Fundamental analysis of stock is the most important method for investors looking to understand the true value of a stock. Investors can make informed decisions about buying or selling stocks by examining the financial health, management quality, and broader economic factors affecting a company. This analysis is particularly relevant for Indian investors, given the dynamic nature of the Indian stock market. Understanding fundamental stock analysis can help navigate the complexities and invest wisely for the long term.

1. Fundamental analysis evaluates a company's intrinsic value.

2. It involves analyzing financial statements, market conditions, and management quality.

3. Key metrics include P/E ratio, ROE, and debt-to-equity ratio.

4. Essential for long-term investment decisions.

5. Important for making informed investment choices in the Indian market.

Fundamental analysis is a method used by investors to determine the intrinsic value of a stock. It involves analyzing various aspects of a company, including its financial statements, management, industry conditions, and overall economy. Unlike technical analysis, which focuses on price patterns and trends, fundamental analysis looks at the underlying factors that affect a company's performance. This approach is crucial for long-term investors who aim to make informed decisions based on a company's actual worth.

It can be compared to looking under the hood of a car to see what’s really going on. Instead of just looking at the car’s exterior (the stock price), you check the engine, the oil levels, and other internal components to ensure everything is running smoothly. This helps investors understand whether a stock is overvalued or undervalued by the market.

The primary goal of fundamental analysis is to identify stocks trading for less than their intrinsic value. By purchasing these undervalued stocks, investors can potentially reap significant returns when the market eventually recognizes the stock's true value.

Conversely, fundamental analysis can also help investors avoid overvalued stocks that may decline in price.

Quantitative analysis involves examining a company’s financial data. This includes analyzing financial statements like the balance sheet, income statement, and cash flow statement. Key metrics in quantitative analysis include:

Quantitative analysis also involves comparing these metrics to industry averages and historical performance to determine if a company is performing well. For example, if TCS has a P/E ratio of 20 while the industry average is 25, it might be considered undervalued.

Qualitative analysis looks at non-numerical aspects such as a company's management quality, brand value, competitive advantage, and industry position. It also considers factors like company reputation, customer satisfaction, and employee relations. This type of analysis provides insights that quantitative data might not reveal.

For example, the reputation of a company like Tata Motors and its management team plays a crucial role in its long-term success. Similarly, a company’s competitive advantage, such as Reliance Industries' diversified business model, can be a significant qualitative factor in its favour.

Let's explore a real-life example of fundamental analysis by examining Reliance Industries Limited (RELIANCE), one of India's largest conglomerates.

Begin by understanding RELIANCE's business model, which spans various sectors, including petrochemicals, refining, retail, and telecommunications. Recognize its market dominance and diversified revenue streams.

Gather RELIANCE's financial statements from reliable sources like its official website or financial databases. Evaluate key metrics such as revenue growth, profit margins, and cash flow to assess its financial health.

Examine the RELIANCE management team led by Chairman Mukesh Ambani. Evaluate their track record of strategic decision-making, capital allocation, and corporate governance practices.

Analyze macroeconomic factors impacting RELIANCE's performance, such as fluctuations in oil prices, government policies affecting the telecom sector, and consumer spending trends influencing its retail business.

Utilize valuation ratios like the P/E ratio, P/B ratio, and dividend yield to determine if RIL's stock is undervalued, fairly priced, or overvalued compared to industry peers and the broader market.

Stay updated on significant developments such as RELIANCE's expansion plans, new product launches, regulatory changes, and competitive threats in its operating sectors.

To illustrate how to conduct a fundamental company analysis, let’s examine Infosys Limited, one of India’s leading IT services companies. Let's analyse their financial statements and key financial ratios to evaluate their performance and intrinsic value.

