Have you ever wondered how big the Adani Group is? They own ports, power plants, airports, and edible oil companies. The list of Adani companies shows how one man's dream became one of India's largest business empires. Gautam Adani, a visionary businessman, leads this group. They have made a mark in almost every major sector in the country.

In this blog, we’ll explore every corner of the Adani empire from the complete Adani Group of Companies and their listed shares to new ventures and investment opportunities. If you have ever wondered, “How many companies does Adani own?” or “Which Adani shares should I watch?” — you are in the right place.

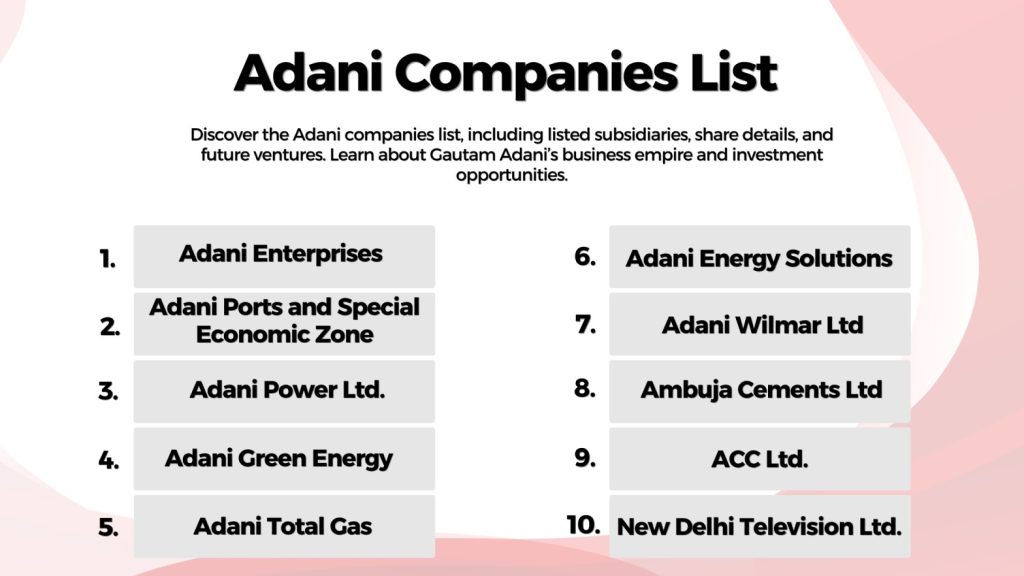

Here’s the complete Adani companies list 2025, covering every major firm owned and operated by the Adani Group of Companies. These companies operate across various sectors, including energy, ports, infrastructure, logistics, cement, media, and FMCG.

| Adani Group of Companies | Sector | CMP (Approx ₹) |

|---|---|---|

| 1. Adani Enterprises Ltd. | Conglomerate / Infrastructure | ₹2,475.70 |

| 2. Adani Ports and Special Economic Zone Ltd. | Ports & Logistics | ₹1,450.00 |

| 3. Adani Power Ltd. | Energy / Thermal Power | ₹157.85 |

| 4. Adani Green Energy Ltd. | Renewable Energy | ₹1,140 |

| 5. Adani Total Gas Ltd. | Natural Gas Distribution | ₹631.60 |

| 6. Adani Energy Solutions Ltd. (Formerly Adani Transmission) | Power & Utilities | ₹986.20 |

| 7. Adani Wilmar Ltd. (AWL) | FMCG / Agri-Business | ₹274.85 |

| 8. Ambuja Cements Ltd. | Cement & Building Materials | ₹565.40 |

| 9. ACC Ltd. | Cement & Construction | ₹1,881.50 |

| 10. New Delhi Television Ltd. (NDTV) | Media & Broadcasting | ₹92.28 |

| Company Name | Sector |

|---|---|

| 1. Adani Airports Holdings Ltd. | Aviation |

| 2. Adani Defence & Aerospace | Defence Manufacturing |

| 3. Adani Realty | Real Estate |

| 4. Adani Road Transport Ltd. | Infrastructure / Logistics |

| 5. Adani Cement Industries Ltd. | Construction Materials |

| 6. Adani Data Networks Ltd. | Telecommunications |

| 7. Adani Capital Pvt. Ltd. | Financial Services |

| 8. Adani Agro Pvt. Ltd. | Agriculture & Food |

| 9. Adani Digital Labs Pvt. Ltd. | Technology & Innovation |

Below is a detailed breakdown of the key companies within the Gautam Adani company list in 2025, including their subsidiaries and detailed financial information to comprehensively understand their market position.

