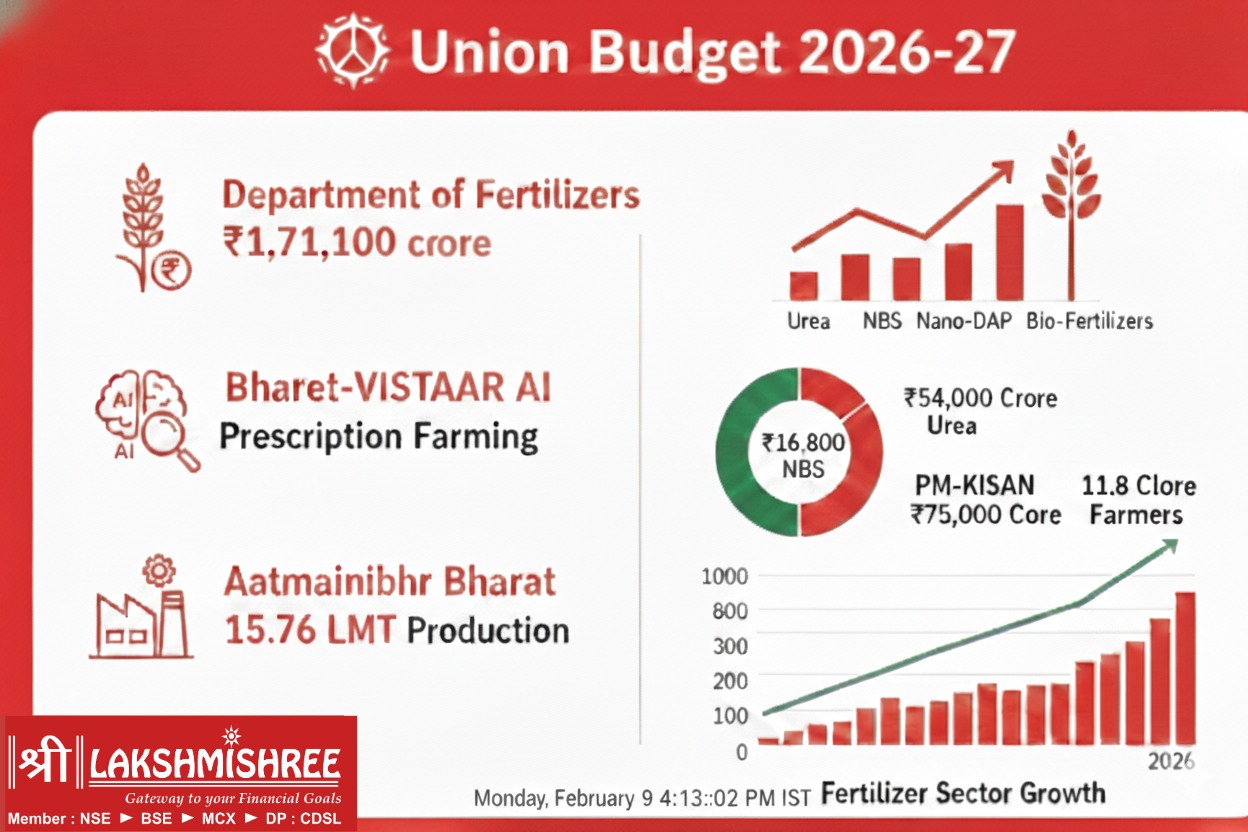

The Fertilizer Stocks in India have entered a Structural Bull Phase i.e. a steady, long-term climb in value triggered by the Union Budget 2026-27. This budget provides a ₹1.71 Lakh Crore subsidy, as a financial "safety net" that protects company profits while keeping farm prices low.

This shift toward self-reliance (Aatmanirbhar) is already showing results. In January 2026, domestic production hit a record 15.76 LMT of P&K (Phosphorus and Potassium) fertilizers. By making our own nutrients, we are successfully reducing our dependence on foreign imports.

Leading the charge are tech-forward industry giants which are moving beyond simple chemical sales to adopt Bharat-VISTAAR AI, A government AI tool assists farmers by analyzing soil needs, promoting precision farming, a precise, sustainable, and profitable long-term practice.

