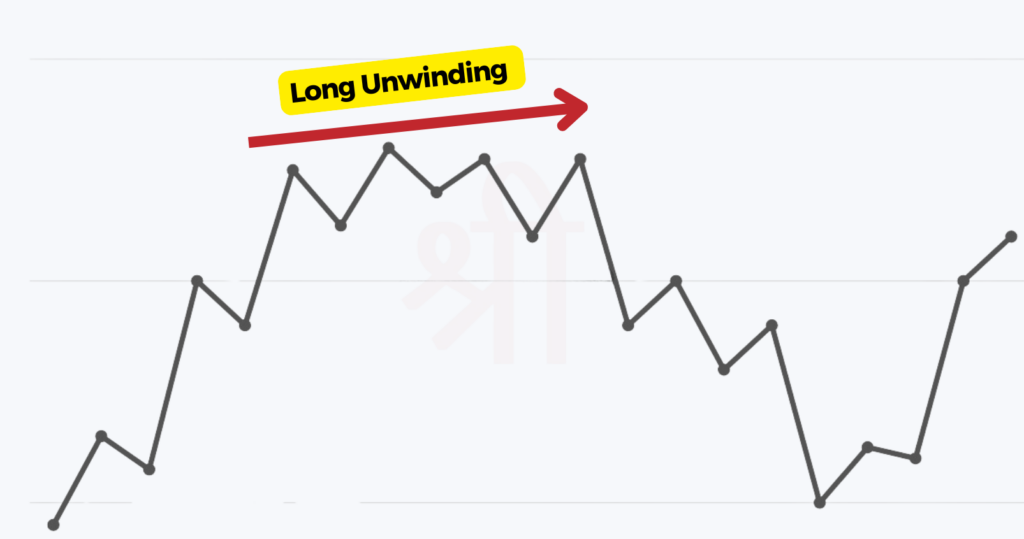

Have you ever heard of an unwinding term in the stock market but felt unsure about what it means? Don’t worry—you’re not alone! Long unwinding happens when traders sell their existing long positions (stocks they’ve already bought) to book profits or cut losses. This usually leads to a drop in stock prices as selling pressure increases.

Understanding the long unwinding meaning is crucial for traders because it helps them predict market trends and make better trading decisions. So, let’s dive deeper and explore why this market phenomenon matters!

In the stock market, It occurs when traders or investors decide to sell their previously purchased stocks or assets. Typically, these stocks were bought with the expectation that their prices would rise, which is known as taking a “long position.” However, if market conditions change or the desired profit is achieved, these traders may sell their stocks, thereby “unwinding” their long positions.

This can happen for various reasons, such as shifts in market sentiment, profit booking, or concerns over potential losses. In simple terms, Long Unwinding is like reversing a bet that the stock price will go up. When many traders start unwinding their long positions, it can create selling pressure, causing stock prices to fall.

Let’s say Ankit buys 200 shares of ABC Ltd. at ₹100, expecting the price to go up to ₹150; This is a “long position”. For a while, everything looks good and the stock goes up to ₹130. But then there’s bad news about the company or the broader market starts to weaken.

Ankit fears a downturn or wants to book his profits, so he sells his 200 shares at ₹130. Selling the stocks he bought earlier is called long unwinding. Ankit avoids losing his earlier profits but his decision also adds to the selling pressure on ABC Ltd. which could push the price lower.

It is common, especially when the market shows uncertainty or investors seek better opportunities elsewhere.

It is seen as a sign that the bullish sentiment in a stock or the overall market is weakening. When traders or investors who were expecting to go up start selling their longs, they are either taking profits or cutting losses. Essentially, they think the stock won’t go up anymore.

This shift in sentiment can mean the stock or market is heading for a consolidation or even a down move. It is a sign of caution or negativity among traders. When big money starts to get out of their positions, it’s often a sign of a broader loss of faith in the market’s ability to hold up.

Here are some key indicators that can help you identify when unwinding is taking place:

In the options market, It happens when traders close their long options positions, which they had bought with the expectation of a price move. This shows up as a decrease in open interest (the total number of contracts) and is a sign of a change in sentiment. As traders exit their positions, demand for those options decreases, and prices decrease.

When it happens in call options, traders who had bought those options ( expecting the stock to go up) are now selling them. This can happen for several reasons: they may have reached their profit target, lost confidence in the stock going up or want to reduce losses before the option expires. It’s a bearish sign of reduced optimism on the stock’s future.

It is crucial in shaping trading strategies, especially during volatile market phases. It serves as a key signal for traders to reassess their positions and adapt their approach based on market sentiment.

Here’s how it fits into different trading strategies:

Long unwinding involves selling off previously bought positions, signalling a shift from bullish to neutral or bearish sentiment. In contrast, short covering occurs when traders buy back stocks they initially sold short, indicating a shift from bearish to neutral or bullish sentiment.