Sector: Infrastructure, Mining, Airports, Incubation.

About: Adani Enterprises is the core holding company of the group. It acts as an incubator for new ventures such as airports, data centers, and green hydrogen projects. From trading commodities in the late 80s to managing airports in the 2020s, the company reflects the group’s evolution.

Key Subsidiaries:

Listed Information:

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -16.58 | -25.87 | 630.40 |

Sector: Ports, Logistics, SEZ Development.

About: APSEZ is India’s largest private port operator and logistics company. It manages critical ports like Mundra, Hazira, and Dhamra, forming the backbone of India’s import-export trade.

Key Projects:

Listed Information:

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| 3.02 | 76.03 | 302.94 |

Sector: Energy / Thermal Power.

About: Adani Power is one of India’s leading private-sector thermal power producers, supplying power across multiple states. Its commitment to reliable energy and large-scale operations has made it a key player in India’s electricity landscape.

Key Plants:

Listed Information:

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| 31.16 | 136.06 | 2,092.78 |

Sector: Renewable Energy.

About: Adani Green Energy is the renewable arm of the Adani Group. It operates large-scale solar and wind projects across India and is one of the world’s top green energy companies.

Key Projects:

Listed Information:

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -30.40 | -45.97 | 32.09 |

Sector: Natural Gas, Clean Energy Distribution.

About: ATGL, a joint venture with TotalEnergies, is focused on supplying piped natural gas and developing cleaner urban energy systems.

Key Projects:

Listed Information:

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -83.05 | -81.78 | 184.78 |

Sector: Power Transmission & Utilities.

About: Formerly known as Adani Transmission, this company manages India’s largest private power transmission network. It plays a key role in delivering electricity efficiently to millions of consumers.

Key Subsidiaries:

Listed Information:

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| 4.24 | -70.16 | 236.87 |

Sector: FMCG / Food Processing.

About: A joint venture with Wilmar International, Adani Wilmar is known for its Fortune brand, one of India’s most trusted household names in edible oil and packaged foods.

Key Products:

Listed Information:

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -18.64 | -59.38 | 20.77 |

Sector: Cement & Building Materials.

About: Acquired by the Adani Group in 2022, Ambuja Cements is one of India’s leading cement manufacturers. It supports Adani’s push into the infrastructure and housing sector.

Key Projects:

Listed Information:

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -2.50 | 8.30 | 117.62 |

Sector: Cement & Construction.

About: A major player in India’s cement industry, ACC is part of Adani’s cement vertical. The acquisition strengthened Adani’s position in the construction materials sector.

Key Facilities:

Listed Information:

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -19.38 | -19.91 | 13.99 |

Sector: Media & Broadcasting.

About: Adani Group’s acquisition of NDTV marked its entry into India’s media and communication sector. The company operates popular news channels NDTV India and NDTV 24x7.

Key Subsidiaries:

Listed Information:

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

|---|---|---|

| -28.80 | -56.81 | 78.28 |

The history of the Adani Group of Companies is one of ambition, courage, and an unshakable vision. Founded in 1988 by Gautam Adani, the group began as Adani Exports, a small trading firm in Ahmedabad, Gujarat. Initially, it traded in agricultural and power commodities. Gautam Adani’s sharp business instincts, combined with India’s economic liberalisation in the early 1990s, paved the way for rapid expansion.