India’s fertilizer sector is currently in a Structural Bull Phase, sustained by high Food Security needs and Favourable Monsoons. This growth is underpinned by the government's Aatmanirbhar (Self-Reliance) mandate, which has turned the industry from an import-dependent sector into a domestic powerhouse.

With Revenue Visibility at an all-time high, the following companies are the primary beneficiaries of this policy stability. Below is the updated list of the best performers, ranked by Market Capitalisation.

| Top 10 Fertiliser stocks in India | Market Cap |

| Coromandel International Ltd. | 67,000 |

| Fertilisers & Chemicals Travancore (FACT) | 51,394 |

| Chambal Fertilisers & Chemicals Ltd. | 17,155 |

| Paradeep Phosphates Ltd. | 12,715 |

| Rashtriya Chemicals & Fertilizers (RCF) | 7,335 |

| National Fertilizers Ltd. (NFL) | 3,852 |

| EID Parry (India) Ltd. | 15,673 |

| Mangalore Chemicals & Fertilizers | 3,650 |

| Krishana Phoschem Ltd. | 3,055 |

| Madras Fertilizers Ltd. | 1,160 |

Data as of 08/02/2026

This table offers a quick snapshot of the top-performing fertilizer stocks, helping you pick investments that align with your goals. Stay tuned as we explore these companies in more detail!

The top 10 Indian fertilizer companies, ranked by 2026 Market Capitalization and Strategic Moat, are listed based on stock performance, fundamentals, and sector leadership.

As India's largest private-sector Phosphatic fertilizer producer, Coromandel is a prime beneficiary of the ₹1.71 Lakh Crore budget subsidy. The company is successfully pivoting toward Value-Based nutrition, with its Nano-DAP and organic specialty nutrients driving higher EBITDA margins. With a robust retail network of over 750 stores, it remains the Gold Standard for rural distribution and Precision Farming adoption.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 23.05 | 150.15 | 195.99 |

This PSU powerhouse is a key pillar of India’s Aatmanirbhar mandate. Following its turnaround success, FACT has focused on record P&K (Phosphorus and Potassium) production, specifically its flagship Factamfos brand. The company is currently utilizing its Southern India dominance to roll out Bharat-VISTAAR AI services, helping millions of farmers optimize their fertilizer consumption and soil health.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| -7.76 | 215.53 | 879.02 |

Chambal is the largest private-sector producer of Urea in India, accounting for nearly 14% of total domestic output. With a low P/E ratio of ~9.20x, it offers significant value for long-term investors. The company’s recent commissioning of its Technical Ammonium Nitrate (TAN) plant in early 2026 has diversified its revenue streams, moving it beyond traditional farming into high-growth industrial chemicals.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| -20.47 | 48.80 | 88.85 |

Paradeep Phosphates, India's second-largest private Non-Urea (P&K) fertilizer producer, has a key strategic advantage in its ₹3,600 Crore plan for 100% Backward Integration for phosphoric and sulphuric acids by FY28. Backed by its promoter, Morocco's OCP Group (custodian of 70% of global phosphate reserves), this move hedges against global price spikes. Despite a 15% revenue rise to ₹5,749 Crore in Q3 FY26, investor focus is on PPL's shift to high-margin Nano-fertilizers and its merger with Mangalore Chemicals to expand its national presence.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 21.65 | 123.43 | 194.07 |

RCF is a Mini-Ratna PSU and a cornerstone of India’s "Aatmanirbhar" goal, with the Government of India holding a 75% stake. Beyond its massive 25.00 Lakh MT Urea annual capacity, RCF is leading the charge in "Next-Gen" Nutrients through its recent environmental clearance for a new Nano-Urea plant at its Trombay facility. Investors are eyeing its February 12th earnings announcement, where the company is expected to report on its ₹1,000 Crore L&T contract for a new complex fertilizer unit and its designated role in reviving dormant urea plants across India. With a healthy dividend payout of ~30%, RCF remains a top pick for those seeking Sovereign Safety combined with high-tech Agri-Innovation.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| -12.32 | 22.71 | 149.44 |

