If you're exploring the stock market or managing your CDSL account, you may have come across the term BO ID. But what exactly is it, and why is it important?

In simple words, your BO ID (Beneficial Owner Identification Number) is a unique identifier that helps track your investments securely. Understanding this number is essential for anyone investing in the share market or managing a demat account. In this guide, we’ll explain what is BO ID, why it matters, and how to find it — all in clear, easy-to-understand language. Keep reading to unlock the key to managing your investments confidently!

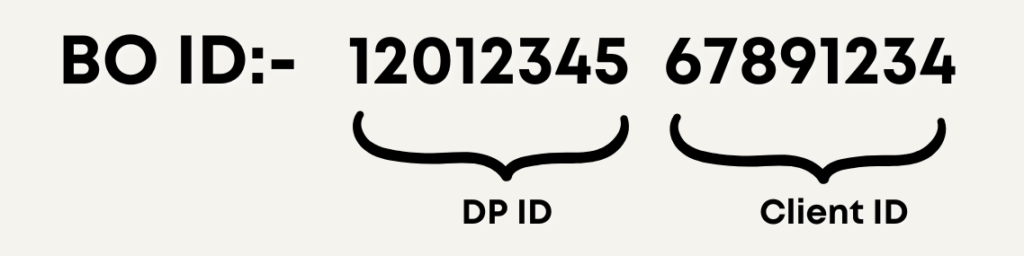

BO ID stands for Beneficial Owner Identification Number. It is a unique 16-digit number assigned to investors when they open a demat account with CDSL (Central Depository Services Limited). This number acts as your identity in the depository system, ensuring your investments are securely linked to you.

Your BO ID is divided into two parts:

Together, these 16 digits form your complete BO ID.

While CDSL uses a straightforward 16-digit format, NSDL assigns a different format that starts with ‘IN’ followed by 14 digits. For example: IN30012345678901.

💡 Pro Tip: If your ID starts with ‘IN’, your account is with NSDL. If it’s purely numeric (16 digits), it’s with CDSL.

Knowing your Ben ID is essential as it’s required to link your demat account to your trading platform, verify transactions, and ensure secure ownership of your investments.

Your BO ID plays a crucial role in safeguarding and managing your investments. Here's why it matters:

Also Read: How to Select Stocks for Intraday Trading

Finding your BO ID in the share market is essential for tracking your investments and ensuring smooth transactions. While the process is generally similar across platforms, the steps may vary slightly depending on your demat account provider.

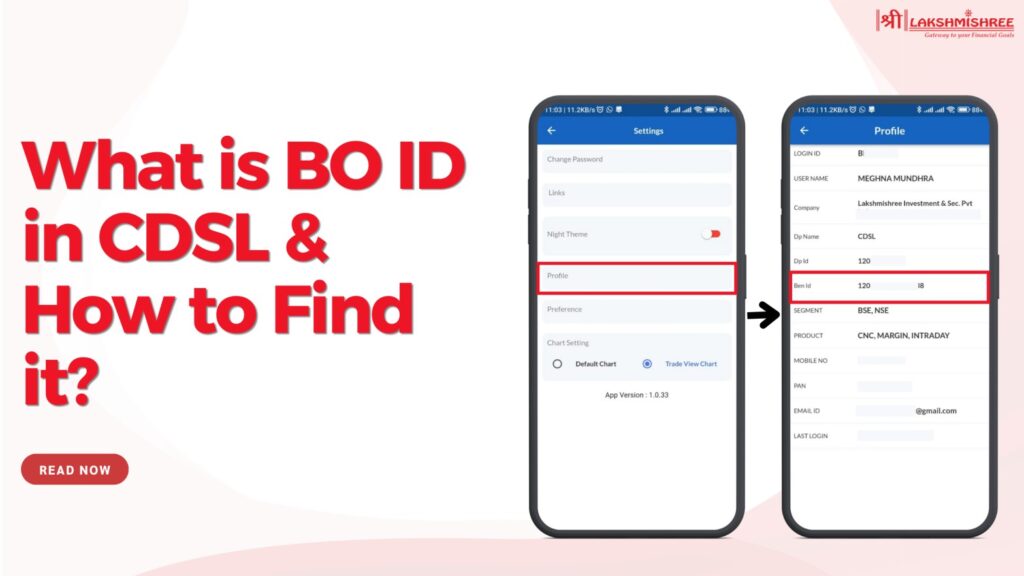

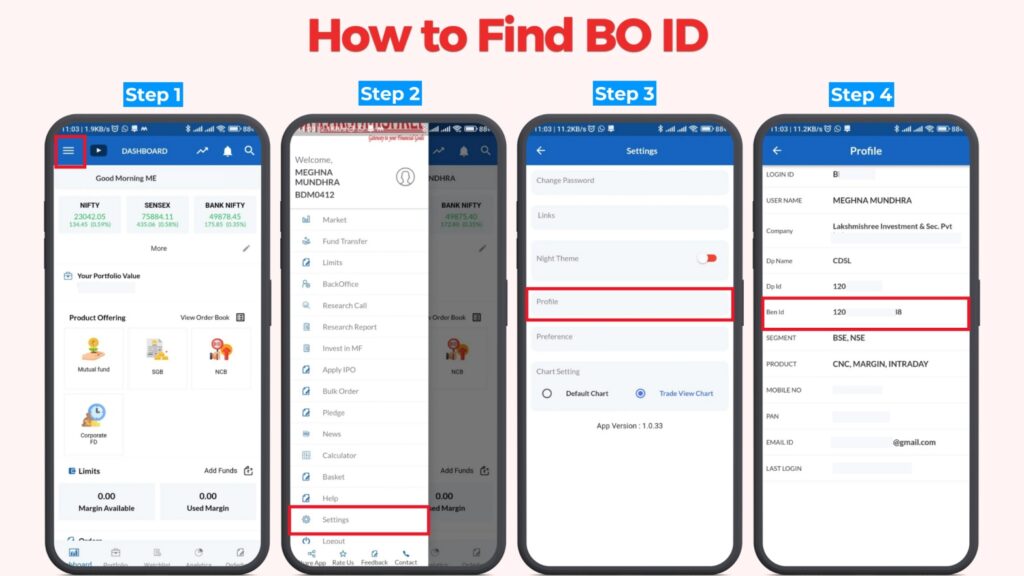

If you're using Lakshmishree, locating your BO ID (also called Ben ID) is straightforward. Follow these steps:

