Did you know that nearly 90% of new traders lose money in their first year? The reason? Most jump into trading without learning the basics, leading to an average loss of ₹50,000–₹1,00,000 for beginners. Trading isn’t a gamble—it’s a skill, and mastering it starts with understanding price action trading.

This blog will guide you to the best price action trading books to help you avoid costly mistakes and build a solid foundation. Whether you’re a beginner or looking to refine your strategies, these books are your key to trading success. Let’s turn those losses into wins!

Price action trading is a strategy that only looks at the price of an asset to make trading decisions. Unlike methods that rely heavily on indicators like moving averages or oscillators, price action trading looks at raw price data through patterns, trends and key levels. This gives traders a better understanding of market sentiment and supply and demand. Price action trading is about how prices react at certain levels, like support & resistance or previous highs and lows.

For More details check the article: Mastering Price Action Trading: Tools and Patterns.

Books on price action trading give you structured and in-depth knowledge that’s missing from short videos or articles. Unlike scattered content, books give you a framework for understanding trend analysis, candlestick patterns and breakout strategies.

Reading books from other traders helps you avoid mistakes and gives you actionable insights that have been tested in live markets. To make better trading decisions, you’ll get clarity on market patterns and volume behaviour and combine price action with support/resistance.

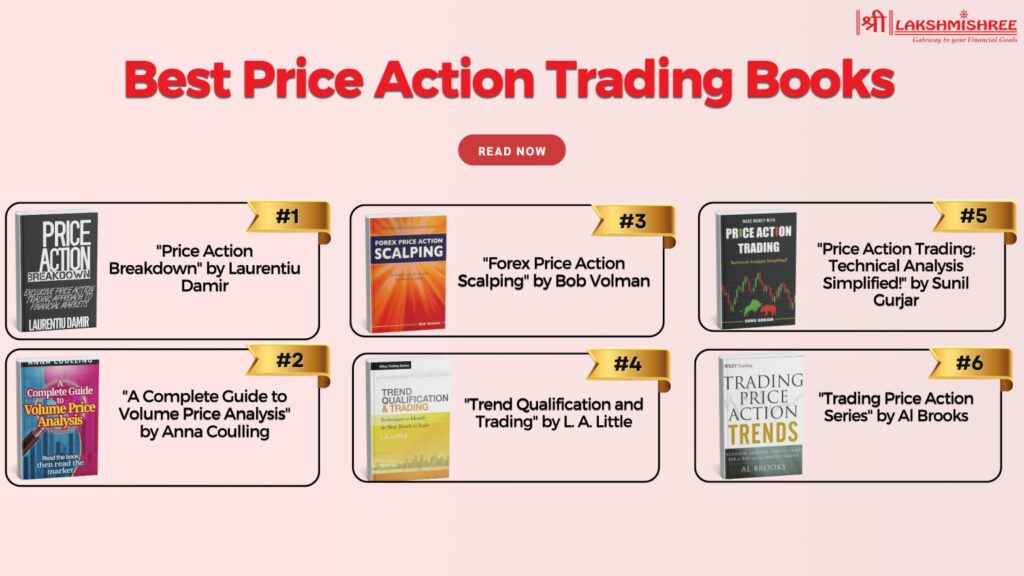

Understanding market behaviour without relying on indicators is what makes price action trading so powerful. The right books can help you decode price patterns, spot key levels, and make smarter trading decisions. Below are the top picks for mastering this trading strategy:

Below is an in-depth look at some of the top price action trading books, carefully selected to enhance your understanding of market movements and trading strategies.

Expertise Level: Beginner to Intermediate

Overview: This book simplifies complex concepts for traders who want a practical approach to price action strategies. Damir breaks down chart patterns, support-resistance levels, and trend reversals step-by-step. The book is known for its clarity, making it an easy read for traders new to technical analysis. Following actionable strategies allows readers to build confidence in analysing charts without relying on indicators.

Why It’s a Must-Read:

Famous Line: "Learn to trade the chart, not your emotions."

Expertise Level: Intermediate

Overview: Anna Coulling focuses on the relationship between volume and price, helping traders better understand market strength and momentum. The book offers insights on using volume patterns to confirm price action signals. It also includes techniques for identifying false breakouts and managing risk effectively. The concepts are versatile and can be applied across stock, forex, and commodity markets.

Why It’s a Must-Read:

Famous Line: "Volume validates the truth behind price movement."

Expertise Level: Advanced

Overview: Focused specifically on forex trading, this book is a practical guide for traders who want to master short-term trading using price action strategies. Volman shares proven techniques for executing quick trades in fast-moving markets. It covers real-world scenarios to help traders learn precision entry points and timing for successful scalping. His emphasis on discipline and observation makes it a valuable resource.

Why It’s a Must-Read:

Famous Line: "Patience is key, even when scalping."

Expertise Level: Intermediate

Overview: This book focuses on understanding and qualifying trends rather than assuming every upward movement is significant. Little provides a unique framework for evaluating trends using price and volume data. His approach helps traders distinguish between meaningful trends and temporary fluctuations. The book offers practical techniques to manage risks and enhance trade efficiency.

