Are you unknowingly paying more to invest in mutual funds when you could be saving those costs for better returns? Choosing the right mutual fund plan—whether direct vs regular mutual fund—can significantly affect how much you earn in the long run. But with so many options and terms being thrown around, it’s easy to feel overwhelmed.

This blog will briefly explain the difference between direct and regular mutual funds. From their characteristics to how they impact your returns, you’ll learn everything you need to know to make an informed investment decision.

The key difference between regular and direct mutual funds lies in how they are purchased and the costs involved. Direct mutual funds are bought directly from the Asset Management Company (AMC), eliminating intermediary commissions and leading to lower expense ratios and higher returns. On the other hand, regular mutual funds are purchased through intermediaries like brokers or advisors, who charge a commission that results in higher costs and slightly lower returns for investors.

A direct plan is ideal if you prefer to save on expenses and handle your research. However, regular plans may suit you better if you need expert guidance and don’t mind paying extra. Understanding this difference is crucial to selecting the right investment path for your financial goals.

Let’s take the HDFC Nifty 50 Index Fund as an example. The direct plan has an expense ratio of 0.20%, while the regular plan charges 0.36%. This 0.16% difference may seem small, but it can significantly impact your returns over time due to compounding.

A direct mutual fund is an investment plan where you invest directly with the Asset Management Company (AMC) without involving intermediaries such as brokers or financial advisors. This means you skip paying commission or distributor fees, making direct plans more cost-effective. The expense ratio of direct mutual funds is lower, which can lead to higher long-term returns compared to regular plans.

For example, popular direct mutual funds in India include Axis Bluechip Fund - Direct Plan, Mirae Asset Large Cap Fund - Direct Plan, and SBI Equity Hybrid Fund - Direct Plan. These funds offer the same portfolio and returns as their regular counterparts but at a lower cost due to the absence of commissions. Direct plans are ideal for investors who are confident about doing their research and don’t require advisory services.

Here are the key features that define direct mutual funds:

A regular mutual fund is a type of investment where you purchase units with the help of intermediaries like brokers, distributors, or financial advisors. Direct and regular mutual funds can be purchased online through platforms or apps; the intermediary receives a commission from the AMC (Asset Management Company) in a regular fund. This commission is built into the expense ratio, making regular mutual funds slightly more expensive than direct funds.

For instance, if you’re investing in an HDFC Flexi Cap Fund - Regular Plan, the broker or distributor helping you will receive a small percentage of your investment as a commission, indirectly lowering your returns. Regular mutual funds are designed for people who prefer expert guidance to select and manage their investments, especially if they lack the time, expertise, or confidence to make these decisions independently.

Here’s what defines regular mutual funds:

Direct and regular mutual funds can technically be purchased online or through apps, but the difference lies in who gets paid for the service. For regular funds, intermediaries (like brokers or advisors) are always involved and paid commissions by the AMC. With direct funds, even if you’re using an app or platform, no commission is charged because you’re directly investing with the AMC.

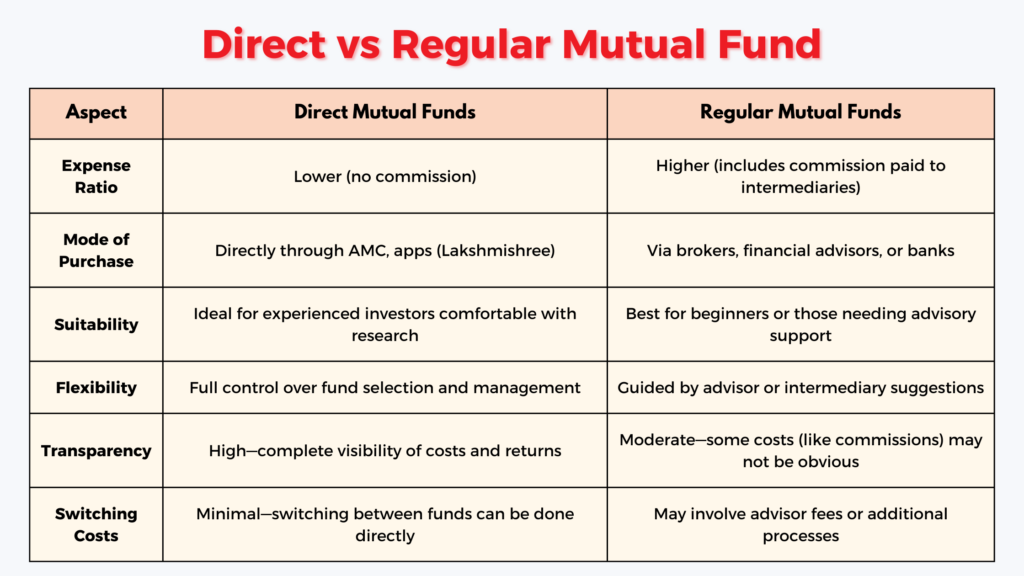

Let’s explore the key differences between regular and direct mutual funds in detail so you can better understand how they impact your investments:

The expense ratio is among the most significant factors that differentiate direct vs regular mutual funds.

