The most expensive share in India 2026 is MRF Ltd., trading at over ₹1.47 lakh per share. Close behind is Elcid Investments, with a share price of ₹1.24 lakh. These high-priced stocks are known not just for their price tags but also for their strong fundamentals, limited availability, and long-term investor trust.

In this blog, we will explore the top 10 most expensive stocks in India, understand what drives their high prices, and whether investing in them makes sense for different types of investors. From iconic names like Page Industries and Shree Cement to niche companies like Yamuna Syndicate and Bombay Oxygen, each stock has a unique growth story worth knowing.

When we talk about the most expensive shares in India, it’s not just about a big price tag. A high share price often reflects a company’s strong financial performance, limited number of shares, and consistent investor demand. These high-priced shares in India usually belong to industry leaders with a trusted brand and stable earnings.

But just because a stock is costly doesn’t mean it’s always the best investment. Sometimes, companies with fewer outstanding shares—like MRF or Elcid Investments—have a high per-share value, even if their overall size (market cap) is smaller than larger companies.

In India, the costliest stocks often come from firms with strong market leadership and low stock availability, which increases their value per share. That’s why it’s important to look beyond just the price and evaluate a company’s fundamentals like revenue, profit growth, debt levels, and long-term prospects before investing.

Here's a detailed table of the top 10 most costly shares in 2026, including their sub-sector, market capitalisation, current market price (CMP), and 3-year return performance.

| Costliest share in India | Market Cap (₹ Cr.) | CMP (₹) | 3yr Return |

| 1. MRF Ltd. | 62,600 | ₹1,47,550 | 72% |

| 2. Elcid Investments | 2,482 | ₹1,24,101 | 5,63,190% |

| 3. Bosch | 1,11,264 | ₹37,730 | 120.30% |

| 4. Page Industries | 38,712 | ₹34,445 | 17.18% |

| 5. 3M India | 38,712 | ₹34,345 | 50.85% |

| 6. Honeywell Auto | 29,566 | ₹33,490 | 16.80% |

| 7. Abbott India | 60,273 | ₹28,365 | 26.85% |

| 8. Shree Cement | 98,139 | ₹27,200 | 12% |

| 9. Yamuna Syndicate | 820 | ₹26,702 | 110.59% |

| 10. Bombay Oxygen | 313 | ₹20,885 | 85% |

Data as of 11/01/2026

When it comes to the most expensive share price in India, these companies are not just leading the pack in terms of stock price but also in their respective industries. Below, we’ll take a closer look at each company, its history, core business, and future outlook.

MRF Ltd. continues to be India’s most expensive stock in 2026, priced above ₹1.47 lakh per share. A pioneer in the tyre manufacturing sector, MRF was founded in 1946 and has grown to become the country's largest tyre manufacturer.

MRF has never split its shares, which keeps the float limited and stock price high. Its strong fundamentals, consistent profits, and premium brand image make it one of the most trusted high-priced shares in India.

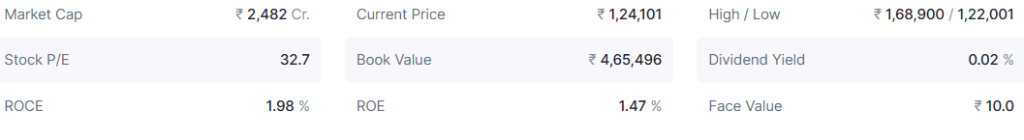

Once the most expensive share, Elcid Investments now ranks second, trading at over ₹1.24 lakh per share. It is a registered NBFC under RBI and primarily acts as an investment company.

Elcid holds valuable investments in top-performing listed companies. Due to its very low public float and minimal trading volume, the stock remains rare and commands a premium price despite limited operational activity.

Bosch Ltd. is one of the costliest shares in India and a leading automotive technology and engineering company in India, known for its innovations in mobility solutions. The company has been operational in India since 1951 and is part of the global Bosch Group. Bosch’s offerings range from automotive components to industrial technology, making it a key player in both sectors.

4. Page Industries

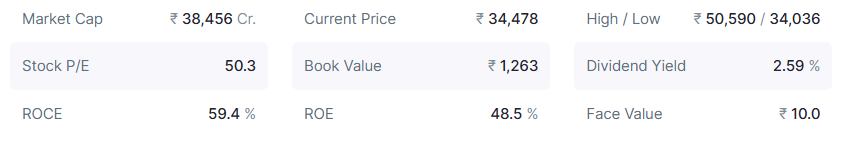

Page Industries, the exclusive licensee of Jockey in India, is a key player in India’s innerwear and lifestyle apparel segment. With a stock price over ₹34,000, it remains one of India’s top high-value stocks.

Known for consistent growth and strong brand loyalty, the company continues to dominate premium innerwear retail, targeting both urban and semi-urban markets.

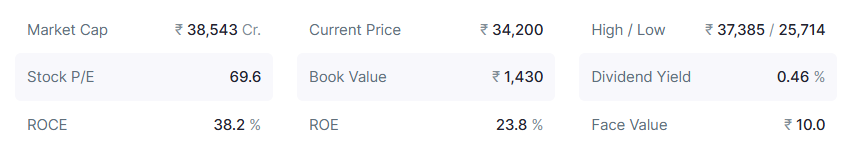

3M India, a subsidiary of the American conglomerate 3M, operates across multiple sectors, including healthcare, industrial products, and consumer goods. Founded in 1988, 3M India has gained a reputation for providing innovative solutions that address everyday needs in areas like safety, energy, and healthcare.

The company’s stock price has remained high due to its diversified product portfolio and its commitment to research and development.

