In 2025, the best AI stocks include Bosch, Oracle Financial Services Software, Persistent Systems, Tata Elxsi, L&T Technology Services, Mphasis, Affle, Cigniti Technologies, Cyient, and Nucleus Software. These companies are at the forefront of India’s AI adoption, supported by initiatives like Digital India and the growing demand for AI-driven solutions worldwide.

From AI in banking software to autonomous driving and manufacturing, Indian companies are investing heavily in AI to stay competitive. This guide will cover the Top 10 Artificial Intelligence Stocks in India for 2025, explain the factors to consider before investing, highlight risks, and provide tips to build a profitable AI portfolio.

Here is a list of the top 10 artificial intelligence (AI) stocks in India 2025, based on their market capitalisation and current market price (CMP). These companies are leaders in IT services, fintech, automation, and digital platforms, making them some of the best AI stocks to watch in NSE and BSE.

| Company | CMP (₹) |

|---|---|

| 1. Bosch | 39,970.00 |

| 2. Oracle Financial Services Software | 8,415.00 |

| 3. Persistent Systems | 5,317.50 |

| 4. Tata Elxsi | 5,257.50 |

| 5. L&T Technology Services | 4,223.00 |

| 6. Mphasis | 2,826.90 |

| 7. Affle (India) | 1,899.00 |

| 8. Cigniti Technologies | 1,639.20 |

| 9. Cyient | 1,181.90 |

| 10. Nucleus Software | 1,014.80 |

Here is a detailed breakdown of the top artificial intelligence stocks in India. Each of these companies is listed on NSE and BSE, actively investing in AI-driven technologies, and showing strong financials.

Bosch is among the best AI stocks in India due to its focus on smart mobility and Industry 4.0 solutions. The company is using AI in driver assistance systems, electric vehicle technology, and advanced manufacturing automation. Its strong R&D base and global presence make it a solid AI stock, though it trades at high valuations, which may bring short-term volatility.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| 25.48 | 129.66 | 227.33 |

OFSS is one of the top AI fintech stocks in India, providing AI-based digital banking platforms, risk management systems, and financial analytics. As a subsidiary of Oracle Corp, it has strong global client reach with recurring software revenues. However, being linked to the global BFSI sector means its growth depends on banking and financial market conditions.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -23.02 | 171.24 | 183.32 |

Persistent is widely regarded as one of the best long-term AI stocks in India. It has partnerships with global tech leaders in cloud computing, generative AI, and data analytics. The company has consistently delivered strong revenue growth and maintains a leadership position in IT services. That said, premium valuations can make the stock sensitive to market corrections.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| 4.06 | 218.71 | 1026.57 |

Tata Elxsi is a leader in AI-based design and product engineering. It develops solutions for autonomous vehicles, connected healthcare, and media streaming. Its ability to integrate AI in embedded systems makes it a top artificial intelligence company in India. Investors must note, however, that the stock often trades at expensive price-to-earnings multiples.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -31.55 | -40.84 | 386.33 |

L&T Technology Services is one of the best AI engineering stocks in India, offering services in defence, industrial automation, and smart manufacturing. The company has a diversified client base across the US, Europe, and India, which makes it resilient. At the same time, a slowdown in global engineering spending could impact short-term performance.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -25.98 | 17.17 | 176.8 |

Mphasis has established itself as a top AI IT stock in India, with strong presence in cloud, data, and automation services. It focuses heavily on AI adoption in banking, insurance, and logistics. The company has long-term contracts with global clients, providing revenue stability, but dependency on US and European IT budgets remains a risk factor.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -5.83 | 39.49 | 159.07 |

Affle is an AI-powered digital advertising stock in India. Its platforms use artificial intelligence to deliver personalized mobile ads and consumer insights. This stock represents India’s growing AI adoption in the digital marketing industry. While growth potential is strong, the business is tied to digital ad cycles, which can cause earnings volatility.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| 17.81 | 45 | 258.79 |

Cigniti is a mid-cap AI technology stock in India known for its work in digital assurance, AI-based software testing, and cybersecurity. It has expanded rapidly into automation and analytics. Investors looking for smaller AI shares in India may find it attractive, but like other mid-caps, it carries higher risk and market fluctuations.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| 21.38 | 189.71 | 464.47 |

Cyient is an engineering services company that uses AI in aerospace, defence, and railway technologies. It is one of the top AI engineering shares in India, helping global clients integrate automation and predictive analytics. While the company is expanding in digital and AI services, heavy exposure to aerospace makes it vulnerable to industry cycles.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -39.94 | 42.96 | 208.42 |

Nucleus Software develops AI-driven fintech platforms for digital lending and transaction banking. It is considered one of the promising small-cap AI stocks in India with high growth potential. Investors must note that smaller AI shares can offer quick gains but are also more vulnerable to market swings compared to large-cap AI stocks.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -26.43 | 156.27 | 103.03 |

