Book Value Per Share (BVPS) is a crucial metric for investors to understand a company's net value on a per-share basis. It is an important tool for evaluating the company's market price relative to its book value, helping investors make informed decisions. Understanding what is book value per share can provide significant insights into a company's financial health and valuation.

1. BVPS is a measure of the value of a company's equity on a per-share basis.

2. It helps investors evaluate the company's market price relative to its book value.

3. It is different from the market value per share.

Book value is the value of a company's assets, as shown on its balance sheet, minus liabilities. It represents the net worth of the company. Book value is calculated as:

Book Value = Total Assets − Total Liabilities

Understanding the book value is essential for investors to understand the company's intrinsic value. This helps in comparing the company's market value with its actual worth.

For example, if a company has total assets worth ₹500 crore and total liabilities of ₹200 crore, the book value would be:

Book Value= ₹500crore−₹200crore

Book Value= ₹300crore

The book value reflects the company's net worth if it were to be liquidated. It is a critical metric for long-term investors interested in the company's fundamental value rather than its market fluctuations.

Book Value Per Share gives an idea of what each share is worth based on the company's equity. This metric is useful for investors as it helps determine whether a stock is undervalued or overvalued. If the market price per share is lower than the BVPS, the stock might be undervalued, presenting a potential buying opportunity.

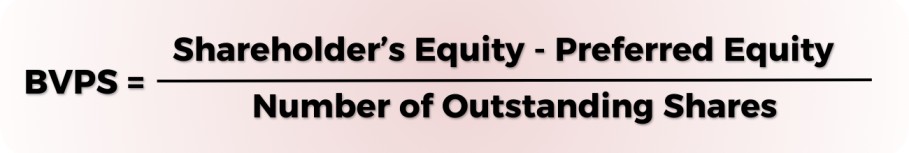

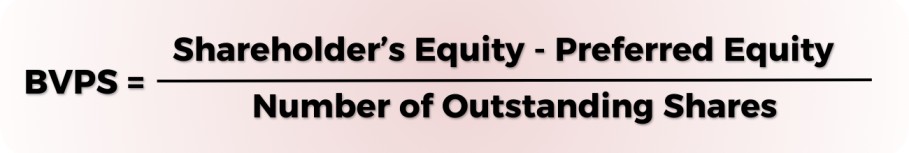

Book Value Per Share is a financial measure that divides the company's book value by the total number of outstanding shares (Shares outstanding refer to a company's stock currently held by all its shareholders). The formula to calculate Book Value Per Share is:

For example, if a company has a shareholder's equity of ₹100 crore, Preferred Equity 0 and 10 lakh outstanding shares, the BVPS would be ₹1000.

It is calculated using the company's shareholder equity, which includes common stock, retained earnings, and additional paid-in capital. It excludes preferred equity and intangible assets like patents and goodwill.

It is essential for value investors who focus on buying stocks at a discount to their intrinsic value. For example, if a company's Value Pe share is ₹200 and its market price per share is ₹150, the stock might be considered undervalued.

Investors use BVPS to determine if a stock is undervalued or overvalued. It provides insights into the company's financial health and stability. Here are the key reasons why it is important:

It can help investors identify potential value stocks and avoid overpaying for stocks. For instance, if a company's market price is significantly lower than its BVPS, it might indicate a good buying opportunity.

However, using it with other financial metrics and analysis tools is important. Relying solely on BVPS might not provide a complete picture of the company's financial health and future prospects.

To calculate it, you must know the shareholder's equity and the number of outstanding shares. Here is a detailed explanation of the calculation process:

However, it's important to understand that different companies might have varying structures and complexities that can affect the calculation. For instance, companies with preferred shares or significant intangible assets might require adjustments to the equity figure.

For more on how companies manage their financial strategies, check out this article on the CDSL business model.

Let's consider Infosys Limited, an Indian multinational corporation. Here’s how we can calculate its BVPS using real financial data.

BVPS= ₹70,00,00,00,000 / 4,20,00,00,000= ₹166.67

This calculation shows that each share of Infosys has a book value of ₹166.67. Comparing this with the market price of Infosys shares, investors can determine if the stock is undervalued or overvalued.

Real-life examples like these help investors understand the practical application in evaluating companies. It provides a tangible basis for investment decisions and helps identify potential investment opportunities.

For more detailed explanations, visit this guide on stock market terminology.

BVPS is crucial for several reasons:

For instance, if Company A has a Value of ₹100 and Company B has a Value of ₹200, investors might infer that Company B has a higher equity value per share. However, it’s important to also consider other financial metrics and factors before making investment decisions.

For more insights into investment strategies, check out this guide on value investing.

While BVPS is a useful metric, it has some limitations:

Knowing these limitations can help investors make better decisions. For instance, a company with significant intangible assets might have a lower Book value, but this doesn’t necessarily mean it’s undervalued. Investors should consider other financial metrics and qualitative factors before making investment decisions.

