If you've ever wondered what CE and PE in the stock market mean, you're not alone! These terms are commonly used in options trading, and understanding them can help you make smarter investment decisions. Knowing how CE (Call Option) and PE (Put Option) work is essential for profiting in the stock market, whether you're a beginner or someone looking to sharpen your trading skills.

In this blog, we'll break down CE and PE in simple words, explain their differences, discuss key trading strategies, and even show you how to calculate important ratios. By the end, you'll be ready to use these options to your advantage! So, let's dive in and decode the world of CE and PE trading.

These are the two main types of options contracts used by traders to speculate on stock price movements. CE and PE are contracts that allow traders to buy or sell stocks at a fixed price before a set date without being forced to go through with the deal. Let’s understand them one by one.

CE stands for Call European Option, commonly known as Call Option (CE) in options trading. It is a type of options contract that gives the buyer the right but not the obligation to buy a stock at a fixed price (strike price) before the expiration date. Traders use CE when they expect the stock price to go up in future.

Think of it like this: Suppose you see a piece of designer jewellery priced at ₹80,000 today but you expect the price to go up to ₹90,000 in next month due to high demand. You go to the store and make a deal with the shopkeeper—you pay ₹2,000 as booking amount to lock in the price of ₹80,000 for next month. If the price indeed goes up to ₹90,000 you can still buy it at ₹80,000 and make a profit of ₹10,000. But if the price doesn’t go up or even drops you can simply walk away losing only ₹2,000 booking amount.

Example of CE in Options Trading

Let’s say Reliance Industries is currently trading at ₹2,500 per share, and you believe its price will rise in the next few weeks. So, you buy a CE with a strike price of ₹2,600, expiring in a month.

Now, two things can happen:

PE stands for Put European Option, commonly known as a Put Option (PE) in options trading. It is an options contract that gives the buyer the right but not the obligation to sell a stock at a fixed price (strike price) before the expiration date. Traders use PE when they expect the stock price to fall in the near future.

Imagine this: You have a bike worth ₹1,00,000 but you are worried that in the next month new models will launch and its resale value may drop to ₹80,000. So you make an agreement with a dealer—you pay a small premium (say ₹2,000) to lock in the right to sell your bike at ₹1,00,000 anytime within a month, no matter how much its price drops.

Now if the resale price really drops to ₹80,000 you can exercise your right to sell it for ₹1,00,000 and protect yourself from the loss. But if the price stays the same or increases you can ignore the deal and lose only the ₹2,000 premium.

Example of PE in Options Trading

Suppose Infosys is currently trading at ₹1,400 per share, and you believe its price will fall. So, you buy a PE with a strike price of ₹1,350, expiring in a month.

Now, two things can happen:

Also read: What is BO ID in CDSL & How to Find it?

Both CE (Call Option) and PE (Put Option) are crucial components of options trading, but they serve opposite purposes. While CE is used when traders expect the stock price to rise, PE is used when they expect the price to fall.

CE vs PE: Key Differences

| Feature | Call Option (CE) | Put Option (PE) |

|---|---|---|

| Full Form | Call European Option | Put European Option |

| Purpose | Used when expecting the stock price to rise | Used when expecting the stock price to fall |

| Right of the Buyer | Right to buy the stock at a fixed price before expiry | Right to sell the stock at a fixed price before expiry |

| Expectation of Profit | Stock price goes above the strike price | Stock price falls below the strike price |

| Loss Scenario | If the stock price does not rise above the strike price, the buyer loses only the premium paid | If the stock price does not fall below the strike price, the buyer loses only the premium paid |

| Who Benefits? | Buyers benefit in a bullish market | Buyers benefit in a bearish market |

