Have you ever wondered why your portfolio's value changes daily, even when you haven’t bought or sold anything? Or why do brokers often talk about "Mark to Market" adjustments in trading? If you’re new to the share market or trading, terms like Mark to Market (MTM) can sound confusing. But here’s the thing—It is the secret sauce that ensures fairness and accuracy when valuing your assets in real-time.

This blog will explain MTM's full form and why it’s crucial in trading and the share market. Whether you’re curious about how it works, the risks it involves, or its benefits, we’ve got you covered.

MTM stands for Mark to Market, a financial practice that adjusts the value of investments or accounts to match their current market price. This method ensures that your portfolio reflects the latest market conditions in the share market, providing real-time accuracy for gains and losses.

Mark-to-market (MTM) is a way to value assets, liabilities or investments based on current market price. In simple terms, it is to update the recorded value of these items to what they are worth today in the market and not what was paid for. This ensures the valuation is accurate, fair and current.

For example, if you bought shares worth ₹50,000 and the market price rises to ₹55,000 by the end of the day, your portfolio will show the updated ₹55,000 value. If the value drops to ₹45,000 your portfolio will show the reduction immediately. This real time valuation helps traders and investors to know their daily profits or losses.

In the case of derivatives like futures and options, where you pay only a margin (a percentage of the trade value) upfront, MTM plays an even bigger role. Every trading day profits or losses are settled based on the change in the market price. For example if your futures contract loses ₹10,000 today, that amount is deducted from your margin balance immediately so you get a fair settlement.

This is important because it gives financial transparency, helps in real-time risk assessment and keeps the trader accountable for the market movement. Without MTM, traders can face unexpected losses or margin calls and businesses can overestimate their financial position.

Mark to Market is essential because it provides a real-time snapshot of the value of assets, liabilities, or investments.

Here’s why MTM in trading is so important:

In India, mark-to-market is a daily settlement process where profits and losses from trading positions are squared off at the end of each day. When you take a position in the market, any change in the asset's price affects the margin in your trading account. Profits are added and losses are deducted immediately.

If the market moves against you and the margin falls below the maintenance margin, the broker will issue a margin call and ask you to deposit more or risk your position getting squared off. This ensures transparency and accountability as all unrealised profits and losses are settled daily.

To better understand how it works, let’s consider an example of a trader buying a futures contract:

| Day | Futures Price | P&L per Share | Lot Size | Total P&L | Margin at Start | Margin at End |

|---|---|---|---|---|---|---|

| Monday | ₹2,000 | - | 200 | - | ₹1,00,000 | ₹1,00,000 |

| Tuesday | ₹2,100 | +₹100 | 200 | +₹20,000 | ₹1,00,000 | ₹1,20,000 |

| Wednesday | ₹1,950 | -₹150 | 200 | -₹30,000 | ₹1,20,000 | ₹90,000 |

| Thursday | ₹1,850 | -₹100 | 200 | -₹20,000 | ₹90,000 | ₹70,000 |

By Thursday, the margin fell to ₹70,000, below the maintenance margin of ₹80,000. At this point, the broker issues a margin call, requiring the trader to deposit more funds or face liquidation of their position.

Mark to Market in accounting means the value of an asset or liability is reflected at the current market price. For example, if a company has a building valued at ₹10 crore but the current market value is ₹9.2 crore due to market conditions, the company has to update the value in their books to ₹9.2 crore. This ensures financial statements are accurate and realistic.

In a broader finance context, MTM values businesses and individuals in real-time. It’s a standard practice for valuing mutual funds, debt instruments and other assets that experience price changes due to market fluctuations. It ensures financials reflect a true and fair position by marking assets and liabilities at current market values.

It is a daily settlement mechanism in trading, especially with derivatives like futures and options. Profits and losses are calculated based on the difference between the current day’s closing price and the previous day’s price. This helps traders understand their exact financial standing, and brokers use this data to manage risks by maintaining adequate margins in trading accounts.

It occurs when the value of an asset, liability, or trading position decreases after being marked to the current market price. These losses are called "unrealised" because they are reflected in your account but haven’t been finalised through selling or closing the position.

MTM losses are significant because they:

Mark to Market Margin (MTM Margin) is the additional collateral required by brokers or exchanges to ensure that traders can cover potential losses caused by changes in the market value of their positions. It acts as a safety buffer, protecting both the trader and the broker from financial risks due to unfavourable market movements.

It is recalculated daily based on the latest market price of the financial instrument. If the market price moves against the trader’s position (resulting in losses), they must deposit additional funds to meet the margin requirement. This process is known as a margin call.

