Acharya Chanakya once famously taught: "Accumulated wealth is saved by spending, just as incoming fresh water is saved by letting out stagnant water." In the modern world of Indian equity, the Union Budget 2026 is the manifestation of this ancient wisdom.

For investors, a common question arises: how does the Indian budget effect on stock market? This blog aims to answer that question, which is frequently asked around the first of February every year. The connection is so obvious that the stock market will remain Open this year on Sunday, February 1st for the first time in history.

What is the Union Budget and Why Does it Matter?

The Union Budget is India’s annual financial report that outlines how much money the government earns (Revenue) and how it plans to spend it (Expenditure) between April 1 and March 31. For investors, it is the ultimate Policy Roadmap. It dictates interest rates, sector growth, and tax structures, all of which directly move share prices on the NSE and BSE. For stock market investors, it signals which industries receive government funding (tailwinds) and which may face higher taxes or tighter regulatory hurdles (headwinds).

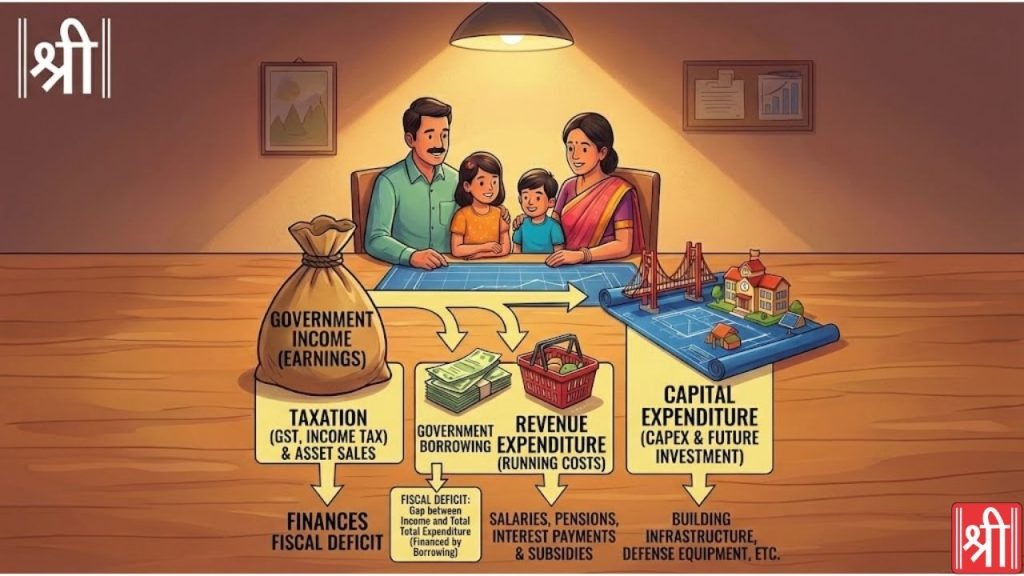

To understand the Budget simply, use the National Household Plan mental model. Every year, a family sits down to decide how to manage their Living Conditions while building for a Long-Term Goal.

The core aspects of government finances, explained through a household analogy, are:

The annual Union Budget affects the stock market by shifting investor expectations. High government spending (Capex) suggests future corporate profit, driving stocks up. However, excessive borrowing can raise interest rates, slowing growth. Changes to Capital Gains tax cause direct, immediate market reactions. Stocks rally when the Budget significantly exceeds market expectations.

To understand how this functions on the trading floor, consider these three live scenarios:

The Capex Boost: Imagine the government announces a ₹1 Lakh Crore expansion for high-speed rail. For a company like L&T, this isn't just a headline; it is a massive influx of new contracts. Investors see these future earnings today, causing the stock to "gap up" the moment the Finance Minister speaks.

The Interest Rate Handbrake: If the government announces it needs to borrow heavily to fund a high Fiscal Deficit, it competes with the private sector for money. This causes banks to raise interest rates. Suddenly, a home loan becomes more expensive, and a real estate developer's debt costs soar, causing their stock price to tumble.

