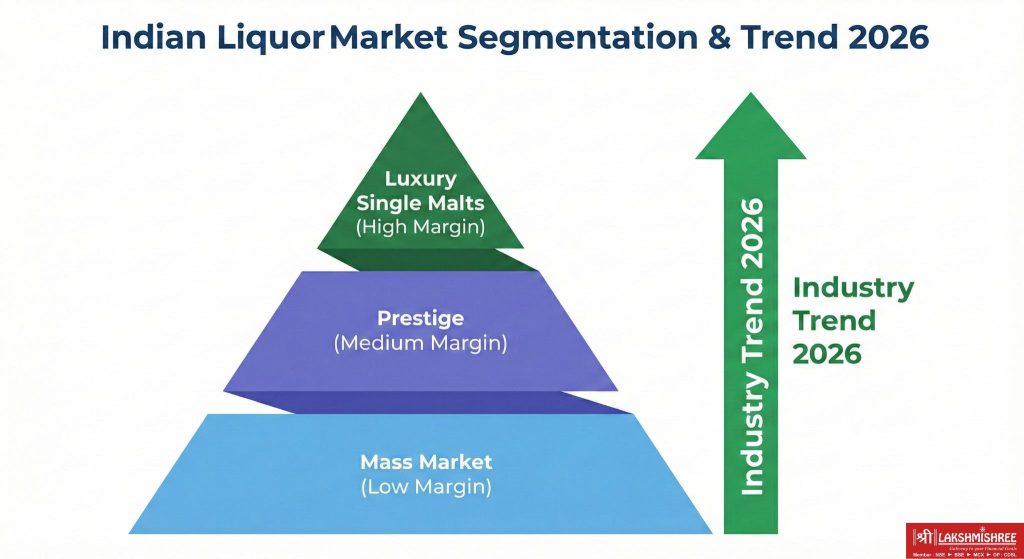

The top liquor companies in India are United Spirits Ltd (USL), United Breweries Ltd (UBL), and Radico Khaitan, which collectively dominate the IMFL (Indian Made Foreign Liquor) and beer segments. The Indian liquor stock market in 2026 is driven by a "Premiumization" super-cycle, where consumers shift to high-margin spirits. These companies are characterized by strong brand moats, extensive distribution networks, and a strategic shift toward high-margin "Prestige" and "Luxury" segments to improve profitability in 2026.

The Indian liquor industry is a highly regulated sector comprising the production of Indian Made Foreign Liquor (IMFL), beer, wine, and country liquor, currently valued at over $55 billion i.e. ₹4.51 Trillion Indian Rupees. It is characterized by a "premiumization" trend where consumers are shifting from low-margin mass-market brands to high-margin premium spirits, driving profitability for listed manufacturers despite complex state-level taxation and distribution policies.

India's increasing consumption of spirits (whiskey, rum, beer, vodka) has created a booming market, making Indian liquor companies strong stock market contenders. While the brands are on everyone's lips or on every tongue, the companies behind them and their economic significance are less known. This blog will analyze the top liquor companies in India , their stocks, key brands, and potential penny stock opportunities.

Market Leaders: United Spirits and United Breweries continue to dominate, but mid-cap players like Radico are gaining ground.