Here’s a quick comparison to help you understand their differences:

| Aspect | Long Unwinding | Short Covering |

|---|---|---|

| Definition | Selling previously held long positions. | Buying back stocks to close previously held short positions. |

| Market Sentiment | Signals weakening bullish sentiment or potential bearish outlook. | Signals weakening bearish sentiment or potential bullish outlook. |

| Action Type | Selling action. | Buying action. |

| Impact on Stock Price | Adds selling pressure, leading to a potential decline in prices. | Reduces selling pressure, causing a potential rise in prices. |

| Trader’s Intent | Exiting positions to lock profits or limit losses. | Closing short positions to avoid further losses. |

By understanding the differences between Long Unwinding and Short Covering, traders can better interpret market trends and adjust their strategies accordingly.

Long unwinding is generally considered a bearish signal. When traders or investors sell off their long positions, it indicates a lack of confidence in the stock’s ability to continue rising. This selling pressure often leads to a decline in stock prices, reflecting a shift from bullish to neutral or bearish sentiment. However, analysing the broader market context is important to confirm whether the unwinding suggests a temporary correction or a more prolonged downtrend.

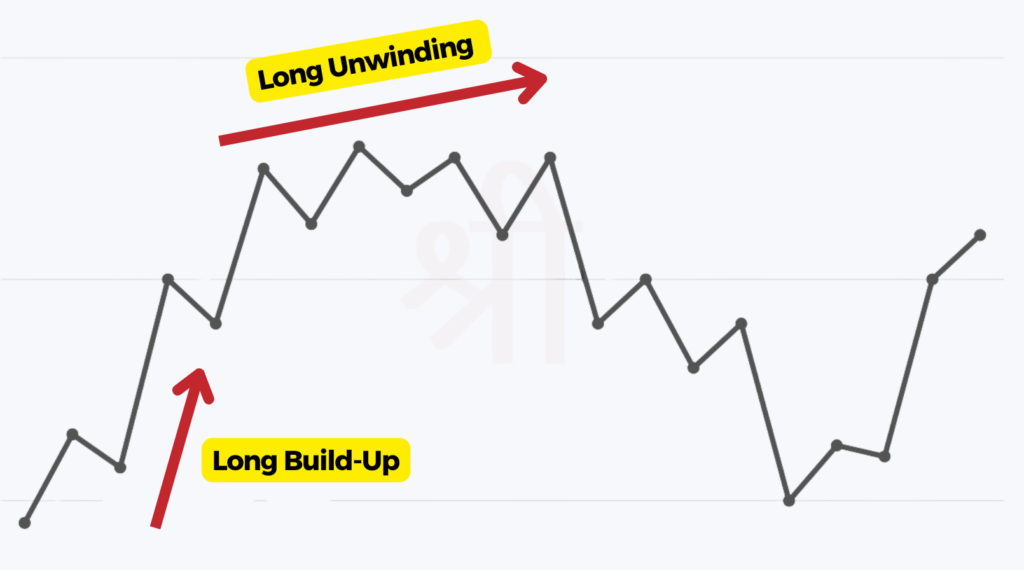

Long build-up occurs when traders buy new positions, signalling optimism and potential bullish momentum. On the other hand, long unwinding happens when traders sell their previously held positions, indicating caution or a shift toward bearish sentiment.

| Aspect | Long Build-Up | Long Unwinding |

|---|---|---|

| Definition | Opening new long positions by buying stocks or contracts. | Closing existing long positions by selling them. |

| Market Sentiment | Indicates bullish sentiment or rising confidence in the stock. | Indicates weakening bullish sentiment or potential bearish outlook. |

| Action Type | Buying action. | Selling action. |

| Impact on Stock Price | Adds buying pressure, leading to potential price increases. | Adds selling pressure, leading to potential price declines. |

| Trader’s Intent | Entering positions to benefit from expected price rises. | Exiting positions to lock profits or limit losses. |

Understanding these two behaviours helps traders interpret market trends and make better-informed decisions based on the prevailing sentiment.

After unwinding, the market typically experiences increased selling pressure, leading to a decline in stock or asset prices. This phase can signal a period of consolidation or a shift toward a bearish trend if selling continues. However, the market might also stabilize if profit booking rather than fundamental weaknesses drove the unwinding.

In some cases, once long unwinding subsides, stocks may regain upward momentum if favourable news or improved market conditions emerge. Traders should closely monitor post-unwinding patterns to determine the next potential trend.

Long unwinding refers to the process in which traders or investors sell off their previously purchased positions, often leading to a decline in stock prices. It typically occurs when market sentiment shifts, signalling traders no longer expect prices to rise further. Understanding this concept is essential for traders, as it helps them recognize market trends and adjust their strategies accordingly.

Long unwinding refers to traders or investors selling off their previously bought stocks or positions. This happens when they believe the upward trend might not continue, and it often leads to a decline in stock prices due to increased selling pressure.

Short covering involves buying back shares to close short positions, which pushes prices up. Long unwinding, on the other hand, is selling long positions, which adds selling pressure and drives prices down.

It can benefit traders who want to secure profits or limit losses. However, it may be seen as bad for the market since it weakens bullish momentum and can trigger price declines.

It can be identified by increased selling volume, consistent price declines, and reduced open interest in derivatives. Negative news or weak market sentiment also points toward unwinding.

It indicate that traders no longer believe the stock will rise. It signals a shift from bullish sentiment to a more cautious or bearish outlook.

Disclaimer: This article is intended for educational purposes only. Please note that the data related to the mentioned companies may change over time. The referenced securities are provided as examples and should not be considered recommendations.