Have you ever wondered why some businesses always seem to have enough money to pay bills, buy stock, or grab new opportunities—while others struggle even with good sales? The secret often lies in something called working capital. And yes, there are different types of working capital that play unique roles in keeping a business alive and growing.

In this blog, we’ll break it down in the simplest way possible. You’ll not only learn how many types of working capital exist, but also their importance, classification, and how smart management can make or break a business.

What is Working Capital?

Working capital is the difference between a company’s current assets and current liabilities. In simple words, it shows how much money a business has left to run dail`y operations after paying off short-term debts. It acts like the fuel that keeps a business engine running smoothly.

Working Capital=Current Assets−Current Liabilities

- Current Assets = Cash, accounts receivable (money customers owe), and inventory (stock).

- Current Liabilities = Bills, short-term loans, and payments due within a year.

For example, if a company has ₹10,00,000 in current assets and ₹7,00,000 in current liabilities, then its capital is:

₹10,00,000−₹7,00,000=₹3,00,000

That means the business has ₹3,00,000 available to cover daily needs and invest in growth.

For Finance individuals, it tells whether a business can pay its short-term debts and still keep money aside for growth. Positive capital means a healthy business, while negative capital may signal trouble.

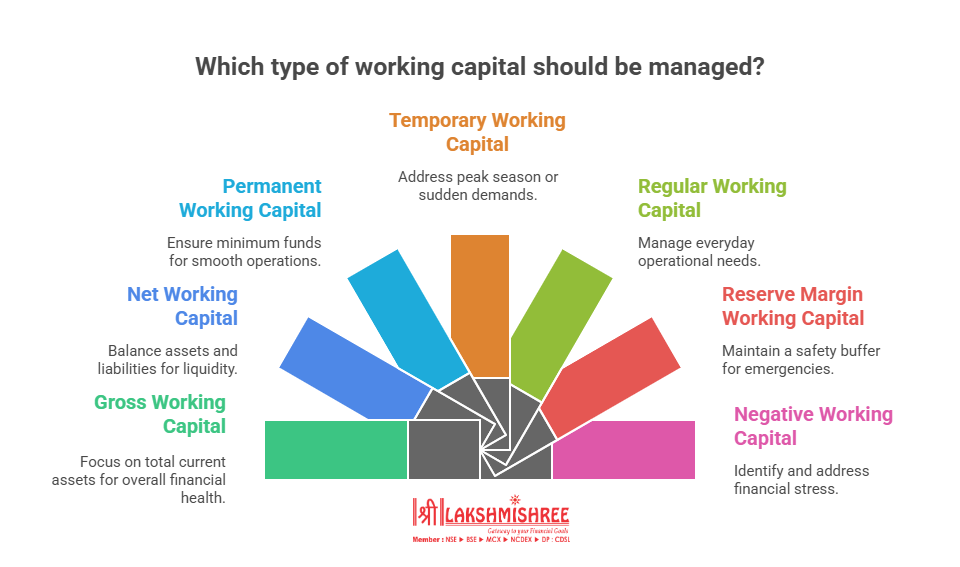

How Many Types of Working Capital Exist?

There are four primary types of working capital that every business needs to understand:

- Gross Working Capital – The total value of current assets (like cash, stock, receivables).

- Net Working Capital – The difference between current assets and current liabilities.

- Permanent Working Capital – The minimum amount of funds a business always needs to run smoothly.

- Temporary Working Capital – Extra funds required during peak seasons or sudden business demands.

Apart from these, businesses may also deal with other forms such as Regular (for everyday operations), Reserve Margin Capital (a safety buffer for emergencies), and Negative Capital (when liabilities are greater than assets, showing financial stress).

Classification of Working Capital

It isn’t the same for every business situation. That’s why it’s divided into several types, each with its own meaning and purpose. Let’s explore each one with clear definitions and examples:

1. Gross Working Capital

- Meaning: Gross WC simply means the total investment a business has made in its current assets. These assets include cash, accounts receivable (money customers owe), inventory (stock), and short-term investments.

- Why it matters: It shows the overall size of resources available for day-to-day operations. The higher the gross wc, the more flexibility a business has to manage short-term needs.

- Example: A retail store holding ₹8,00,000 in stock, ₹2,00,000 in cash, and ₹5,00,000 in receivables has a gross working capital of ₹15,00,000.

2. Net Working Capital

- Meaning: Net WC is the difference between a company’s current assets and current liabilities. Unlike gross WC, it shows the real financial strength of the business to meet short-term obligations.

- Why it matters: A positive net capital means the company can pay its bills easily, while a negative one indicates financial stress.

- Formula:

Net Capital=Current Assets−Current Liabilities

- Example: If a company has ₹12,00,000 in assets and ₹9,00,000 in liabilities, its net capital is ₹3,00,000. This shows extra liquidity for growth.

3. Permanent Working Capital

- Meaning: Permanent capital refers to the minimum level of current assets a business must always maintain to continue its operations smoothly. It never falls below a certain point, regardless of business activity.

- Why it matters: It ensures business continuity—like keeping shelves stocked or ensuring basic raw material is always available.

- Example: A grocery shop may always need stock worth ₹1,50,000 to function, no matter if sales are high or low. That amount is its permanent capital.

4. Temporary (or Variable) Working Capital

- Meaning: Temporary capital is the extra fund requirement that arises during busy seasons, festivals, or special circumstances. It changes depending on market demand.

- Why it matters: Without this, businesses may fail to meet sudden customer needs and lose sales.

- Example: An ice cream manufacturer requires additional capital during summer months to buy more raw materials and increase production.

5. Regular Working Capital

- Meaning: Regular capital is the portion of capital used for routine activities such as paying wages, electricity bills, rent, or raw material purchases.