A Depository Participant (DP) is an authorised intermediary between investors and the central depositories like CDSL (Central Depository Services Limited) and NSDL (National Securities Depository Limited). Think of a DP as a bridge that connects you, the investor, to these depositories, allowing you to hold and manage your securities electronically in a demat account.

A DP offers a range of services that are essential for managing your investments, including:

For instance, Lakshmishree is a registered Depository Participant that offers seamless demat account services, ensuring investors can manage their investments easily and securely.

Locating your DP ID and Demat Account Number is crucial for identifying your account and ensuring smooth transactions. While both are important, they serve different purposes. Let's break it down:

Your DP ID identifies the depository participant (such as Lakshmishree) where your account is registered, while your Demat Account Number is a unique identifier that represents your personal account in the depository system.

Key Differences Between Demat Account and DP ID

| Feature | DP ID | Demat Account Number |

|---|---|---|

| Definition | Identifies your depository participant (broker/firm). | Identifies your unique demat account for holding securities. |

| Digits | First 8 digits of your BO ID. | A 16-digit number (for CDSL) or starts with ‘IN’ followed by 14 digits (for NSDL). |

| Purpose | Used to identify the financial institution managing your demat account. | Used to track and manage your individual investments. |

| Example | 12012345 (DP ID for Lakshmishree). | 1201234567891234 (Complete Demat Account Number). |

| Required For | Linking your demat account to your trading platform. | Buying, selling, or transferring shares and securities. |

Protecting your ID is crucial to ensuring your investments remain safe from fraud and unauthorised access. Since your ID directly links to your securities, mishandling it can put your investments at risk. Follow these key security tips to stay protected:

Despite being an important part of investment management, there are several misunderstandings about the Ben ID that often confuse investors. Let’s clarify some common myths to help you manage your demat account confidently.

1. BO ID and DP ID Are the Same

🚫 Myth: Many believe that the two numbers are identical.

✅ Reality: While the DP ID (Depository Participant ID) is the first 8 digits of your Beneficial Owner Identification Number, the full BO ID is a 16-digit code that also includes your Client ID. For example, in 12012345 67891234, the DP ID is 12012345, while the full identification number is 1201234567891234.

2. BO ID Can Be Changed

🚫 Myth: Some assume they can modify their unique identification number by changing brokers.

✅ Reality: Once assigned, this number is permanent for your demat account with that specific depository. If you open a new account with a different participant, you’ll receive a new identification number — but your old one will remain active for your previous account.

3. NSDL Accounts Don’t Have a Ben ID

🚫 Myth: Some investors think that only CDSL accounts use this system.

✅ Reality: While CDSL assigns a 16-digit numeric code, NSDL assigns a similar identifier starting with ‘IN’ followed by 14 digits (e.g., IN30012345678901). Both serve the same purpose of identifying your account in their respective depository systems.

4. Sharing Ben ID is Risk-Free

🚫 Myth: Some believe that disclosing their identification number is harmless.

✅ Reality: While this number alone may not enable fraud, scammers can misuse it for unauthorised activities. Always share it only with trusted platforms or authorised entities when necessary.

5. BO ID is Required for Every Trade

🚫 Myth: Many think they must provide their identification number each time they buy or sell shares.

✅ Reality: Your Beneficial Owner Identification Number is automatically linked to your demat account via your DP, so you don’t need to provide it for every trade. However, it’s essential when linking accounts, transferring securities, or verifying ownership details.

A BO ID (Beneficial Owner Identification Number) is a unique 16-digit number assigned to investors when they open a demat account with CDSL. It combines the DP ID (first 8 digits) and the Client ID (last 8 digits) to create a complete identification number for tracking and managing investments. The Ben ID is essential for verifying ownership, linking demat accounts to trading platforms, and ensuring secure transactions in the share market. Investors can find their Ben ID through their broker’s platform, demat account details, or their CDSL statement.

In the share market, BO ID (Beneficial Owner Identification Number) is a 16-digit unique number assigned to investors holding a demat account with CDSL. It helps track securities, verify ownership, and facilitate smooth transactions in the stock market.

To find it, log in to your broker’s platform, go to Account Details or Profile, and check the Demat Account Number section. It is also available in your CDSL Holding Statement sent via email or accessible through the CDSL website.

The DP ID is the first 8 digits of your demat account number and identifies your depository participant (broker). The BO ID includes both the DP ID and Client ID, forming a 16-digit unique identification number for your account.

No, CDSL provides a 16-digit numeric code, while NSDL assigns a number starting with ‘IN’ followed by 14 digits. Both serve the same purpose but follow different formats.

A BO (Beneficial Owner) account is automatically created when you open a demat account with a registered depository participant (DP) like Lakshmishree. You need to submit KYC documents, PAN card, and bank details to get started.

Disclaimer: This article is intended for educational purposes only. Please note that the data related to the mentioned companies may change over time. The securities referenced are provided as examples and should not be considered as recommendations.