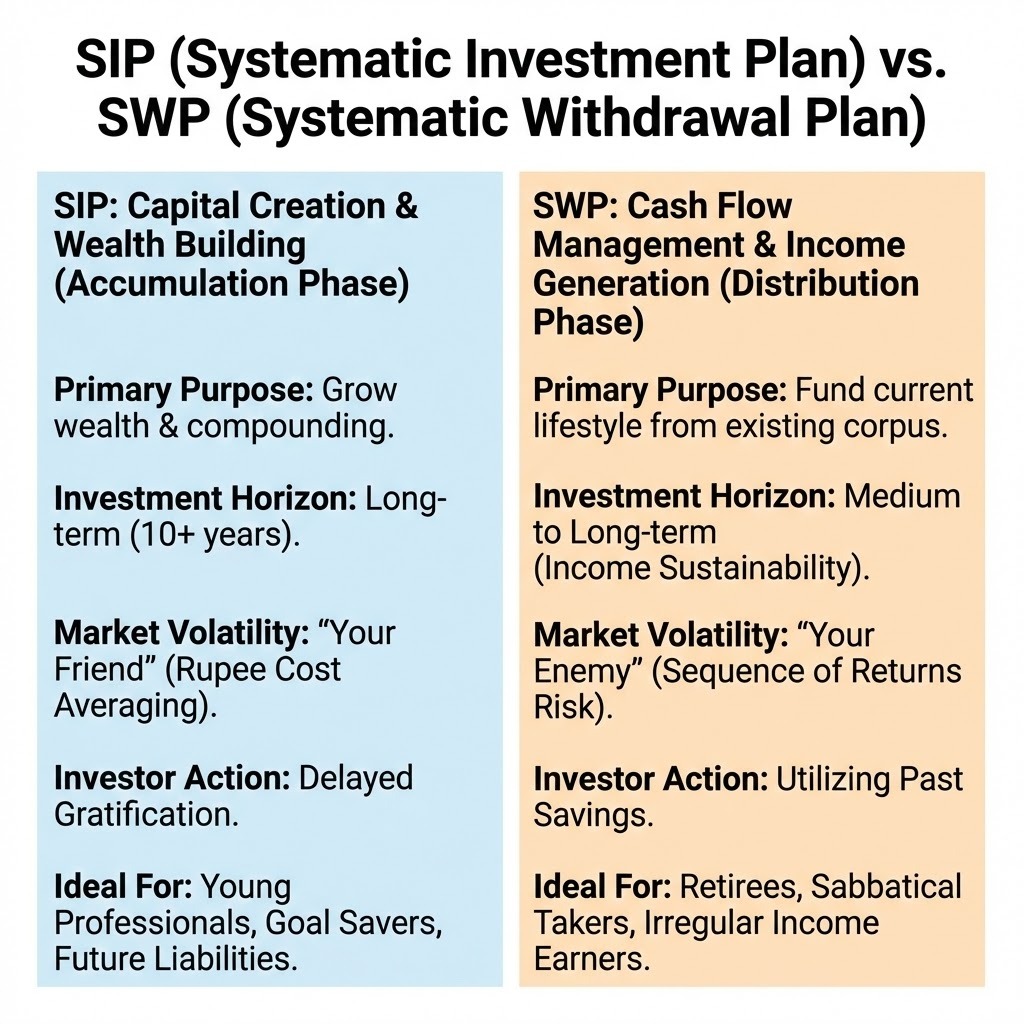

SIP involves regular, small investments over time to build wealth. SWP is for the income phase, allowing investors to systematically withdraw fixed amounts from their corpus, often post-retirement, for a steady income stream. The decision of SIP vs SWP ultimately hangs on whether the goal is to build a corpus (SIP) or distribute it (SWP).

Like teeth and tongue can fight, but they will never stop working together to eat, such is the relationship between SIP and SWP in the world of investment. This guide will explore their mechanics, combination formula, how they differ from each other and from Fixed Deposits, real-life examples, and why being consistent leads to independence.

