Ever wondered how big traders make money even while they sleep? That’s the magic of algorithmic trading, where computers make smart trading decisions in seconds. But here’s the thing: you don’t need to be a math genius or a Wall Street expert to get started. With the best algorithmic trading books, anyone- even a curious beginner- can learn how it works, step by step.

In this blog, we’ve picked out the top algo trading books that simplify tough concepts and teach you everything from building strategies to writing basic trading code. Whether you're a student, a techie, or just someone who wants to understand the stock market better, these books can be your shortcut to smart, automated trading.

Algo trading is the use of computer programs to place trades automatically. These programs follow a set of instructions called algorithms that decide when to buy, sell, or hold based on real-time market data. Simply put, it removes emotions from trading and replaces them with logic, speed, and accuracy.

But here’s what most websites won’t tell you: algo trading is not only for large hedge funds or financial institutions. Today, anyone with basic programming skills and a good understanding of the market can create their own trading bots. Free platforms like QuantConnect or Backtrader have access to historical data, and even beginners can start testing strategies without risking real money at first.

Algo trading can help you:

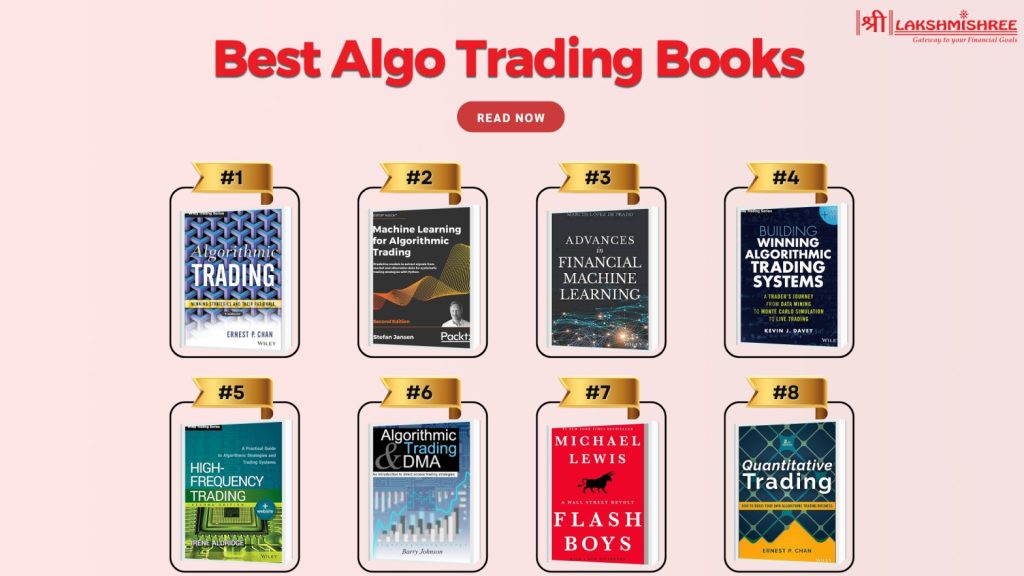

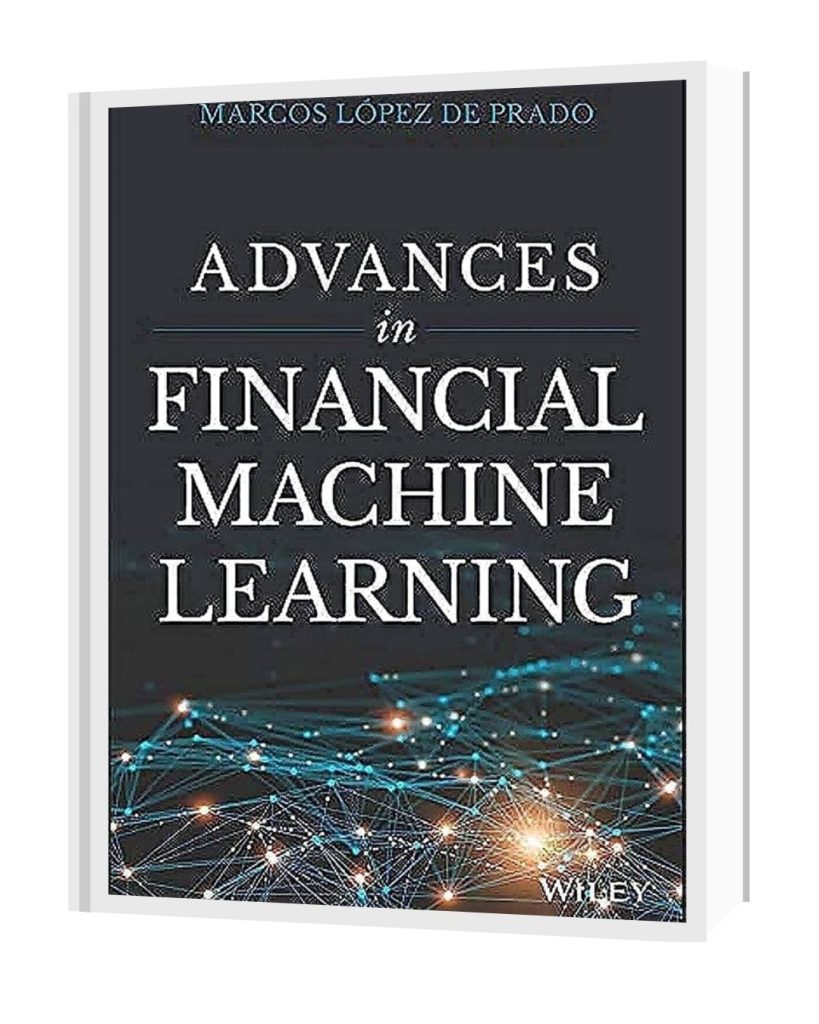

This handpicked list of the best algo trading books will help you understand the key concepts, tools, and techniques used by successful traders and quants.

Expertise Level: Beginner to Intermediate

Overview: This book by Dr. Ernest P. Chan is a go-to resource for anyone starting their journey in algorithmic trading. It focuses on practical strategies that can be implemented using historical market data, without getting lost in heavy theory. Chan covers momentum, mean reversion, and intraday strategies using real-world examples, making this book both accessible and actionable.

Why It’s a Must-Read:

Famous Line: “Strategies that perform well in backtesting often fail in live trading due to overfitting.”

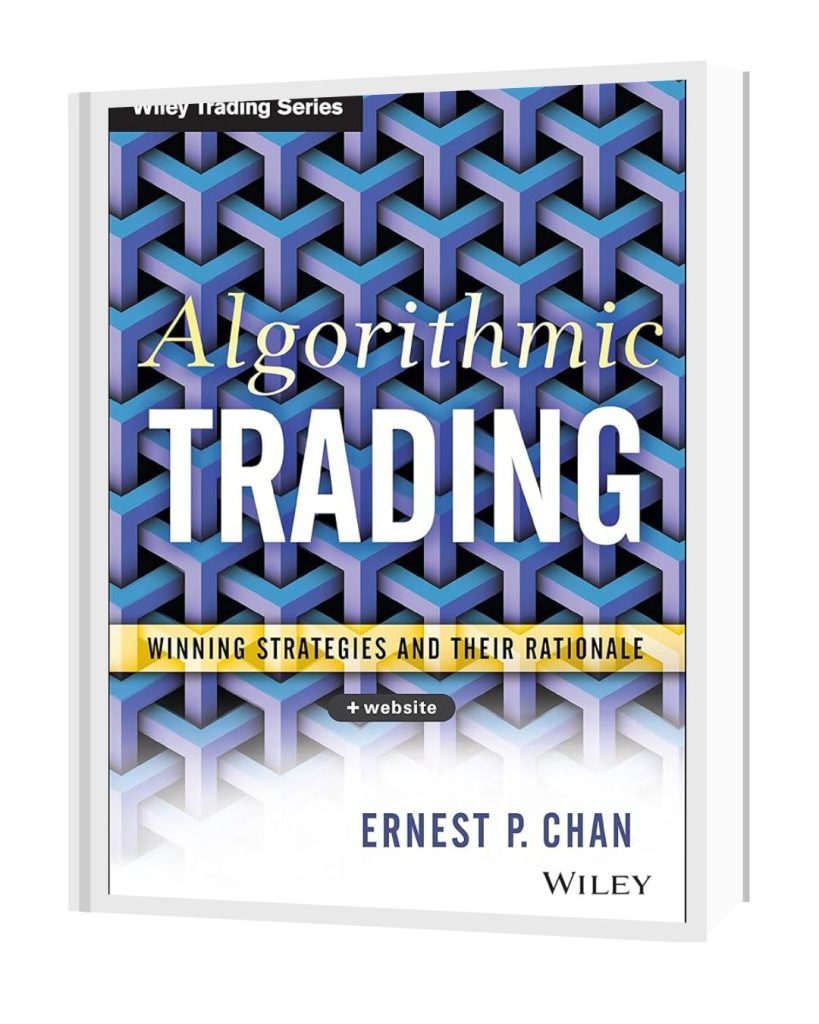

Expertise Level: Intermediate to Advanced

Overview: Stefan Jansen dives into how machine learning can be applied to financial markets. This book goes beyond traditional algo strategies and introduces deep learning, feature engineering, and time series forecasting using Python. It’s one of the most insightful algo trading books for those who want to blend data science with trading strategies.

