or property within a specific period from the date of acquisition, the profit made from this sale is categorized as STCG.

The taxation of STCG varies depending on the type of asset. Capital gains of up to Rs 1 lakh annually are exempted from capital gains tax. For equity shares and equity-oriented mutual funds, the STCG is taxed at a flat rate of 15%, plus applicable cess and surcharges, under Section 111A of the Income Tax Act. For other assets like debt mutual funds or property, the STCG is added to your income and taxed according to your income tax slab rate.

To understand better, consider an example: If you bought shares worth ₹50,000 and sold them for ₹70,000 within 10 months, your STCG would be ₹20,000. This gain would not be taxed as the gain is below the 1 lakh limit. Similarly, if you sold a property purchased for ₹30,00,000 for ₹35,00,000 within two years, your STCG would be ₹5,00,000, which would be added to your income and taxed according to your slab rate.

The holding period required for an asset to qualify as a short-term or long-term investment varies based on the type of asset. Here are the specific holding periods for common asset types:

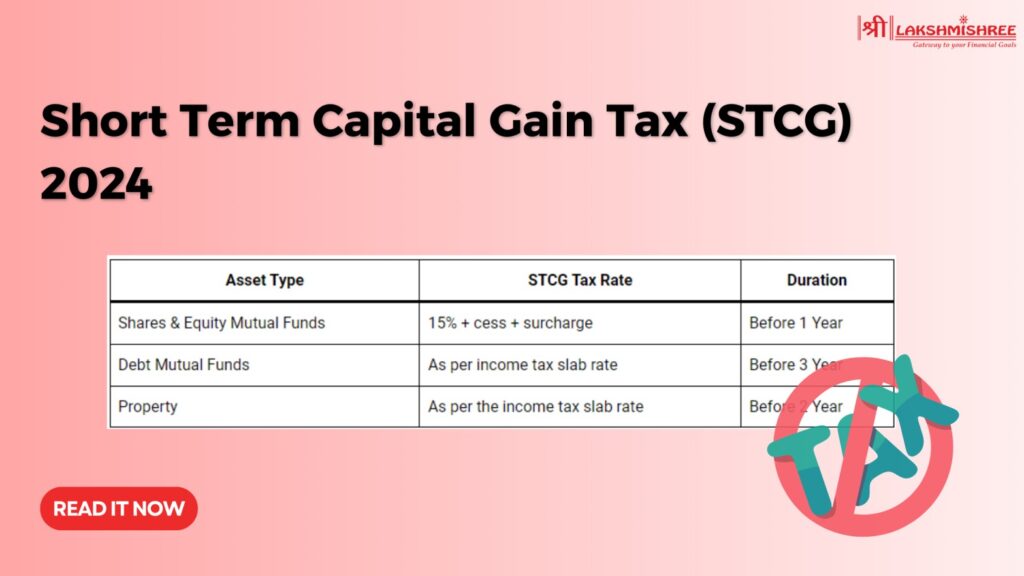

Regarding short-term capital gains (STCG), the tax rates vary depending on the type of asset you are dealing with. Here is a detailed look at the tax rates applicable to shares, equity mutual funds, debt mutual funds, and property:

| Asset Type | STCG Tax Rate | Duration |

|---|---|---|

| Shares & Equity Mutual Funds | 15% + cess + surcharge | Before 1 Year |

| Debt Mutual Funds | As per income tax slab rate | Before 3 Year |

| Property | As per the income tax slab rate | Before 2 Year |

Understanding the formula for calculating short-term capital gains (STCG) tax is essential for accurately determining the tax liability for your investments. Let's break down the formula and explain each component in detail:

Formula:

STCG Tax = (Sale Price - Purchase Price - Associated Costs) * Tax Rate

Explanation of Each Component:

Understanding how to calculate Short Term Capital Gains (STCG) tax with practical examples can provide clarity on the process. Let's delve into detailed examples for an equity share, mutual funds, and properties:

1. Equity Share:

Scenario: You purchased 1000 shares of XYZ Company at ₹100 per share, incurring brokerage fees of ₹500. After holding them for 1 year, you sold all 1000 shares at ₹150 per share, incurring brokerage fees of ₹600.

Calculation:

Note: In the above case, STCG Tax is not applied as the total gain is below 1 lakh limit

2. Mutual Funds:

Scenario: You invested ₹50,00,000 in an equity mutual fund scheme and held it for 10 months. After 10 months, you redeemed your investment for ₹60,00,000, incurring exit load charges of ₹1,000.

Calculation:

3. Property:

Scenario: You purchased a residential property for ₹50 lakhs and sold it within 2 Years for ₹70 lakhs. You also incurred legal fees of ₹50,000 during the sale.

Calculation:

Following these example calculations for equity shares, mutual funds, and property, you can understand how Short Term Capital Gains tax is computed in various investment scenarios. Remember to consult with a tax advisor or good stock broker like lakshmishree for precise calculations and compliance with tax regulations.

Calculating short-term capital gains tax involves considering various factors influencing the final tax liability. Here's a concise overview:

1. Market Conditions: Fluctuations in market prices directly impact capital gains or losses upon selling assets. Timing the sale during favourable market conditions can yield higher gains.

