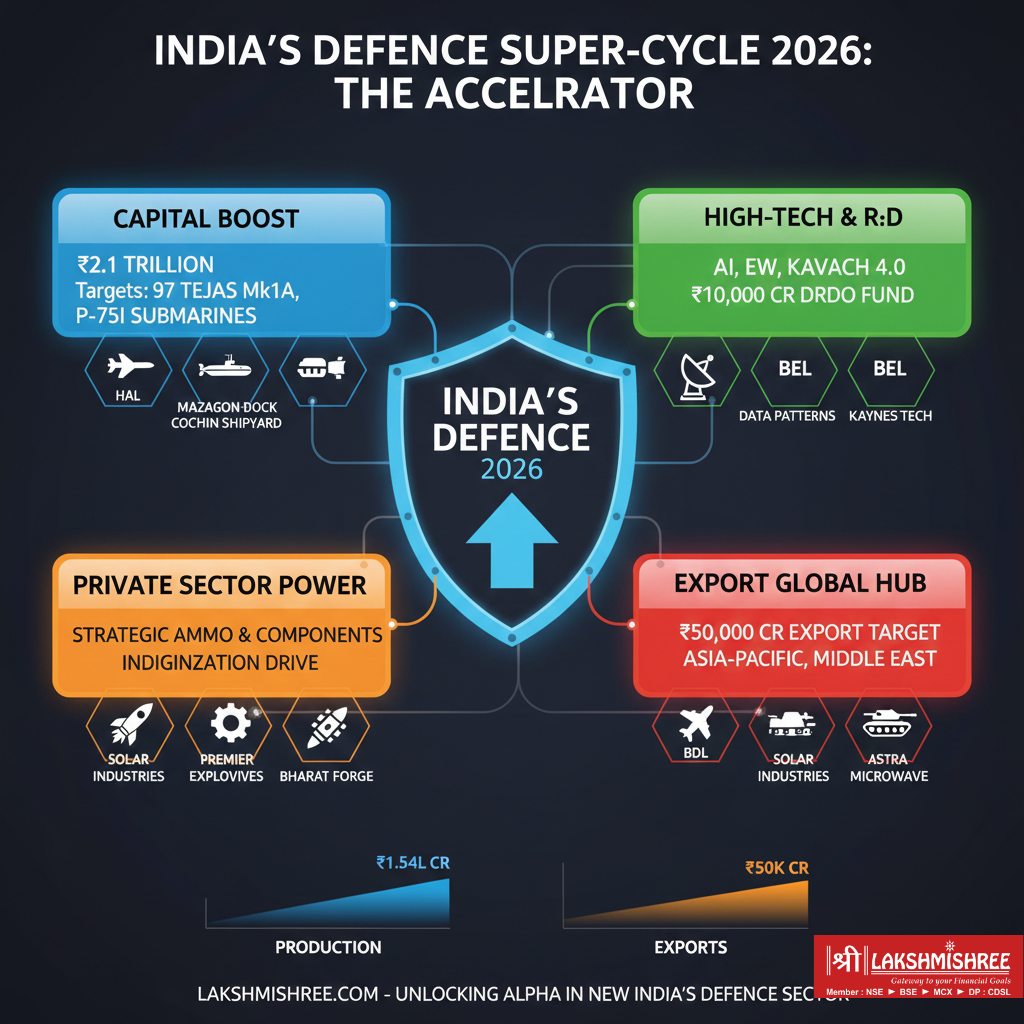

India's defence sector has transitioned into a high-execution "super-cycle," moving aggressively toward absolute self-reliance and global export ambitions. Fuelled by geopolitical imperatives and a record Union Budget allocation of ₹6.81 lakh crore (a 9.5% increase), the sector is witnessing an unprecedented drive for indigenous production.

The current focus is sharp: shifting from basic "Make in India" to mastering high-end Deep Tech, AI-enabled warfare, and the rapid, mass rollout of major platforms. Key projects like the Tejas Mk-1A and the P-75(I) submarine program signal India's commitment to becoming a powerhouse of advanced defence technology by early 2026.

The sector is experiencing "Execution-Led Growth," bolstered by an expected ₹2.8 Trillion Union Budget 2026 capital outlay. Companies are categorized by focus:

| # | Company Name | Key Business Segment |

| 1 | Hindustan Aeronautics (HAL) | Fighter Aircraft, Helicopters & Aero-engines |