| Maximum Loss | Limited to the premium paid | Limited to the premium paid |

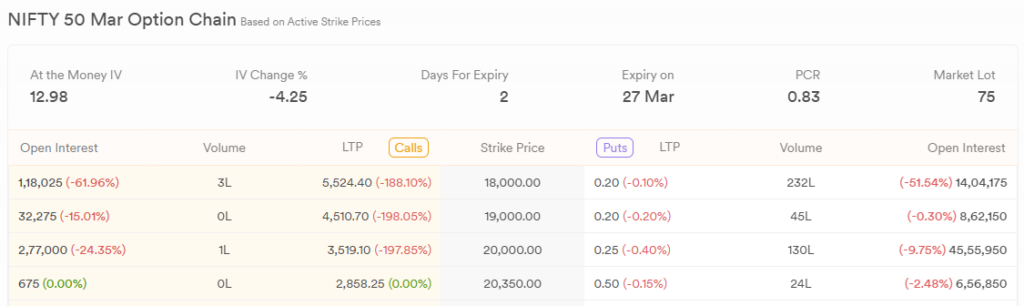

The Put Call Ratio (PCR) is a great tool for traders to gauge market sentiment in the options market. It helps you figure out if investors are bullish or bearish by comparing the number of Put options (PE) to Call options (CE) traded. A high PCR means more people are buying PEs, bearish, and a low PCR means more people are buying CEs, bullish.

Traders and investors use PCR as a contrarian indicator, so if too many people are bearish, it could mean a reversal in the opposite direction.

This ratio helps determine whether traders are more inclined toward buying Call Options (CE) or Put Options (PE), which can indicate the market's potential direction.

CE and PE Ratio Formula

The formula to calculate the CE and PE ratio is:

Here’s what it indicates:

Suppose in a particular trading session:

Then, the CE/PE Ratio would be:

Since the ratio is greater than 1, it suggests a bullish market sentiment, meaning that traders are expecting stock prices to rise.

Trading CE (Call Options) and PE (Put Options) offers a great opportunity to profit from market movements without needing to buy the actual stock. However, options trading comes with both advantages and risks, which every trader should understand before entering the market.

Also Read: Best Intraday Trading Tips & Strategies | Expert Advice 2025

To succeed in CE and PE options trading, traders must use strategies that balance risk and reward. Here are some popular trading strategies used by experienced traders:

🔹 Example: If you own 100 shares of Reliance at ₹2,500 and sell a CE with a strike price of ₹2,600, you collect a premium. If Reliance stays below ₹2,600, you keep the premium as profit.

🔹 Example: If you own Infosys shares at ₹1,400 but fear a market fall, buying a PE with a strike price of ₹1,350 ensures you can sell at ₹1,350 even if the price crashes.

🔹 Example: If HDFC Bank is trading at ₹1,500, a trader can buy:

If the stock moves sharply above ₹1,550 or below ₹1,450, one of the options will gain big.

🔹 Example: If NIFTY is at 17,500, a trader might:

As long as NIFTY stays between 17,400 and 17,600, the trader profits from the premium collected.

To succeed in CE and PE trading, follow these essential tips:

CE and PE in the stock market are a must for options traders. CE (Call Options) works in a bullish market, and PE (Put Options) works in a bearish market. Traders can make informed decisions using the Put Call Ratio (PCR), CE/PE ratio and technical indicators. But options trading comes with risk, so proper risk management, strategy selection and market analysis is key to long-term success. Whether you are a beginner or an experienced trader, mastering these concepts can help you make more money and less loss.

The full form of CE in the share market is Call European Option, but it is commonly known as a Call Option. It is used in options trading when a trader expects a stock’s price to increase. By purchasing CE, traders can lock in a price and potentially profit if the stock rises above the strike price before expiry.

CE, or Call Option, in the share market is a contract that gives the buyer the right, but not the obligation, to buy a stock at a fixed price before expiry. Traders buy CE when they expect the stock price to rise, as it allows them to secure a lower price before an upward move. If the stock price increases beyond the strike price, the CE holder can sell it for a profit.

CE and PE are opposite option contracts used in trading. CE, or Call Option, is bought when traders expect the stock price to rise, while PE, or Put Option, is purchased when they anticipate a decline. CE gives the right to buy a stock at a fixed price before expiry, whereas PE gives the right to sell at a fixed price.

When buying CE or PE, the maximum loss is limited to the premium paid for the option. However, selling CE or PE can lead to unlimited losses if the market moves in the wrong direction. This is why traders should always use stop-loss orders and risk management strategies when trading options.

PE, or Put Option, in the share market is a contract that allows the buyer to sell a stock at a predetermined price before expiry. Traders buy PE when they expect a stock’s price to fall. If the price drops below the strike price, the PE option gains value and can be sold for a profit.

Disclaimer: This article is for educational purposes only and should not be considered financial advice. Always conduct your research and consider consulting with a financial advisor before making any investment decisions.