The Tax Reality Check: Suppose you have a ₹10 Lakh profit in the market. If the LTCG (Long-Term Capital Gains) tax is unexpectedly raised from 10% to 15%, your take-home profit just vanished by ₹50,000. Institutional investors often sell off immediately to lock in gains under the old tax rate before the new rules kick in.

Budget expectations are the collective market forecasts concerning government spending, taxation, and fiscal deficit targets before the official presentation.

Budget expectations are mathematically derived from Economic Survey data, historical ministry fund utilization, and long-term policy targets like Viksit Bharat 2047 to determine which sectors will receive fresh capital or face new regulatory challenges.

To build a decent strategic assumption, professional analysts use a Tripartite Calculation Model:

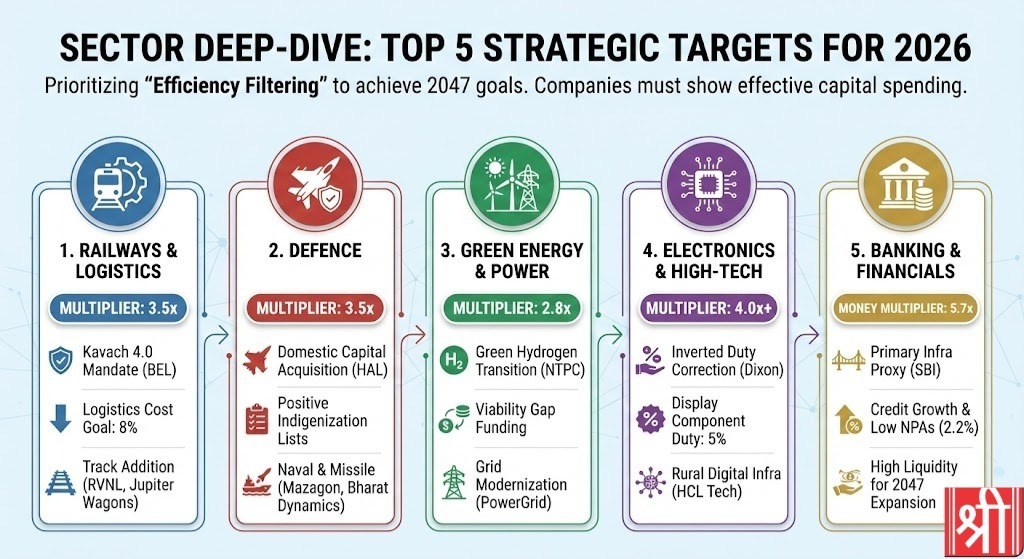

Budget 2026 allocates expenditure based on an Efficiency-Based Filtering Model that prioritizes sectors with high "Economic Multipliers." Funds are funneled into "renovation" projects where ₹1 of spending generates ₹2.50 to ₹4.50 in economic activity for steel, cement, and logistics firms.

Filtering for Efficiency: Who gets the government money?

The government does not distribute money randomly; it filters for companies with high Execution capability:

