Is Money kept idle profitable? The answer is No. To make your money more profitable there are various ways you can invest whether for the short or long term. One of them is the stock market where you can buy the stocks of companies that are believed to perform well for a day, week, month, or year. There are a few types of trade through which you decide the length of time for which you invest your money. One such way is doing a swing trade. A trader has to do a technical analysis before selecting a stock for swing trading.

Swing in simple words is a big up-and-down movement in the prices of a share of a company. Swing Trading is a technique used in trading where the traders buy or sell any financial instrument based on the trend of that particular stock. To make this type of trade successful for any trader detailed analysis should be done by him/ her.

There is no time frame for a swing trade, it can be for a few days or a few months and helps provide perspective for short-term as well as long-term trading.

Trading can take place in various market conditions whether it be upward, downward, or in between the two.

When the stock market is in a bullish mood most of the shares are expected to increase. But along with increasing they also diminish for shorter intervals of time. The investors try to make profits during this time.

In a bullish market, you have to be careful and watch the markets with due diligence as they can change at any time and you may have to incur losses.

Trading is a bit tough when the market is bearish as compared to the bullish trends. During this time almost all the securities are on a downtrend. It is not suggested to buy shares for swing trade during this time.

When the market is in a bearish mood, shares should not be bought with the expectation that they would increase in short term and bear profits for the trader.

Trading when the market is highly volatile can be dangerous. Changes in the price of any stock are regular and can happen anytime during trading time. While making a swing trade the trader needs to know to do a technical analysis of a stock.

The technical analysis helps the trader learn about the past movements of the stock and their trading activity which helps to predict what the future would be like for that particular stock.

Technical analysis means studying the trends and patterns of the stock so that it can provide trading opportunities for the trader or investor.

Swing Traders focus on stocks that can provide them profits in a short amount of time which generally are shares of large-cap companies. These stocks have high trading volumes which help the investor know the market’s perspective on the company.

Like many other types of trading Swing Trading comes with many risks. In the swing trade, securities are held for some time they are much more prone to gap risk. Gap risk is the risk where the price of a share can fall or rise in response to any news or event when the markets are closed overnight or on weekends.

When the market opens on the next trading day the price at which the stock opens reflects on that news or event. If the news is in favor of the company, the price of that share will increase while if they are against them, the price of the share will fall.

The longer market is closed there are increased chances of unexpected gains or losses and the traders while focusing on a short holding period may miss long-term security holding.

Swing Traders before investing in any stock analyze it and then move forward to trade or invest in it. They also rely on different indicators which help them in selecting the stocks for swing trading. Some of these are discussed below:

The Moving Average is the average of a share’s prices over time. It is a lagging indicator and makes the daily price fluctuations very less. The Moving Average also smooths the short-term spikes in the prices of the shares of any company.

The traders use the Moving Average indicator when the short-term moving average crosses the long-term moving average.

Volume is the most important indicator for swing traders as it depicts the strength of the ongoing trend. Volume as an indicator is important when there is a breakout. A change in the price without a change in the volume of trading is not a change in trend.

When the volume is high, it indicates that real buyers and sellers are present in the market. Volume as an indicator is used to spot the bullish trend.

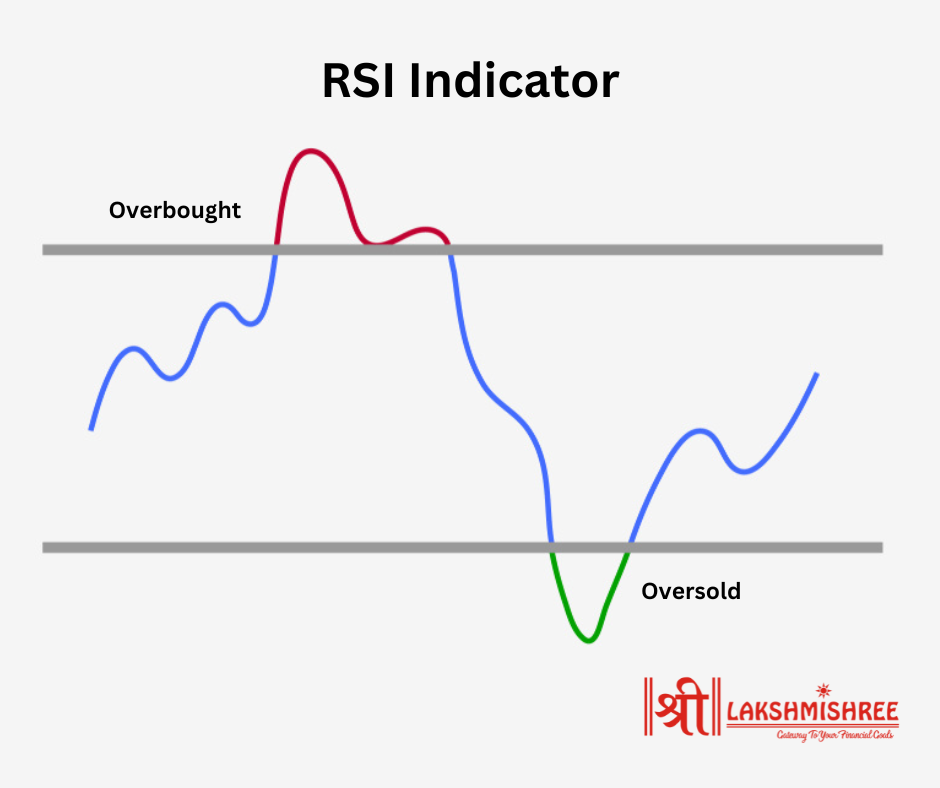

The Relative Strength Index (RSI) shows whether the prices of shares of a company are in the overbought zone or the oversold zone. If they are in the oversold zone the prices are expected to an uptrend while if they are in the overbought zone the share prices reverse to the downtrend.