Honeywell Automation India Ltd. is a leader in the field of industrial automation and control systems, serving a wide range of industries, including manufacturing, aerospace, and energy. Honeywell Automation’s stock has earned the position of the high-price stock in India thanks to its commitment to innovation and its role in driving digital transformation across Indian industries.

The company's focus on research and development ensures that it stays ahead of competitors.

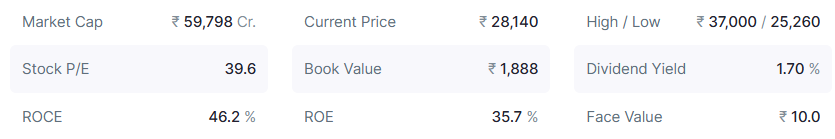

Abbott India, a subsidiary of the global healthcare company Abbott, has been serving the Indian market for over 100 years. The company provides trusted pharmaceutical products and nutritional supplements, including popular names like Thyronorm and Digene.

Abbott India’s stock has consistently performed well due to its debt-free balance sheet, high return ratios (ROE/ROCE), and strong market presence.

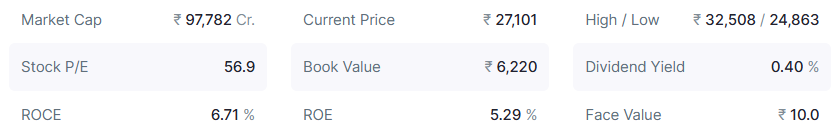

Shree Cement is one of India’s leading cement producers, focusing on eco-friendly manufacturing processes and operational efficiency. Founded in 1979, the company has grown its market share through strategic capacity expansions and by adopting innovative, sustainable practices.

Despite cyclical ups and downs in the infrastructure sector, Shree Cement maintains a high per-share value due to its cost leadership and strong brand in North and East India.

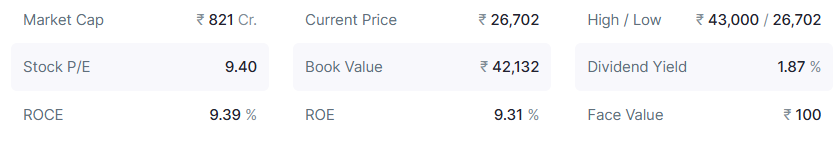

Yamuna Syndicate is a trading and marketing company that deals in a variety of products, including batteries, lubricants, and agricultural products. It also holds significant investments in other listed entities like ISGEC Heavy Engineering.

Its high share price reflects the company’s strong investment book, stable cash flows, and limited liquidity in the market.

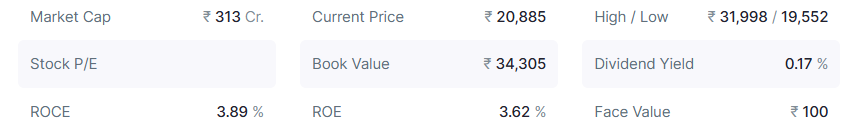

Bombay Oxygen Investments Ltd. started as a manufacturer of industrial gases but has now transformed into an investment company. Initially established in 1960, the company was known for supplying oxygen and other gases to various industries. However, in recent years, Bombay Oxygen has shifted its focus to investments and has since rebranded itself as a non-banking financial company (NBFC).

Its stock price is driven primarily by the value of its underlying investments rather than core operations, making it a unique "holding company" play in the Indian market.

These 10 companies represent the top 10 most expensive and high-priced shares in India in 2026, known for their limited float, strong business models, and long-term investor confidence.

The costliest shares in India remain expensive due to a combination of strong financial fundamentals, brand dominance, and limited share availability. These high valuations are not random—they are backed by real business performance and investor sentiment.

Investing in the most expensive shares in India can be a tempting option, but it’s essential to consider the pros and cons.

Before jumping into buying the costliest shares in India, here are key factors to consider:

The high-priced stocks in India aren’t just for high-net-worth individuals. Thanks to platforms offering fractional shares or SIPs (Systematic Investment Plans), even retail investors can buy into these high-value companies.

Investing in high-priced stocks is no longer limited to the wealthy, but it’s still important for all investors, regardless of size, to carefully evaluate their investment goals and risk tolerance before diving in.

In India, companies like MRF avoid stock splits to maintain a premium brand image and attract serious long-term investors. While a high share price might seem restrictive to retail buyers, for these companies, it signals stability, exclusivity, and financial strength.

While stock splits make shares more accessible, they do not impact the company’s fundamentals or long-term value. The actual worth of the company remains unchanged — only the number of shares and the face value are adjusted.

In 2023, HDFC Bank announced a stock split, and within the first quarter post-split, retail investor participation jumped by nearly 15%. This shows that splitting high-priced shares can lead to higher liquidity and wider retail interest.

Key Insights:

In India, while many investors welcome splits for affordability, some of the most expensive shares prefer not to split to retain their elite market image.

The most expensive shares in India are not just high in price—they are backed by strong fundamentals, trusted business models, and consistent performance. Stocks like Elcid Investments, MRF, and Page Industries have built a reputation for stability and long-term value, attracting investors who look beyond just price.

In today’s market, these companies represent more than just premium tags—they reflect reliability, brand leadership, and steady earnings potential. However, investors must always assess their risk appetite, goals, and portfolio allocation before adding such stocks.

In short, India’s most costly stocks for 2026—especially top high-priced shares like Elcid, MRF, and Bosch—can be ideal for patient, long-term investors seeking quality over quantity.

Disclaimer: This article is for educational purposes only and should not be considered financial advice. Always conduct your research and consider consulting with a financial advisor before making any investment decisions.