Moreover, It might not provide an accurate picture for companies in industries with crucial intangible assets, such as technology and pharmaceuticals. In such cases, metrics like earnings per share (EPS) and cash flow might be more relevant.

Companies can increase their BVPS through several strategies:

For example, if Infosys earns ₹10 crore and decides to retain it rather than distribute it as dividends, the shareholder equity increases by ₹10 crore. This increases the book value, assuming the number of outstanding shares remains constant.

The Price-to-Book (P/B) ratio is a financial metric used to evaluate the valuation of a company relative to its book value. It is calculated by dividing the market price per share of a company by its book value per share.

P/B Ratio= Market Price per Share / Book Value per Share

A lower P/B ratio might indicate that the stock is undervalued. However, it’s important to consider other factors as well.

For instance, if a company’s market price per share is ₹100 and its book value is ₹50, the P/B ratio would be:

P/B Ratio= ₹100 / ₹50=2

P/B ratio of 2 means the market price is twice the book value per share. This ratio helps investors determine if the stock trades at a fair value. A lower P/B ratio might suggest the stock is undervalued, whereas a higher P/B ratio could indicate overvaluation.

However, the P/B ratio should not be used in isolation. Investors should also consider other financial metrics such as earnings per share (EPS), price-to-earnings (P/E) ratio, and cash flow.

For more on market strategies, explore this guide on trading in the equity market.

Differences:

| Aspect | Book Value Per Share | Market Value Per Share |

|---|---|---|

| Definition | The net asset value of a company per share | The current trading price of a company's stock |

| Calculation | (Total Assets - Total Liabilities) / Total Shares Outstanding | Determined by the stock market through buying and selling |

| Basis | Accounting value based on the company's balance sheet | Perceived value based on investor sentiment and market conditions |

| Stability | More stable and less volatile | Highly volatile and fluctuates with market dynamics |

| Use Case | Useful for assessing the intrinsic value and financial health of a company | Useful for determining the current market perception and investment value |

| Indicator of Value | Indicates the value of the company's net assets | Indicates what investors are willing to pay for the stock |

| Influencing Factors | Company’s financial statements, accounting policies | Market demand and supply, investor sentiment, economic conditions |

| Impact of Intangibles | Often does not account for intangible assets like brand value or intellectual property | Can include the perceived value of intangible assets |

| Investors’ Insight | Helps value investors find potentially undervalued stocks | Helps growth investors understand market trends and opportunities |

| Example Calculation | If Total Assets = ₹100M, Total Liabilities = ₹40M, and Total Shares Outstanding = 10M, then Book Value Per Share = (₹100M - ₹40M) / 10M = ₹6 | If a company's stock is trading at ₹50 per share on the stock market, then the Market Value Per Share is ₹50 |

While companies cannot easily manipulate their Book Value Per Share as it is based on the audited balance sheet, they can influence it through strategic financial decisions. For example, retaining earnings instead of paying dividends, share buybacks, and asset revaluations can impact the Book Value. However, these actions must be disclosed and are subject to regulatory scrutiny.

While Book Value is an essential metric, it should be used alongside other financial metrics for a comprehensive analysis. Here are some key metrics to compare with BVPS:

Understanding What is Book Value Per Share is essential for making informed investment decisions. It helps in assessing the intrinsic value of a company and comparing it with its market value. However, it's important to use book value alongside other metrics for a comprehensive analysis.

It provides a solid foundation for evaluating a company's financial health and stability. It helps investors identify undervalued stocks and make informed investment decisions. By understanding the importance, calculation, and limitations of Book Value Per Share, investors can enhance their investment strategies.

For more on investment strategies and financial health, check out this guide on common investing mistakes.

Book Value Per Share is a financial measure that indicates the value of a company's net assets divided by the number of its outstanding shares. It's essentially what each share would be worth if the company were liquidated at its book value.

BVPS is calculated by dividing the total equity by the number of outstanding shares. For example, if a company has a shareholder's equity of ₹100 crore and 10 lakh outstanding shares, the book value would be ₹1000.

It helps investors determine if a stock is undervalued or overvalued. It provides insights into the company's financial health and stability, making it a crucial metric for value investors.

A good Book Value Per Share typically indicates that a company's stock is undervalued if the Book value is higher than its current market price. However, what constitutes a "good" BVPS can vary by industry and should be compared with similar companies in the same sector.

Yes, Book Value Per Share can change based on changes in the company's assets and liabilities. Factors such as earnings retention, share buybacks, and asset management can impact the BVPS.

It is one of many metrics used and should be considered alongside other financial indicators. While BVPS provides valuable insights into a company's equity value, it should be used in conjunction with other metrics like EPS, P/E ratio, and cash flow.