Ever wondered how big companies raise so much money without the hassle of a full IPO? If you’re an investor watching the stock market, you must have heard of Qualified Institutional Placement. It’s one of the fastest and most efficient ways for companies to raise funds from big institutional players like mutual funds and insurance companies. But what is QIP?

This blog will break it down for you—simple, straightforward, and jargon-free. Whether you're curious about the QIP meaning, how it works in the share market, or why companies prefer it, stick around.

QIP stands for Qualified Institutional Placement. It’s a capital-raising tool that allows publicly listed companies to issue shares or other securities exclusively to Qualified Institutional Buyers (QIBs).

What is Qualified Institutional Placement: QIP Meaning

Qualified Institutional Placement is a mode of fundraising where listed companies in India can raise capital by issuing equity shares or convertible securities to institutional investors. Unlike public issues, which are time-consuming and heavily regulated, QIP is a faster and more streamlined process that targets qualified institutional buyers (QIBs) like mutual funds, insurance companies, and banks.

For example, in 2020, Axis Bank used this to raise ₹10,000 crores from institutional investors. The raised capital strengthened the bank’s balance sheet and funded its future growth plans. This is how it is a better option for companies to raise funds without the complexities of public issues.

Why Was QIP Introduced?

SEBI introduced this to solve a growing problem: Indian companies were going to foreign markets for capital through instruments like Foreign Currency Convertible Bonds (FCCBs) and Global Depository Receipts (GDRs). Overdependence on foreign funding exposed companies to currency risks and weakened the domestic capital market.

To address these issues, SEBI launched QIP in 2006. The objective was to provide companies with a faster way to raise funds domestically and reduce their dependence on foreign capital.

For example, instead of raising funds from foreign markets and risking losses due to rupee depreciation, a company can now use QIP to raise capital from domestic institutional investors quickly

QIP in the Share Market: How It Works?

In the share market, Qualified Institutional Placement operates as a targeted fundraising strategy designed to meet the needs of both companies and institutional investors. Unlike traditional methods like IPOs or FPOs, which are open to the public, QIPs focus solely on Qualified Institutional Buyers (QIBs), offering a more efficient capital-raising process.

Here's why this method stands out:

- Targeted Fundraising: It allows companies to approach only QIBs—seasoned investors who know the risks and opportunities. So company gets the required funds quickly and a professional investor base.

- Speed and Efficiency: One of the biggest advantages of QIP is speed. It can be done from board approval to listing in a few weeks. This is useful for companies that need capital urgently to grab growth opportunities or address financial needs.

- Flexibility in Pricing and Allocation: The company can fix a floor price and decide the final price based on bids from QIBs. So, shares are issued at a price that reflects the market conditions and the company’s fundraising goals.

- Minimal Market Disruption: Since They are not open to retail investors, they usually have a limited impact on the overall market sentiment or stock price volatility. This makes it an attractive option for companies looking to avoid the hype and unpredictability of public offerings.

In short, It offers a win-win solution: companies get quick access to funds, and institutional investors gain access to quality investment opportunities. This symbiotic relationship strengthens the capital market ecosystem.

What are Qualified Institutional Buyers (QIBs)?

Qualified Institutional Buyers (QIBs) are the backbone of QIPs. These are large, well-established financial institutions with the expertise and resources to evaluate and invest in high-value opportunities. Since it bypasses retail investors, participation is limited to these institutional players due to their ability to manage complex risks effectively.

Some common examples of QIBs include:

- Banks

- Mutual Funds

- Pension Funds

- Insurance Companies

- Venture Capital Funds

- Foreign Portfolio Investors (FPIs)

These entities are deemed to have the financial acumen and market knowledge to make informed decisions. By targeting QIBs, companies can ensure their capital is raised efficiently while maintaining transparency and regulatory compliance.

What is the Procedure for QIP?

The procedure for a Qualified Institutional Placement is designed to be faster and less complicated than a traditional public offering. Here’s a simplified step-by-step breakdown of how it works:

- Board and Shareholder Approval:

- The company’s board of directors must approve the plan to raise funds via QIP.

- Shareholder consent is typically obtained through a special resolution, giving the company the green light to proceed.

- Appointment of Lead Managers:

- Preparation and Filing of Placement Document:

- A placement document containing crucial information about the company’s financial health, fundraising purpose, and QIP details is prepared and filed with the stock exchanges.

- Setting the Floor Price:

- A minimum price per share (floor price) is calculated based on SEBI’s pricing formula, often using the average stock price over a set period.

- Book Building Process:

- QIBs submit bids during the book-building phase, specifying how many shares they want and at what price.

- Allotment of Shares:

- After reviewing the bids, the company, in consultation with its lead managers, decides on the final price and allocates the shares accordingly.

- Listing of Shares:

- The new shares are listed on the stock exchange within a few days, making them available for trading.

This streamlined process allows companies to raise capital efficiently, often completing everything in just a few weeks.

Rules for Issuing QIP

The Securities and Exchange Board of India (SEBI) has set clear rules for Qualified Institutional Placement to ensure fairness and transparency. Here are the key points:

- Eligibility: The company must be listed on a recognized stock exchange in India for at least one year and meet minimum public shareholding norms.