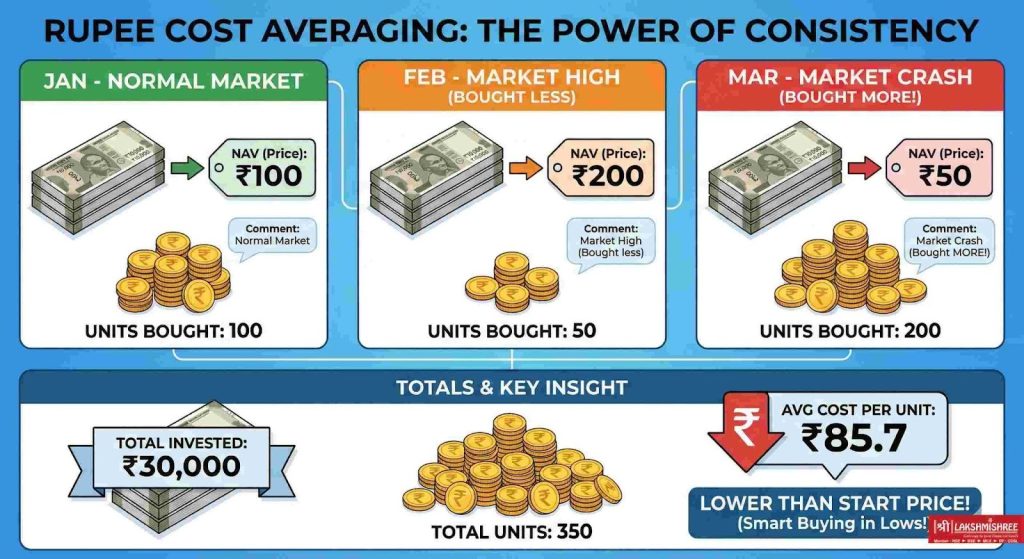

A Systematic Investment Plan (SIP) involves regular, fixed investments from a bank account into a mutual fund. SIP uses rupee-cost averaging to buy more units when prices fall, primarily aiding earners (aged 25-55). Its key strength is compounding, which accelerates long-term wealth growth.

| Aspect | Description |

| Primary Goal | Wealth Accumulation (building a corpus for future financial security) |

| Mechanism | Regular, fixed investments from a bank account into a mutual fund. |

| Financial Flow | Bank → Systematic Investment Plan (SIP) in a Mutual Fund |

| Best For | Earning individuals (age 25–55) saving for long-term goals like retirement or a child's education. |

| Key Strength | Compounding, which accelerates long-term wealth growth by earning returns on returns. |

The Systematic Withdrawal Plan (SWP) is a wealth distribution tool providing regular cash flow from a mutual fund investment. A fixed amount is withdrawn periodically into a bank account, allowing the remaining capital to stay invested and potentially grow.

| Aspect | Description |

| Primary Goal | Wealth Distribution (generating income for consumption) |

| Mechanism | Systematic withdrawal of a fixed amount periodically into a bank account. Remaining capital stays invested. |

| Financial Flow | Mutual Fund → Bank Account |

| Best For but not limited to | Retired individuals (age 60+) needing regular, predictable monthly income from a lump sum. |

A Systematic Investment Plan (SIP) simplifies investing by automatically deducting a fixed amount on a regular basis. This mechanism promotes financial discipline and removes the burden of tracking daily market movements.

This process effectively lowers the average unit cost over the investment period, eliminating the need to time the market.

A Systematic Withdrawal Plan (SWP) allows you to regularly sell mutual fund units to receive a fixed amount. When you use an SWP, you are withdrawing a mix of your original investment (capital) and any profits, not just interest.

Related Example:

Mr. Sharma has a ₹50 Lakh corpus and a monthly SWP of ₹30,000 (7.2% annual withdrawal).

| Scenario | Portfolio Growth Rate | Withdrawal Rate | Impact on Corpus |

| Scenario A(Favorable) | 10% | 7.2% | The corpus will continue to grow (Returns > Withdrawal Rate). |

| Scenario B (Risk) | 5% | 7.2% | The corpus will steadily shrink (Withdrawal Rate > Returns), eventually leading to the fund running out. |

READ before Investing in 2026 : 10 Best SWP Mutual Funds in India 2026 Updated

Investors often confuse SIP and SWP, unsure which tool suits their needs. SIP is generally for long-term wealth accumulation goals, such as buying a home, funding education, or retirement.

A Systematic Withdrawal Plan (SWP) provides regular income from a corpus, often for post-retirement expenses or supplementing income. Investors frequently compare SWP (withdrawal) with SIP (investing) to understand the difference and when to use each strategy. A detailed comparison follows to aid your decision.