| 2 | Bharat Dynamics (BDL) | Guided Missile Systems & Underwater Weapons |

| 3 | Mazagon Dock Shipbuilders | Stealth Frigates, Destroyers & Submarines |

| 4 | Cochin Shipyard | Aircraft Carriers & Specialized Naval Vessels |

| 5 | BEML Limited | Heavy Duty Ground Vehicles & Armored Recovery |

| 6 | Garden Reach (GRSE) | Fast Patrol Vessels & Anti-Submarine Corvettes |

| 7 | Mishra Dhatu Nigam (MIDHANI) | Specialized Titanium & Super-alloys |

| # | Company Name | Key Business Segment |

| 8 | Bharat Electronics (BEL) | Radars, Communication Systems & Kavach 4.0 |

| 9 | Data Patterns (India) | Avionics, Processor-based Electronics & Radars |

| 10 | Zen Technologies | Combat Training Simulators & Anti-Drone Tech |

| 11 | Astra Microwave | Radio Frequency (RF) & Microwave Sub-systems |

| 12 | Paras Defence | Defence Optronics & Space Research Hardware |

| 13 | Kaynes Technology | Strategic Electronic Manufacturing (EMS) |

| 14 | Avantel Limited | Satellite-based Tactical Communication (SATCOM) |

| # | Company Name | Key Business Segment |

| 15 | Solar Industries India | Weapon Warheads, Explosives & Loitering Munitions |

| 16 | Bharat Forge | Advanced Artillery Systems & Armored Forgings |

| 17 | MTAR Technologies | Precision Engine Components & Nuclear Hardware |

| 18 | Nibe Limited | Modular Bridging & Naval Structural Engineering |

| 19 | Premier Explosives | Solid Propellants for Rockets & Tactical Missiles |

| 20 | Azad Engineering | Critical Rotating Parts for Aerospace Turbines |

If you're looking to invest in India's booming defence sector, here's a curated defence stocks list featuring the top-performing companies based on their 3-year returns. These stocks have shown strong growth, backed by government contracts, military modernisation, and self-reliant manufacturing initiatives.

| Company Name | 3-Year Returns (%) |

| 1. Kaynes Technology | 721.15% |

| 2. Premier Explosives | 606.39% |

| 3. Mazagon Dock Shipbuilders | 572.36% |

| 4. Cochin Shipyard | 438.41% |

| 5. Bharat Electronics (BEL) | 313.56% |

| 6. Hindustan Aeronautics (HAL) | 241.15% |

| 7. Bharat Dynamics (BDL) | 222.64% |

| 8. Solar Industries | 215.03% |

| 9. Astra Microwave Products | 188.14% |

| 10. Data Patterns | 162.67% |

These defence stocks have outpaced broader market indices, making them attractive for investors seeking long-term growth in a strategically vital sector.

India's defence sector is growing rapidly, with various companies playing critical roles in the country's push for self-reliance. Here’s a list of the best defence stocks in India that offer excellent growth potential and strong market performance.

Kaynes has reached the top spot by providing integrated solutions in aerospace and defence electronics. As the government ramps up high-tech sensor procurement in the 2026 Budget, Kaynes’ specialized electronic components have become mission-critical. (Whalesbook/Emkay Research, Dec 2025).

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| -30.00% | 344.15% |

Note: Data as of 28/01/2026

A leading supplier of solid propellants for missiles. Increased export demand and the Budget 2026 push for larger strategic ammunition reserves have propelled Premier Explosives to a top performer position.(PIB MoD Review, Nov 2025).

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 25.00 | 596.26 | 1671.30 |

Note: Data as of 28/01/2026

Dominant in shipbuilding and naval repair. The 2026 Budget’s allocation for next-gen naval vessels ensures that Cochin Shipyard remains a high-growth play in the maritime defence segment. (Quest Investment Managers, Jan 2026).

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 13.93 | 588.93 | 843.46 |

Note: Data as of 28/01/2026

Specializes in the construction of warships and submarines. With massive order backlogs for stealth frigates, Mazagon Dock is a direct beneficiary of the ₹2.8 Trillion capital spending spree in FY26. (Business Today, Jan 28, 2026).

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 6.31 | 587.94 | 2,276 |

Note: Data as of 28/01/2026

The leader in defence electronics and radars. BEL is uniquely positioned in 2026 as the primary digital enabler for the nationwide Kavach 4.0 railway safety rollout while managing a ₹73,000 Cr defence order book. (Nomura/Business Today, Jan 2026).

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 70.52 | 373.32 | 911.58 |

Note: Data as of 28/01/2026

India’s premier aerospace company. HAL’s 2026 outlook is bolstered by the 12% YoY increase in aircraft budgetary support and the newly signed Tejas Mk1A engine JVs.

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 26.55 | 272.65 | 881.69 |

Note: Data as of 28/01/2026

A leader in guided missiles and torpedoes. The continued focus on indigenizing the Akash and Astra missile platforms in Budget 2026 makes BDL a stable long-term growth contender.

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 26.26 | 232.67 | 832.18 |

Note: Data as of 28/01/2026

Specializes in explosives and ammunition manufacturing. The shift toward creating long-term ammunition "Strategic Reserves" in 2026 provides Solar Industries with massive revenue visibility. (PIB Defence Atmanirbharta Report, Nov 2025).

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 43.95 | 227.67 | 1031.90 |

Note: Data as of 28/01/2026

A leading manufacturer of microwave systems for radar and EW. Astra Microwave is a niche beneficiary of the government's 2026 mandate to indigenize radar sub-systems for all indigenous aircraft.

