If you're planning to invest in mutual funds, it's important to understand what Net Asset Value means. A mutual fund's price per unit reflects its current market value. Understanding the concept and its significance in mutual fund investments allows you to make informed decisions and achieve your financial goals. Let's explore what is NAV and how it impacts mutual fund investments in India.

NAV stands for Net Asset Value. It represents the per-unit market value of a mutual fund scheme on a specific date. NAV indicates the fund's performance and determines the buying and selling price of mutual fund units.

It is calculated once a day, typically at the end of the trading day, based on the closing prices of the fund's underlying assets.

In simpler terms, Consider a mutual fund a large basket filled with different investment options, like shares of popular companies (Reliance or Infosys), government bonds, or even gold ETFs. It tells you the current worth of each unit (like a single item) in that basket. It's like a price tag that reflects the combined value of the mutual fund's investments on a specific date.

Just like the price of groceries changes, the NAV of a mutual fund can go up or down daily based on the performance of their underlying investments. If the mutual fund invests in companies doing well, the NAV might rise, and vice versa.

Let's say you invest ₹10,000 in a mutual fund with an NAV of ₹10 per unit. This means you'll be able to purchase 1000 units (₹10,000 / ₹10 per unit). If the NAV of the fund increases to ₹12 per unit after a year, the value of your 1000 units will become ₹12,000 (1000 units * ₹12 per unit)

To understand, we need to break down its components:

Breaking Down the Equation:

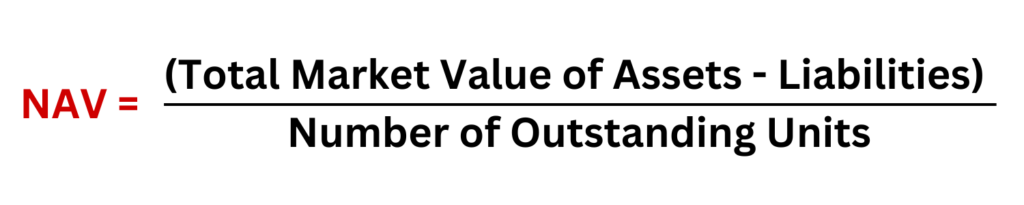

The formula is a simple mathematical equation that calculates the net asset value per unit of a mutual fund:

This formula highlights the key components influencing the Asset Value.

Step-by-Step Guide:

While you don't necessarily need to calculate it yourself, understanding the process can be empowering. Here's a step-by-step guide:

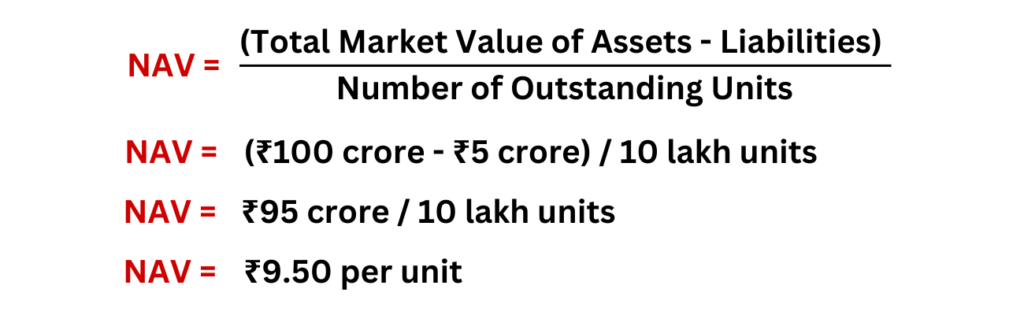

NAV= (Total Market Value of Assets - Liabilities) / Number of Outstanding Units

Let's say you're interested in a mutual fund named " Lakshmishree Growth Plus," and you've gathered the following information:

Applying the Formula:

Based on this calculation, the current NAV of "Lakshmishree Growth Plus" is ₹9.50 per unit. This means that each unit in the fund is currently worth ₹9.50. Remember, it can fluctuate daily based on market movements.

Assets and liabilities play a crucial role in the calculation. Here's how they influence:

We learned that it reflects the per-unit value of a mutual fund. But what makes this value go up and down? Here's a breakdown of the key factors influencing NAV, explained in relatable terms:

1. Market Movements (Up and Down)

Imagine you invest in a mutual fund that holds shares in companies like Reliance and Infosys. The NAV of your fund is directly linked to the performance of these companies' shares.

2. Fund Inflows and Outflows

Think of your mutual fund like a large basket holding investment units.

3. Dividend Distribution

Mutual funds might sometimes distribute some of their profits as dividends to investors. This is like taking a slice out of the investment pie.

NAV stands for Net Asset Value in Mutual Funds.

Contrary to popular belief, It doesn't have a formal full form. It's a widely accepted term used in the financial world to represent the Net Asset Value per unit of a mutual fund scheme.

Mutual funds are investment vehicles that pool money from multiple investors and invest it in a diversified portfolio of assets. This allows investors to participate in the stock market with smaller investment amounts and benefit from professional management expertise.

It plays a vital role in the functioning of mutual funds:

Focus on Overall Costs:

While entry and exit loads might exist in some funds, they're not always present. When choosing a mutual fund, consider the overall expense ratio (discussed earlier) and any potential loads to understand the total cost involved.

Assessing Investment Performance:

Tracking the Value of your mutual fund investments gives you a sense of their performance over time. A rising Asset Value suggests your investment might grow, while a falling might indicate a potential decline.