Read more on topic: Understanding the Impact of Trading Psychology on Investment Decisions

The SIP mechanism benefits from rupee cost averaging. When the market falls, the fixed investment amount buys more units. This lowers the average purchase cost over time. A fluctuating, even declining, market allows the investor to "buy cheap units," which is essential for maximizing long-term returns.

If the market experiences a severe downturn right when withdrawals begin (e.g., immediately after retirement), the investor is forced to sell a greater number of units at a low price to meet the fixed withdrawal amount. This premature depletion of the corpus significantly increases the risk of running out of money, a phenomenon known as the "Sequence of Returns Risk."

Note: For a carefully curated list of high AUM stability funds suitable for withdrawal strategies in 2026, refer our best analysis on- 10 Best SWP Mutual Funds in India [2026 Updated]

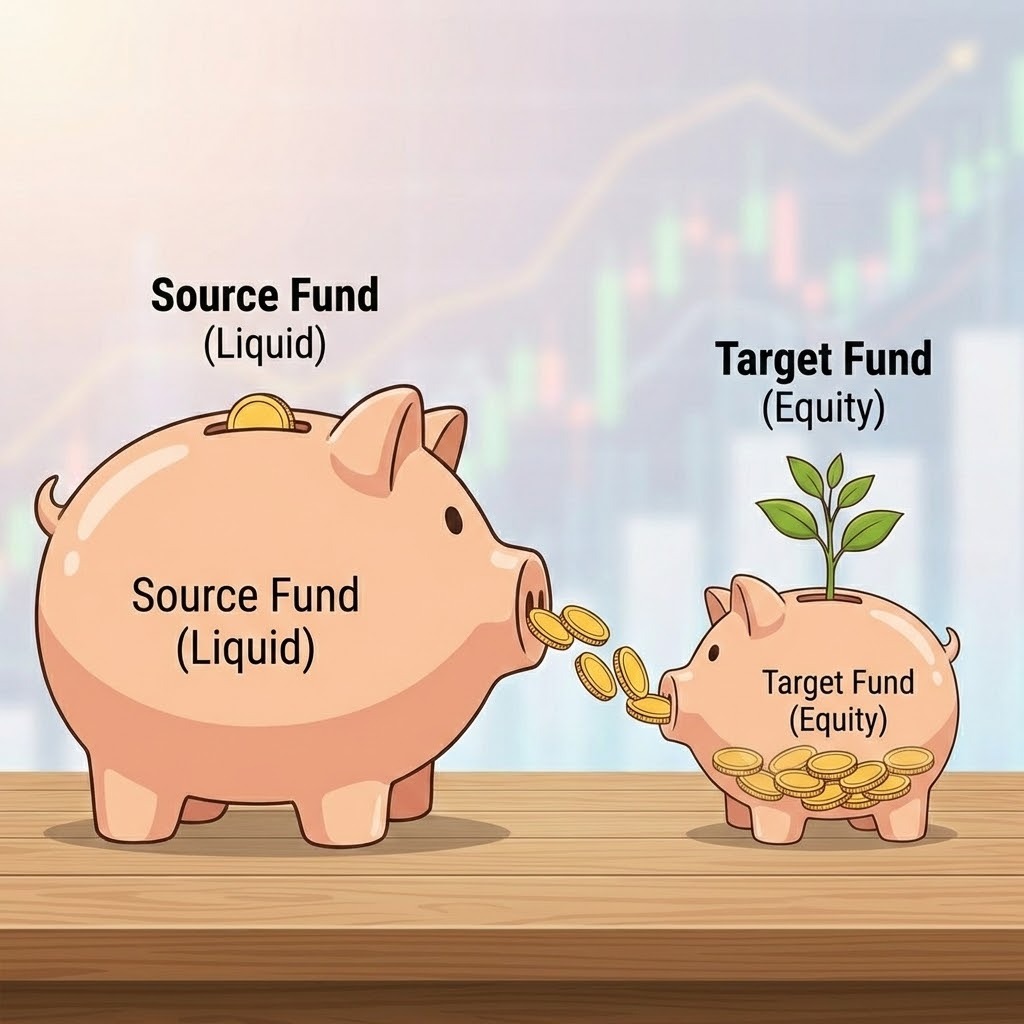

While most investors know about SIP and SWP, the third crucial component is the STP (Systematic Transfer Plan). Think of the STP as the intermediary, facilitating movement within your portfolio.