The simplified versions of Infosys's financial statements for the fiscal year 2023 are:

| Income Statement (in Rs Cr) | Balance Sheet (in Rs Cr) | Cash Flow Statement (in Rs Cr) |

|---|---|---|

| Revenue: 146,767 | Assets: 121,200 | Operating Cash Flow: 25,700 |

| Expenses: 110,972 | Liabilities: 39,500 | Investing Cash Flow: -10,000 |

| Net Income: 25,110 | Equity: 81,700 | Financing Cash Flow: -6,000 |

Let's calculate and interpret some key financial ratios for Infosys:

1. P/E Ratio (Price-to-Earnings): To calculate the P/E ratio, we need the stock price and earnings per share (EPS). Let's assume Infosys’s stock price is ₹1,400, and the EPS is ₹59.52.

P/E Ratio= Stock Price / Earnings per Share

P/E Ratio= 1400 / 59.52

P/E Ratio= 23.52

A P/E ratio of 23.52 suggests that investors are willing to pay ₹23.52 for every rupee of earnings, indicating growth expectations.

2. P/B Ratio (Price-to-Book): Assuming the book value per share is ₹174.58:

P/B Ratio= Stock Price / Book Value per Share

P/B Ratio= 1400 / 174.58

P/B Ratio= 8.02

This ratio indicates that Infosys is trading at 8.02 times its book value, which could imply that the market expects high growth from the company.

3. Debt-to-Equity Ratio:

D/E Ratio= Total Debt / Total Equity

D/E Ratio= 39500 / 81700

D/E Ratio= 0.48

A debt-to-equity ratio of 0.48 shows that Infosys has a relatively low level of debt compared to its equity, indicating a strong balance sheet.

4. Return on Equity (ROE):

ROE= Net Income / Total Equity

ROE= 25110 / 58700

ROE= 0.31 OR 31%

An ROE of 31% signifies that Infosys is generating a return of 31% on the shareholders' equity, reflecting efficient management and profitability.

By analyzing Infosys’s financial statements and key ratios, we assess its financial health and intrinsic value. In the assumed data, Infosys shows strong profitability, prudent financial management, and high growth expectations, making it an attractive investment candidate in the Indian IT sector. Fundamental analysis helps investors make informed decisions by evaluating a company's true worth based on its financial performance and market potential.

Note: This example focuses on quantitative data. However, a comprehensive fundamental analysis involves evaluating other crucial factors like management quality, economic indicators, and industry conditions, which are discussed in the subsequent sections.

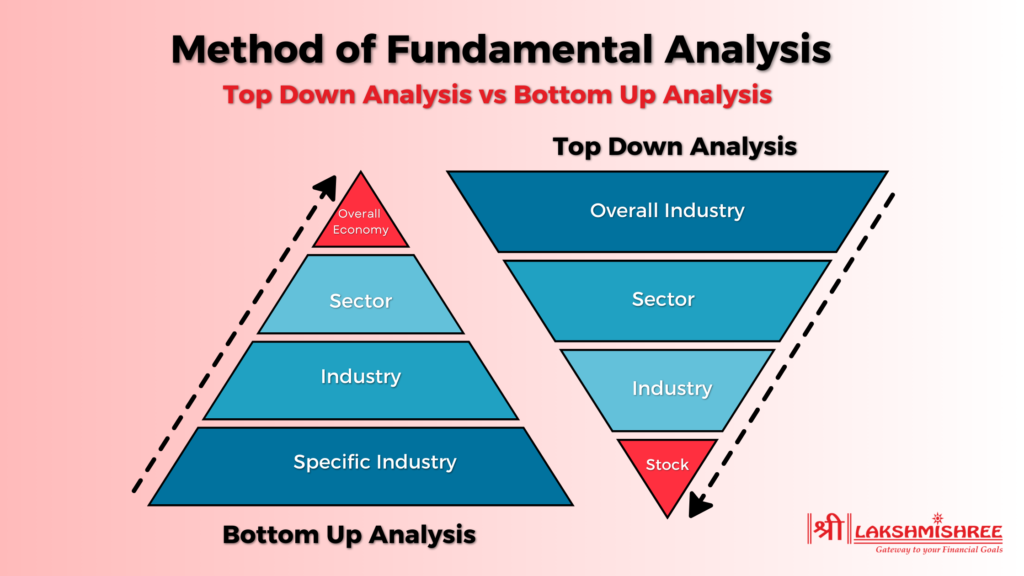

Fundamental analysis, the cornerstone of stock market investing, offers two distinct approaches: top-down and bottom-up analysis. Each method follows a unique path to uncovering investment opportunities, catering to different investor preferences and market conditions.

