In the stock market, one of the simplest ways to spot undervalued opportunities is by looking at high book value stocks. These are shares where the company’s book value—the value of its assets after subtracting liabilities—is higher than what investors are currently paying in the market. For many, this makes them attractive because they may be trading at a discount to their actual worth.

As we step into 2026, Indian investors are showing more interest in such opportunities, from well-known large-cap companies to high book value penny stocks. This blog will guide you through the top high book value shares in India 2026, explain what they mean, and help you understand whether they’re really a good buy or just appear cheap on the surface.

Here’s a list of some of the high book value shares in India 2026, arranged with their latest book value figures. These stocks often belong to businesses with large asset bases or strong long-term investments, making them interesting for value-focused investors:

| High Book Value Stocks in India 2026 | Book Value |

| 1. Elcid Investment | ₹4,65,496.00 |

| 2. Yamuna Syndicate | ₹42,132.00 |

| 4. Bombay Oxygen Investments | ₹34,305.00 |

| 3. Nalwa Sons Invst | ₹31,668.00 |

| 5. JSW Holdings | ₹29,286.00 |

| 6. Maharashtra Scooters | ₹28,887.00 |

| 7. Kalyani Investment Company | ₹20,576.00 |

| 8. Pilani Investment and Industries | ₹15,347.00 |

| 9. Naga Dhunseri Group | ₹13,064.00 |

| 10. Laxmi Mills Company | ₹12,766.00 |

Data as of 14/01/2026, Source: Screener

These companies stand out because of their strong balance sheets, but it’s importato remember that a high book value alone doesn’t guarantee good returns.

These stocks are often valued differently compared to regular operating companies, since their strength lies in their investments and long-term holdings. Below is a detailed look at the top High Book Value Stocks and their performance.

Elcid Investments is one of the most talked-about high book value stocks in India, thanks to its exceptionally large book value per share. The company functions as a non-banking financial entity, holding strategic investments in blue-chip companies. Its limited floating stock and strong asset position make it stand out among investors who track book value closely.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| -24.52 | 3321.91 | 514.09 |

Data as of 14/01/2026

Yamuna Syndicate is engaged in trading, distribution, and investment activities. The company holds significant interests in various industrial and automotive businesses. With a solid book value, it reflects the financial strength and long-standing presence of the group. Investors often see it as a steady holding company with stable asset backing.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| -33.49 | 30.09 | 22.3 |

Data as of 14/01/2026

Earlier known for manufacturing industrial gases, Bombay Oxygen has shifted towards investment operations. The company maintains a portfolio of listed equity shares, which contributes to its high book value. With its strong base of assets and limited business risk from operations, it appeals to investors focused on asset-backed companies.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| -27.4 | 19.4 | 15.52 |

Data as of 14/01/2026

A part of the O.P. Jindal Group, Nalwa Sons Investments primarily manages long-term holdings in the group’s companies. Its high book value shares position comes from the strength of its assets in steel and infrastructure sectors. For investors looking at book value-based opportunities, this stock offers insights into the potential of group-based investment firms.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| -10.68 | 40.20 | 44.70 |

Data as of 14/01/2026

JSW Holdings is the investment arm of the JSW Group, with strong stakes across the steel, energy, and cement sectors. Its high book value is supported by these strategic holdings, which have shown growth in recent years. For those tracking top book value stocks, JSW Holdings frequently appears as a reliable example of a holding company’s asset strength.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 2.95 | 63.03 | 39.81 |

Data as of 14/01/2026

Maharashtra Scooters, part of the Bajaj Group, functions mainly as an investment company with long-term holdings in Bajaj Auto and related businesses. Its consistent dividend income and high book value reflect strong financial health. Over time, it has been considered a safe bet for investors who prefer asset-backed stocks.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 51.61 | 47.20 | 31.39 |

Data as of 14/01/2026

Kalyani Investment Company is part of the Kalyani Group and invests in listed and unlisted companies of the group, including Bharat Forge. Its high book value stems from these strategic stakes. Investors tracking stocks below book value often look at such companies for potential mispricing in the market.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| -9.08 | 34.16 | 24.59 |