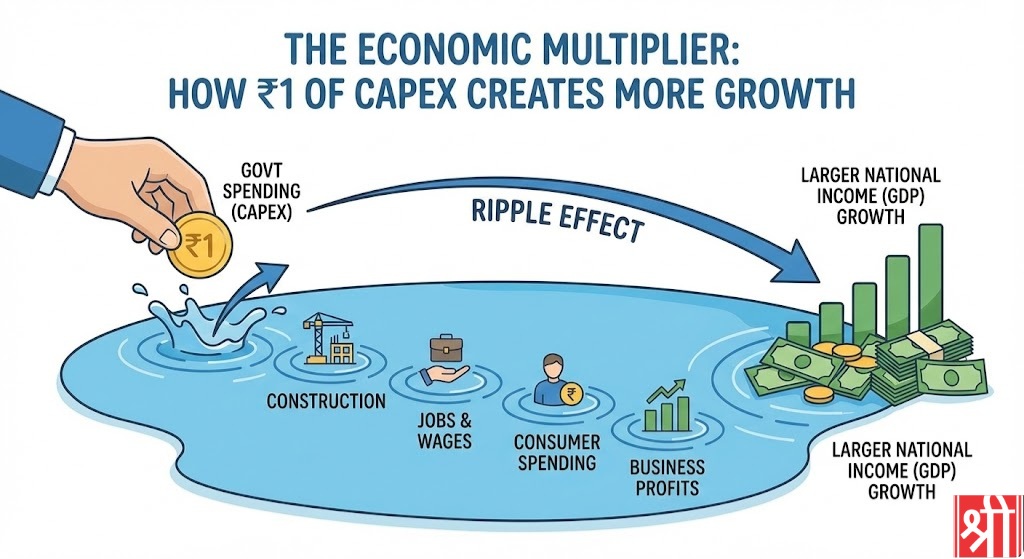

The Economic Multiplier measures the total change in national income (GDP) resulting from an initial change in government spending. In the context of Budget 2026, it describes how ₹1 of government Capex "multiplies" into profits for cement, steel, and logistics companies by triggering multiple rounds of private sector demand and job creation across the supply chain.

Think of government spending like a pebble thrown into a pond. The "splash" is the initial project, such as building a new high-speed rail line. The ripples that travel outward represent the real economic impact. When the government pays a construction company, those funds become wages for workers, who then spend that money on groceries and clothing. Those shopkeepers then have more money to hire staff or stock more goods. This cycle repeats multiple times, ensuring the original ₹1 spent results in several rupees of total growth for the country.

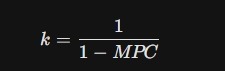

The primary formula used by economists to estimate this impact is:

In this equation, MPC (Marginal Propensity to Consume) is the percentage of every extra rupee that a citizen spends rather than saving. This formula interprets how much "leakage"—money that leaves the system through savings or imports, occurs. If people spend more of their income locally, the multiplier is higher. For Budget 2026, a high multiplier of 2.5x to 3.5x is expected because Make in India initiatives are keeping more money circulating within the domestic economy.

The government uses an "Efficiency Filtering" model, prioritizing companies that have proven they can spend capital effectively to reach the 2047 goals.

Banking & Financials | The 5.7x Money Multiplier The State Bank of India (SBI) stands as the ultimate proxy for India’s 2047 vision. With the "Money Multiplier" surging to 5.7 and NPAs dropping to a lean 2.2%, the banking sector is flush with the liquidity required to fuel the nation's expansion. However, not all balance sheets are created equal in this high-growth era.

To navigate this capital surge, you must distinguish between the industry titans and the growth challengers:

