Investing in the stock market can be a powerful way to build wealth over time. While short-term trading can be risky and unpredictable, long-term investments offer a more stable and reliable path to financial growth. In India, the stock market has shown impressive resilience and growth potential, making it an attractive option for long-term investors. This article will explore the best long term stocks to invest in 2024.

These stocks have been selected based on their strong financial performance, market position, and future growth prospects. By understanding the value and potential of these investments, you can make informed decisions to secure your financial future. Let's dive into the top stocks that can help you achieve your long-term investment goals.

Long-term stocks are shares in companies that investors plan to hold for an extended period, typically five years or more. These stocks are often from well-established companies with strong growth potential and solid financial health. Investing in long-term stocks allows investors to benefit from the company's growth over time, leading to potential price appreciation and dividend income. This approach requires patience and a focus on the company's fundamentals and future prospects, making it less volatile than short-term trading strategies.

In the Indian stock market, long-term investing is particularly advantageous due to the country's robust economic growth and burgeoning industries. Investors looking for long-term gains should consider companies with a proven track record of stability, consistent revenue growth, and a sustainable competitive advantage.

Below is a table showcasing some of the top long term stocks for 2024, including their market capitalization, dividend yield, and five-year return. These stocks are selected based on their strong performance, financial stability, and growth potential. Click respectively to learn more about them.

| List of 10 Best Long Term Stocks to Invest (2024) | Div Yeild | Mkt Cap (Cr) | 5yr Return |