Below is a brief look at the key milestones in the journey of the Adani Group of Companies:

| Year | Key Event / Launch | Description |

|---|---|---|

| 1988 | Expands into data centres, airports, roads, and digital infrastructure. | Gautam Adani establishes Adani Exports (now Adani Enterprises) in Ahmedabad, focusing on commodity trading. |

| 1994 | Entry into Infrastructure | Secures contract for Mundra Port, marking the group’s entry into large-scale infrastructure. |

| 1996 | Formation of Adani Power Ltd. | Starts operations in thermal power generation. |

| 1999 | Adani Wilmar Joint Venture | Forms a joint venture with Wilmar International of Singapore to produce edible oils and FMCG products. |

| 2006–2010 | Expansion in Energy & Mining | Expands into coal mining, logistics, and power transmission sectors. |

| 2014–2019 | Entry into Renewable Energy | Launches Adani Green Energy to lead in solar and wind energy. |

| 2020 | Major Acquisitions | Acquires Ambuja Cements, ACC, and RRPR Holdings (NDTV’s parent company). |

| 2021–2023 | New Ventures & Digital Push | Expands into data centers, airports, roads, and digital infrastructure. |

| 2025 | Global Recognition | Adani Group becomes one of India’s most diversified and valuable conglomerates with interests in over 10 sectors. |

Today, the Adani Group represents one of India’s greatest corporate success stories, growing from a single trading company into a global conglomerate with billions in market capitalisation and a firm commitment to building India’s infrastructure future.

The Adani Group listed companies on the National Stock Exchange (NSE) represent some of India’s most powerful and fastest-growing businesses. Each company under the Adani Group of Companies operates in a vital sector of India’s economy from energy and ports to FMCG and media.

Below is the complete Adani companies list currently listed on NSE in 2025:

These Adani Group listed companies together have a combined market capitalization crossing several lakh crores, showing the group’s dominance across diverse business sectors in India.

The Adani Group continues to expand aggressively into futuristic and high-growth industries, strengthening its position as one of India’s most forward-looking conglomerates. Under the leadership of Gautam Adani, the group’s focus remains on green energy, infrastructure development, digital transformation, and nation-building projects.

Here’s a look at the upcoming Adani ventures and future plans shaping the next decade:

These ventures not only promise sustainable growth for investors but also align with India’s larger vision of self-reliance and clean development.

The Adani Group of Companies operates across several critical sectors that fuel India’s economy. Its diversification from ports and power to FMCG and media has made it one of the most influential business empires in the country. Below is a breakdown of the key sectors and the companies driving growth in each:

Here’s a quick look at the top leadership team driving the Adani Group of Companies:

These key individuals have played an instrumental role in expanding the Adani group subsidiaries across global markets while ensuring steady financial performance.

While the Adani Group listed companies offer strong growth potential, investors should be aware of certain risks before investing:

Investors should analyse each company independently, maintain portfolio diversification, and consider a long-term approach when investing in the Adani share list.

Before diving into the Adani share list, it’s important to keep a few key factors in mind to make smart investment decisions. The Adani Group listed companies are diverse and dynamic, so analyzing the right metrics can help balance risk and reward effectively.

Here are the most important factors to consider:

The Adani companies list showcases one of India’s most powerful and fast-growing business empires, spanning energy, infrastructure, logistics, and FMCG. Under the visionary leadership of Gautam Adani, the group continues to drive India’s growth story with innovation and global expansion. Investing in the Adani Group listed companies offers both opportunity and responsibility—investors must research deeply, understand market conditions, and invest wisely.

As of 2025, the Adani companies list includes around 10 major listed companies and several unlisted subsidiaries operating across energy, ports, cement, FMCG, and media sectors.

The Adani Group listed companies on NSE include Adani Enterprises, Adani Ports, Adani Power, Adani Green, Adani Total Gas, Adani Energy Solutions, Adani Wilmar, Ambuja Cements, ACC, and NDTV.

To invest in the Adani share list, open a Demat and trading account with platforms like Zerodha or Groww, search for Adani stocks, analyze performance, and place your buy order directly through NSE or BSE.

The Adani Group of Companies has strong fundamentals and diversified businesses, but investors should still assess risks like market volatility and debt levels before long-term investment.

Adani Enterprises Ltd. is the flagship company overseeing multiple Adani group subsidiaries, managing new projects and emerging ventures across sectors like airports, data centers, and renewable energy.

Disclaimer: This article is intended for educational purposes only. Please note that the data related to the mentioned companies may change over time. The securities referenced are provided as examples and should not be considered as recommendations.