Top-down analysis takes a macroeconomic view, starting from the broader economic landscape and gradually narrowing down to individual companies. Here's how it works:

In the top-down approach, investors assess macroeconomic trends to identify promising sectors before selecting specific companies. For instance, with declining interest rates in India, an investor might recognize the potential for growth in the consumer goods and housing sectors. They then pinpoint companies within these sectors, like Hindustan Unilever and HDFC Ltd, which are likely to benefit from increased consumer spending and demand for housing.

Contrary to top-down analysis, bottom-up analysis starts at the micro level, focusing on individual companies before considering broader market trends. Let's see the breakdown of the bottom-up analysis:

Bottom-up analysis focuses on individual company fundamentals rather than broader economic trends. For example, despite regulatory challenges in the pharmaceutical sector, an investor might identify a specific company with a strong product pipeline and efficient management. This company's growth potential and competitive advantage outweigh sector-wide concerns, making it an attractive investment opportunity.

There are three major components that help the investors effectively assess the financials of the company. These are:

Just as weather affects business plans, the economy profoundly impacts a company's performance. Investors study key elements such as GDP growth, inflation, and interest rates to understand the broader economic landscape comprehensively. By analyzing these factors, investors can better anticipate how macroeconomic trends may influence a company's operations and profitability.

Industry analysis plays a pivotal role in the fundamental analysis process, akin to a major player in a larger picture. By studying the overall industry dynamics, analysts examine market trends, competitive landscapes, and the performance of specific sectors. Understanding industry-specific factors enables investors to identify growth opportunities, assess competitive threats, and anticipate changes in market conditions that may impact individual companies within the sector.

Zooming in on the company itself, investors conduct a detailed evaluation of its economic, financial, and market performance. This involves thoroughly examining financial statements, management quality, competitive positioning, and growth prospects. By analyzing a company's historical performance and future potential, investors gain insights into its intrinsic value and long-term viability.

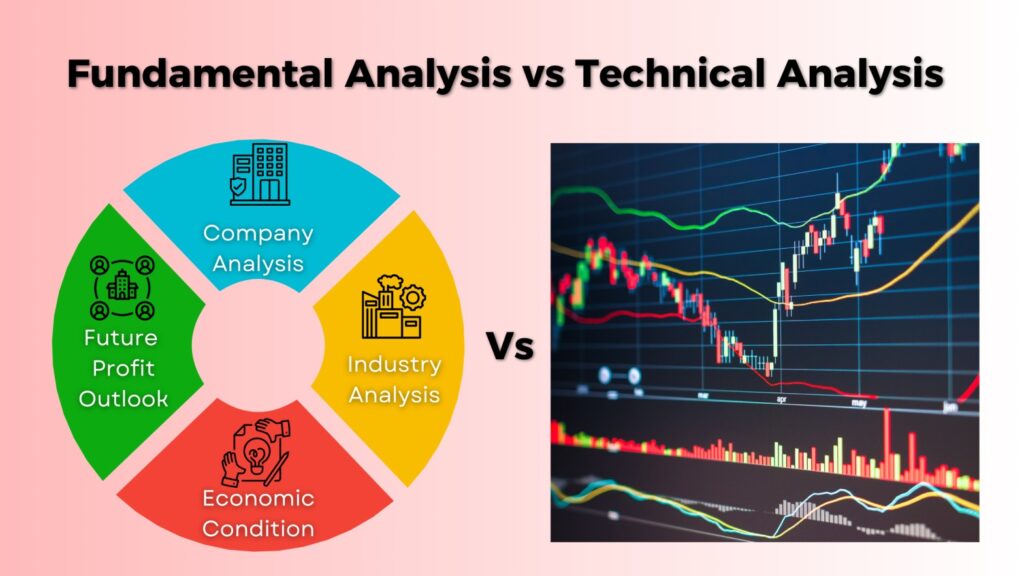

Understanding the difference between fundamental and technical analysis is crucial for making informed investment decisions in the stock market. These two approaches offer distinct methods and insights for evaluating stocks.