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 38.29 | 262.00 | 720.85 |

Note: Data as of 28/01/2026

Provides innovative solutions in aerospace electronics. Despite a temporary dip in margins, the 2026 digital warfare push keeps Data Patterns at the forefront of the electronic warfare (EW) suite market. (Times of India/FICCI, Jan 28, 2026).

| 1Y Return (%) | 3Y Return (%) | 5Y Return (%) |

| 27.76 | 105.87 | 202.96 |

Note: Data as of 28/01/2026

Small-cap defence stocks offer high-growth potential, especially in a rapidly expanding sector. These small-cap defence stocks in India significantly contribute to India's military modernisation, providing niche solutions and innovative technologies.

| Company Name | Market Cap (₹ Cr) |

| 1. NIBE Ltd | 1,494.80 |

| 2. Krishna Defence & Allied | 1,415.00 |

| 3. TAAL Enterprises Ltd | 897.19 |

| 4. Taneja Aerospace (TAAL) | 627.00 |

| 5. Global Vectra Helicorp | 242.60 |

Note: Data as of 28/01/2026

India’s defence sector is a pillar of national security and a major growth area for investors. The country currently maintains one of the largest military budgets in the world, and this number continues to rise as India pushes for absolute self-reliance. For FY 2025-26, the government allocated ₹6.81 lakh crore to defence, with a record ₹1.80 lakh crore dedicated to capital outlay for new procurement.

The industry is entering a super-cycle of growth, driven by the Ministry of Defence’s (MoD) "Year of Reforms" initiative aimed at achieving 70%+ self-reliance by late 2026. By the end of FY 2025-26, the sector is on track to hit a production turnover of ₹1.75 lakh crore, with exports scaling toward a new ₹30,000 crore target by March 2026. This shift from "import substitution" to "global export hub" makes defence stocks a high-conviction theme for long-term investors.

Defence stocks in India represent companies that manufacture critical military assets from Tejas Mk1A fighter jets and Kavach 4.0 safety systems to advanced anti-drone electronic warfare suites.

Driven by the 'Atmanirbhar Bharat' mission, the sector has seen structural growth. With Acceptance of Necessity (AoN) greenlit for projects worth over ₹9 lakh crore in the last 36 months, these companies now enjoy multi-year revenue visibility. Investing in these stocks allows investors to participate in India's journey toward becoming a top-tier global defence industrial power.

Investing in defence stocks provides an opportunity to align with India’s national security objectives while participating in the growth of one of the country's most vital sectors.

**As of January 2026, the share of the private sector in defence production has reached 23% (up from 15% a decade ago).

In 2026, the focus for investors has shifted from "Order Wins" to "Execution Depth." Here are the critical points to evaluate:

At Lakshmishree, we provide the tools to help you navigate this high-growth sector with precision:

As the Finance Minister prepares to present the Union Budget 2026 on February 1, the market is positioning for a "Technology-First" allocation. Based on latest industry memoranda from FICCI and SIAM, here are the key expectations:

Defence stocks are often viewed as "Counter-Cyclical." Because military spending is tied to national security rather than consumer demand, these companies are less affected by inflation or global recessions. In early 2026, while other sectors faced volatility due to global trade shocks, the Nifty India Defence Index remained resilient, supported by sovereign-backed contracts and fixed payment schedules.

Investing in defence stocks in India comes with its own set of risks, which should be carefully considered:

Awareness of these risks will help investors make more informed decisions when considering defence stocks for their portfolio.

Investing in top defence stocks in India presents a strong opportunity for long-term growth, driven by the country’s growing defence budget, technological advancements, and the push for self-reliance under initiatives like ‘Make in India’. With a steady focus on military modernisation and expanding export capabilities, India’s defence sector is poised for continued expansion and innovation.

For those looking to diversify their portfolios with a stable, high-potential sector, defence stocks in India offer a unique opportunity to tap into the nation's strategic defence capabilities and future growth.

HIgh-execution stocks like HAL, BEL, and Mazagon Dock due to their record order books. For high-growth alpha, private players like Kaynes Technology and Data Patterns are favored for their leadership in AI-led military modernization and electronic warfare

The surge is driven by expectations of a 20-25% hike in capital outlay in the upcoming Union Budget. Additionally, the recent rollout of the Kavach 4.0 safety system and the government’s ₹30,000 crore export target for March 2026 have boosted investor confidence in the sector's execution capabilities.

Yes, for long-term investors. While valuations are higher than historical averages, the "Year of Networking and Data Centres" (2026) initiative and massive contracts like the ₹62,370 Crore Tejas Mk1A deal provide multi-year revenue visibility that justifies current premiums.

Small-caps like NIBE Ltd, Krishna Defence, and Astra Microwave are in focus due to niche dominance in firearm manufacturing and radar sub-systems. These companies benefit from the ADITI 2.0 scheme, which offers grants for indigenous deep-tech innovations.

Following recent geopolitical friction, the government is expected to prioritize "Force Multipliers." This includes a projected ₹10,000 crore increase for DRDO to fast-track drone swarms, anti-drone systems, and long-range missile forces to maintain a qualitative edge.

Disclaimer: This article is for educational purposes only and should not be considered financial advice. Always conduct your research and consider consulting with a financial advisor before making any investment decisions.