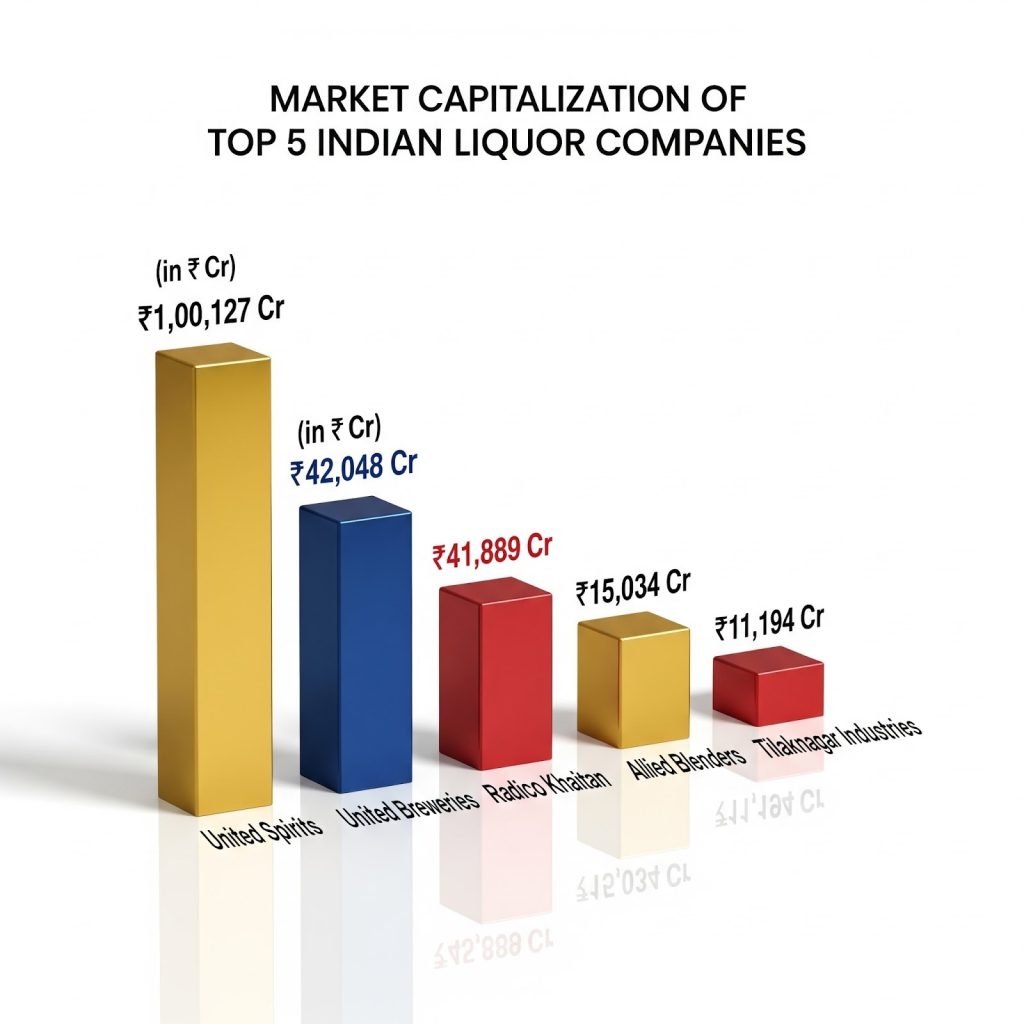

These companies Listed below not only dominate locally but also have a growing international presence. Investors keep a close watch on them, as liquor stocks in India have shown steady demand and rising valuations. Below is a snapshot of the best liquor companies in India by market cap (2026):

| Company | Market Cap (Cr) | Flagship Brand | Primary Growth Driver |

| 1. United Spirits | ₹1,00,127 | Johnnie Walker | Premiumization & UK FTA |

| 2. United Breweries | ₹42,048 | Kingfisher | Rising Beer Consumption |

| 3. Radico Khaitan | ₹41,889 | Rampur / Magic Moments | Luxury Exports |

| 4. Allied Blenders & Distillers | ₹15,034 | Officer's Choice | Debt Reduction & New Launches |

| 5. Tilaknagar Industries | ₹9,097 | Mansion House | Brandy Market Dominance |

| 6. Piccadily Agro industries. | ₹6,043 Cr | Indri Single Malt | Capacity Expansion (Chhattisgarh) |

| 7. India Glycols | ₹5,201 | Soulmate Whisky | Chemical & Spirit Diversification |

| 8. Globus Spirits | ₹2,980 | Governor's Reserve | Ethanol Blending (E20) |

| 9. Som Distilleries & Breweries | ₹2,579 | Hunter Beer | Regional Expansion |

| 10. Sula Vineyards | ₹2,422 | Sula / Dindori | Wine Tourism |

Source: https://www.nseindia.com/

The following list ranks the top liquor stocks in India based on market capitalization. Data is current as of January 2026.

The table below provides a comprehensive breakdown of the trailing returns for India's leading liquor companies.

Note: Returns shown are Absolute Returns (total wealth creation), not CAGR. Data is as of January 2026.

| Company Name | D/E Ratio | 5Y Return (%) | 1Y Return (%) | P/E Ratio |

| Tilaknagar Ind. | 0.05* | 2,782% | 47.5% | 43.0 |

| Som Distilleries | 0.22 | 1,180% | 11.8% | 33.3 |

| Radico Khaitan | 0.27 | 596% | 42.6% | 105.0 |

| India Glycols | 0.59 | 498% | 37.4% | 21.2 |

| Assoc. Alcohols | 0.20 | 302% | 8.3% | 23.2 |

| Globus Spirits | 0.53 | 297% | -14.8% | 118.5 |

| Piccadily Agro | 0.40 | 138% | 13.0% | 57.2 |

| United Spirits | 0.06 | 138% | -14.6% | 60.5 |

| United Breweries | 0.14 | 71% | -13.6% | 116.8 |

| Allied Blenders | 0.68 | NA | 51.7% | 61.7 |

| Sula Vineyards | 0.51 | NA | -40.5% | 42.3 |

*Source: Market data as of Jan 2026. Note on Tilaknagar: Reported D/E is 0.05, but this is expected to rise significantly in FY27 following the ₹2,100 Cr debt financing for the Imperial Blue acquisition.

The investment case for Indian liquor stocks in 2026 rests on three structural pillars: Premiumization, Demographics, and Ethanol Integration.

The most critical trend in 2026 is the shift from "quantity" to "quality." Consumers are trading up from cheap country liquor to "Prestige" and "Luxury" IMFL.