RSI is a price oscillator that moves between 0% to 100% with limits at 30 % and 70 %. The area below 30% and above 70% is known as the oversold and overbought areas respectively.

It is a technical analysis that explains the relationship between the rate of change in the price of an asset with its volume. It is used to determine how with ease the price of a share can either rise or fall.

The lines of support and resistance create a price band between which the price of a security moves. These lines help the traders to plan the entry and exit in the market for a share of any company. When the price falls it reaches the support line which means that the demand has increased while if the price is rising that will mean that there is an increase in supply and the price will be near the resistance line.

If the price reaches any of the lines the trader may not gain much during this time.

The stock market is not at all stable and the prices of all the shares fluctuate every minute when the market is open. Various strategies can be used to pick a stock for the swing trade some of them are:

This strategy is used by traders to identify the support and resistance levels of stock and reversal levels as well. The traders know that the prices of shares often retrace to a certain percentage and then reverse again. This strategy helps traders know the high and low levels of a share price.

Support and resistance lines are the pillars of any technical analysis. A support line is a price level below the current market price where the purchasing pressure overcomes the selling pressure. The resistance level is the price level above the current market price which is the complete opposite of the support level. While applying this strategy in swing trading keep in mind that when a share price reaches the support or resistance level the roles of each are interchanged, i.e., what once was the support level will become the resistance level and vice-versa.

In this strategy of swing trading, the stock that is selected should have a strong trend and trade within a channel. If the channel is of a bullish trend a sell position should be created when the price falls off the top line. When the price is in a downtrend a trader would consider making sell positions unless when it breaks the channel and reverses to start an uptrend.

Another popular strategy is the Simple Moving Averages (SMA). The prices of stocks are constantly changing which results in calculating the average prices constantly. The 10-day SMA adds the closing price of the last ten days and divides by 10 while in the 20-day SMA the average price is calculated for the previous 20 days.

There are two lines of SMA placed by the trader. When the 10-day (shorter) SMA line crosses the 20-day (longer) SMA line it signals a buy position while if it is the opposite, it signals a sell position.

This strategy is a simple way to recognize opportunities to swing trade a stock. It consists of two moving averages – the MACD line and the signal line. The buy and sell signals of a share are generated when these two lines cross. If the MACD line crosses from above bullish trend is indicated and if it crosses from below, it indicates a bearish trend. A swing trader waits for the two lines to cross before entering the market.

One of the popular strategies among traders is the 44- day moving average (MA). It calculates the average trading activity of a share in the last 44 days. The 44-day MA gives an idea to the trader whether a stock is in an uptrend or downtrend.

If a stock has a high 44 MA it means that the price of the stock has been trading higher for the past 44 days while if the MA is low the stock is trading lower for the past 44 days and is volatile.

DLF was founded by Chaudhary Raghuvendra Singh in 1946. The company is in the business of real estate development i.e., from the acquisition of land to the construction and marketing of the projects. The company is known for developing some of the first residential colonies in Delhi. In 1985 the company was expanded to Gurugram, then an unknown place. Today DLF has properties in 15 states.

Godrej Properties Ltd. was established in 1990 and is a real estate development company part of the Godrej Group business which was established in 1897. Godrej Properties was originally incorporated as Sea Breeze Constructions and Investments Pvt. Ltd. in 1985. The company develops residential, commercial, retail and IT projects in cities like Pune, Mumbai, Bengaluru, Gurugram, Noida, Hyderabad, etc.

Sobha Limited formerly known as Sobha Developers Limited is one of the leading real estate developers. It was founded by PNC Menon in 1995 and obtained its ISO certificate in 1997. Their first residential project was launched in 1997 in Bengaluru. In October 2003 Sobha Construction and Sobha Research and Development Center started operating.

IRB was incorporated in 1998 to fund the capital requirements of the IRB Group initiatives in the infrastructure sector. The company builds roads, highways, bridges, and tunnels. They have now started working in the real estate development sector too. They have a presence in Build – Operate – Transfer (BOT) space. Their main vision is to develop safe and comfortable roads and highways for India.

Nagarjuna Construction Company (NCC) is a construction company that was established as a partnership firm in 1978 but was converted to a limited company in 1990. They are primarily involved in the construction of commercial and industrial buildings along with flyovers, bridges, environmental projects, etc.

Incorporated in 1984 with the name Columbia Leasing & Finance Limited which was later renamed Ruchi Infrastructure in 1995. It is one of the biggest private companies that have bulk storage of edible oils.

Swing Trade and Day Trade are very similar in many ways. But there are some differences between them mainly regarding holding time and the number of transactions.

Swing Trading means trading with the ongoing trend. People who are new to trading can start with swing trading as it is held for more than a day which gives the new traders some time to assess the stock. The traders do not try to make big profits in a single go but small profits at regular intervals. The time required during swing trading is less compared to the time and concentration required in day trading.

Swing trade can be subjected to the risk of an event that may happen when the markets are closed. All the traders who are venturing out to the field of swing trading are suggested to do an in-depth technical and fundamental analysis of the company in which they want to trade.

While making any decision regarding a trade contact us at Lakshmishree to know how can you benefit from it.

Swing is a movement of a share's price, whether upward or downward and sometimes it may bring new levels of the price of that share.

Both are similar in many ways other than the holding period, a trader who wants a really quick profit should go for day trading while if they want a high profit, they can go to swing trading.

Before making any trade if a lot of technical and fundamental analysis is done and have seen the past movements of the price, they are said to be more successful.

If the trader is making a swing trade he should hold his share for at least a few weeks and book their profit when the price is high of that share.