When companies in India plan to raise funds from the public, they’re required to share detailed documents with investors. These documents explain the company’s financial health, risks, and other important details. One such document is called a shelf prospectus.

In recent years, the term has gained importance in company law and investment discussions. But many still wonder why it exists, how it works, and how it differs from other documents like a red herring prospectus. This blog will walk you through everything — from the meaning and benefits of a shelf prospectus to its role for investors and companies — in a simple and easy-to-grasp way.

A shelf prospectus is a legal document that allows a company to issue securities to the public in multiple rounds without filing a fresh prospectus each time. Instead, one approved document can be used for several offers within a fixed period, usually up to one year.

Under Section 31 of the Companies Act, 2013, and as regulated by SEBI in India, a shelf prospectus is mainly used by public financial institutions, banks, and companies planning to raise funds more than once. It helps save time, reduce costs, and ensures that investors receive transparent and updated information before making investment decisions.

In simple words, the shelf prospectus meaning can be understood as a “ready-made prospectus” that sits on the shelf and can be used whenever a company decides to launch a new issue of securities.

In India, the concept of a shelf prospectus in company law is governed by Section 31 of the Companies Act, 2013, along with the regulations of the Securities and Exchange Board of India (SEBI). This provision allows certain companies to file a single shelf prospectus with the Registrar of Companies and then issue multiple offers of securities under it, without preparing a fresh prospectus each time.

The law specifies that this prospectus remains valid for up to one year from the date of its first issue, and during this period, the company can launch different rounds of fundraising by filing only an information memorandum for updates. This ensures that investors still get the latest details while companies save time and costs.

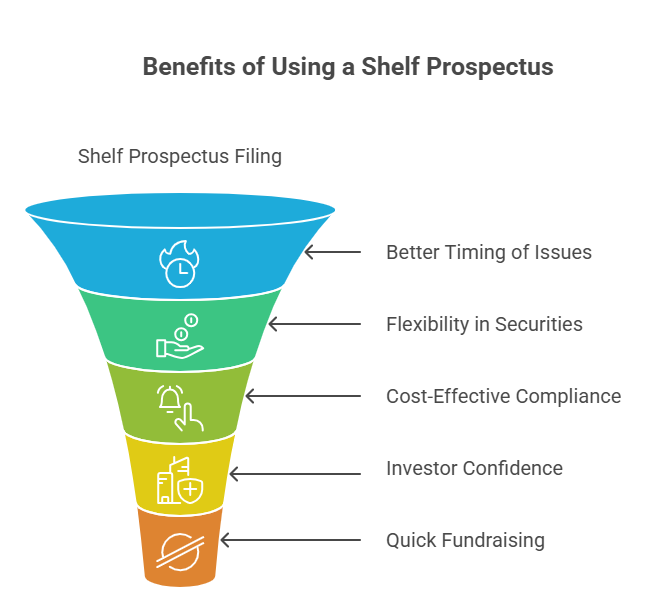

A shelf prospectus is not just about saving paperwork; companies use it as a smart strategy to align fundraising with their long-term goals. It allows them to plan multiple rounds of capital raising while staying flexible with timing and market conditions.

Here are the main reasons why companies prefer using a prospectus:

In short, companies use this prospectus because it gives them flexibility, cost savings, and credibility — advantages that are difficult to achieve with traditional prospectus filings.

Not every company in India can file this prospectus. To protect investors and maintain transparency, SEBI and the Companies Act set clear rules that companies must follow.

A company must meet the following eligibility criteria to issue a shelf prospectus in India:

For investors, this provides extra protection because the document is linked with regulatory approval, high credit ratings, and strict eligibility filters.

In India, Only selected categories of entities are allowed to use it, mainly because of the financial strength and credibility required to protect investors.