Risk: Domestic brands (like Allied Blenders) may face stiff competition from cheaper imported scotch, forcing them to upgrade quality or lower prices. Source:(https://m.economictimes.com/news/economy/foreign-trade/india-uk-trade-pact-expected-to-come-into-force-by-first-half-of-2026-british-envoy/articleshow/126302798.cms)

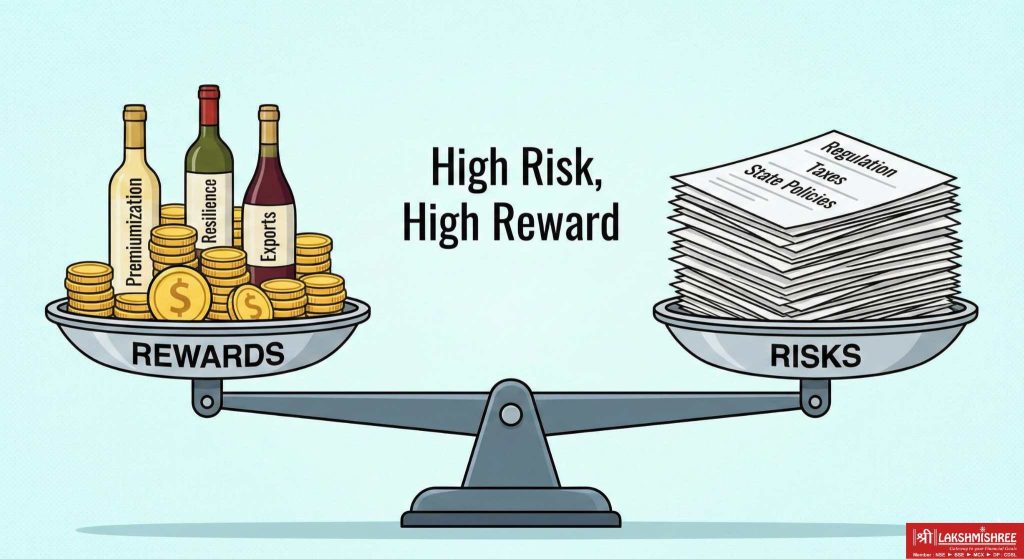

Indian liquor stocks offer a compelling long-term investment due to stable demand, strong brand loyalty, and growth in premium and mass markets. Key challenges include high taxes, strict regulations, and advertising restrictions, which affect profit margins. Platforms like Lakshmishree simplify investing in major players (United Spirits, Radico Khaitan) and potential penny stocks.

The market is booming, fueled by rising disposable incomes. While whiskey dominates, vodka, rum, and gin are growing fast. The sector sees intense competition between strong domestic brands (Radico Khaitan, Tilaknagar Industries) and global giants (Diageo, Pernod Ricard).

4-Step Liquor Stock Assessment Model: This framework assesses a spirits company's potential for sustainable growth, superior profitability, and financial stability.

The "Premiumization" Test (The Growth Driver)

Core Question: Is the company successfully shifting its sales mix toward higher-margin products?

Core Question: Does the company generate exceptional returns on the capital it employs?

Core Question: Is the balance sheet robust enough to withstand market fluctuations, regulatory changes, and working capital pressures?

Core Question: Are internal strengths in place to protect the company from major external threats?

Source:(https://www.moneyworks4me.com/company/news/index/id/791822)

Investors must treat this sector as "High Risk, High Reward" due to regulatory volatility.

Also Read: Top High Book Value Stocks in India 2026

Investing in liquor companies in India is easy and works the same way as buying stocks of any listed company. Here’s a simple step-by-step guide to get started:

The Indian liquor sector in 2026 has fundamentally shifted from a volume game to a value-driven "premiumization" story, offering investors a rare cocktail of growth and defensive stability. With the expected India-UK FTA poised to reduce scotch tariffs and the government’s E20 ethanol mandate providing a profit floor for distilleries, the real opportunity lies in distinguishing between agile innovators like Piccadily Agro and diversified giants like United Spirits that can withstand regulatory volatility. For the smart investor, the strategy is now clear: look beyond the bottle count to brand equity and balance sheet strength, as these will be the true differentiators in a market set to outperform global averages.

Disclaimer: This article is for educational purposes only and should not be considered financial advice. Always conduct your research and consider consulting with a financial advisor before making any investment decisions.

United Spirits Ltd (USL) is the number one alcohol company in India by revenue and market capitalization (₹1,00,127 Cr). Owned by Diageo, it commands the leading market share in the premium whisky segment.

The biggest companies by market cap are United Spirits, United Breweries, and Radico Khaitan. Allied Blenders & Distillers is also a major player, ranking third in terms of volume sales.

Look for Debt-to-Equity ratios below 0.5 (liquor is capital intensive), Gross Margins above 45% (indicates pricing power), and a rising share of "Prestige" segment volumes.

United Spirits and United Breweries are consistent dividend payers. Sula Vineyards has also emerged as a strong dividend payer due to its high cash-generation model and low capex requirements compared to spirits manufacturers.

While strict "penny stocks" are risky, smaller cap companies like Associated Alcohols or Som Distilleries trade at lower absolute valuations compared to the giants, though they carry higher regulatory risks.