In 2026, the best AI stocks include Bosch, Oracle Financial Services Software, Persistent Systems, Tata Elxsi, L&T Technology Services, Mphasis, Affle, Cigniti Technologies, Cyient, and Nucleus Software. These companies are at the forefront of India’s AI adoption, supported by initiatives like Digital India and the growing demand for AI-driven solutions worldwide.

From AI in banking software to autonomous driving and manufacturing, Indian companies are investing heavily in AI to stay competitive. This guide will cover the Top 10 Artificial Intelligence Stocks in India for 2026, explain the factors to consider before investing, highlight risks, and provide tips to build a profitable AI portfolio.

Here is a list of the top 10 artificial intelligence (AI) stocks in India 2026, based on their market capitalisation and current market price (CMP). These companies are leaders in IT services, fintech, automation, and digital platforms, making them some of the best AI stocks to watch in NSE and BSE.

| Top AI Stocks | Market Cap (₹ Cr.) | LTP (₹) | 1Y Return (%) | 3Y Return (%) |

| Bosch | ₹1,07,430.58 | 36,425.00 | +35.80% | +104.52% |

| Oracle Financial Services | ₹60,320.12 | 6,932.00 | -14.23% | +120.21% |

| Persistent Systems | ₹74,663.08 | 4,733.00 | -13.52% | +93.38% |

| Tata Elxsi | ₹28,113.84 | 4,513.00 | -18.88% | -30.71% |

| Affle (India) | ₹19,376.53 | 1,377.20 | -5.67% | +39.09% |

| Cyient | ₹10,162.52 | 914.70 | -30.07% | -5.37% |

| Zensar Technologies | ₹12,840.86 | 564.75 | -29.20% | +93.67% |

| RateGain Travel | ₹6,251.73 | 529.35 | +5.27% | +53.15% |

| Happiest Minds | ₹5,478.85 | 359.80 | -48.61% | -58.22% |

| Saksoft | ₹1,877.85 | 141.67 | -19.06% | +24.23% |

Here is a detailed breakdown of the top artificial intelligence stocks in India. Each of these companies is listed on NSE and BSE, actively investing in AI-driven technologies, and showing strong financials.

Bosch is among the best AI stocks in India due to its focus on smart mobility and Industry 4.0 solutions. The company is using AI in driver assistance systems, electric vehicle technology, and advanced manufacturing automation. Its deep integration of AI in autonomous driving systems and high-end manufacturing automation keeps it at the forefront of industrial innovation, though it trades at high valuations, which may bring short-term volatility.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| 35.80 | 104.52 | 145.21 |

OFSS is one of the top AI fintech stocks in India, providing AI-based digital banking platforms, risk management systems, and financial analytics. As a subsidiary of Oracle Corp, it has strong global client reach with recurring software revenues. However, being linked to the global BFSI sector means its growth depends on banking and financial market conditions.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -14.23 | 120.21 | 127.76 |

Persistent is widely regarded as one of the best long-term AI stocks in India. It has partnerships with global tech leaders in cloud computing, generative AI, and data analytics. The company has consistently delivered strong revenue growth and maintains a leadership position in IT services. That said, premium valuations can make the stock sensitive to market corrections.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -13.52 | 93.38 | 471.43 |

Tata Elxsi is a leader in AI-based design and product engineering. It develops solutions for autonomous vehicles, connected healthcare, and media streaming. Its ability to integrate AI in embedded systems makes it a top artificial intelligence company in India. Investors must note, however, that the stock often trades at expensive price-to-earnings multiples.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -18.88 | -30.71 | 69.80 |

Affle is an AI-powered digital advertising stock in India. Its platforms use artificial intelligence to deliver personalized mobile ads and consumer insights. This stock represents India’s growing AI adoption in the digital marketing industry. While growth potential is strong, the business is tied to digital ad cycles, which can cause earnings volatility.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -5.67% | 39.09% | 32.44% |

Cyient is a major player in AI-powered engineering and digital solutions, particularly for the aerospace and defense sectors. While its 1-year performance shows significant consolidation, its role in integrating AI into complex engineering workflows remains a key driver.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -30.07% | -5.37% | 40.19% |

Zensar focuses on experience-led digital transformation, using AI for hyper-personalization and intelligent automation in retail and manufacturing. Despite recent volatility, the company has nearly doubled investor wealth over the last three years.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -29.20% | 93.67 | 91.28 |

RateGain is a standout in the AI SaaS space, providing revenue management and pricing intelligence for the global travel and hospitality industry. It is one of the few AI stocks showing positive growth over the last year in a challenging market.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| 5.27 | 53.15 | 55.67 |