Example of Mark to Market Margin:

Suppose a trader buys a futures contract worth ₹2,00,000 with an initial margin of ₹50,000. If the market price drops, reducing the contract's value to ₹1,90,000, the trader incurs a loss of ₹10,000. The broker might issue a margin call to cover this loss, requiring the trader to deposit an additional ₹10,000 to maintain the required margin balance.

MTM margin ensures that:

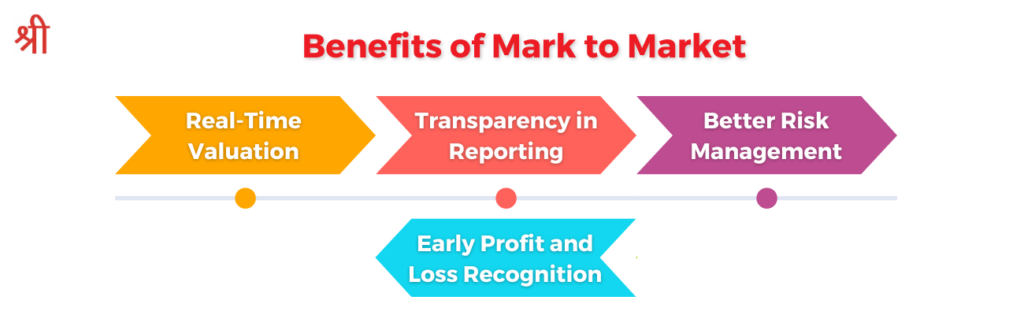

Mark to Market offers several advantages, making it a vital financial practice. Here are the key benefits:

While MTM in trading has its benefits, it also comes with risks that need to be carefully managed:

Pro traders often rely on advanced Mark to Market strategies to gain a competitive edge in volatile and complex financial markets. Here are some advanced concepts that can help experienced traders make more informed decisions:

Regarding the tax treatment of mark-to-market losses, the Income Tax Act of India provides specific guidelines to determine whether these losses are deductible. These losses are generally categorised as "real losses" or "notional losses," depending on the nature of the financial instrument and the taxpayer's intentions.

1. Business Income for Traders

If you are a trader who actively trades in securities, losses from open positions in stocks, derivatives, or futures may qualify as business expenses under Section 28 of the Income Tax Act. These losses can be offset against your business income, helping to reduce your overall tax liability. Recent Income Tax Appellate Tribunal (ITAT) rulings have clarified that MTM losses on forward contracts are not speculative and can be treated as allowable business losses.

2. Capital Loss for Investors

For long-term or short-term investments, MTM losses may be considered capital losses. Such losses can only be set off against capital gains and not against other sources of income. Carry-forward provisions allow you to offset these losses for up to eight assessment years.

3. Notional vs. Real Losses

MTM losses on open positions are classified as notional losses until the position is closed or settled. Notional losses are typically not tax-deductible unless they are realised (i.e., when the position is closed, converting the notional loss into a real loss).

4. Tax on Unrealized Gains

While losses may reduce your taxable income, any MTM profits (unrealised gains) are generally not taxed until the asset is sold or settled. This aligns with the principle of taxing only realised income.

Mark to Market (MTM) is a critical financial concept that ensures transparency, real-time valuation, and fairness in trading and the share market. From helping traders track profits and losses daily to assisting businesses in managing their financial positions, it plays an integral role across accounting, trading, and derivatives.

Whether you’re a beginner or a seasoned trader, understanding what MTM means in the share market and how it works can help you make informed decisions, manage risks, and comply with financial regulations effectively.

The full form of MTM is Mark to Market. It refers to the process of valuing financial assets, liabilities, or positions based on their current market prices, providing real-time insights into their worth.

In the share market, MTM (Mark to Market) is the practice of updating the value of investments or trading positions based on the day’s closing market price. It calculates daily profits or losses, particularly in margin trading.

To calculate Mark to Market:

1. Find the closing market price of the asset for the day.

2. Subtract the previous day’s closing price from the current day’s closing price.

3. Multiply the price difference by the number of units or lot size.

For example:

Price change = ₹2,100 (today) - ₹2,000 (yesterday) = ₹100

MTM = ₹100 x 200 shares = ₹20,000 profit.

For derivatives, MTM is used to settle daily profits or losses. For example, if a trader holds a futures contract at ₹2,000, and the price rises to ₹2,100, they earn a profit of ₹100 per unit. This profit is credited to their margin account daily.

Mark to Market margin is the additional collateral brokers or exchanges require to cover potential losses from daily price fluctuations. If the market moves against a trader’s position, they may face a margin call, requiring them to deposit more funds to maintain their trading position.

Disclaimer: This article is for educational purposes only and should not be considered financial advice. Always conduct your research and consider consulting with a financial advisor before making any investment decisions.