Ever wondered why the stock market sometimes falls even when everything looks normal? Or why some days the market jumps like it’s had an energy drink? A lot of these sudden moves can be understood by looking at one powerful indicator, FII and DII data. This simple daily number shows who is buying and selling in the Indian stock market: foreign investors or our own domestic institutions. And trust me, once you learn how to read it, the market will start making a lot more sense.

In this blog, we’re going to break down what this data means, how it works, and how you can actually use it to make smarter trading decisions.

Foreign Institutional Investors (FII) and Domestic Institutional Investors (DII) are the two big players who move large amounts of money in the Indian stock market. Think of FIIs as investors coming from outside India, big global funds, foreign banks, pension funds, and international investment companies. DIIs, on the other hand, are our own homegrown institutions like Indian mutual funds, insurance companies, and banks. When these groups buy or sell in bulk, the entire market reacts.

In simple words:

If both start buying, the market usually goes up. If both start selling, the market usually becomes weak. But when one buys and the other sells, the tug-of-war creates confusion or volatility. That’s why traders and investors closely track their daily activity, it gives clues about market direction, sentiment, and trend strength.

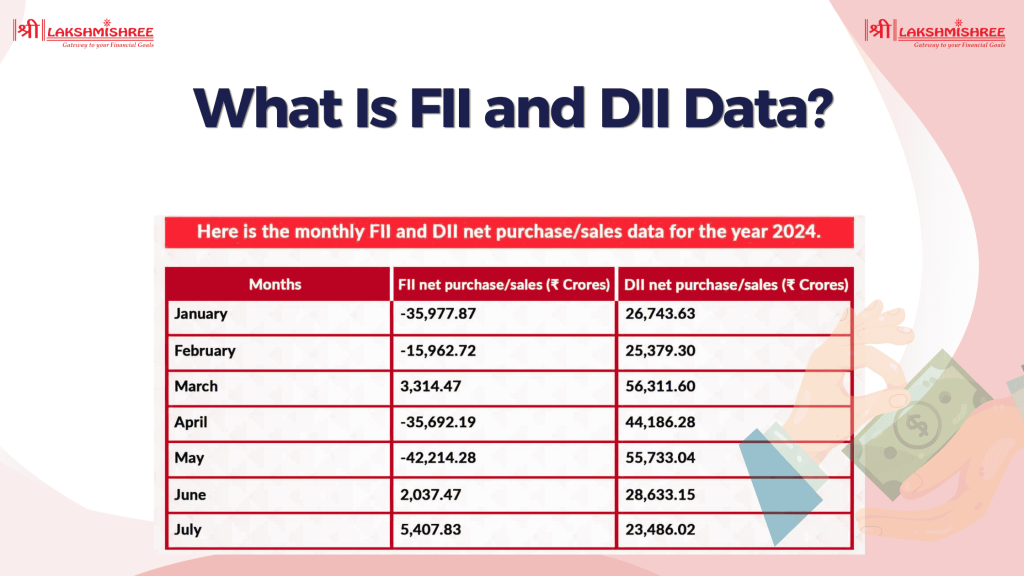

Now, when we talk about FII and DII data, we’re referring to the daily numbers that show how much money FIIs and DIIs bought or sold in the Indian market. This data helps traders understand who is controlling the market on a particular day and what might happen next. When read correctly, this information becomes a powerful tool for intraday traders, swing traders, and long-term investors.

Knowing the different types of FIIs and DIIs helps you see who is putting money into the Indian market and how their decisions show up in the daily FII and DII data. Each group invests in its own way, and these flows directly influence market trends, stability, and sentiment.

FIIs are large foreign organisations that invest big money into the Indian stock market. Here are the main types:

1. Sovereign Wealth Funds (SWF): These are government-owned investment funds created by countries using surplus money, often from natural resources or foreign reserves. When SWFs invest in India, it means strong long-term confidence in the economy.

2. Foreign Government Agencies: These are official agencies or institutions from other countries that invest in India for economic or strategic purposes. Their participation often signals stable and reliable foreign interest.

3. International Multilateral Organisations: These organisations are formed when three or more countries come together for global development, welfare projects, and cooperation. When they invest in India, it usually aligns with economic development and long-term market stability.

4. Foreign Central Banks: Foreign central banks invest in India through bonds, securities, and other approved financial instruments. They are one of the most stable and low-risk participants in the FII category, adding confidence to India’s financial markets.

DIIs are institutions based in India that invest large amounts of money into the stock market. They help maintain stability, especially when FIIs sell heavily.

1. Indian Insurance Companies: Companies like LIC and other private insurers invest policyholders’ money into equity and debt markets. Their investments often act as a stabilizing force during volatile periods.

2. Indian Mutual Fund Companies: Mutual funds take money from lakhs of Indian investors and invest it into stocks, bonds, and other assets. They play a major role in shaping long-term market trends and retail investor confidence.

3. Indian Banks & Financial Institutions: Banks invest their profits into equity, debt, and other financial markets. They also participate through treasury operations, helping balance market liquidity.

4. Pension Funds & Other Domestic Bodies: These include retirement funds, provident funds, and other government-backed institutions that invest with a long-term perspective. Their buying and selling activity adds strength to DII flow data.

FIIs and DIIs are the two biggest forces that move the Indian stock market. While FIIs bring foreign money into India, DIIs invest using domestic funds. The balance between their buying and selling is what creates market trends, volatility, and long-term direction in fii and dii data.