While a rising NAV is generally positive, but it's not the sole indicator of a good mutual fund. Here's why:

Impact on Portfolio Management:

Understanding this allows you to make informed decisions about your mutual fund investments. You can compare the Net Value of different funds within the same category to assess their relative performance and adjust your portfolio allocation accordingly.

Checking the Net Asset Value of your mutual fund investments is a breeze. Here are some ways to do it:

Imagine you invest ₹10,000 in a mutual fund today. The money you invest goes towards buying units of the fund, which hold various investments like stocks and bonds. However, some ongoing costs are involved in managing this basket of investments. These costs are called "expense ratios" and are a percentage of the fund's total value deducted before calculating the NAV.

Think of your mutual fund as a delicious dosa filled with different investment options. The expense ratio is like the cost of the ingredients and the chef's expertise in preparing the dosa.

A lower expense ratio (0.5%) means a smaller portion is deducted for managing the fund (around ₹50 per year on your ₹10,000 investment) before calculating the NAV. This translates to a potentially higher price per unit.

A higher expense ratio (1.5%) means a larger chunk is taken out before calculating the net value. While it might initially seem small, it can significantly impact your overall returns.

According to SEBI regulations, the expense ratio of mutual funds cannot exceed 2.25%, though most mutual funds maintain ratios well below this limit. For instance, Bandhan Regular Savings Fund Direct Plan Growth's expense ratio is 1.19%, comparatively higher than other mutual funds. Generally, good mutual funds typically range between 0.20% to 1.00%, which is considered favourable for investors. Like ICICI Prudential Nifty 50 Index Fund has 0.34%.

In certain instances, some brokers may impose a higher expense ratio when you invest through them, as they include their commission. Therefore, selecting a reliable stock broker like Lakshmishree is crucial, who doesn't charge any additional commission over the mutual funds' expense ratio. This ensures transparency and helps you maximize your returns on investments.

This expense is taken out before calculating the next net asset value, which means fund managers won't charge you separately for it from your investment amount.

This is like a window into the world of a mutual fund. It tells you the current worth of each unit, but its role extends far beyond just a price tag. Let's delve deeper into how it can be a valuable tool for evaluating a fund's performance:

Imagine two mutual funds, Fund A and Fund B, investing in similar large-cap stocks. Here's where net value can help you differentiate:

Lower Expense Ratio, Higher Potential Returns: Fund A might have a lower expense ratio, meaning the fees charged to manage the fund are lower. This translates to a larger portion of the fund's assets being available for potential investment returns. If both Fund A and B experience similar market movements, a lower expense ratio in Fund A could lead to a higher net value over time, potentially indicating more efficient management.

Rising Net Value, Potential Growth: A rising net value over time can suggest the underlying value of the fund's investments is increasing. This might indicate a well-performing fund, but remember, past performance does not guarantee future results.

Net Value is a Snapshot, Not a Crystal Ball: It reflects the current market value but doesn't predict future performance. Market fluctuations can cause it to rise and fall.

Look Beyond the Numbers: While It is a helpful tool, consider the fund's investment strategy, risk profile, and your own financial goals. A high-risk fund might have a higher potential return and a higher chance of experiencing significant fluctuations. Align your investment choices with your risk tolerance and investment horizon.

Compare Within Categories: When comparing Net values, focus on funds within the same category (e.g., large-cap, small-cap, debt). Comparing an equity fund's value to a debt fund's value wouldn't be an apples-to-apples comparison due to their inherent risk-return profiles.

Here are some common misconceptions to be aware of:

Net Asset Value is a critical concept for Indian investors venturing into mutual funds. Understanding what is NAV, how it is calculated, and its implications allows you to make informed investment decisions.

1. NAV Definition: It is a financial metric that represents the per-share market value of a mutual fund, ETF, or similar investment, calculated by subtracting total liabilities from total assets and dividing by the number of outstanding shares

2. NAV Calculation: This is calculated by subtracting liabilities from the total market value of the fund's assets and then dividing them by the number of outstanding units.

3. Importance of NAV: It helps assess investment performance, compare mutual funds, and make informed portfolio decisions.

4. Limitations of Net Asset Value: Consider expense ratios and focus on long-term performance alongside Net value for a holistic view.

Remember: It is a powerful tool but just one piece of the puzzle. When investing in mutual funds, consider your risk tolerance, investment goals, overall portfolio diversification, and Net Value analysis.

Beyond the core concepts, here are some additional points to ponder:

The world of mutual funds offers exciting investment opportunities in India. By equipping yourself with knowledge about net value and other key concepts, you can confidently make informed decisions to achieve your financial goals.

These both are related but distinct concepts:

NAV: It reflects a mutual fund scheme's net asset value per unit. It represents the underlying value of each unit based on the current market value of the fund's assets minus its liabilities.

Shareholder Equity: This refers to the total net assets of a company, which is the difference between its total assets and liabilities. It's not directly applicable to mutual funds.

NAV stands for Net Asset Value and represents the per-share value of a mutual fund. It's calculated by dividing the total value of all net assets in the fund's portfolio by the number of outstanding shares.

To calculate a mutual fund's unit price, subtract the total liabilities from the total assets. Then, divide the result by the number of outstanding shares. This formula gives you the price per share.

The formula for the Net Asset Value of a mutual fund is:

NAV=(Total Asset Value−Total Liability) / Total Number of Outstanding Shares

A mutual fund's good NAV is not determined by a specific value but by various factors. Investors should not solely rely on the NAV to evaluate the quality of a mutual fund. Instead, they should take into account the fund's past performance, investment objectives, risk profile, expense ratio, and their own financial goals. A lower or higher NAV does not inherently indicate a better or worse fund. It is crucial to assess the fund thoroughly before making investment decisions.