Data as of 14/01/2026

Pilani Investment is part of the Birla Group, serving as a holding company for group businesses in cement, financial services, and more. With a strong book value and diversified portfolio, it often represents the stability of group-based investment structures in India.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 0.11 | 37.26 | 20.66 |

Data as of 14/01/2026

Naga Dhunseri is involved in investments and financial activities, maintaining a diversified set of holdings across sectors. Its steady returns and strong book value reflect the long-term approach of the group. For investors tracking high-value asset-based shares, it stands as a niche but notable name.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| -30.62 | 27.35 | 29.91 |

Data as of 14/01/2026

Laxmi Mills, part of the traditional textile sector, also maintains a significant asset base that contributes to its high book value. While the core business has seen challenges over time, its long-standing presence and assets continue to support its valuation. This makes it one of the lesser-known but important high book value shares in India.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 26.76 | 24.59 | 34.10 |

Data as of 14/01/2026

Here’s a snapshot of a few penny stocks in India 2026 that are trading with notable book values compared to their CMP. While these stocks may look attractive due to their affordable price tags, it’s important to remember that penny stocks often come with higher risks and need careful research before investing.

| High Book Value Penny Stocks | CMP (₹) | Mark Cap(₹ Cr) | Book Value (₹) |

| 1. GFL | 54.70 | 601 | 230.00 |

| 2. Hindustan Media Ventures | 71.10 | 524 | 211.00 |

| 3. Kothari Products | 68.80 | 411 | 188.00 |

| 4. GHCL Textiles | 75.00 | 716 | 153.00 |

| 5. Dhampur Bio Organics | 80.60 | 535 | 145.00 |

Data as of 14/01/2026, Source: Screener

These penny stocks may appear undervalued when compared with their book value, but investors should evaluate fundamentals, debt levels, and business prospects before making decisions.

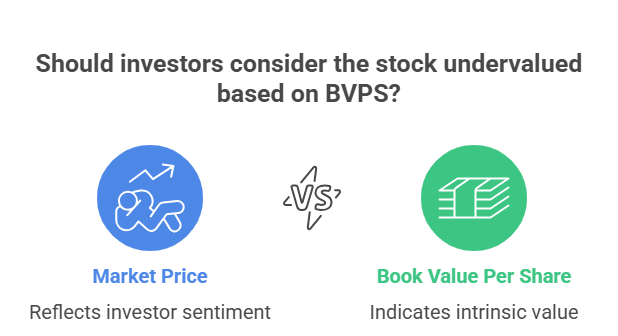

High book value stocks are shares of companies whose book value is higher than their current market price. In simple terms, the company’s actual worth on paper (its assets minus liabilities) is greater than what investors are paying in the stock market. For many value investors, this signals a potential buying opportunity, as such stocks may be undervalued.

The book value of a company represents its net worth and is calculated by subtracting total liabilities from total assets. When this figure is divided by the number of outstanding shares, it gives the book value per share (BVPS). This metric is useful because it shows how much each share is theoretically worth if the company were liquidated.

Investors often track high book value shares as they can highlight companies with strong asset backing. However, not every stock with a high book value compared to its market price turns out to be a great investment; sometimes, low prices reflect weak earnings or poor future prospects. That’s why book value should be studied along with other ratios and fundamentals.

The calculation of book value per share (BVPS) is straightforward and widely used in stock analysis. The formula is:

Book Value Per Share (BVPS) = (Total Assets – Total Liabilities) ÷ Total Number of Outstanding Shares

For example, if a company has total assets worth ₹500 crore, total liabilities of ₹200 crore, and 10 crore outstanding shares, then:

BVPS = (500 – 200) ÷ 10 = ₹30 per share

This means the book value of each share is ₹30. If the market price of that share is, say, ₹20, then the stock is trading below its book value and may be considered undervalued by investors.