- Why it matters: It keeps the daily cycle of business running without interruption.

- Example: A textile factory may need ₹80,000 every month for paying salaries and buying yarn. This is its regular capital.

6. Reserve Margin Working Capital

- Meaning: Reserve margin capital is the extra safety cushion businesses keep aside to deal with unexpected situations—like sudden market slowdowns, supplier delays, or emergencies.

- Why it matters: It protects a business from risks and uncertainties by ensuring funds are available even during tough times.

- Example: A construction company might keep ₹2,00,000 aside to cover sudden increases in raw material costs.

7. Negative Working Capital

- Meaning: Negative capital happens when current liabilities are higher than current assets. This means the company doesn’t have enough short-term resources to cover its obligations.

- Why it matters: It often signals liquidity problems. However, in fast-moving industries like e-commerce or retail, some businesses may operate successfully with negative capital due to quick cash inflows.

- Example: If a business has ₹6,00,000 in assets and ₹8,00,000 in liabilities, its capital is –₹2,00,000, showing a shortfall.

Types of Working Capital Management

Knowing the types of working capital is only half the story. The real challenge lies in managing it smartly. This is where capital management comes into play—it’s about balancing current assets (cash, receivables, inventory) with current liabilities (loans, payables, expenses) so that a business neither runs out of cash nor blocks too much money unnecessarily.

Broadly, there are three main types of working capital management approaches:

1. Aggressive Approach

- Meaning: In this approach, a business keeps lower levels of current assets and relies more on short-term borrowings to meet its needs.

- Why businesses use it: It frees up funds for growth and expansion because less money is tied up in inventory or receivables.

- Risk factor: While it may increase profits, it’s also risky. If short-term loans cannot be repaid on time or sudden expenses arise, liquidity problems can occur.

- Example: A tech startup may keep very little stock and depend on fast supplier deliveries and short-term loans. This way, they invest more money in marketing and product development.

2. Conservative Approach

- Meaning: This is the “safety-first” approach. A business maintains higher levels of current assets and depends more on long-term funds rather than short-term borrowings.

- Why businesses use it: It reduces the risk of running out of funds and ensures smooth operations even during tough times.

- Risk factor: The drawback is that too much money stays tied up in inventory or idle cash, which lowers profitability.

- Example: A manufacturing unit may always keep extra raw material and cash in hand, even if it means lower returns. This way, they never face stockouts or cash shortages.

3. Hedging or Matching Approach

- Meaning: This is a balanced approach where assets and liabilities are matched according to their duration. Short-term assets are financed by short-term funds, and long-term assets are financed by long-term funds.

- Why businesses use it: It combines safety with profitability, reducing both liquidity risk and unnecessary fund blocking.

- Risk factor: Though balanced, if sales or collections get delayed, short-term obligations may still become a challenge.

- Example: A company buying raw materials on 3-month credit and selling products within the same 3 months is following the matching approach—it aligns inflows with outflows.

Importance of Working Capital in Business

Working capital is more than just numbers on a balance sheet—it’s the lifeline of a business. Here are the most important reasons why it matters:

- Smooth Day-to-Day Operations – Adequate capital ensures that wages, bills, and supplier payments are made on time without interruptions.

- Liquidity & Stability – Positive capital gives confidence that the business can meet short-term obligations without stress.

- Better Creditworthiness – Banks and suppliers are more willing to extend loans or credit when a company shows healthy capital.

- Supports Business Growth – With enough funds, businesses can invest in new opportunities, stock up for festive seasons, or expand operations.

- Crisis Survival – Strong capital acts as a cushion during slowdowns, supply chain issues, or sudden emergencies.

Common Mistakes in Managing Working Capital

Even profitable businesses can run into trouble if they mishandle working capital. Here are the most common mistakes:

- Overstocking Inventory – Tying up too much money in stock reduces cash for other needs.

- Loose Credit Policies – Allowing customers too much time to pay can create cash flow problems.

- Over-reliance on Short-Term Debt – Too many loans increase repayment pressure and risk.

- Ignoring Negative Capital Risks – Relying only on supplier credit without backup can be dangerous if sales drop.

- Poor Cash Flow Forecasting – Not planning future inflows and outflows leads to sudden liquidity crunches.

Conclusion

Working capital is truly the heartbeat of any business—it keeps operations running, supports growth, and protects companies from financial stress. By understanding the types of working capital, their classification, and the different capital management approaches, businesses can make smarter financial decisions. The importance of capital lies in its ability to balance liquidity and profitability, ensuring long-term success. Whether it’s a small shop or a large corporation, managing capital wisely is the key to financial stability and growth.

Frequently Asked Questions

What are the different types of working capital?

The main types of working capital are gross capital, net capital, permanent capital, and temporary capital. Businesses may also use regular, reserve margin, and negative capital depending on their needs and financial situation.

How many types of working capital are there?

There are four primary types—gross, net, permanent, and temporary capital. Along with these, other categories like regular, reserve margin, and negative capital also exist to explain specific business requirements.

What is the classification of working capital?

Working capital is classified based on time and purpose. It can be gross (total assets), net (assets minus liabilities), permanent (minimum funds always needed), or temporary (extra funds for seasonal demand).

Why is working capital important for a business?

It is important because it ensures smooth operations, maintains liquidity, and supports growth. Positive capital shows financial strength, while negative capital signals risk.

What are the types of working capital management approaches?

There are three types—aggressive, conservative, and hedging. The aggressive approach focuses on profitability with risk, the conservative approach ensures safety with lower returns, and hedging balances both by matching assets and liabilities.

Disclaimer: This article is intended for educational purposes only. Please note that the data related to the mentioned companies may change over time. The referenced securities are provided as examples and should not be considered recommendations.