- Issue Size: Cannot exceed five times the company’s net worth or 25% of its paid-up capital in a financial year.

- Allotment Rules: At least 10% must go to mutual funds, with a minimum of 2 allottees for issues up to ₹250 crore and 5 for larger issues. No single investor can get more than 50% of the issue.

- Pricing: Determined by the two-week average share price preceding the issue.

- Lock-In Period: Shares issued under this are subject to a one-year lock-in period.

- Promoter Restriction: Promoters or major stakeholders cannot participate.

Why Do Companies Opt for QIP?

Fundraising is crucial for companies to fuel growth, manage debt, or fund new projects. While several capital-raising methods exist, Qualified Institutional Placement has become a preferred choice for many businesses.

- Quick Access to Funds: One of the biggest advantages is its speed. The process is significantly faster than traditional public offerings, allowing companies to meet urgent funding needs.

- Streamlined Process: Unlike an IPO or FPO, a Qualified Institutional Placement does not involve extensive regulatory filings or public disclosures. This reduces the administrative burden and allows companies to focus on securing funds without delays.

- Lower Costs: By avoiding the lengthy documentation and marketing efforts associated with public offerings, companies save on legal fees, underwriting costs, and listing expenses.

Regulatory Framework for QIP in India

The regulatory framework for Qualified Institutional Placement in India is governed by the Securities and Exchange Board of India (SEBI) to ensure transparency and fairness. SEBI mandates that companies issuing QIPs must be listed on a recognized Indian stock exchange for at least one year and comply with minimum public shareholding norms.

The issue size is capped at 25% of the company’s paid-up capital per financial year, while the maximum amount raised cannot exceed five times the company’s net worth.

Benefits of Qualified Institutional Placement

It is a widely favoured method for raising capital due to its numerous advantages for companies and institutional investors. Here’s why it stands out:

- Faster Fundraising: It enables companies to raise funds much quicker than traditional methods like IPOs or FPOs, making it ideal for urgent capital requirements.

- Simplified Process: Unlike IPOs, QIPs involve less paperwork and fewer regulatory hurdles, allowing companies to bypass lengthy pre-issue filings.

- Targeted Investor Base: It focuses on Qualified Institutional Buyers (QIBs), such as mutual funds and insurance companies. These investors are experienced, stable, and often have a long-term perspective, ensuring reliable capital inflows.

- Minimal Shareholder Dilution: Since It involves a limited number of investors, there is less dilution of existing shareholder stakes than public offerings.

Risks and Challenges of Qualified Institutional Placement

While they offer several benefits, they also come with their own set of risks and limitations that both companies and investors must consider:

- Market Dependency: Its success heavily relies on market conditions. Attracting QIBs can be challenging in volatile markets, even at competitive prices.

- Dilution of Ownership: While the dilution is less than in IPOs, issuing additional shares through Qualified Institutional Placement can still reduce ownership stakes for existing shareholders.

- Regulatory Scrutiny: Although less than IPOs, QIPs still require compliance with SEBI regulations, which can be complex and time-consuming for companies.

- Potential for Misuse: Concerns about companies using it for short-term gains or to benefit promoters rather than focusing on strategic long-term objectives have been raised.

How QIP Differs from Other Fundraising Methods

It stand out from other fundraising methods like IPOs, FPOs, and Rights Issues due to its speed, simplicity, and exclusivity. Here's how:

- Target Audience: They are offered exclusively to Qualified Institutional Buyers (QIBs), while IPOs and FPOs cater to the general public, including retail investors.

- Regulatory Process: It involves minimal paperwork and doesn’t require extensive SEBI approvals, unlike IPOs or Rights Issues.

- Cost-Effectiveness: They are cheaper to execute as they bypass underwriting, advertising, and public listing expenses typical of IPOs or FPOs.

- Execution Time: They are faster, usually taking a few weeks, whereas IPOs and Rights Issues require months of preparation and approvals.

- Control Dilution: While it causes limited shareholder dilution, IPOs and Rights Issues can lead to greater dilution depending on investor participation.

It offers a streamlined and efficient solution for raising funds, making it ideal for companies with urgent financial needs.