Here’s a quick and simple comparison to help you understand the major differences:

| Point of Difference | FII (Foreign Institutional Investors) | DII (Domestic Institutional Investors) |

|---|---|---|

| Origin | Investors from outside India | Investors located within India |

| Examples | Foreign banks, global funds, pension funds, SWFs | Mutual funds, insurance companies, Indian banks |

| Investment Style | Fast, opportunity-based, high volume | More stable, long-term, risk-managed |

| Market Impact | Strong influence; can move markets quickly | Acts as a stabilizer when FIIs sell |

| Risk Approach | Higher risk appetite; reacts to global cues | More conservative; reacts to domestic factors |

| Data Reflected In | Part of daily fii and dii data showing foreign flow | Part of daily dii fii data showing domestic flow |

| Regulated By | SEBI rules for foreign investment | SEBI, RBI, IRDAI depending on institution type |

Daily FII DII trading activity tells you exactly how much money foreign investors (FIIs) and domestic investors (DIIs) bought or sold in the Indian market on a given day. This data is released after market hours and is one of the quickest ways to understand the market’s mood for the next session. When you know how to read it properly, you can predict whether the market might open strong, weak, or sideways the next day.

The two most important numbers you will see are:

From these, the exchanges give you the Net Value, which is the actual buying or selling impact. If net value is positive → buying pressure. If negative → selling pressure. But the real magic lies in interpreting how strong that pressure is.

Here’s how to make sense of the daily fii and dii data like a pro:

1. Look at Net Buying vs Net Selling — Not Just the Amount

If FIIs buy ₹1,000 crore and DIIs sell ₹800 crore, the market may still move up because FII buying has stronger influence. It’s not about who is buying, it’s about whose buying is dominating.

2. Focus on Consistency, Not One-Day Spikes

A single day of FII selling doesn’t mean the market will fall. But if FIIs sell heavily for 5–7 days in a row, it usually signals a trend. Consistent flow shows real intent.

3. Compare FII vs DII Flow Together

4. Check Whether the Activity Is in Cash or Derivatives

Cash market activity impacts the market more deeply than F&O trades.

5. Understand the Size of the Flow

Large flows (like ₹3,000–₹5,000 crore) signal major shifts.

Small flows (₹100–₹300 crore) might not affect market direction much.

This helps in predicting if the next day will be trending or range-bound.

6. Use the Data to Gauge Next-Day Sentiment

Heavy FII buying often results in:

Heavy FII selling often results in:

This is why intraday traders always check fii dii activity before planning trades.

FIIs Allowed in India

The following foreign institutional investors are permitted to invest in Indian markets under SEBI regulations:

Additional Note: Some other entities like charitable trusts, university endowment funds, and foundations registered abroad (with at least 5 years of operation) are also allowed to invest in India as FIIs.

The following domestic institutional investors are allowed to participate in the Indian financial markets:

fii and dii data gives intraday traders a quick picture of who controlled the market in the previous session. These flows often indicate whether the next day might open strong, weak, or range-bound. Here are the most useful ways traders apply this data during intraday trading:

Long-term investors often watch FII–DII trends to understand whether smart money is entering or exiting the market. When these trends are studied over weeks or months instead of one or two days, they reveal the market’s real direction, upcoming cycles, and potential long-term opportunities.

1. Spotting Market Cycles Early (Bull & Bear Trends)

When FIIs keep buying for many weeks, it usually signals the start of a strong bull phase.

When they sell continuously for months, markets often shift into a slow decline.

DIIs usually step in to balance the fall, but long-term FII behaviour shows the broader cycle.

2. Identifying Sector Rotation

FIIs don’t invest randomly, they rotate money between sectors like IT, banking, FMCG, auto, and metals. If FIIs shift money into a specific sector for several weeks, that sector often becomes a long-term outperformer.

3. Strengthening SIP and Lump-Sum Decisions

Continuous FII selling with strong DII buying often means the market is correcting, not crashing.

This is usually the best phase for long-term SIP investors to accumulate units at lower prices.

Lump-sum investors also use these trends to decide whether to invest fully or in staggered phases.

4. Reading Long-Term Confidence in India

When FIIs bring large inflows for months, it shows rising global confidence in India’s economy, interest rates, and policy stability. This increases the probability of long-term market growth.

When FIIs pull out heavily, it often signals global risk sentiment turning negative, important for cautious allocation.

5. Avoiding Emotional Portfolio Decisions

Many investors panic when the market drops for a few days. Tracing long-term FII & DII trends helps filter noise and avoid emotional selling.

If DIIs keep buying even when FIIs sell, it often means domestic confidence remains strong, and corrections are temporary.

Here are reliable sources where traders and investors can check fii and dii data every day without confusion:

Fii and Dii data gives a clear picture of how the biggest market players are positioning themselves. When this information is tracked consistently, it becomes easier to understand market direction, identify strong trends, and make confident trading or investing decisions. FIIs shape momentum with foreign flows, while DIIs maintain stability with steady domestic money, and together their activity forms the backbone of India’s market movement. Using this data in the right way helps reduce guesswork and builds a more disciplined, informed approach to the stock market.

FII and DII data shows how much money foreign investors and domestic institutions bought or sold in the Indian market each day. It reflects market sentiment and helps traders understand buying or selling pressure.

Intraday traders use this data to set their market bias, confirm possible trend directions, and avoid trading against strong institutional flow. It becomes a key part of pre-market preparation.

No, the market can stay stable even when FIIs sell if DIIs absorb the selling with strong buying. Short-term price movement depends on multiple factors, not just FII flow.

Reliable sources include NSE, BSE, Moneycontrol, Trendlyne, and NSDL. These platforms update the data daily after market hours.

FIIs bring large foreign capital, and their buying often creates strong upward momentum. Their long-term flows show global confidence in India’s economic conditions.

Disclaimer: This article is intended for educational purposes only. Please note that the data related to the mentioned companies may change over time. The securities referenced are provided as examples and should not be considered as recommendations.