Fundamental analysis focuses on assessing a company's intrinsic value by analyzing its financial health, management quality, industry conditions, and economic factors. This approach involves studying financial statements, evaluating key metrics like the P/E ratio and ROE, and considering qualitative factors such as competitive advantage and industry trends.

For example, an investor using fundamental analysis might analyze Tata Consultancy Services (TCS) by examining its revenue growth, profit margins, and market positioning to determine its long-term investment potential.

In contrast, technical analysis relies on historical price and volume data to predict future price movements. Technical analysts study charts and patterns to identify trends and patterns in stock prices using tools like moving averages, MACD, and RSI indicators.

For instance, a technical analyst might use Infosys' historical price charts to identify support and resistance levels, trend reversals, and momentum indicators to make short-term trading decisions.

Several books offer invaluable insights and guidance for investors seeking to deepen their understanding of fundamental analysis and hone their investment skills. Check out our dedicated blog post on fundamental analysis books for a detailed overview of these essential reads. This comprehensive list includes classics like "The Intelligent Investor" by Benjamin Graham and "One Up On Wall Street" by Peter Lynch. These books provide a wealth of knowledge from some of the most successful investors in history, perfect for both novice and seasoned professionals looking to enhance their investment acumen.

Feel free to check the blog to dive deeper into each book's insights and learn how they can help you become a more informed investor.

Fundamental analysis of stock is crucial for making smart investment decisions. It involves looking at a company's financial health, management, industry, and economic factors to find its true value. For Indian investors, this method helps identify good investment opportunities and avoid overpriced stocks. By using fundamental analysis, you can build a strong portfolio and make informed decisions for long-term financial growth.

Fundamental analysis evaluates a company's intrinsic value by examining related economic, financial, and other qualitative and quantitative factors. This involves analyzing a company’s financial statements, its management, competitive advantages, competitors, and markets.

Fundamental analysis of stock helps investors determine if a stock is undervalued or overvalued by the market, guiding long-term investment decisions. It focuses on identifying the fair value of a stock based on its earnings, revenue, future growth potential, and risk.

The main components include:

1. Economic Analysis: Assessing macroeconomic indicators like GDP, interest rates, and inflation.

2. Industry Analysis: Examining industry trends and sector performance.

3. Company Analysis: Analyzing financial statements, management efficiency, and competitive positioning.

1. Quantitative Analysis: Focuses on numerical data from financial statements like earnings, revenue, and key ratios (e.g., P/E ratio).

2. Qualitative Analysis: Evaluates non-numerical factors such as management quality, brand value, and competitive positioning.

1. Income Statement: Shows the company’s revenue, expenses, and profits over a specific period.

2. Balance Sheet: Provides a snapshot of the company’s assets, liabilities, and shareholders' equity.

3. Cash Flow Statement: Details cash inflows and outflows from operating, investing, and financing activities.

Key ratios include:

1. Price-to-Earnings (P/E) Ratio: Measures a company's current share price relative to its per-share earnings.

2. Return on Equity (ROE): Indicates how efficiently a company is using shareholders' equity to generate profits.

3. Debt-to-Equity Ratio: Compares a company’s total debt to its shareholder equity, indicating financial leverage.

1. Top-Down Approach: Starts with the macroeconomic environment, then narrows down to sectors and finally to individual companies.

2. Bottom-Up Approach: Begins with individual companies and then moves to the industry and the broader economic environment.