National Fertilizers Limited (NFL) is India's second-largest producer of Urea and a designated Navratna PSU. Operating five gas-based plants, NFL is expanding with a new Ammonia-Urea complex (AVFCCL) in Namrup, Assam, due by 2029, and pivoting to Nano-Urea with a 27-million-liter plant in Bathinda. With a market cap of ₹3,958 Crore, the company offers investors diversification and sovereign-backed stability. A board meeting on February 13, 2026, is scheduled to clarify Q3 FY26 recovery and subsidy receivables.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| -20.40 | 40.10 | 96.39 |

EID Parry is a flagship of the Murugappa Group and a unique holding-cum-operating play in the agri-space. While it is a global leader in Sugar and Ethanol, its primary value driver for fertilizer investors is its 56% stake in Coromandel International. The company is a massive beneficiary of the Union Budget 2026 ‘Biopharma Shakti’ initiative, which supports its Nutraceuticals segment. With a Market Cap of ₹16,276 Crore and a scheduled board meeting on February 12, 2026, EID Parry offers investors diversified exposure to Institutional Sugar demand, Ethanol blending targets (20%), and the booming Farm Input sector through its subsidiary.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 8.96 | 79.30 | 173.72 |

Mangalore Chemicals & Fertilizers (MCF) is the dominant agri-input provider in Southern India and a key subsidiary of the Adventz Group. Following its successful merger integration with Paradeep Phosphates, MCF has seen a massive performance boost, delivering 159% returns over the last three years. With a Market Cap of ~₹3,659 Crore, the company is leveraging its strategic port-based facility in Mangaluru to ramp up production of high-margin Complex Fertilizers (NPK) and Ammonium Bicarbonate. Backed by 60% Promoter Holding and strong government contracts, MCF is now pivoting toward the Aatmanirbhar goal by localizing raw material sourcing to improve its EBITDA margins, which recently touched 13% in the latest quarter.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 85.31 | 290.96 | 425.38 |

9. Krishana Phoschem Ltd

Krishana Phoschem is a high-growth "Multibagger" within the Ostwal Group, specialized in Single Super Phosphate (SSP) and NPK/DAP complex fertilizers. The company achieved a historic milestone in January 2026 by hitting 113,155 tonnes in quarterly production, with its SSP plants operating at 107% capacity utilization. With a Market Cap of ₹ 3,057 Crore, Krishna Phoschem’s primary competitive advantage is its "Rock-to-Root" integration. It is the only private player in India that upgrades low-grade rock phosphate in-house. Investors are highly optimistic about its March 2026 expansion, which will add 50% more NPK/DAP capacity at its Meghnagar plant, potentially adding ₹1,000 Crore to its annual revenue.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 153.31 | 118.33 | 1,346.19 |

Madras Fertilizers (MFL) is a strategic South India PSU link whose 85.27% Promoter Holding (with GOI & NIOC) ensures sovereign-backed stability. In a historic FY 2025-26 breakthrough, MFL recorded its highest-ever Urea production (5.28 Lakh MT) alongside its lowest-ever Specific Energy Consumption (to be specific 6.875 GCal/MT). With a Market Cap of ₹1,160 Crore, the company is aggressively expanding its "Vijay" brand into bio-fertilizers and organic manure. Investors are now focused on the February 11, 2026, Board Meeting for Q3 results, positioning MFL as a lean, energy-efficient contender for long-term agricultural growth.

Returns:

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| -16.31 | 28.02 | 185.35 |

In FY25, Indian farmers purchased a record 65.6 million tonnes of fertilizer, signaling a Structural Bull Phase in demand. The industry is currently on a high-growth trajectory, projected to reach a market value of USD 70.2 billion by 2032. This growth is driven by a shift from volume-based chemical use to efficiency-based Nano-nutrients and Bio-fertilizers.

Under the Union Budget 2026-27, the government allocated ₹1.71 Lakh Crore to fertilizer subsidies. This funding is split into two critical "Proximity Clusters":

By digitizing this through the new e-bill platform, the government is ensuring Revenue Visibility for companies, allowing them to invest in Precision Farming tools like Bharat-VISTAAR AI.

