Have you ever noticed a stock suddenly stop moving—either at its highest or lowest point of the day—and wondered, "Why can't I buy or sell it anymore?" Well, that’s where the upper circuit and lower circuit come into play. These are special limits set by the stock market to control wild price movements and protect both traders and investors from big losses or hasty decisions.

In this blog, we’ll break down everything you need to know about these circuits in the simplest way possible. Whether you’re a new investor trying to make sense of stock market terms or just curious about how these price limits work—don’t worry, we’ve got you. Let’s dive in and uncover why these circuits matter, how they’re triggered, and what you should do when you see a stock hit one.

In simple words, a circuit in stock market is like a safety switch that stops a stock or index from moving too much in a single day. Just like how a circuit breaker in your home cuts off electricity during overload, the stock market uses circuit breakers or circuit brackets to prevent extreme price changes. These are set limits that decide how high or how low a stock’s price can go during a trading session.

These limits are part of a system called circuit filters. If a stock hits this upper or lower boundary, trading in that stock is either paused or completely stopped for some time. This gives traders and investors time to cool down, avoid panic, and make better decisions. Circuit limits are important in keeping the market stable, especially during times of heavy buying or selling pressure. These are decided by the stock exchanges (like NSE or BSE) and are applied to individual stocks as well as market indices like Nifty and Sensex.

An upper circuit in the stock market refers to the highest price a stock can reach in a single trading day. Once this price limit is hit, no more buy orders can push the price higher for the rest of the session. It’s like a speed breaker placed by the stock exchange to control excessive price spikes caused by heavy buying interest or market euphoria.

Upper circuits are part of what's called the circuit filter or circuit breaker system, and they are set by exchanges like NSE or BSE. These filters protect investors from sudden and sharp movements by temporarily stopping the stock from moving further. When a stock hits the upper circuit, trading may either be paused or allowed only on the sell side, depending on the situation.

Now, the upper circuit percentage isn’t the same for every stock. It depends on the stock’s category, past volatility, and SEBI’s circuit rules. For example, some stocks may have a 2% or 5% circuit limit, while others can go up to 10% or even 20%.

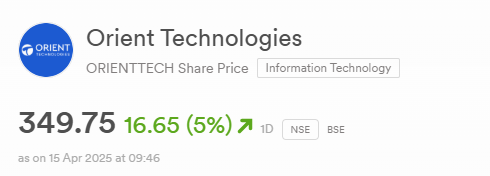

On 11th April 2025, Orient Technologies Ltd. hit its upper circuit of 5%, rising from a day low of ₹341 to a high of ₹349.75. That’s a price increase of ₹16.65 in a single trading session. As a result, no further buying was allowed beyond this price for the rest of the day.

DRHP Full Form in IPO – Meaning, SEBI Filing & DRHP vs RHP

A lower circuit in the stock market is the lowest price a stock can fall to in a single trading day. When the price hits this limit, trading is either halted or restricted to prevent it from falling any further. This mechanism is a type of circuit breaker or circuit filter, set in place to stop panic selling and give the market time to breathe.

Think of it like a safety net — when investors start selling a stock rapidly due to fear, bad news, or rumors, the price may crash uncontrollably. To avoid a total free-fall, the exchange places a lower circuit limit, which is a fixed percentage based on the previous day’s closing price. Once this limit is hit, no more selling orders can be executed beyond that price. However, buyers are still allowed to place bids, but only at or above the lower circuit level — which makes exiting a falling stock extremely difficult.

Just like upper circuits, lower circuit percentages can also vary — common bands are 2%, 5%, 10%, or 20%, depending on the stock's category, volatility, and whether it's in the derivatives segment.

On 11th April 2025, Raj Television Network Ltd. hit its lower circuit of 10%, tumbling from a high of ₹88 down to a low of ₹72 during the day. The sharp decline likely triggered panic among retail investors, and no further selling was allowed once the price touched that circuit limit.

The difference between upper circuit and lower circuit lies in the direction of price movement and the reason behind the trading halt. While an upper circuit stops a stock from rising further due to high demand, a lower circuit prevents it from falling endlessly during panic selling.

| Factor | Upper Circuit | Lower Circuit |

|---|---|---|

| Price Movement Direction | Upward (stock price rises sharply) | Downward (stock price falls rapidly) |

| Market Sentiment | Bullish (strong buying interest) | Bearish (heavy selling pressure) |

| Trading Impact | No further buying is allowed after hitting the limit | No further selling allowed beyond the limit |

| Investor Emotion | Excitement, FOMO (Fear of Missing Out) | Fear, Panic, Uncertainty |

| Reason/Trigger | Positive news, strong earnings, breakout patterns | Negative news, poor earnings, market panic |

| Liquidity Status | Buyers available, sellers disappear | Sellers exist, but buyers become scarce |

| Circuit Filter Percentage | Typically 2%, 5%, 10%, or 20% | Same – depends on stock category and volatility |

| Example | Orient Technologies Ltd. hitting 5% upper circuit | Raj Television Network Ltd. hitting 10% lower circuit |

While circuit limits are commonly known for individual stocks, many new investors don’t realize that even stock market indices like Nifty and Sensex have upper and lower circuit breakers. These index-wide limits are put in place to handle broad market volatility and prevent sudden crashes or spikes from creating chaos in the system.

