Understanding the Price-to-Book Ratio is crucial for making informed investment decisions, as it helps identify potential investment opportunities and assess a company's financial health within its industry. In this comprehensive guide, we will delve into the intricacies of the P/B Ratio, including its calculation, significance, and application in investment strategies.

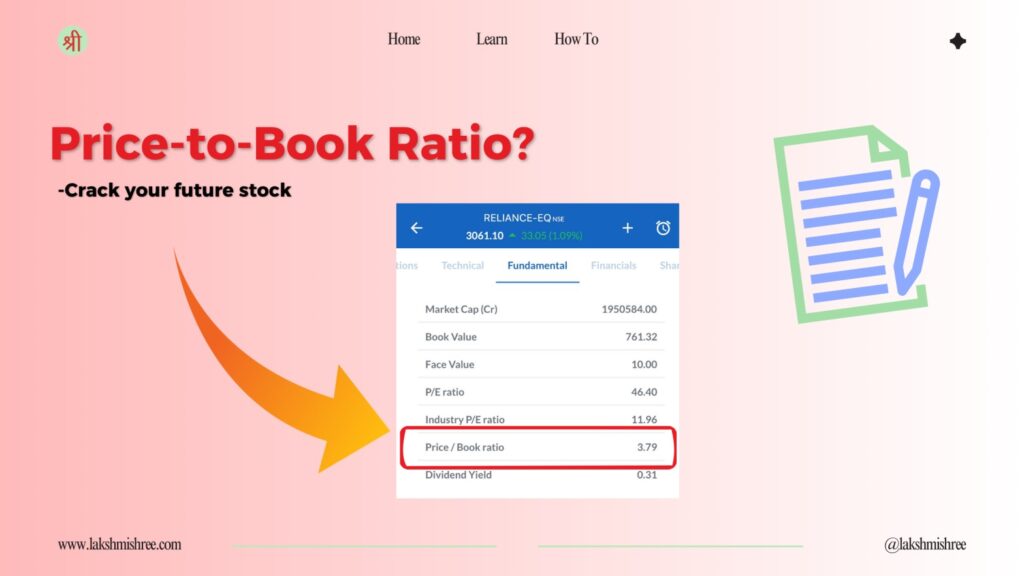

The Price-to-Book Ratio (P/B Ratio) is a fundamental financial metric that investors use to evaluate the market value of a company relative to its book value.

The Price-to-Book Ratio (P/B Ratio) is a financial metric that compares a company's market value to its book value. This ratio is calculated by dividing the market price per share by the book value per share. The book value represents the net asset value of a company, calculated as total assets minus intangible assets (like goodwill) and liabilities. Investors use the P/B Ratio to assess whether a stock is undervalued or overvalued.

For example, if a company's P/B Ratio is less than 1, it means that the market is valuing the company at less than its book value, which could indicate an undervalued stock. Conversely, a P/B Ratio greater than 1 suggests that the market values the company more than its book value, which could indicate potential overvaluation. This metric is particularly useful for value investors looking to find stocks trading for less than their intrinsic value.

Using the P/B Ratio effectively requires a good understanding of the underlying assets and the overall financial health of the company, which is why it's often used alongside other indicators like the P/E Ratio (Price-to-Earnings Ratio) and the PEG Ratio (Price/Earnings to Growth Ratio). For a deeper dive into these topics, you can read more about fundamental analysis and how to use these strategies to select the best stocks for long-term investment.

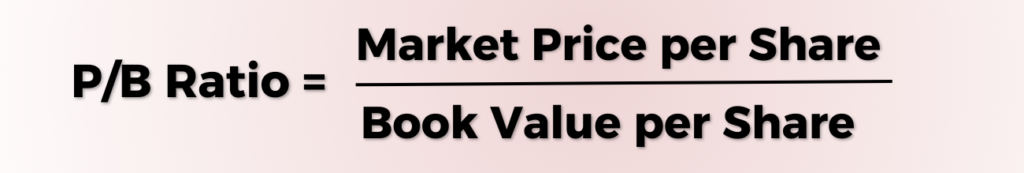

The Price-to-Book Ratio (P/B Ratio) is a straightforward financial metric used to compare a company's market value with its book value. Here’s how to calculate it:

Formula:

Step-by-Step Calculation:

To better understand the Price-to-Book Ratio (P/B Ratio), let's walk through a practical example using a sample dataset. This will help illustrate how the ratio is calculated and interpreted.

Sample Data for XYZ Company

| Parameter | Value |

|---|---|

| Market Price per Share | ₹200 |

| Total Assets | ₹1000 crores |

| Intangible Assets | ₹100 crores |

| Total Liabilities | ₹400 crores |

| Number of Outstanding Shares | 20 crores |

This calculation shows that XYZ Company has a P/B Ratio of 8, indicating that the market values the company at eight times its book value. Such a high P/B Ratio could suggest that investors are expecting significant growth from the company, but it could also mean the stock is overvalued.

The price-to-book value ratio is a valuable tool for assessing the value of a company by comparing its market price to its book value. This helps investors determine whether a stock is undervalued or overvalued, guiding informed investment decisions.

A primary use of the price-to-book value ratio is to evaluate a company's intrinsic value. A P/B Ratio of less than 1 may indicate an undervalued stock, presenting a potential investment opportunity. Conversely, a high P/B Ratio might suggest overvaluation.

The P/B Ratio allows investors to compare companies within the same industry, highlighting which are trading at a premium or discount relative to their peers. This comparison is essential for evaluating long-term investment stocks in India and identifying attractive investment opportunities.

