Ever seen the term “DRHP” in news articles about upcoming IPOs and thought, “What even is that?” You’re not alone. A lot of us hear about companies going public, but when we come across documents like the DRHP, it feels like we’ve entered a world of complex finance jargon. Well, not anymore.

In this blog, we’re going to break down the DRHP full form, what it actually means in the IPO process, and why it’s such a big deal — all in super simple language. Whether you’re a first-time investor or just curious about how companies go public, this guide will help you understand everything about Draft Prospectus in a way that just makes sense.

The full form of DRHP in IPO is Draft Red Herring Prospectus. It’s a detailed preliminary document submitted by a company to SEBI before launching an IPO. This draft version offers investors an initial look at the company’s financials, operations, and purpose of raising funds, but doesn’t include final share price or issue size.

The DRHP meaning in IPO is quite straightforward once you cut through the finance jargon. A Draft Red Herring Prospectus is like a company’s pitch to the public and to regulators. It tells the story of who they are, what they do, why they want to raise money through an IPO, and how they plan to use that money — all before the IPO actually happens.

This document is prepared by the company along with its merchant bankers and is filed with SEBI for review. Think of it as a pre-approval checklist — it includes everything from the company’s business model, financial history, management bios, industry outlook, and the risks involved in investing. While it doesn’t mention the final IPO price or number of shares, it’s packed with everything else an investor needs to start evaluating the offer.

The purpose? Two-fold:

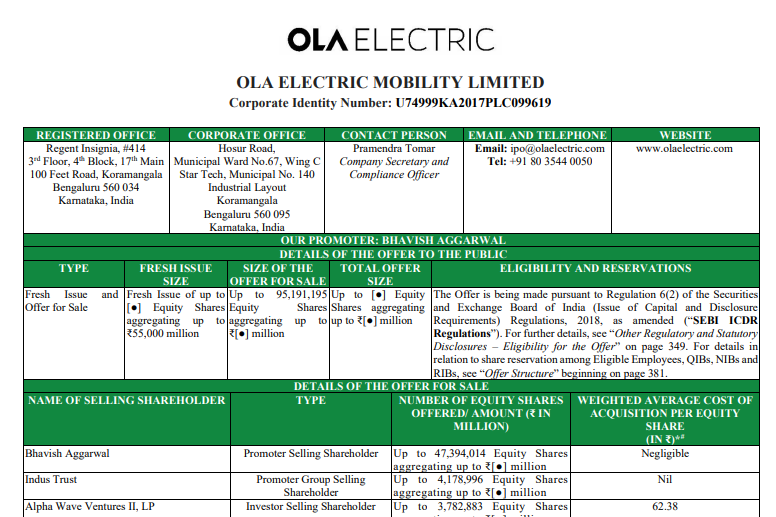

Let’s take a real-world example — Ola Electric.

In December 2023, Ola Electric filed its Draft Red Herring Prospectus (DRHP) with SEBI to raise around ₹7,250 crore through an IPO. The Draft Prospectus had everything from their financials to their plans for the electric vehicle space. It had details on their R&D spends, manufacturing plans, battery innovations, risk factors and how the IPO proceeds would be used — to expand their production facilities and build EV infrastructure.

Also Read: What is IPO in Share Market; How to invest in IPO

The Draft Red Herring Prospectus isn’t just another boring company brochure — it’s a detailed document packed with crucial information that gives investors a complete snapshot of the business before it goes public.

A prospectus is a formal legal document that a company issues when it plans to go public. It has all the information an investor needs to decide whether to invest in the IPO.

The prospectus is filed with SEBI and has verified details like the company’s business model, objects of the offer, financials, risk factors and most importantly the final issue price and number of shares. Think of it as the final version of the DRHP — reviewed, approved and locked in.

While the Draft Red Herring Prospectus is filed earlier for review and public feedback, the prospectus is filed later, just before the IPO opens.

The Red Herring Prospectus (RHP) is the final version of that offer document a company files just before its IPO launch. That's where the real details are finalised—number of shares, price band and those all-important IPO dates.

After SEBI's reviewed the Draft Red Herring Prospectus and the public has had its say, the RHP is filed. It's the document that investors use when applying for shares—and it's the one that really matters. You can find the RHP on SEBI's website, the company's site and stock exchanges like BSE and NSE. Once it's out, the IPO is usually just days away from going live.

The key difference between DRHP and RHP is that the DRHP is a draft document for regulatory review, while the RHP is the final version with complete IPO details. The Draft Prospectus doesn’t include the final share price or offer dates, whereas the RHP does.

