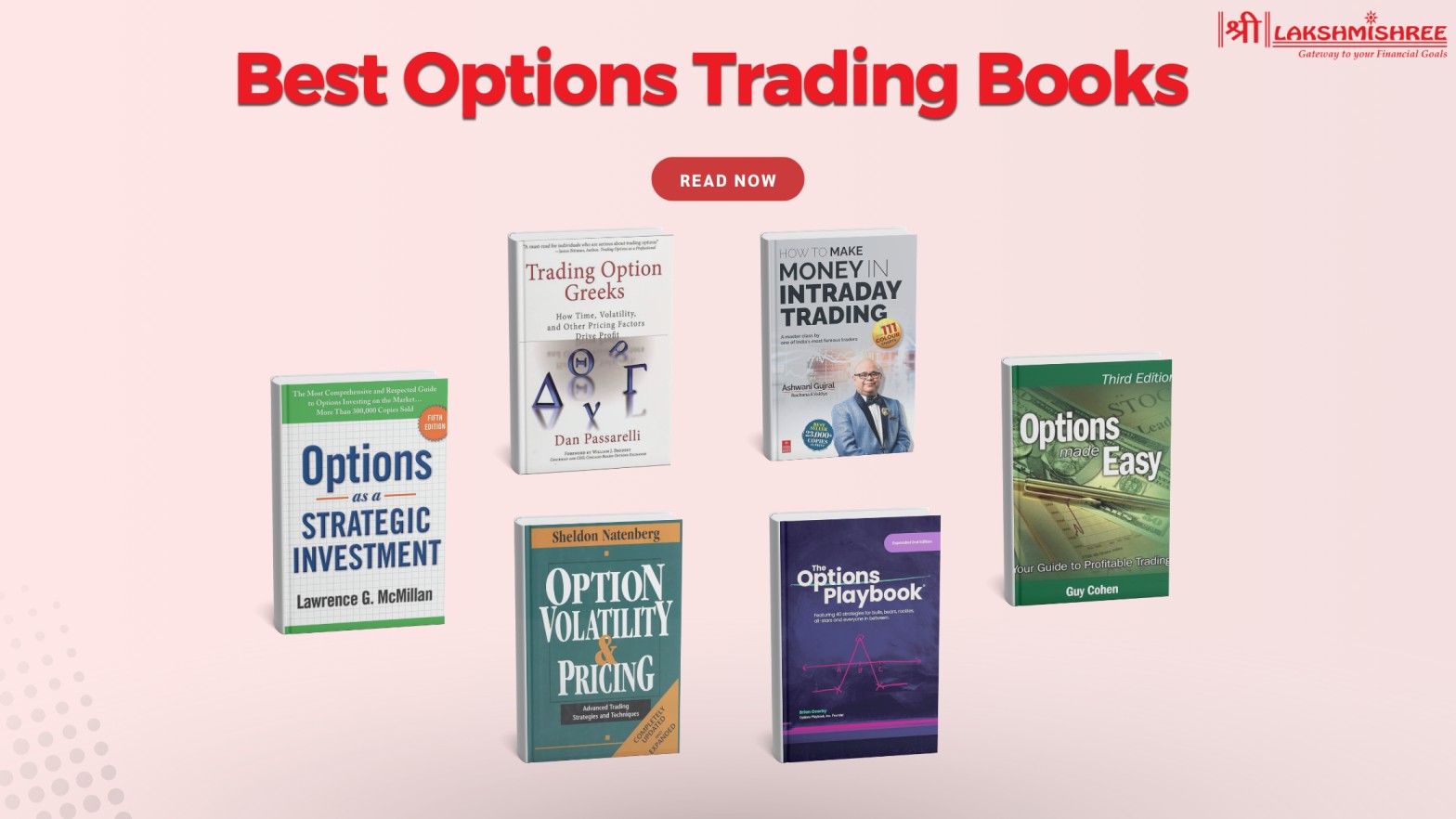

Options trading might sound complex initially, but don’t worry! It’s not as intimidating as it seems when you’ve got the right resources. Whether you're just dipping your toes into the stock market or looking to refine your strategies, reading the right option trading books can be a game-changer. These books simplify the basics and help […]