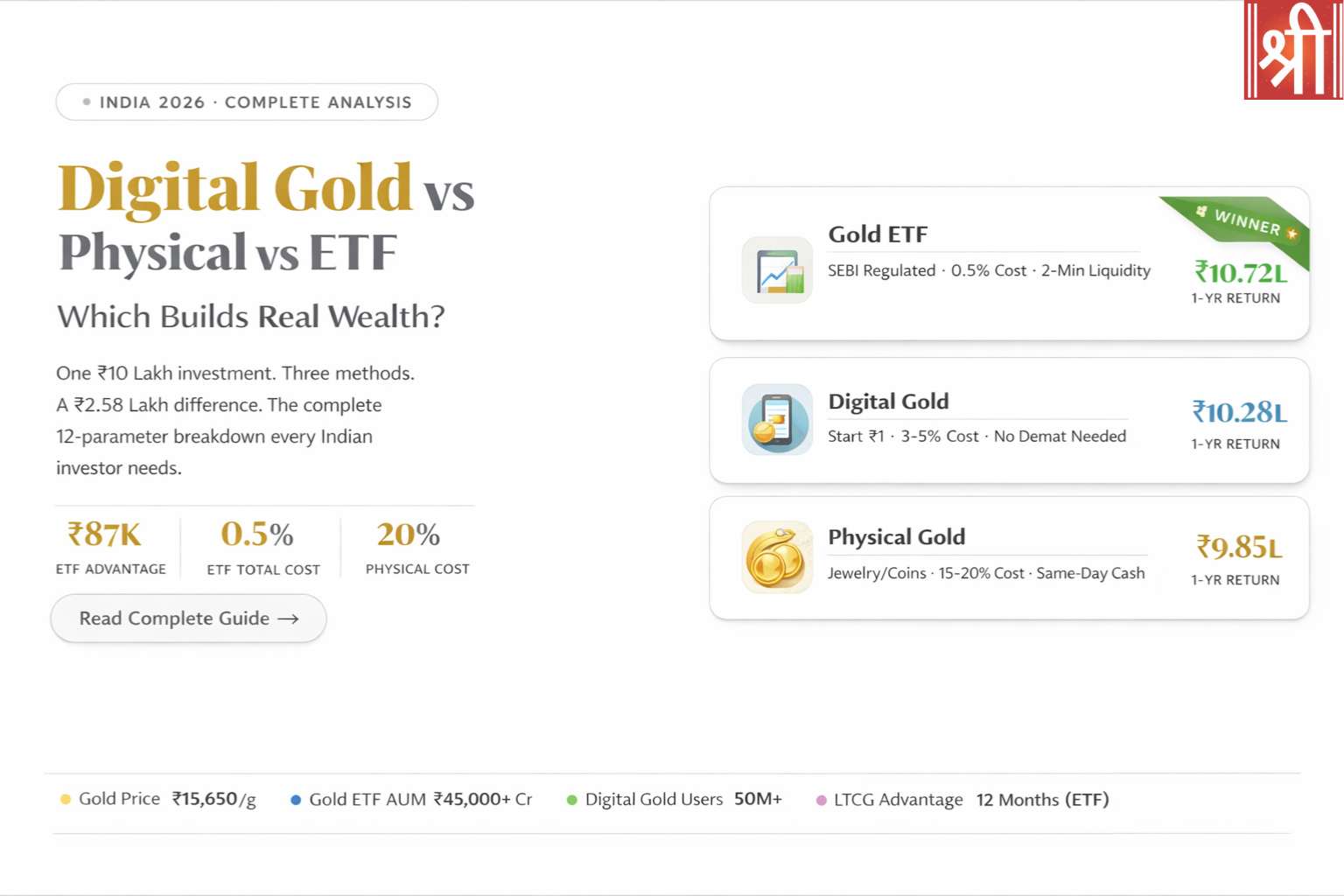

. Quick Answer For most Indian investors in 2026, Gold ETFs are the superior choice. They offer the lowest entry cost (₹130), highest net returns (up to ₹87,000 more than physical gold on ₹10L), and instant liquidity. Best for Wealth: Gold ETF Best for Beginners: Digital Gold Best for Tradition: Physical Gold Scroll down for […]