|---|---|---|---|

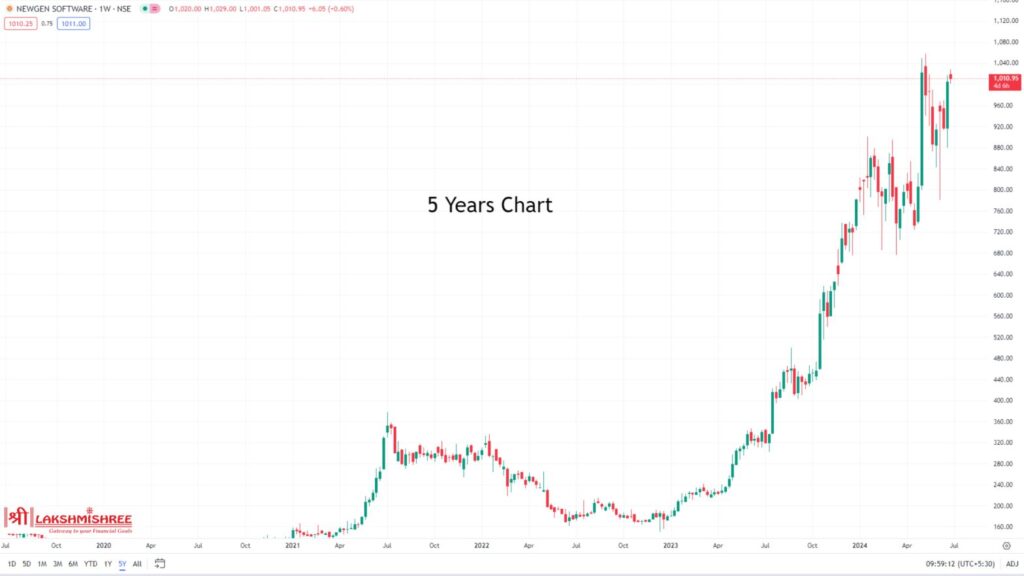

| 1. NEWGEN | 0.42 | 13366 | 567.71% |

| 2. EVEREADY | 0.29 | 2511 | 406.93% |

| 3. SMSPHARMA | 0.00 | 2007 | 322.54% |

| 4. MIDHANI | 0.31 | 8629 | 262.13% |

| 5. ALEMBIC LTD | 2.16 | 2852 | 170.88% |

| 6. RELIANCE | 0.34 | 1966686 | 129.41% |

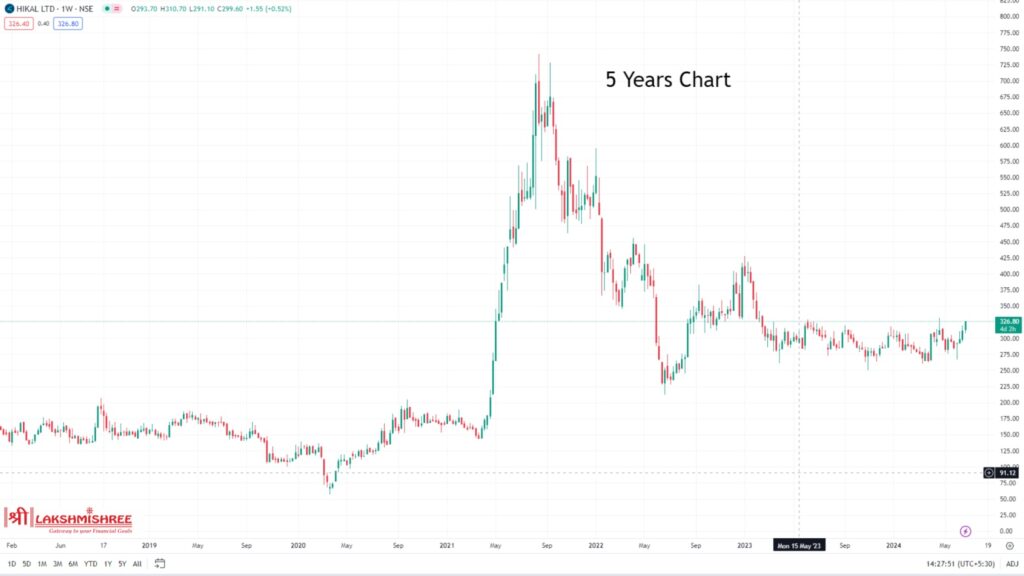

| 7. HIKAL Ltd | 0.19 | 3847 | 90.62% |

| 8. WIPRO | 0.20 | 256555 | 71.66% |

| 9. ZOMATO | 0.00 | 171332 | 67.20% |

| 10. KOTAKBANK | 0.11 | 352563 | 18.01% |

Here is a comprehensive overview of India's 10 best long-term stocks, detailing their market capitalization, historical returns, trading volume, and key milestones.

Newgen Software Technologies Limited is one of the best long-term stocks for investment in 2024; it leads the market in business process management (BPM) and enterprise content management (ECM), With over 800 installations worldwide across more than 40 countries, Renowned research firms such as Frost and Sloan have identified Newgen as a hot company to look for In their 2009 global ECM market analysis.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 209.92 | 272.88 | 567.71 |

In the dry cell battery market, Eveready Industries (India) Ltd. is a well-known brand.In addition to dry cell batteries, the company produces package tea, insect repellent, and lamps, or torches.In the future, Eveready Industries India intends to expand its range of products.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 5.02 | 9.91 | 406.93 |

Modern facilities and a robust research and manufacturing staff enable SMS Pharmaceuticals Ltd., a major participant in the API manufacturing industry, to operate globally. They are the biggest manufacturer of products that prevent ulcers. The company is expanding into the CRAMS space by building research and manufacturing facilities that better meet regulatory market criteria and appeal to a global clientele.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 147.50 | 30.04 | 322.54 |

The premier specialised metals and metal alloys manufacturing plant in India is called Mishra Dhatu Nigam Limited (Midhani) which is one of the best long term stock to buy in 2024, and it is situated in Hyderabad, Andhra Pradesh. An ISO 9001:2000 is MIDHANI.A company that possesses state-of-the-art metallurgical facilities and a high level of technical competence in producing a broad range of Superalloys, Titanium, Special Purpose Steels, and other unique metals and alloys.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 64.34 | 121 | 262.13 |

Alembic Limited's main activities at Baroda are the manufacturing of tinctures and alcohol. The company also produces active pharmaceutical ingredients for antidepressants, macrolides, cephalosporins, anti-parkinson's, and other medications. Bulk Pharmaceuticals: This division produces intermediates and bulk phosgene-based pharmaceuticals.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 52.87 | -15.25 | 170.88 |

Reliance Industries Ltd., the largest private sector company in India, operates in the energy and materials value chains and is one of the best long term stocks to hold for the long run. The company operates in the following business segments: Retail, Textiles, Petroleum Refining and Marketing, Petroleum Refining and Production, and Exploration and Production.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 16.01 | 31.0 | 129.41 |

Research and development, production, and marketing of fine chemicals for the agrochemical and pharmaceutical sectors are the activities of Hikal Ltd. The company provides solutions in contract Research, Custom Synthesis, and Custom Manufacturing and collaborates with innovative companies.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 3.51 | -31.67 | 90.72 |

