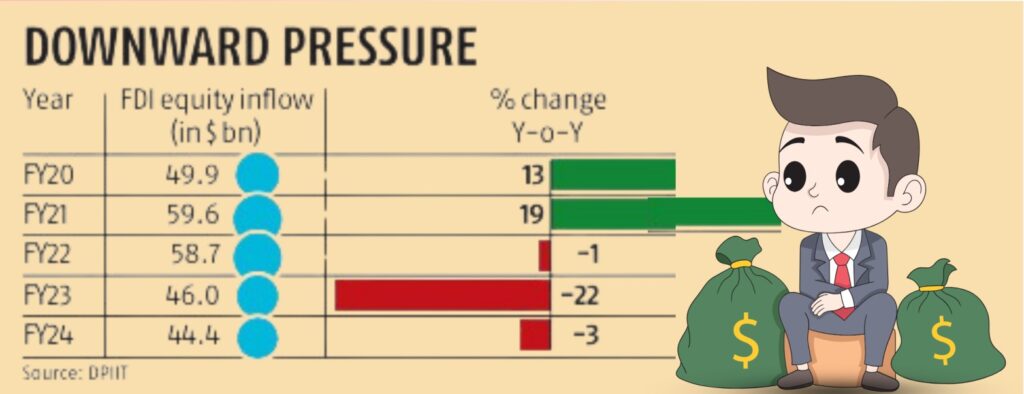

Foreign direct equity investments in India hit a five-year low in the financial year ending March 31, 2024 (FY24), totalling $44.42 billion. This decline is attributed to external factors such as high interest rates in advanced economies and a limited absorptive capacity in various sectors in India.

According to data released by the Department for Promotion of Industry and Internal Trade (DPIIT), FDI inflows contracted by 3.5% year-on-year (YoY) in FY24. Foreign investment, including FDI equity inflows, is crucial for supplementing domestic resources and financing the current account deficit. These inflows are a good indicator of a nation's appeal as a long-term investment destination.

Madan Sabnavis, the chief economist at Bank of Baroda, explained, "The fall in FDI equity inflows can be attributed to two reasons – globally, investible funds have fallen, and interest rates have hardened. Several sectors, including IT and startups, are seeing investment saturation."

Total FDI, which includes equity capital of unincorporated bodies, reinvested earnings, and other capital, contracted by 1% YoY to $70.95 billion during FY24, compared to $71.35 billion in the previous year.

Singapore remained the top investor with $11.77 billion in FDI during FY24. It was followed by Mauritius ($7.97 billion), the United States ($4.99 billion), the Netherlands ($4.92 billion), Japan ($3.18 billion), the United Kingdom ($1.21 billion), the United Arab Emirates ($2.92 billion), Cyprus ($806 million), Germany ($505 million), and the Cayman Islands ($342 million).

The computer software and hardware sector was the highest recipient of FDI at $7.97 billion, down 15.1% YoY. The services sector followed with $6.64 billion, down 24%. This sector includes financials, banking, insurance, research & development, and courier services, among others. Trading garnered $3.86 billion, contracting by almost 20%, while investment inflows in the automobile industry stood at $1.52 billion in FY24 compared to $1.9 billion in FY23.

Maharashtra continued to be the most favoured destination for investors, receiving $15.11 billion worth of investments, although inflows declined by 2%. Karnataka followed with $6.57 billion in FY23, down from $10.42 billion the previous year. In the case of Delhi, FDI inflows decreased to $6.52 billion from $7.53 billion a year ago.

The drop in FDI equity inflows to a five-year low underscores India's broader economic challenges amid a global environment marked by high interest rates and reduced liquidity. While the government continues to position India as an attractive destination for foreign investment, it is crucial to address sector-specific constraints and enhance the economy's absorptive capacity. Strategic policy interventions aimed at fostering a more conducive investment climate could help reverse this downward trend and sustain long-term economic growth.