Are you trying to figure out whether swing trading or day trading is the right strategy for you? With so many trading styles out there, it's easy to feel overwhelmed. But don't worry—understanding the difference between swing trading vs day trading is the first step in choosing the approach that suits you best. In this blog post, we will explain both trading strategies and compare the pros and cons so that you may achieve an idea of what to plan for your trading style and financial goals.

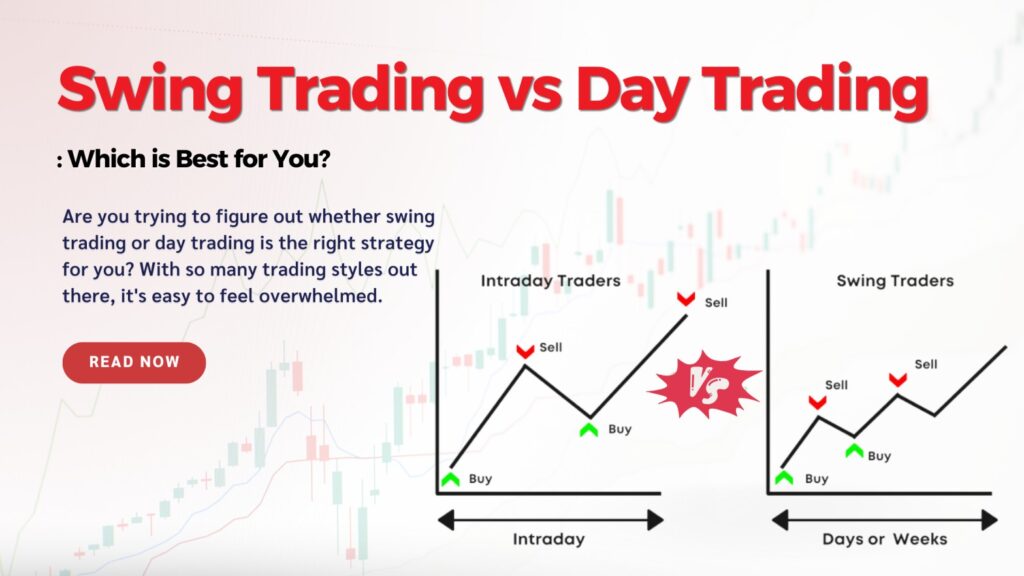

Two very famous trading techniques, desirable to most traders in efforts to make money from market movements, are day trading and swing trading. Conversely, these strategies differ by a great margin in terms of approach and commitment of time involved. Day trading involves buying and selling financial instruments within one trading day; thus, this mandates that a day trader must be very active and engaged over the market hours.

In contrast to this, swing trading entails a longer time frame in which the positions are held for several days or weeks. With that, it allows traders to exploit swings in markets without constant monitoring. It is, therefore, important to understand the differences between these trading styles in order to determine which one best fits your goals as a trader and your lifestyle.

Day trading is an active strategy where the trader buys and sells financial assets like stocks within the trading day. The goal to be attained is to achieve prompt profits from very small changes in price. All the day traders close their positions before the market closes, thereby fully avoiding all risks resulting from holding stocks overnight.

It is a time-consuming approach that demands a lot of time and attention. Day traders generally sit in front of their trading screens most of the time, hoping to find opportunities to let them buy low and sell high or vice versa throughout the trading day. This method involves quick trading and quick decisions.

For instance, a day trader may buy 100 shares of the company that decline in the morning while the price is low and then sell before the closing of the market to earn a profit. The only important thing here is that the buying and selling processes take place in one day.

Day trading may sound exciting because it gives one the opportunity to make money fast, but it also comes with the risk of losing money fast. To be successful at day trading, one must be aware of market trends and focused throughout the day.

Day trading offers several benefits for those who enjoy an active and fast-paced trading environment:

However, day trading also has its challenges:

Swing trading is a strategy where traders hold onto financial assets, like stocks, for several days, weeks or even months. The main idea is to profit from the market's short- to medium-term price swings. Unlike day trading, swing trading doesn’t require constant monitoring of the market, making it a more flexible option for those who can’t dedicate their entire day to trading.

Swing traders normally identify the trends through technical analysis and then decide when to buy or sell. They want to get in on a trade when its price is starting to swing and out when the trend is about to turn in the other direction, thus taking advantage of bigger price movements over time.

For example, a swing trader might buy shares of a company when they believe the price is starting to rise. They’ll hold onto those shares for several days or weeks, waiting for the price to reach their target before selling. This approach requires patience and a solid understanding of market trends.