Leading global supplier of IT services, including business process outsourcing (BPO) services, with headquarters in India Wipro Ltd. In addition, Wipro operates additional companies in the areas of infrastructure engineering, consumer care, lighting, and IT products.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 30.13 | -8.91 | 71.66 |

Zomato Limited is an online platform facilitating communication between users, delivery partners, and restaurant partners. In addition, the company supplies ingredients to restaurant partners and offers a platform for businesses to advertise to specific audiences in India and overseas. Its segments are Hyperpure Supplies (a B2B company), Quick Commerce Company, India Food Ordering and Delivery, and All other residual segments.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 161.56 | 67.20 | 67.20 |

The activities of Kotak Mahindra Bank Limited include asset management, life insurance, stock broking, car financing, investment banking, and commercial banking. Its segments include the Treasury, Investments, and Balance Sheet Management Unit (BMU). BMU deals with debt, equities, money market, currency, derivatives, and investments, as well as the dealership of government securities.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| -4.08 | 1.28 | 18.01 |

Investing in India’s top stocks for the long term offers several compelling benefits. The Indian economy is among the fastest-growing in the world, driven by a young population, rapid urbanization, and technological advancements. This robust economic growth translates into substantial opportunities for investors who focus on long-term stocks.

Long-term investments in Indian stocks allow you to capitalize on the growth potential of established companies. These companies often have strong fundamentals, including solid financial health, consistent revenue growth, and competitive advantages in their respective industries. Holding these stocks over several years benefits investors from compound returns and potential dividend payouts.

Moreover, the Indian stock market has shown resilience and the ability to recover from downturns, making it a viable option for long-term investments. By investing in stocks with strong performance records and future growth potential, you can build a diversified portfolio that mitigates risks associated with market volatility.

In summary, investing in the best long-term stocks in India can provide significant returns, leveraging the country’s economic momentum and the inherent strengths of its leading companies.

When choosing the best long-term stocks to invest in, it's important to evaluate several key factors to ensure stability and growth:

Investing in the best long-term stocks in India through Lakshmishree is straightforward. Here’s a quick guide:

By following these steps, you can efficiently invest in long-term stocks through Lakshmishree and build a strong investment portfolio.

Selecting the best long-term stocks to invest in requires careful consideration of several key factors. Here's a concise guide to help you make informed decisions when choosing long-term investments:

By focusing on these factors, you can identify the best long-term stocks for your investment portfolio, ensuring stable and substantial returns over time.

Investing in the best long-term stocks in India can be highly rewarding, but it also carries certain risks. Understanding these risks is crucial for any investor aiming for long-term gains.

Investors need to be aware of these risks and plan their strategies accordingly. Thorough research and a diversified portfolio can help mitigate these risks.

Investing in the best long term stocks in India can be a highly rewarding strategy for those looking to build wealth over time. By carefully selecting stocks with strong fundamentals, growth potential, and sound management, you can benefit from the power of compounding and economic growth.

Long-term investments require patience and a well-researched approach. Companies like Reliance Industries, which have demonstrated consistent financial performance and adaptability, are prime examples of successful long-term investments. You can mitigate risks and maximise returns by diversifying your portfolio and staying informed about market trends and economic indicators.

Remember, the key to successful long-term investing is to stay committed to your investment goals, regularly review your portfolio, and make informed decisions based on thorough research.

The best long-term stocks are NEWGEN, SMSPHARMA, MIDHANI, ALEMBIC LTD, and RELIANCE, which are known for their consistent and high return payouts and have good potential for the long run in India.

Reviewing your long-term investment portfolio at least twice a year is advisable. This helps ensure that your investments are performing as expected and allows you to adjust based on market changes or your financial goals.

In India, long-term capital gains (LTCG) on stocks held for more than one year are taxed at 10% if the gains exceed INR 1 lakh in a financial year. Dividends received from these investments are also taxable based on your income tax slab.

The best time to buy long-term stocks is when you have thoroughly researched the companies and believe in their future growth potential. Generally, investing during market dips or corrections can provide good opportunities for long-term gains.

The amount you should invest in long-term stocks depends on your financial goals, risk tolerance, and investment horizon. A general rule of thumb is to invest a portion of your savings that you can afford to leave untouched for several years.

The best sectors for long-term investment often include technology, pharmaceuticals, consumer goods, and financial services. These sectors have stable growth, innovation, and resilience during economic fluctuations.

Disclaimer: This article is for educational purposes only and should not be considered financial advice. Always conduct your research and consider consulting with a financial advisor before making any investment decisions.