Fertilizer stocks represent a strategic category of publicly listed companies that form the sovereign backbone of India’s Food Security and Climate Resilience. These entities manage the high-stakes cycle between Atmospheric Nitrogen, Soil Organic Carbon (SOC), and Crop Productivity.

They operate within four hyper-connected Semantic Clusters:

Also read: Top Ethanol Stocks in India 2025: You Must Know

The Indian fertilizer sector has transitioned into a Structural Bull Phase, shifting from a volatile commodity market to a high-growth Agri-Tech ecosystem. As of February 9, 2026, the investment case is anchored by three hyper-connected clusters:

The Union Budget 2026–27 has shifted the industry's narrative from "Subsidy Dependence" to "Efficiency-Driven Profitability." The following anchors define the roadmap for fertilizer companies this fiscal year:

The ₹1.71 Lakh Crore Subsidy Safety Net:

Bharat-VISTAAR AI Deployment:

Domestic Production Records (15.76 LMT):

PM-KISAN & Cash Flow Velocity:

Also read: 10 Best EV Stocks in India 2026: Electric Vehicle Shares

Investing in fertiliser stocks can be a great way to capitalise on the growth of India's agriculture sector, especially with the increasing demand for fertilisers.

Investing in the Indian fertilizer sector has evolved into a strategic play on Sovereign Food Security and Digital Agriculture. With the Union Budget 2026-27 establishing a robust ₹1.71 Lakh Crore fiscal floor, the industry has achieved unprecedented Revenue Visibility.

Whether you are targeting the high-margin Agri-Tech innovation of private leaders like Coromandel International or the "Green Ammonia" pivot of sovereign anchors like FACT and NFL, the narrative is clear: India is no longer just consuming fertilizers; it is engineering Agricultural Efficiency. As domestic production hits historic highs of 15.76 LMT and Bharat-VISTAAR AI revolutionizes nutrient delivery, these stocks offer a rare combination of Defensive Stability and Structural Capital Appreciation.

For the long-term investor, the fertilizer sector is the Invisible Engine driving India’s journey toward a USD 70.2 Billion market by 2032.

Top fertilizer stocks in India by market capitalization are Coromandel International (~₹67,000 Cr), FACT (~₹51,300 Cr), Chambal Fertilisers (~₹17,150 Cr), Paradeep Phosphates (~₹12,700 Cr), and Rashtriya Chemicals & Fertilizers (RCF) (~₹7,300 Cr)

Coromandel International is the top choice for 2026. Its ₹67,000 Cr market cap, massive pivot to Nano-DAP, and 18.39% ROCE make it the primary beneficiary of the new Bharat-VISTAAR AI and precision farming mandates.

The AI tool shifts companies from "bulk commodity" to "specialty service" models. By using Prescription Farming to recommend exact dosages, companies sell higher-margin Nano-nutrients and Bio-stimulants, directly expanding their EBITDA margins and customer loyalty.

The best time to invest in fertilizer stocks is usually before the sowing seasons i.e. Rabi (October–December) and Kharif (May–July). Policy announcements during the Union Budget or Agriculture reforms can also trigger growth opportunities and investor interest.

The ₹1.71 Lakh Crore subsidy acts as a Profit Protector. By absorbing the volatility of global Natural Gas and Rock Phosphate prices, the government ensures that fertilizer companies maintain stable EBITDA margins. For investors, this reduces the risk of earnings misses, making stocks like RCF and NFL reliable defensive plays in a volatile market.

PSU fertilizer stocks are surging due to the "Green Ammonia" Transformation. Following the India Carbon Credit Trading Scheme (CCTS), sovereign-backed giants are receiving massive incentives to decarbonize. This turns a traditional manufacturing business into a Green Energy play, attracting ESG (Environmental, Social, and Governance) funds and institutional investors.

India has over 30 active fertilizer companies, including both public sector units (PSUs) and private players, producing urea, DAP, potash, NPK, and organic fertilizers. These companies cater to the country’s diverse soil and crop requirements across agro-climatic zones.

Disclaimer: This article is intended for educational purposes only. Please note that the data related to the mentioned companies may change over time. The referenced securities are provided as examples and should not be considered recommendations.