Why It’s a Must-Read:

Famous Line: "Every trend tells a story—qualifying it makes all the difference."

Expertise Level: Beginner

Overview: Written by one of India’s leading trading educators, this book simplifies technical analysis for Indian traders. It focuses on price action strategies tailored to the unique conditions of the Indian stock market. Sunil Gurjar uses practical examples from the NSE and BSE markets, making the content relatable for Indian readers. The book provides insights into entry points, exits, and managing trade risks.

Why It’s a Must-Read:

Famous Line: "Simple analysis leads to powerful trades."

Expertise Level: Advanced

Overview: Al Brooks' series is a deep dive into understanding price action trends, reversals, and trading ranges. It’s a comprehensive guide for professional traders who want to sharpen their skills. The series covers advanced setups, including breakouts and high-risk trades, helping traders become self-reliant in their trading decisions. Brooks also provides insights into managing trading emotions and improving discipline.

Why It’s a Must-Read:

Famous Line: "Price action is the purest form of market truth."

Selecting the perfect price action trading book can make a huge difference in your trading journey. Here’s what to consider when picking the best resource for your needs:

Reading a book on price action trading is just the beginning. Here’s how to effectively apply what you’ve learned:

Books on price action trading offer invaluable insights for traders who want to decode market behaviour without relying on technical indicators. Here’s why learning from books can enhance your trading skills:

Day traders rely on precise timing and fast decision-making, making price action books essential for success. Below are two standout recommendations for mastering short-term trading strategies:

"Trading Price Action Trends" by Al Brooks

Al Brooks' book is a total guide for traders who want to understand price trends in all market conditions. Trend analysis, breakout setups and risk management. Perfect for forex and stock day traders.

These books are equally valuable for traders in stocks, commodities, and forex markets, as they help readers improve their timing and decision-making in fast markets.

Price and indicator-based trading have their strengths, but price action often stands out for its simplicity and direct approach. By focusing solely on raw price movements, traders understand market sentiment better without delays from lagging indicators like moving averages or oscillators.

Why Price Action Works:

Many successful traders combine price action with select indicators to strengthen their strategies. For example, a trader may identify a breakout using price action and confirm it using volume analysis or the RSI. This hybrid approach offers the best of both worlds—real-time insights from price action and indicator confirmation signals.

The best price action book for traders in India is "Price Action Trading: Technical Analysis Simplified!" by Sunil Gurjar. Sunil is a well-known trading educator in India, who simplifies complex trading concepts and applies them to the Indian market. This book is a must-have for traders trading NSE and BSE stocks.

This book gives practical insights into identifying price levels, managing risk, and confidently trading. By focusing on price action rather than indicators, Gurjar helps you develop a disciplined and data-driven trading approach for the Indian market.

Although there are limited Hindi resources specifically focused on price action, one excellent recommendation is the Hindi translation of "Japanese Candlestick Charting Techniques" by Steve Nison

This book delves into candlestick patterns and their significance in predicting price movements, making it a powerful tool for traders who prefer learning in Hindi. With detailed examples and clear explanations, it is a comprehensive guide for mastering key elements of price action analysis.

Mastering price action trading allows traders to interpret market trends without relying heavily on technical indicators. Like those mentioned in this guide, the right books provide comprehensive strategies, real-world examples, and actionable insights that empower traders to make smarter decisions.

Whether you're a beginner or an experienced trader, learning directly from expert authors helps you build a strong foundation and refine your trading skills. Start your journey today with the best price action trading books and unlock new opportunities in the dynamic trading world.

The best price action trading books include Price Action Breakdown by Laurentiu Damir and Trading Price Action Trends by Al Brooks. These books cover everything from identifying key chart patterns to executing trades with minimal reliance on indicators.

For beginners, Price Action Breakdown by Laurentiu Damir is one of the top choices. The book simplifies complex trading concepts, including trend reversals, support-resistance levels, and entry-exit strategies, making it easier for new traders to understand and apply price action techniques.

Yes, you can effectively learn price action trading from books. Well-structured books provide detailed explanations of market behaviour, actionable strategies, and case studies that help traders develop a disciplined approach to analysing market trends and making informed trading decisions.

Learning price action trading is important because it enables traders to read market movements directly from price charts without relying on lagging indicators. By understanding patterns, trends, and support-resistance levels, traders can make more accurate predictions and identify profitable trading opportunities.

While there are limited Hindi-specific price action books, the translated version of Japanese Candlestick Charting Techniques by Steve Nison, is an excellent resource. It covers essential candlestick patterns that are fundamental to understanding price action strategies.

The best way to learn price action trading is by reading comprehensive books, practising on demo accounts, and analysing historical charts to identify key patterns and market behaviours. Combining theoretical learning with hands-on practice ensures a better understanding and application of price action strategies.

Disclaimer: This article is intended for educational purposes only. Please note that the data related to the mentioned companies may change over time. The securities referenced are provided as examples and should not be considered as recommendations.