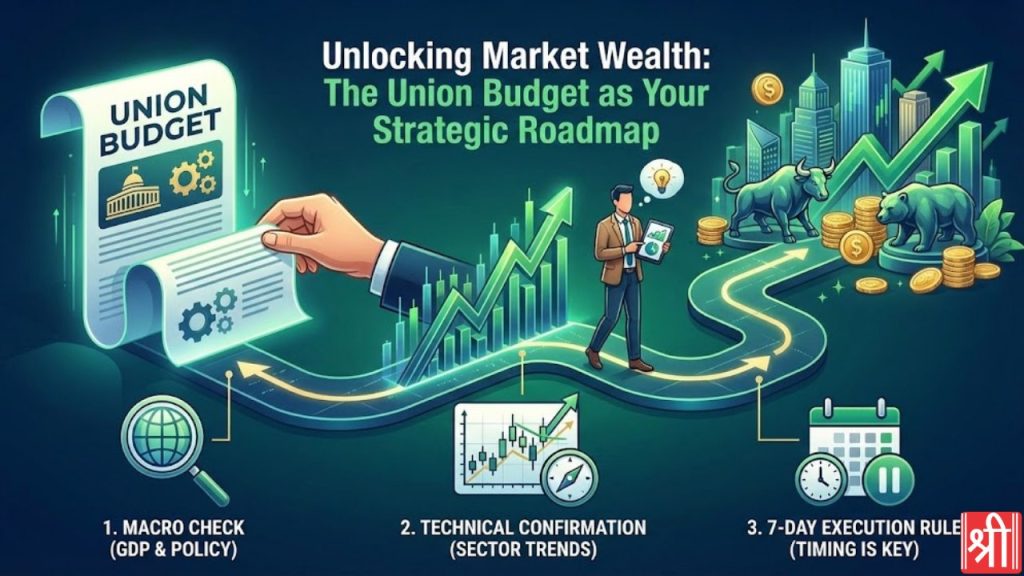

To navigate the high-volatility environment of the Union Budget, investors should use this structured 3-step decision-making model for money allocation and capital preservation.

Step 1: The Macro Check (The Green Light Signal)

Economic Survey (Jan 29) Analysis: The 2026 Survey raised India’s potential GDP growth to 7%. This structural "Green Light" supports 12–14% corporate earnings growth (Nifty EPS), fueling long-term equity rallies.

Step 2: Technical Confirmation (The Nifty PSE Index)

Nifty PSE Index Watch: The index has completed a multi-month "Cup and Handle" pattern. Trading at 10,179.5 (above the 10,000 neckline as of Jan 29, 2026), it signals an 11,500 target, driven by anticipated successful government Capex.

Step 3: The 7-Day Rule (Patience Over Prediction)

Wait for the "Fine Print": Budget Day volatility (2.65% range) is an emotional trap. Historically, returns the week after the Budget (+1.35%) are 7x larger than the day itself. Wait for a clear trend before entering, avoiding headline reactions.

The next logical question is: How do you actually position your capital to benefit from these 3.5x multipliers?"

If picking individual stocks feels overwhelming, the best Exchange-Traded Funds (ETFs) are the most efficient way to capture the growth of the Defence, Railway, and Banking sectors highlighted in this year's fiscal roadmap.

Follow these simple steps to start your investment journey:

The first and most critical step is to establish an online Trading and DEMAT Account. This is where your units will be safely stored.

Once your account is active, use the Shree Varahi App to search for ETFs that align with the Budget’s priority sectors.

Decide whether you want to make a one-time "Lumpsum" investment or utilize the 7-Day Rule by setting up a Systematic Investment Plan (SIP).

After choosing your ETF, place a "Buy" order during market hours (9:15 AM – 3:30 PM).

The Lakshmishree system will automatically debit the investment amount from your linked bank account. You can then monitor your portfolio’s real-time growth 24/7 through the Shree Varahi dashboard.

The Union Budget 2026 is far more than a government balance sheet; it is the cornerstone of India’s journey toward Viksit Bharat 2047. While the budget effect on Indian stock markets often begins with a storm of volatility, the underlying current is one of massive structural growth. By earmarking ₹12.4 trillion for Capex, the government has provided the "fresh water" needed to nourish the next generation of market leaders in Defence, Railways, and Green Energy.

While a major overhaul of the tax slabs is unlikely, there is a strong expectation that the Standard Deduction under the New Tax Regime might increase from ₹75,000 to ₹1,00,000. This move would increase disposable income for the middle class, potentially boosting consumer stocks in the FMCG and retail sectors.

Budget Day is dominated by "Intraday Volatility" and sentiment-driven price action. The 7-Day Rule allows the market to digest the actual Finance Bill, leading to more stable and consistent directional returns compared to the noise of the speech.

The Economic Survey flags a 10–20% risk that global tech firms moving 120 billion in data center spending into "off-balance sheet" vehicles could trigger a financial crisis similar to 2008 if AI adoption fails to justify the debt.

For FY27, the government is expected to prioritize Railways, Defence, and Green Energy. The Ministry of Railways, having utilized over 80% of its previous budget by December 2025, is a top candidate for a 10–15% hike. Defence remains a focus under the "Aatmanirbharta" initiative, with continued support for domestic manufacturing.