Happiest Minds is built on a "Born Digital. Born Agile" philosophy, centering its growth around AI, cloud, and security. While the stock has faced extreme valuation pressure over the past year, it remains a pure-play bet on the adoption of Generative AI.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -48.61 | -58.22 | -32.36 |

Saksoft provides niche digital transformation services, using AI to enhance business intelligence and software automation for mid-sized enterprises. Its 5-year return of over 400% highlights its success in scaling within the digital technology space.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -19.06 | 24.23% | 408.51% |

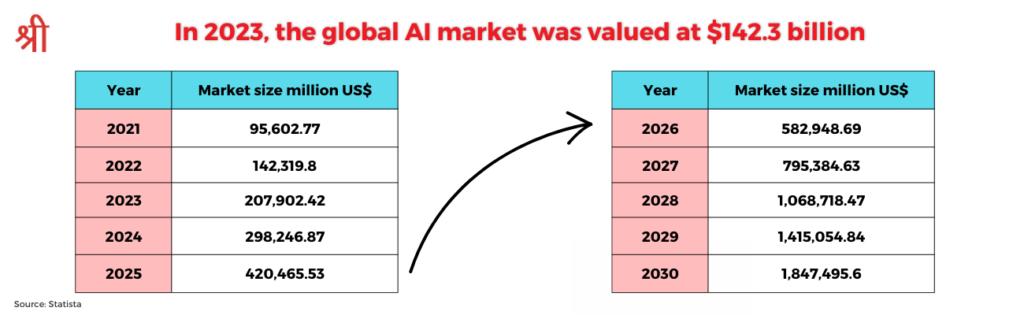

In 2026, Artificial Intelligence (AI) has moved beyond being a trend. It is now the engine driving the next industrial Execution Supercycle. By enabling machines to learn, solve problems, and recognize patterns, AI is revolutionizing everything from medical diagnostics to autonomous defense systems. With India's AI spending projected to surpass $11.78 billion, the market is at a critical tipping point for investors.

Listed companies on the NSE and BSE are no longer just using AI; they are rebuilding their core business models around it to unlock unprecedented efficiency. Whether it is IT services, fintech, or smart manufacturing, these AI stocks offer a unique window into the future of the Indian economy. For those looking to participate in this growth, the key lies in identifying which companies are successfully converting AI potential into measurable revenue.

Investing in AI stocks in India is becoming more attractive each year, thanks to rapid adoption, strong government support, and booming market potential. Here are the key benefits backed by fresh data:

Before buying AI shares in India, investors must check a few critical factors. Since artificial intelligence requires high investment and continuous innovation, looking at the right signals will help identify the best AI-related stocks in NSE and BSE.

Investing in artificial intelligence stocks through Lakshmishree is simple and hassle-free. Whether you're a seasoned investor or just starting out, our platform offers the tools and insights you need to tap into the growing AI market in India.

Supported by the IndiaAI Mission and the massive scale-up of Digital India, these Artificial Intelligence (AI) Stocks are now core to the IT, fintech, and smart manufacturing sectors. For investors, the 2026 market offers a dual-track opportunity:

While the high-growth nature of these NSE and BSE listings can lead to short-term price swings, their essential role in India’s journey toward a $1 trillion AI-driven economy ensures a powerful long-term outlook.

Also Check

| Best Infrastructure Mutual Funds in India 2024 |

| Best Long Term Stocks to Invest |

| Highest Dividend Paying Stocks |

| Best EV Stocks in India |

Persistent Systems leads the group with an exceptional 5-year return of 471.43%, followed closely by Saksoft at 408.51%. These companies have successfully scaled their AI and digital transformation services to capture massive global demand over the last half-decade.

Risks include volatility from fast-changing AI trends, strict data privacy rules in India, and high competition among IT majors like Infosys, Wipro, and TCS. Many AI companies also trade at premium valuations, making them vulnerable to market corrections.

In 2026, the AI penny stock landscape is led by AvenuesAI (Infibeam) focusing on agentic fintech at ₹18.56 and Sagility India driving healthcare AI at ₹46.00. Vertoz Ltd (₹49.86) masters ad-tech modeling, whileMagellanic Cloud (₹25.08) provides niche automation. Higher-risk Kellton Tech (₹19.90) offers engineering services but remains volatile following recent profit fluctuations.

Tata Elxsi remains the leader in efficiency with an industry-high ROCE of 52.73%. Its specialized focus on AI-led design for autonomous vehicles and healthcare allows it to generate superior returns on every rupee invested.

To invest in AI stocks, you can open a trading account with Lakshmishree, fund your account, and use our research tools to identify the top-performing AI companies. After that, simply place your order through our trading platform.

Disclaimer: This article is for educational purposes only and should not be considered financial advice. Always conduct your research and consider consulting with a financial advisor before making any investment decisions.