STP is the ideal strategy when you have a large sum of money (e.g., from a property sale, like ₹50 Lakhs) that you want to invest in the volatile stock market (Equity), but you are hesitant to deploy it all at once due to market timing risk.

Here's the two-step strategy:

The Benefit: Instead of moving all the money into the volatile Equity Fund at once, you transfer it in small, regular installments (this process is essentially a SIP). This uses Rupee Cost Averaging you buy more units when the price is low and fewer when the price is high. It lowers your average purchase cost and removes the need to worry about timing the market.

The fund type also determines the potential return and risk of your strategy (e.g., high-risk equity vs. low-risk debt).

For a full overview of Mutual Funds, see our blog: Types of mutual funds

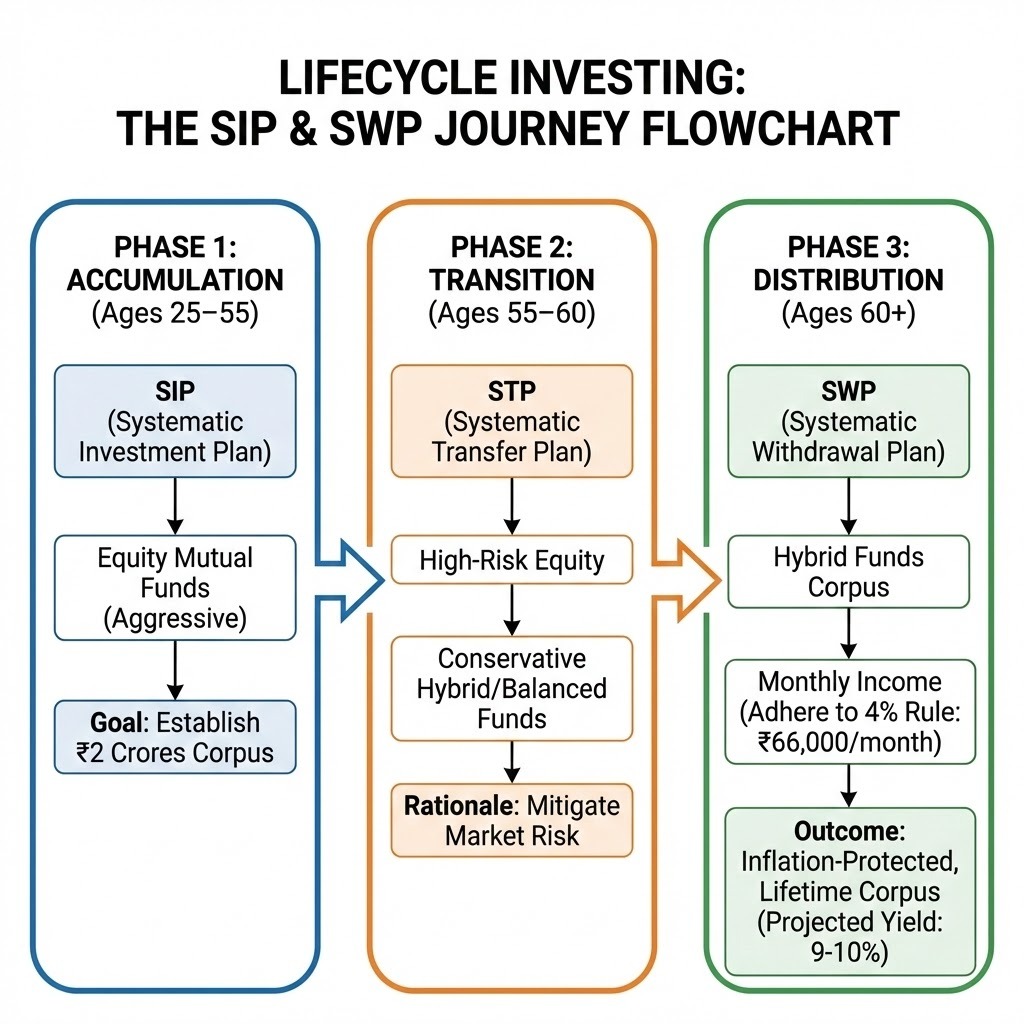

Optimal long-term financial planning, or "Lifecycle Investing," involves three phases:

Accumulation (Ages 25–55):

Aggressively use a Systematic Investment Plan (SIP) in Equity Mutual Funds. Increase the SIP by 10% annually to build a target corpus of ₹2 Crores.