Why It’s a Must-Read:

Famous Line: “Markets are noisy, but patterns do exist—you just have to learn how to find them.”

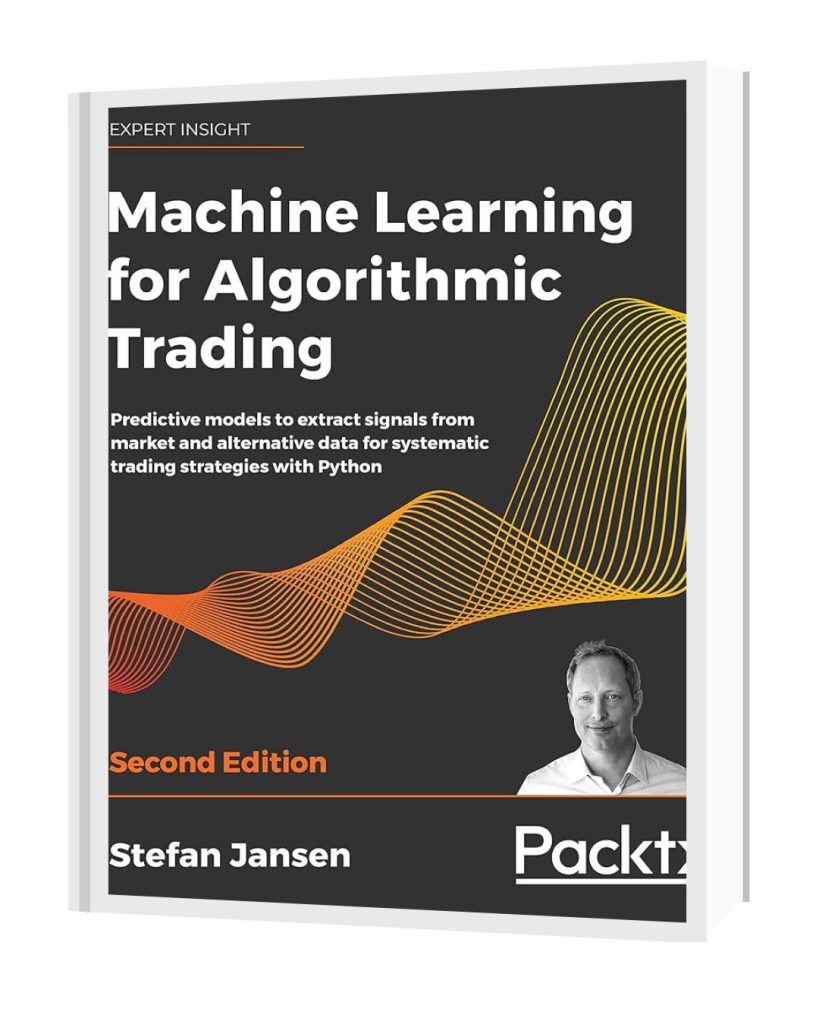

Expertise Level: Advanced

Overview: This is not your average trading book. De Prado brings years of quantitative finance experience into this well-structured guide. Aimed at professional quants and advanced learners, it focuses on topics like backtest overfitting, meta-labelling, and feature importance in financial modelling.

Why It’s a Must-Read:

Famous Line: “Most backtests are bunk. It is easy to fit a model to past data. The real challenge is out-of-sample performance.”

Expertise Level: Beginner to Intermediate

Overview: Kevin Davey, a full-time professional trader and past winner of the World Cup Trading Championship, shares a detailed, behind-the-scenes look at how he builds, tests, and improves trading systems. This book isn’t about just theory—it walks you through the entire lifecycle of a trading idea, from research and backtesting to live execution. It’s perfect for traders who want a step-by-step, real-world approach to algo trading.

Why It’s a Must-Read:

Famous Line: “The only way to prove a trading strategy works is not through hope, but through proper testing and validation.”