Value investors use the P/B Ratio to find stocks trading below their book value, which may be temporarily undervalued. This can lead to potential price appreciation as the market corrects itself.

A low P/B Ratio might indicate potential issues within a company, while a high P/B Ratio can reflect strong financial performance. However, using this ratio alongside other metrics for a comprehensive analysis is important.

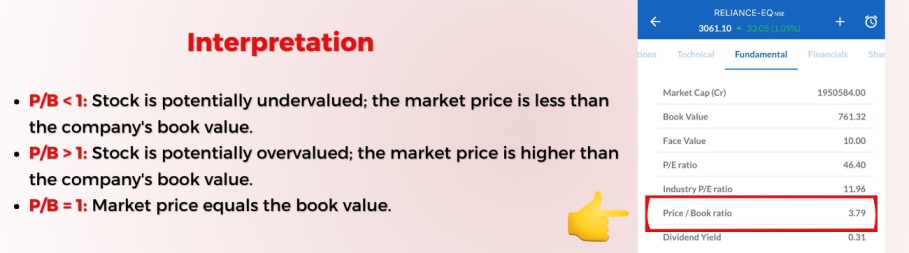

The Price-to-Book Ratio (P/B Ratio) compares the market value of a company's shares to its book value of equity. Essentially, it helps investors determine whether a stock is fairly valued, overvalued, or undervalued based on the company's net asset value.

The market value of a company's shares is the price at which the stock is currently trading. The book value of equity, on the other hand, represents the value of the company's assets as recorded on the balance sheet minus its liabilities.

A P/B Ratio of one indicates that the stock price is trading in line with the company's book value. In this scenario, the stock is considered fairly valued from a P/B standpoint. If the P/B Ratio is higher than one, it suggests that investors are willing to pay more than the book value for the company's assets.

For value investors, the P/B Ratio is a key metric. They look for stocks with a low P/B Ratio, assuming the market may not be accurately reflecting the company's true worth. This approach is based on the belief that the market is somewhat inefficient and that stocks can trade for less than their actual value.

It's important to compare the P/B Ratio of a company with its industry peers. Different sectors have varying capital structures and asset requirements, leading to different average P/B Ratios. For example, tech companies often have higher P/B Ratios due to their growth potential and intangible assets, while manufacturing companies might have lower ratios.

A price to book value ratio can be positive as well as negative. Different types of investors look for different P/B ratios. A value investor finds a ratio less than 1 more preferable as they look for stocks that are undervalued, while if the P/B Ratio is above 3, the stock is assumed to be overvalued, and the investors expect the share to perform well in the stock market. Thus, the definition of a “Good Price to Book ratio varies, but in standard, an ideal investor considers a stock undervalued when the P/B ratio is less than 3.

In industrial relations, if a startup company have a PB Ratio below 3, then it will be considered good due to its higher growth potential, but on the other hand, if a well-established company have a PB ratio below 3, then it will be less appealing if its growth is slow.

As an investor, a Good PB ratio should be determined while evaluating the Industrial Benchmark, Growth Prospect, Company Fundamentals and Market Conditions.

A negative Price-to-Book Ratio (P/B Ratio) occurs when a company’s liabilities exceed its assets. This situation means that the company’s book value is negative, which can be a red flag for potential investors. However, it is not always a definitive indicator of poor investment quality and requires deeper analysis.

Investors should conduct a detailed financial analysis and compare the company’s P/B Ratio with industry peers. Reviewing the company's management strategy and future outlook is crucial.

For more insights, read about fundamental analysis and long-term stocks in India.

The main limitation of using the price to book value ratio is that it only considers tangible assets (i.e., the assets seen on the balance sheet) and does not consider the company's intangible assets (i.e., patents of the company, intellectual property, brand value, etc.).

Thus, the P/B ratio cannot be used to compare two companies; a tech or pharma company will likely have more intellectual property than a media company. The PB ratio also fails on account of the company's future growth prospects.

One another limitation is the book value which is historically based, so it may not reflect the inflation and current value of assets, so the appreciation on the asset will also not be recorded like the real estate held on books at historical price, which may worth much in the current market.

Price-to-Book Ratio (P/B Ratio) is essential for making informed investment decisions. This ratio helps investors identify whether a stock is undervalued or overvalued by comparing a company's market price to its book value. It serves as a valuable tool for assessing a company's financial health, comparing companies within the same industry, and identifying potential investment opportunities. By using the P/B Ratio alongside other financial metrics, investors can develop a comprehensive view of a company's true value and make smarter investment choices.

A low Price-to-Book Ratio (P/B Ratio) typically indicates that a stock is undervalued, meaning the market price is less than the company's book value. This may suggest a potential buying opportunity for investors looking for undervalued stocks.

Yes, the Price-to-Book Ratio can be negative if a company's liabilities exceed its assets, resulting in a negative book value. This is often seen as a red flag, indicating potential financial distress, but requires further analysis to understand the underlying reasons.

A high Price-to-Book Ratio indicates that the market values the company significantly higher than its book value. This can be due to investor optimism about the company's future growth prospects, strong financial performance, or valuable intangible assets.

Investors use the Price-to-Book Ratio to compare companies within the same industry. It helps identify which companies are trading at a premium or discount relative to their peers, aiding in the selection of attractive investment opportunities.

The Price-to-Book Ratio mainly considers tangible assets and does not account for intangible assets like intellectual property or brand value. It also relies on historical book values, which may not reflect current market conditions or inflation, limiting its accuracy in some cases.