Transition (Ages 55–60):

Use a Systematic Transfer Plan (STP) to move funds from high-risk Equity to conservative Hybrid/Balanced Advantage Funds. This de-risks the portfolio pre-retirement.

Distribution (Ages 60+):

Start a Systematic Withdrawal Plan (SWP) from the Hybrid Funds, adhering to the 4% Rule (₹8 Lakhs/year or ₹66,000/month).

This strategy is projected to sustain the corpus lifelong and protect it against inflation, as the 4% withdrawal rate is significantly lower than the projected 9-10% fund yield.

NOTE: Investors should use a SIP Calculator to make a realistic, achievable projection about their target Corpus.

This is a critical, often-overlooked detail that could lead to significant financial loss.

To put it in perspective, consider an example investment corpus of ₹1 Crore with an annual withdrawal of ₹6 Lakhs (6%).

| Aspect | Regular Plan | Direct Plan | Difference |

| Estimated Annual Return | 8% | 9% | +1% |

| Annual Withdrawal Rate (Example) | 6% | 6% | 0% |

| Net Corpus Growth Annually | 8% - 6% = +2% | 9% - 6% = +3% | +1% |

As illustrated in our comparative analysis of Direct vs Regular Mutual Fund: Which One Should You Choose? This variance can result in a corpus erosion exceeding ₹20 Lakhs over a two-decade horizon.

A Systematic Withdrawal Plan (SWP) is a versatile financial tool for generating structured, regular cash flow from an investment corpus, extending its use beyond just retirement.

Key Applications:

Mistakes are common,even among experienced investors. These points should be kept in mind before making a decision for SIP vs SWP.

* Tip: increasing contributions is the better strategy.

Here's a tip: Wait one year before starting your SWP, that way, you skip the extra fees and pay less tax.

Solution: Withdraw only a fraction of the fund's return (e.g., 4-5% of a 10% return) and reinvest the rest. This grows the corpus, allowing for increased future withdrawals to combat inflation.

Visit our complete guide on mutual funds and tax Tax On Mutual Funds

For 2026, diversify by adding commodities like silver as an inflation hedge. Use a SIP for ETF investments; List of Best Silver ETFs in India 2026 [Updated]

Personal finance consists of two distinct stages: The primary tool for the initial stage (when you earn and invest) should be the Systematic Investment Plan (SIP) because it ensures consistent, automatic savings and compounding. The goal of this phase is achieving Financial Independence which is the point where accumulated assets are sufficient to switch from active saving via the SIP to passive spending. In the spending phase (when you retire from earning and want income to spend), it should be managed through a Systematic Withdrawal Plan (SWP). This dual-phase structure provides a clear financial roadmap, using the SIP as the engine for growth and the SWP as the mechanism for sustainable retirement income.

Yes! You can have a SIP running in an Equity Fund (to build wealth for 10 years later) and simultaneously run an SWP from a Debt Fund. They are independent instructions.

SWP carries Market Risk. If the market crashes 30%, your fund value drops. For absolute safety, Senior Citizens should keep 5 years of expenses in SCSS (Senior Citizen Savings Scheme) or FDs. The rest of the money can go into SWP for higher returns and tax saving. Never put 100% of retirement money into equity SWP.

Yes, at your convenience. You may increase, decrease, pause, or cancel it with a single selection on your application. There are no fees associated with modifying instructions.

A global rule of thumb that says if you withdraw 4% of your retirement savings annually, you will likely never run out of money. In India, due to higher inflation, financial planners suggest a range of 3% to 4% as the "Safe Withdrawal Rate.

A Systematic Withdrawal Plan (SWP) is generally preferable. Dividends are subject to taxation at the individual's income tax bracket (which can be 30% for high-income individuals) and are not assured, as the fund manager determines the distribution. Conversely, an SWP is taxed as capital gains (resulting in a lower tax incidence) and the withdrawal amount is guaranteed, as it is determined by the investor.