In India, the SEBI-mandated circuit breaker system is activated when major indices move sharply — either upward or downward — by 10%, 15%, or 20% from the previous day’s closing level. When triggered, these index circuit filters lead to a temporary halt in both the equity and derivatives markets, allowing time for traders, investors, and institutions to assess the situation calmly.

Here’s a simple breakdown of how long the trading pause lasts depending on the size of the market movement and the time it happens:

1. 10% Movement (Rise or Fall)

2. 15% Movement (Rise or Fall)

3. 20% Movement (Rise or Fall)

Stocks usually hit the upper or lower circuit when there's an extreme shift in demand or supply due to strong news, sudden developments, or emotional trading behaviour.

Here are the real and practical reasons why stocks hit circuit limits in India:

When a stock hits either its upper circuit or lower circuit, it means the price has reached its maximum allowed movement for the day, as per the circuit filter set by the stock exchange. Once this limit is reached, trading in that stock gets restricted to control excessive volatility and prevent panic.

Here’s what typically happens:

NRML Full Form in Share Market | NRML vs MIS

Stocks that hit their circuit limits may look exciting, but they come with their own set of risks and rewards. Understanding both sides is crucial before making any trade decisions.

Keeping an eye on stocks that hit upper or lower circuits can help you understand market trends, spot momentum stocks, or avoid getting trapped in illiquid trades. Luckily, you don’t need to guess — there are reliable sources that update this data in real-time.

Here’s where you can track circuit-hit stocks daily:

1. NSE India (Official Website)

2. BSE India (Official Website)

3. Moneycontrol & Economic Times Markets

4. Stock Market Apps (like lakshmishree)

Circuit breakers have played a critical role in stabilizing the Indian stock market during extreme volatility. They are automatic trading halts triggered when Nifty or Sensex move sharply — up or down — by 10%, 15%, or 20%.

Case Study: March 2020 COVID Crash

During the first wave of the pandemic in March 2020, Indian markets saw record-breaking falls. On March 13, 2020, Nifty plunged nearly 10%, triggering a circuit breaker for the first time in over a decade. The halt allowed investors and institutions to pause, assess the situation, and reduce panic selling — preventing a complete market meltdown.

Why Circuit Breakers Matter

The role of upper circuit and lower circuit in the stock market goes far beyond just price limits — they act as essential tools to maintain balance during sudden buying or selling pressure. Whether a stock is racing upward or crashing down, these circuit filters help prevent panic and protect investors from extreme volatility. In India, knowing how these price bands work, when they're triggered, and what actions you can take during circuit hits can make a big difference in your trading results.

The upper circuit and lower circuit limits for each stock are set by the stock exchanges—primarily NSE (National Stock Exchange) and BSE (Bombay Stock Exchange)—based on guidelines issued by SEBI (Securities and Exchange Board of India).

A stock’s circuit limit can change depending on its price volatility, trading volume, and category. For example, if a stock consistently hits its 5% upper circuit with high volume and investor interest, the exchange may decide to increase the upper circuit filter to 10% (or higher) to allow more price discovery.

The lower circuit in the share market refers to the lowest price level a stock can fall to in a day. When the price hits this lower limit, no more sell orders can be executed unless there are buyers willing to purchase at that exact circuit price. This system is designed to protect investors from panic-driven free falls and sudden negative news, giving time for the market to cool off and recover rationally.

Buying at the lower circuit price can be risky and should be approached with caution. While it may seem like a stock is available at a bargain, the lack of buyers and negative sentiment can indicate deeper issues, such as poor fundamentals or regulatory concerns.

Buying upper circuit stocks might look attractive due to the strong momentum, but it can be tricky. These stocks often rise rapidly due to hype, news, or speculation, and once the circuit is hit, you may not be able to buy any more unless the circuit limit is revised. It’s important to evaluate whether the stock’s rally is backed by strong fundamentals or just a short-term spike.

Disclaimer: This article is for educational purposes only and should not be considered financial advice. Always conduct your research and consider consulting with a financial advisor before making any investment decisions.