For instance, if you invest ₹10,00,000 in a mutual fund that offers 12% annualised returns, a direct plan could give you ₹1.7 crores after 20 years, while a regular plan with a 1% higher expense ratio would only yield ₹1.5 crores—a difference of ₹20 lakhs!

The way you purchase these funds also differentiates direct and regular mutual funds.

The cost difference between direct and regular plans has a compounding impact over time:

This is especially important for long-term investors aiming for financial goals like retirement or children’s education, where every percentage saved matters.

Regarding returns, direct mutual funds offer better performance than regular mutual funds, primarily due to their lower expense ratio. Since direct plans eliminate the commission paid to brokers or advisors, they typically provide 0.5% to 1% higher annual returns.

The Power of Compounding

Even a small difference in expense ratios can lead to significant wealth differences over time. Consider this:

| Plan Type | Expense Ratio | Net Annual Return | Wealth After 20 Years |

|---|---|---|---|

| Direct Mutual Fund | 0.8% | 11.2% | ₹8.09 crore |

| Regular Mutual Fund | 1.5% | 10.5% | ₹6.73 crore |

A 0.7% cost difference can result in a wealth gap of ₹1.36 crore over 20 years.

For instance, the Axis Bluechip Fund - Direct Plan (expense ratio: 0.55%) has delivered 12.4% annualised returns over the last 5 years, while the regular plan (expense ratio: 1.75%) delivered only 11.1%. This 1.3% difference is due entirely to cost savings in the direct plan.

Investing in direct mutual funds through Lakshmishree is quick and easy. Here’s how:

Start your mutual fund investment journey today with Lakshmishree—smart, secure, and cost-effective!

To identify if a mutual fund is direct or regular, simply check the fund name:

You can easily differentiate between a direct and regular mutual fund by carefully checking the fund name.

The choice between direct and regular mutual funds depends on your investment knowledge and financial goals. Direct mutual funds are ideal if you are experienced, comfortable researching funds, and confident managing your portfolio. They offer lower expense ratios since no commissions are paid to intermediaries, which results in higher long-term returns.

On the other hand, if you are new to investing or prefer professional guidance, regular mutual funds can be a better option. Financial advisors or brokers provide personalised advice and portfolio monitoring and help you make informed decisions. However, these services come at a cost, as regular plans have higher expense ratios due to the intermediary’s commission, which can reduce returns over time.

Ultimately, choose direct plans for cost efficiency and higher control or regular plans if you need expert assistance and convenience. Assess your confidence in managing investments before making the decision.

Choosing between direct vs regular mutual funds depends on your investment knowledge and preferences. Direct mutual funds are ideal for investors seeking cost efficiency and higher long-term returns, as they eliminate intermediary commissions. Meanwhile, regular mutual funds offer convenience and professional advice, making them suitable for beginners or those who value expert guidance. Whether you prefer independence or support, pick the option that best suits your needs and helps you maximise your returns.

The main difference between direct and regular mutual funds is the cost. Direct funds are purchased directly from the AMC, eliminating intermediary commissions, which leads to a lower expense ratio and higher returns. Regular funds are bought through brokers or advisors, who charge commissions, making them more expensive.

Direct mutual funds are better for experienced investors seeking higher returns and lower costs. Regular mutual funds are better for beginners who need professional guidance and portfolio management, even though they come with higher expenses.

Direct mutual funds require self-research and active portfolio monitoring. They don’t offer advisory support, making them challenging for beginners or those unfamiliar with market trends.

Switching from a regular to a direct mutual fund plan can save costs and increase returns over the long term. Before switching, check for exit loads and tax implications to avoid unnecessary charges.

Look at the fund name to check if a mutual fund is regular or direct. Direct funds include the word "Direct" in the name, while regular funds do not. You can also verify this in your account statement or online platform.

Regular mutual funds offer expert advice, portfolio monitoring, and convenience, making them ideal for beginners or busy investors. These benefits come at a higher cost due to intermediary commissions.

Disclaimer: This article is intended for educational purposes only. Please note that the data related to the mentioned companies may change over time. The referenced securities are provided as examples and should not be considered recommendations.