2. Holding Period: Assets held for less than 2 years, like property, are considered short-term, attracting higher tax rates than long-term holdings. The duration of ownership affects the tax liability.

3. Asset Improvement Costs: Expenses incurred to enhance asset value, like renovations, can be added to the purchase price, reducing capital gains upon sale.

4. Transaction Fees: Brokerage charges and other transaction fees reduce net sale proceeds, influencing capital gains calculation.

Tax-saving funds are investment vehicles designed to help individuals save on taxes while growing their wealth. These funds are specifically structured to provide tax benefits under various sections of the Income Tax Act. The primary purpose of these funds is to offer tax deductions on investments, thereby reducing the overall taxable income of the investor.

Minimizing tax liability on short-term capital gains (STCG) can significantly enhance your overall returns. Here are some effective strategies to avoid or reduce taxes on STCG:

1. Tax Loss Harvesting: Tax loss harvesting involves selling underperforming or loss-making assets to offset the gains from profitable investments. By realizing these losses, you can reduce your taxable capital gains. For instance, if you have made a short-term gain of ₹10,000 from one investment and a short-term loss of ₹5,000 from another, you can offset the gain with the loss, thereby reducing your taxable gain to ₹5,000.

2. Holding Assets for Longer Periods: One of the simplest ways to avoid higher taxes on short-term gains is to hold your investments for longer periods. By holding equity shares and mutual funds for more than 12 months, they qualify for long-term capital gains (LTCG), which are taxed at a lower rate or may even be tax-free up to a certain limit. For real estate, holding the property for more than 24 months shifts the gains from short-term to long-term, reducing the tax rate.

3. Investing in Tax-Efficient Funds: Some mutual funds and investment schemes are more tax-efficient than others. For instance, Equity Linked Savings Schemes (ELSS) not only provide tax benefits under Section 80C but also offer the potential for long-term growth. By choosing tax-efficient funds, you can minimize your tax outgo and enhance your net returns.

4. Strategic Gifting of Assets: Gifting assets to family members in lower tax brackets can be an effective way to minimize STCG tax. For instance, if you gift shares to a spouse or children who are in a lower tax bracket, the capital gains realized on the sale of these shares will be taxed at their lower rate. However, it's essential to be aware of the tax implications and legal considerations of such gifts.

Additional Tips:

Capital gains can be classified as either short-term or long-term based on the asset's holding period. Short-term capital gains arise when assets are sold within a short duration from their acquisition, leading to a Short Term Capital Gain Tax. Long-term capital gains, on the other hand, are realized when assets are held for a longer period before being sold. Understanding the differences between these two types of gains is crucial for effective tax planning and investment strategy.

Table of Differentiation

| Feature | Short-Term Capital Gain | Long-Term Capital Gain |

|---|---|---|

| Holding Period | Less than 12 months for equity, less than 36 months for debt and less then 24 month for property | More than 12 months for equity, more than 36 months for debt and more than 24 month for property |

| Tax Rate | For equity: 15% + cess + surcharge; For debt and property: as per income tax slab rate | For equity: 10% without indexation (if gain exceeds ₹1 lakh); For debt and property: 20% with indexation |

| Indexation Benefit | Not available | Available for debt and property, helps in reducing tax liability by accounting for inflation |

| Impact on Tax Liability | Generally higher due to higher tax rates | Generally lower due to lower tax rates and indexation benefits |

| Relevance in Financial Planning | Crucial for short-term investors looking for quick returns | Important for long-term investors aiming for wealth accumulation over time |

| Examples | Selling shares in 10th month, selling property in 20months | Selling shares in 2nd year, selling property in 5th year |

When it comes to short-term capital gains (STCG), there are specific situations where you might be able to minimize or even eliminate your tax liability. Here are some key exemptions and strategies available in India for 2024:

By understanding these exemptions and strategies, you can effectively plan to minimize your short-term capital gain tax liability, ensuring you make the most out of your investments.

Understanding the nuances of Short-Term Capital Gain Tax (STCG) is essential for anyone involved in buying and selling assets like mutual funds, shares, and property. STCG is applicable when these assets are held for a short period, and the gains made are taxed accordingly. The tax rate for STCG on equity mutual funds and shares is generally 15%, while for debt mutual funds and property, the gains are added to your income and taxed as per your applicable income tax slab. By comprehensively knowing how STCG works, you can make more informed investment decisions and potentially reduce your tax liability through strategic planning.

The holding period for STCG varies by asset type:

- Equity shares and equity-oriented mutual funds: Less than 12 months.

- Debt mutual funds: Less than 36 months.

- Property: Less than 24 months.

STCG on equity shares is calculated at 15% of the gain plus applicable cess and surcharge. For instance, if you made a gain of ₹1,00,000, the STCG tax would be ₹15,000 plus cess and surcharge.

Generally, there are no exemptions for STCG. However, losses from STCG can be set off against other short-term or long-term capital gains.

While you cannot entirely avoid STCG tax, you can reduce your liability by:

1. Offsetting gains with losses.

2. Holding assets for a longer period to qualify for long-term capital gains, which are taxed at a lower rate.

3. Investing in tax-saving instruments.

Yes, if your total tax liability, including STCG, exceeds ₹10,000 in a financial year, you need to pay advance tax in instalments.