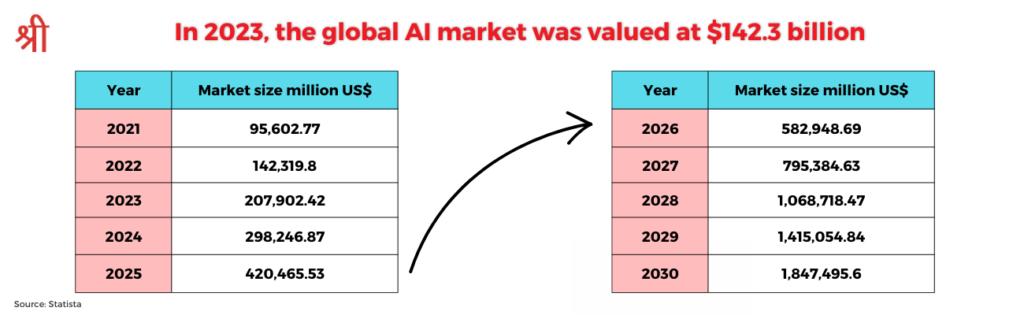

Artificial Intelligence (AI) is the technology that enables machines and software to perform tasks that normally require human intelligence—like learning, problem solving, recognising patterns, or making decisions. Today, AI powers everything from speech recognition and medical diagnosis to fraud detection and self-driving cars. According to industry reports, India’s AI spending is projected to reach $11.78 billion by 2025, making it one of the fastest-growing markets for AI adoption.

Companies listed on NSE and BSE are integrating AI into their core business models, boosting efficiency and revenue. These artificial intelligence stocks give investors a chance to participate in the growth of sectors like IT services, fintech, defence, and digital platforms, where AI demand is expected to rise sharply in the coming years.

Investing in AI stocks in India is becoming more attractive each year, thanks to rapid adoption, strong government support, and booming market potential. Here are the key benefits backed by fresh data:

Before buying AI shares in India, investors must check a few critical factors. Since artificial intelligence requires high investment and continuous innovation, looking at the right signals will help identify the best AI-related stocks in NSE and BSE.

Investing in artificial intelligence stocks through Lakshmishree is simple and hassle-free. Whether you're a seasoned investor or just starting out, our platform offers the tools and insights you need to tap into the growing AI market in India.

AI stocks in India are among the best long-term investments in 2025 due to rising adoption in IT, fintech, automotive, and manufacturing. Backed by government initiatives like Digital India and strong demand for global outsourcing, these stocks are positioned to deliver sustained growth.

For investors, the opportunity lies in both large-cap IT companies with established AI practices (like Infosys, TCS, and Persistent Systems) and mid-cap innovators (like Tata Elxsi, Affle, and Cigniti). While valuations may bring short-term volatility, the long-term outlook for AI-related stocks in NSE and BSE remains strong.

Also Check

| Best Infrastructure Mutual Funds in India 2024 |

| Best Long Term Stocks to Invest |

| Highest Dividend Paying Stocks |

| Best EV Stocks in India |

The best AI stocks in India 2025 include Bosch Ltd, Oracle Financial Services, Persistent Systems, Tata Elxsi, L&T Technology Services, Mphasis, Affle India, Cigniti Technologies, Cyient Ltd, and Nucleus Software. These companies are leaders in AI adoption across IT, fintech, automotive, and industrial automation.

Yes, AI shares in India are strong long-term investments in 2025 due to rapid adoption in IT services, digital banking, and smart manufacturing. Backed by Digital India and global outsourcing demand, AI-related stocks listed on NSE and BSE offer sustained growth potential despite short-term volatility.

Risks include volatility from fast-changing AI trends, strict data privacy rules in India, and high competition among IT majors like Infosys, Wipro, and TCS. Many AI companies also trade at premium valuations, making them vulnerable to market corrections.

AI penny stocks in India 2025 include Nucleus Software Exports, Cigniti Technologies, and Affle India. These emerging players focus on fintech, digital advertising, and AI automation. While they offer high growth potential, they also carry higher volatility compared to large-cap AI-related stocks.

Most leading AI-related stocks in India are listed on both NSE and BSE, including Persistent Systems (NSE: PERSISTENT), Tata Elxsi (NSE: TATAELXSI), Bosch Ltd (NSE: BOSCHLTD), and Oracle Financial Services (NSE: OFSS). Investors can trade them easily through any registered stockbroker platform.

To invest in AI stocks, you can open a trading account with Lakshmishree, fund your account, and use our research tools to identify the top-performing AI companies. After that, simply place your order through our trading platform.

Disclaimer: This article is for educational purposes only and should not be considered financial advice. Always conduct your research and consider consulting with a financial advisor before making any investment decisions.