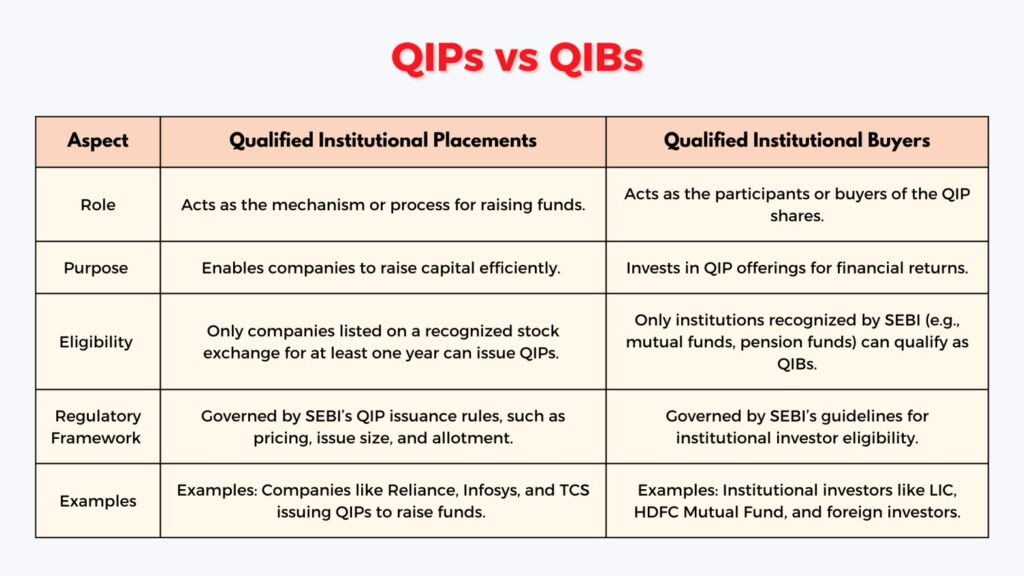

Qualified Institutional Placements (QIPs) vs Qualified Institutional Buyers (QIBs)

While Qualified Institutional Placements and Qualified Institutional Buyers (QIBs) are closely linked, they serve distinct roles in the share market.

- QIP: A fundraising method companies use to raise capital by issuing shares exclusively to QIBs. It’s a tool that allows companies to meet financial goals quickly and efficiently.

- QIB: An investor category comprising mutual funds, insurance companies, pension funds, and foreign institutional investors recognized by SEBI for their expertise and ability to evaluate risks.

In simple terms, QIPs are the mechanism, while QIBs are the participants, making their roles interdependent for successful capital raising in the share market.

How to Invest in QIP as an Institutional Investor

It is an exclusive fundraising method that allows companies to raise capital by offering shares to Qualified Institutional Buyers (QIBs). If you’re an institutional investor looking to participate, here’s how to get started:

- Eligibility: Ensure you meet SEBI’s criteria to qualify as a QIB. Eligible entities include mutual funds, insurance companies, pension funds, and foreign institutional investors.

- Due Diligence: Conduct a detailed analysis of the company issuing the QIP. Review its financial health, market position, and the purpose of fundraising to assess investment viability.

- Pricing Review: These shares are based on the two-week average share price preceding the issuance date. Evaluate whether the offered price aligns with the company’s current valuation and your return expectations.

- Subscription Process: Participate in the bidding process when it opens for subscription. Institutional investors can bid based on the number of shares and the price they are willing to pay, subject to the SEBI floor price.

- Compliance: Ensure your investment adheres to SEBI regulations, including lock-in requirements. Shares issued under this typically come with a one-year lock-in period.

- Post-Investment Monitoring: After subscribing, monitor the company's performance to ensure that the raised capital is being utilized for the stated purpose, as this will impact the share value in the long term.

Conclusion

Qualified Institutional Placement (QIP) is a game-changing fundraising tool for publicly listed companies in India. It offers a faster, more efficient alternative to traditional public offerings, enabling businesses to raise capital from Qualified Institutional Buyers (QIBs) with minimal regulatory hurdles. By leveraging this, companies can quickly secure growth funds, reduce foreign capital dependency, and ensure a stable financial outlook.

For investors, it provides exclusive access to premium shares of top companies, making it a valuable opportunity in the dynamic share market.

Frequently Asked Questions

1. What is QIP in the share market?

Qualified institutional placement is when listed companies raise capital by selling shares to institutional investors. This allows them to fund growth without the lengthy process of a public offering, making it a fast and efficient option.

2. What is the QIP full form in the share market?

QIP stands for Qualified Institutional Placement. It is a mechanism that helps listed companies raise funds from institutional buyers quickly and with fewer regulatory steps.

3. How does Qualified Institutional Placement benefit companies?

It offers companies a fast way to raise funds while minimizing compliance burdens. It also helps maintain stability in stock prices by targeting institutional investors rather than retail buyers.

4. How is QIP different from an IPO?

Unlike an IPO, which is open to the public, QIP is exclusive to institutional investors like mutual funds and banks. It involves less paperwork, quicker execution, and less regulatory scrutiny, making it a more efficient way to raise capital.

5. Is QIP a safe investment for institutional investors?

Yes, it offers institutional investors access to premium securities of well-established companies. Although risks remain, it provides detailed disclosures, helping investors make informed decisions.

6. Who regulates the QIP process in India?

The Securities and Exchange Board of India (SEBI) regulates QIP to ensure transparency and protect the interests of both issuers and investors. SEBI’s guidelines help companies issue shares at fair prices.

7. Can retail investors participate in QIP?

No, it is restricted to institutional investors such as mutual funds, banks, and insurance companies. Retail investors are excluded to maintain exclusivity and reduce investment risks.

Disclaimer: This article is intended for educational purposes only. Please note that the data related to the mentioned companies may change over time. The referenced securities are provided as examples and should not be considered recommendations.