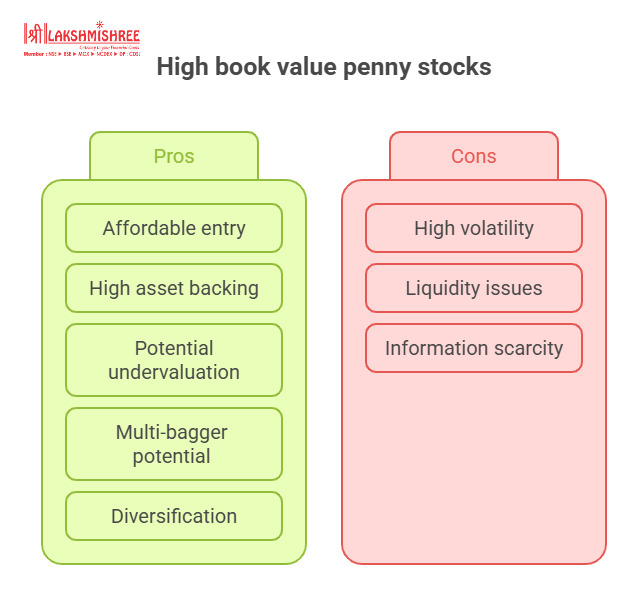

Investors are often curious about high book value penny stocks because these low-priced shares sometimes indicate undervalued opportunities. Here are the main reasons why they attract attention:

The terms book value and market value are often confused but represent very different concepts in stock investing. Here’s a clear breakdown:

| Factor | Book Value | Market Value |

| Definition | Net worth of the company (Assets – Liabilities) per share. | The current trading price of a company’s share in the stock market. |

| Based On | Accounting records, financial statements, and company’s actual asset position. | Demand and supply, investor sentiment, growth potential, and market trends. |

| Stability | More stable, changes slowly as per balance sheet updates. | Highly volatile, changes every second during trading hours. |

| Investor View | Indicates the intrinsic or underlying value of the company. | Shows how much investors are willing to pay right now. |

| When Higher | If book value > market value, stock may be undervalued. | If market value > book value, stock may be overvalued or growth-oriented. |

High book value low price stocks can sometimes be genuine bargains when the company has strong fundamentals, steady earnings, and a healthy balance sheet, but the market has temporarily undervalued them. However, they can also be value traps if the low price is due to weak business prospects, poor management, or declining revenues. The key is to not just look at the book value but also check profitability, debt levels, and future growth potential before investing.

Not every stock trading below its book value is a good buy. While such stocks may look undervalued, the low market price often reflects deeper problems like falling profits, high debt, or a weak industry outlook. Some stocks below book value remain cheap for years without delivering returns. Investors should compare book value with other metrics like return on equity (ROE), earnings growth, and sector performance to judge if the stock is a true opportunity or just a risky bet.

High book value stocks in India continue to attract attention from value-focused investors who look beyond short-term market noise. These stocks, backed by strong assets and healthy balance sheets, can sometimes offer opportunities when their market price trades below intrinsic worth. From well-established investment companies to high book value penny stocks, the Indian market provides a variety of options for those willing to do proper research. However, relying only on book value can be misleading; it must be combined with profitability, growth outlook, and overall financial health before making decisions.

High book value stocks in India include Elcid Investments, Yamuna Syndicate, Nalwa Sons Investments, Bombay Oxygen, and JSW Holdings, all of which are known for their strong asset bases and high book value.

High book value low price stocks includes Hindustan Media Ventures, Dhampur Bio, GHCL Textiles, Kothari Products, and GFL are some examples. These stocks often attract investors who are looking for undervalued opportunities at affordable entry points.

A high book value per share can be considered good because it reflects strong asset backing for each share. However, it doesn’t always mean the stock is profitable or growing. A company may have a large book value but still struggle with weak earnings, high debt, or poor future prospects. So, while high BVPS is a positive sign, it must be assessed along with profitability and growth metrics.

Investors can find stocks trading below book value by checking financial platforms like Screener, Moneycontrol, NSE, or BSE websites. These sites provide data on book value per share and the current market price (CMP). If the CMP is lower than the book value, the stock is considered to be trading below its book value. Screening tools and filters make this process much easier for retail investors.

No, high book value stocks do not guarantee good returns. While they indicate strong assets, returns depend on many other factors such as earnings growth, industry outlook, management quality, and overall market conditions. Some stocks remain undervalued for years despite high book values.

Disclaimer: This article is for educational purposes only and should not be considered financial advice. Always conduct your research and consider consulting with a financial advisor before making any investment decisions.