Expertise Level: Intermediate to Advanced

Overview: Barry Johnson’s book offers an in-depth look at how algorithmic orders are placed and executed in real-world electronic markets. It focuses heavily on direct market access (DMA), market microstructure, and order placement logic, making it a valuable read for those who want to build sophisticated trading algorithms that work efficiently in live markets. This is a goldmine for anyone eyeing roles in institutional trading or high-frequency environments.

Why It’s a Must-Read:

Famous Line: “Algorithms that ignore market microstructure often pay the price in real-world execution.”

Expertise Level: Advanced

Overview: This is one of the few books that truly unlock the inner workings of high-frequency trading (HFT). Irene Aldridge, an expert in HFT systems and quantitative trading, breaks down the mechanics of designing high-speed, low-latency strategies that operate on a tick-by-tick level. The book blends finance theory with advanced technology, giving readers a complete understanding of what it takes to succeed in this ultra-competitive space.

Why It’s a Must-Read:

Famous Line: “In the world of high-frequency trading, your strategy is only as good as your milliseconds.”

Expertise Level: Beginner to Intermediate

Overview: Unlike technical manuals, Flash Boys tells a gripping real-world story of how Wall Street was transformed by high-frequency trading. Through investigative journalism, Michael Lewis reveals how a group of traders and techies uncovered the hidden mechanics of electronic markets—and how algorithms were being used to gain unfair advantages. It’s more narrative than instructional, but it gives readers a strong understanding of the real impact of algorithmic trading on financial markets.

Why It’s a Must-Read:

Famous Line: “The market wasn’t broken. It was fixed.”

Expertise Level: Beginner to Intermediate

Overview: In this book, Dr. Ernie Chan explains how individual traders can design and run their own algorithmic trading business—without needing a massive budget or a team of PhDs. He covers every essential step: strategy development, risk management, infrastructure setup, and even how to outsource parts of your workflow. If you're someone looking to take algo trading from a hobby to a profitable venture, this book is a complete playbook.

Why It’s a Must-Read:

Famous Line: “Don’t try to predict the future—react to what the data tells you.”

If you're new to trading or just starting to explore the world of automation, picking the right book can save you a lot of time and confusion. These beginner-friendly algo trading books are perfect for building a solid foundation without overwhelming you with complex math or coding.

Here are 4 great picks to get started:

These algo trading books focus on Python and other tools used to automate and execute trading ideas efficiently.

Understanding theory is one thing, but seeing how algorithms behave in real financial markets is what makes the knowledge stick. These are the best books on algo trading that offer real-world examples, market structure insights, and stories from professionals who’ve used algorithms to gain an edge.

Not every algo trading book is right for everyone. Your current skill level, goals, and how comfortable you are with coding should decide what you pick up first. Here’s how to make the right choice without wasting time or money:

Mastering algorithmic trading doesn’t happen overnight, but picking the right book is the smartest way to begin. Whether you’re learning to code, build strategies, or simply understand how algo systems work in real markets, quality learning materials can save you from years of trial and error. We’ve shared the most useful and trusted algo trading books to guide your path. Now, it's your move: choose one, start reading, and take the first real step toward smarter, data-driven trading.

The best books on algo trading, including Quantitative Trading by Ernie Chan and Algorithmic Trading 101 by Zura Kakushadze, are excellent choices. They break down strategy logic, risk management, and how algorithmic systems function, without overwhelming you with too much code or math.

Yes, there are several books that focus specifically on coding for algorithmic trading. Titles like Python for Finance by Yves Hilpisch and Algorithmic Trading with Python by Chris Conlan are great if you're looking to build systems using real Python code. These algo trading books guide you through the process of writing, testing, and executing trading strategies in live environments.

Books provide a strong foundation, but practical experience is key. You can learn a lot from the best algorithmic trading books, especially those that include case studies, Python scripts, or strategy examples. However, combining them with hands-on practice using platforms like QuantConnect, Backtrader, or Lakshmishree (for Indian markets) will give you real confidence.

For strategy-focused learning, Algorithmic Trading: Winning Strategies and Their Rationale by Ernie Chan remains one of the best. It continues to be relevant in 2025 because it teaches tested strategies like mean reversion and momentum trading using clear examples and data-driven techniques. It’s one of the most trusted books on algo trading among retail and professional traders alike.

Python has become the most popular language in this field, so yes, many of the best algo trading books now use Python for examples and practical implementation. While you don’t need to be an expert coder, basic knowledge of Python helps you understand and apply the concepts more effectively. It’s recommended to learn the basics before diving into coding-heavy books

Disclaimer: This article is intended for educational purposes only. Please note that the data related to the mentioned companies may change over time. The securities referenced are provided as examples and should not be considered as recommendations.