Both a shelf prospectus and a red herring prospectus are used by companies to raise money from the public, but they serve very different purposes.

| Basis of Comparison | Shelf Prospectus | Red Herring Prospectus |

|---|---|---|

| Meaning | A prospectus that allows a company to issue securities multiple times within a year without filing a fresh prospectus each time. | A preliminary prospectus issued before an IPO that contains most details but excludes the final price of shares. |

| Purpose | Used for repeated fundraising (mainly through bonds, debt instruments, or multiple issues). | Used for initial public offerings (IPOs) to give investors information before price discovery. |

| Validity | Valid for up to one year from the first offer. | Valid only until the IPO is finalised. |

| Regulated By | Section 31 of the Companies Act, 2013 and SEBI guidelines. | Section 32 of the Companies Act, 2013 and SEBI regulations. |

| Information Provided | Contains complete and updated disclosures; later issues only need an information memorandum. | Contains most information but excludes the share price and quantum of issue. |

| Common Users | Financial institutions, banks, NBFCs, and SEBI-approved companies. | Companies are going for IPOs on the stock market. |

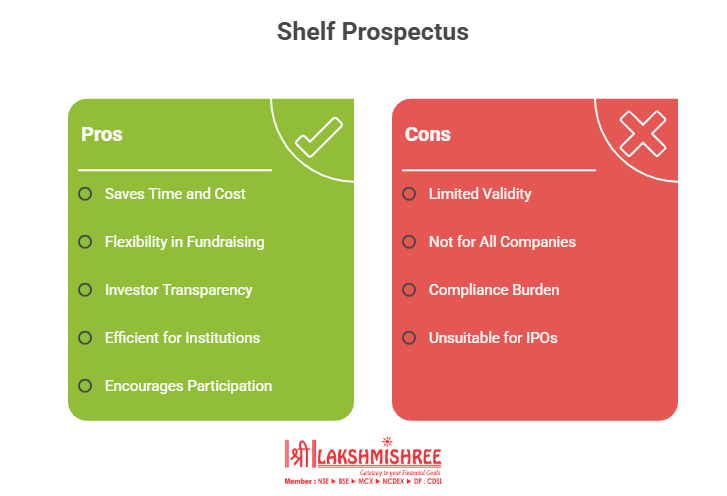

This prospectus has its own strengths and limitations. Understanding both sides helps companies and investors know when this document is truly beneficial and when it may not be the best fit.

For an investor, a prospectus may not look like a direct advantage, since it is mainly designed to make fundraising easier for companies. However, it still plays an important indirect role in protecting investors and improving their decision-making.

Here’s how it helps investors:

A shelf prospectus is a special type of prospectus in company law that lets eligible companies issue securities multiple times within a year without filing fresh documents. Regulated by SEBI and the Companies Act, 2013, it helps institutions like banks, NBFCs, and financial companies save time and cost while ensuring transparency for investors.

For companies, it provides flexibility and efficient fundraising; for investors, it offers trust and easy access to reliable information. Though not useful for all businesses, a prospectus plays a key role in India’s capital markets by balancing company convenience with investor protection.

A shelf prospectus is a type of prospectus that allows a company to raise money through multiple issues of securities under a single approved document. Instead of filing a new prospectus every time, the company can use one shelf prospectus for all offers within a year, updating details through information memorandums as required by SEBI.

Section 31 of the Companies Act, 2013, deals with the legal provision of a shelf prospectus. It states that certain entities, such as public financial institutions, scheduled banks, and SEBI-authorised companies, can file this prospectus and issue securities in multiple rounds without having to prepare fresh documents for each issue.

Under company law, the four main types of prospectus are: the shelf prospectus, the red herring prospectus, the deemed prospectus, and the abridged prospectus. Each serves a different purpose in fundraising, with a shelf prospectus allowing multiple issues, a red herring prospectus being used for IPOs, a deemed prospectus covering offers through intermediaries, and an abridged prospectus providing a summary version to investors.

A shelf prospectus can be issued by public financial institutions, scheduled banks, Non-Banking Financial Companies (NBFCs), and other SEBI-approved companies that meet eligibility criteria. These companies must have a market capitalisation of at least ₹500 crore, a strong credit rating of AA- or above, a clear record of debt repayment, and no pending regulatory actions against their promoters or directors.

The difference between a shelf prospectus and a red herring prospectus lies in their purpose and usage. A shelf prospectus is used for repeated fundraising through bonds or securities within one year, while a red herring prospectus is issued during an IPO and contains most details except the final share price.

In India, a shelf prospectus is valid for a period of one year from the date of its first issue. Within this time, a company can issue multiple rounds of securities under the same document, provided it submits updated information memorandums to SEBI and the Registrar of Companies for each new offer.

Disclaimer: This article is intended for educational purposes only. Please note that the data related to the mentioned companies may change over time. The referenced securities are provided as examples and should not be considered recommendations.