Swing trading offers various advantages for traders in search of a less intensive approach:

However, swing trading has its drawbacks as well:

| Criteria | Day Trading | Swing Trading |

|---|---|---|

| Meaning | Buying and selling financial assets within the same day. | Holding financial assets for several days or weeks to capture price swings. |

| Time Frame | Trades are opened and closed within the same day. | Trades are held for several days or even weeks. |

| Market Monitoring | Requires constant monitoring throughout the trading day. | Involves less frequent monitoring; a few times a day may be sufficient. |

| Trading Strategies | Focuses on catching small price movements and implements strategies such as scalping, momentum trading, and high-frequency trading | Focuses on capturing larger price swings; it uses such strategies as trend following, technical analysis, and support/resistance levels. |

| Which is Safer? | Generally considered riskier because it is fast and decisions must be made quickly. Yet, there is no overnight risk. | Safer in terms of less frequent trading, but higher overnight risk due to market exposure over several days. |

| Tools Used | Advanced trading platforms, real-time data feeds, technical indicators, and charting tools. | Charting software, technical indicators, and fundamental analysis tools. Less emphasis on real-time data. |

| Leverage | Often uses higher leverage to amplify gains, but this also increases the potential for significant losses. | Typically uses lower leverage compared to day trading, focusing more on longer-term gains with manageable risk. |

| Risk Level | Lower overnight risk, but high intraday volatility. | Higher overnight risk due to holding positions longer. |

| Time Commitment | Very time-intensive; often like a full-time job. | More flexible; can be done alongside other activities or jobs. |

| Potential for Quick Profits | High potential for small, quick gains multiple times a day. | Potential for larger profits over a longer period. |

| Skill and Experience | Requires quick decision-making and deep market knowledge. | Requires patience, technical analysis skills, and trend analysis. |

| Capital Requirements | Typically requires more capital due to frequent trading and margin requirements. | Generally requires less capital but still needs enough to manage overnight risks. |

| Stress Levels | High, due to fast-paced and continuous decision-making. | Lower, as trades are less frequent and spread over a longer time. |

When it comes to profitability, the answer isn’t straightforward—both day trading and swing trading can be profitable, but the outcome depends on various factors.

It is common to note that day traders can trade in high volumes within a single day, which may quickly help them gain higher profits. Because they open and close trades quickly on movements, it allows them to take advantage of very small price changes. However, this doesn’t guarantee that day traders will always earn more profit than swing traders. The fast-paced nature of day trading requires sharp skills and quick decision-making to maximise gains and minimise losses when the market moves against them.

On the other hand, swing traders typically make fewer trades but aim to capture larger price movements over a longer period. The longer a swing trader holds a position, the more likely it is that the market will move significantly from its opening price. If the market moves in the direction predicted by the swing trader, they stand to make a substantial profit. However, the opposite is also true—if the market moves against their position, the losses can be significant as well.

Both day trading and swing trading carry significant risks, but the type of risk varies. Day trading focuses on smaller price movements within a single trading day, so while the individual risks might be lower, the fast-paced nature means traders can experience multiple small profits or losses throughout the day.

On the other hand, swing traders can hold their positions for days and sometimes even weeks. This can bring potentially larger profits but simultaneously increases the possibility of greater losses due to market fluctuations over time. At the end, risk in both strategies greatly depends on how good and experienced the trader is and his or her ability to handle those risks operationally.

There are several misconceptions about swing trading and day trading that can mislead traders. Here are four important myths to be aware of:

Deciding between swing trading vs day trading ultimately comes down to your personal preferences, lifestyle, and financial goals. If you thrive in a fast-paced environment and can dedicate several hours each day to monitoring the markets, day trading might suit you best. On the other hand, swing trading could be a better fit if you prefer a more measured approach with less daily time commitment. Both strategies have their own risks and rewards, so choose the one that aligns with your trading style and risk tolerance.

Swing trading is generally considered safer due to its longer time frame and less frequent trades, but it still carries risks, especially with overnight market changes.

Swing trading is often recommended for beginners because it requires less time and allows more room for analysis before making decisions.

While you can start both strategies with modest capital, day trading typically requires more due to the need for margin and frequent trades.

Day trading involves buying and selling within the same day for quick profits. Swing trading holds positions for days to weeks to capture medium-term price swings. Position trading holds for months or years, focusing on long-term trends.

Profitability depends on skill and market conditions. Day trading can offer faster gains but is riskier and time-intensive. Swing trading may yield larger individual profits with less daily stress.

Disclaimer: This article is for educational purposes only and should not be considered financial advice. Always conduct your research and consider consulting with a financial advisor before making any investment decisions.