Here’s a quick comparison to make it clearer:

| Feature | DRHP (Draft Red Herring Prospectus) | RHP (Red Herring Prospectus) |

|---|---|---|

| Purpose | Initial draft for SEBI and public feedback | Final version before IPO launch |

| Approval Status | Yet to be approved by SEBI | Approved and filed with SEBI |

| Includes Share Price? | No — price band usually not included | Yes — includes final price band or fixed price |

| Includes Number of Shares? | Not always specified | Fully disclosed |

| Publicly Available? | Yes, on SEBI and the company website | Yes, on SEBI, exchanges, and registrar websites |

| Contains SEBI Observations? | Not yet incorporated | Incorporated and finalised |

| Timing in IPO Process | Filed early in the IPO preparation stage | Filed just before IPO opens |

| Legal Filing Name | Draft offer document | Final offer document |

Filing a Draft Red Herring Prospectus is a carefully regulated process and a crucial milestone for any company planning to launch an IPO in India. It’s not just about writing a document — it’s about meeting strict SEBI norms, ensuring transparency, and building investor trust. Here's how the DRHP filing process works step-by-step:

Step-by-Step Draft Prospectus Filing Process

Also Read: What is IPO in Share Market; How to invest in IPO

SEBI really sets the bar high when it comes to reviewing Draft Red Herring Prospectuses. Once a company files its DRHP, SEBI puts that document under the microscope to make sure there are no gaps in disclosures, regulatory compliance or investor protection.

SEBI checks for completeness, transparency and clarity on all the material risks and financial details. If anything is missing or unclear, SEBI sends its observations back to the company-and its merchant bankers-for revision. That's when the real work begins. Only after those changes are made and approved can the company actually move forward with its IPO by filing the final Red Herring Prospectus.

Preparing a Draft Red Herring Prospectus is a strategic and detail-heavy task, and companies don’t do it alone. Here's how the process unfolds:

This step is essential not just for transparency but also for building investor confidence and regulatory trust.

Retail investors often dive into IPOs based on market hype — but a smarter move? Actually reading the Draft Red Herring Prospectus. This document isn't just for financial analysts; it's your first look into the true picture of the company you're about to invest in.

This gives investors:

The Draft Red Herring Prospectus isn’t just a regulatory formality — it brings a host of advantages for both companies and investors. Here's why it matters:

While the DRHP filed with SEBI is packed with valuable data, it’s not perfect. Here's where it falls short:

So yes, the DRHP is helpful, but it's not the full story — which is why waiting for the RHP (Red Herring Prospectus) or consulting financial experts is also a good idea before investing.

Here are the most reliable sources to access a company’s Draft Red Herring Prospectus:

DRHP stands for Draft Red Herring Prospectus, and it's one of the most crucial documents filed by companies before going public through an IPO. Filed with SEBI, this document gives a detailed view of the company's business, financial health, risk factors, and fund usage plans. While it may not include final IPO pricing or dates, the DRHP helps investors evaluate whether the IPO is worth investing in.

The full form of DRHP in IPO is Draft Red Herring Prospectus. It’s a preliminary document that a company files with SEBI before launching its IPO. It contains detailed information about the company’s operations, financials, risks, and how the IPO funds will be used, helping investors make informed decisions.

The DRHP in IPO is essentially the first official document that reveals everything about the company planning to go public. From business plans to financial health and risk factors, the DRHP gives potential investors a comprehensive picture before the actual IPO hits the market.

Yes, absolutely. Filing a DRHP is a mandatory step for any company in India planning to raise funds through an IPO. Without it, SEBI won’t allow the company to move ahead with the public issue. It’s the first stage in the IPO approval process.

You can find a company’s DRHP on SEBI’s official website under the "Public Issues" section. It’s also available on the websites of stock exchanges like NSE and BSE. Many merchant bankers and financial news portals like Lakshmishree News – IPO Section also exist.

The Red Herring Prospectus (RHP) is the final version of the DRHP, submitted after SEBI gives its observations and the company makes required updates. It includes final IPO details like pricing, issue dates, and number of shares, which are often missing in the draft version. This document is shared with the public before the IPO opens for bidding.

The DRHP is submitted to the Securities and Exchange Board of India (SEBI). While SEBI does not "approve" an IPO in terms of endorsing the company, it does review and comment on the DRHP to ensure all mandatory disclosures and compliance norms are met.

No, SEBI does not guarantee the success or quality of any IPO after the DRHP filing. SEBI’s role is regulatory — it ensures that the company has made fair and adequate disclosures. The investment decision still lies with the investor, and SEBI clearly mentions that its review doesn’t serve as a recommendation or assurance regarding the company’s performance.

Disclaimer: This article is for educational purposes only and should not be considered financial advice. Always conduct your research and consider consulting with a financial advisor before making any investment decisions.