In the stock market, prices often follow certain patterns, and learning to spot them can help you make smart trading choices. One of these patterns is called the Descending Triangle Pattern. Imagine a stock that keeps dropping to a certain price but struggles to go much higher over time. This pattern may indicate that sellers are gaining strength, and the price could soon break lower.

In this blog, we’ll explain what the descending tri-pattern means, how to spot it on a stock chart, and ways you can use it to improve your trading game.

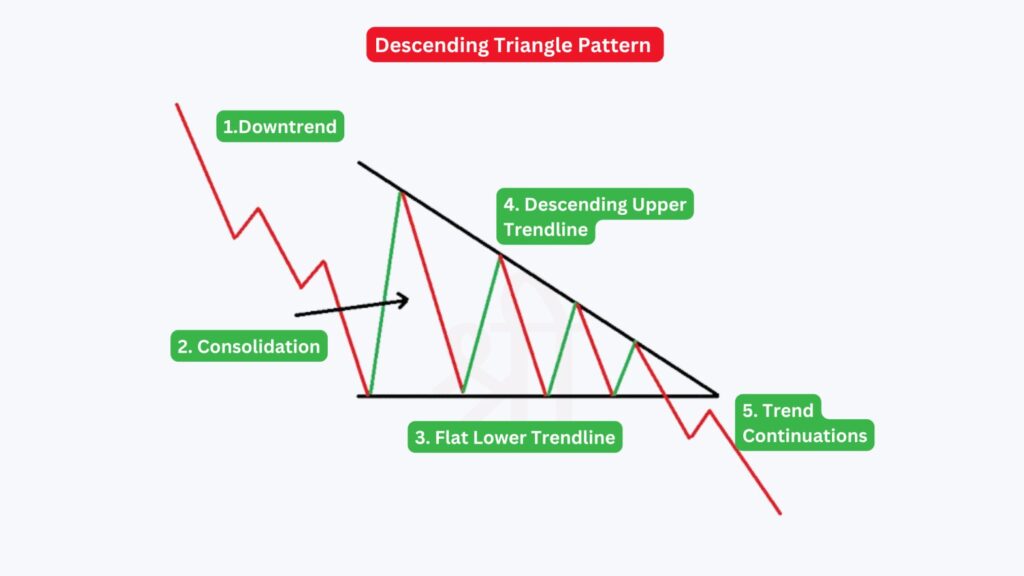

A Descending Triangle is a bearish chart pattern traders often look for when analysing stock prices. This pattern is formed by two key trendlines: a horizontal line connecting a series of lows (the support level) and a downward-sloping line connecting a series of lower highs (known as the resistance level). The shape created by these lines looks like a triangle pointing downward.

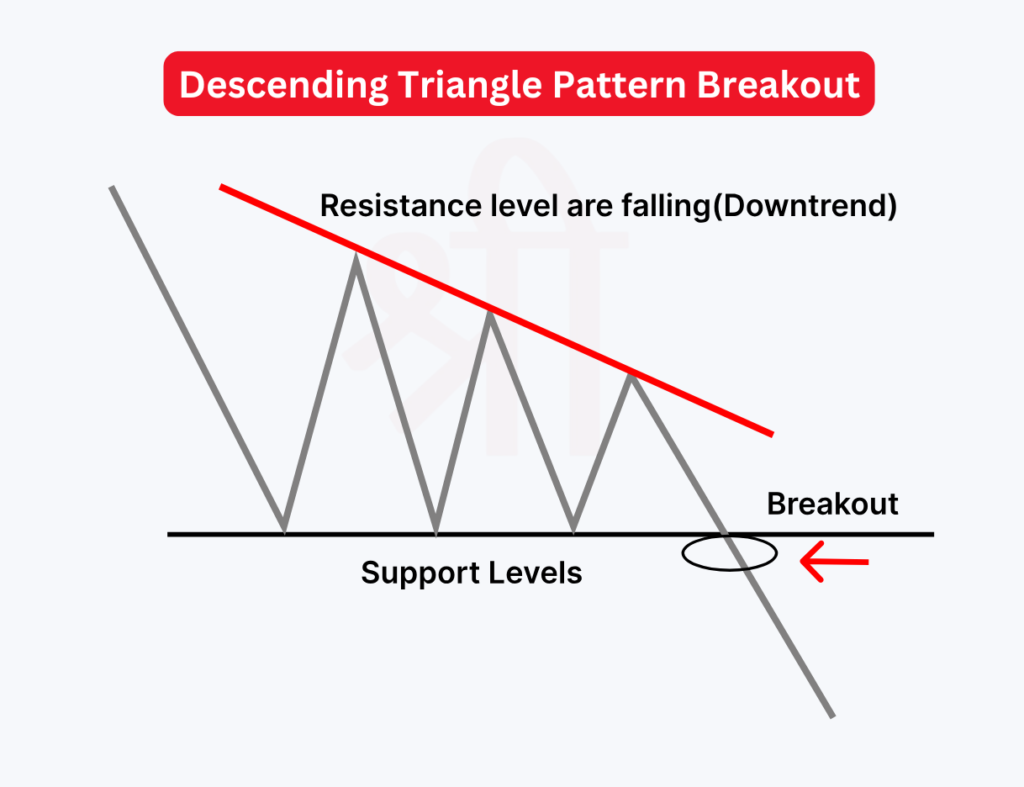

This chart pattern indicates that the selling pressure is increasing, whereby buyers cannot push the price upwards. When the price nears the point where both lines meet, it ultimately results in a breakout. In case of breaking the price below the support level, then the indication is a possible downtrend, which further suggests the stock may have more falls. Traders are well aware of this chart pattern so that they may make an informed decision during a bear market environment.

The Descending Triangle Pattern is a key indicator for traders, providing insight into market trends and potential price movements. This pattern typically suggests buyers are losing strength as the stock price keeps forming lower highs while finding support at a certain level.

Here are the key messages conveyed by the descending triangle:

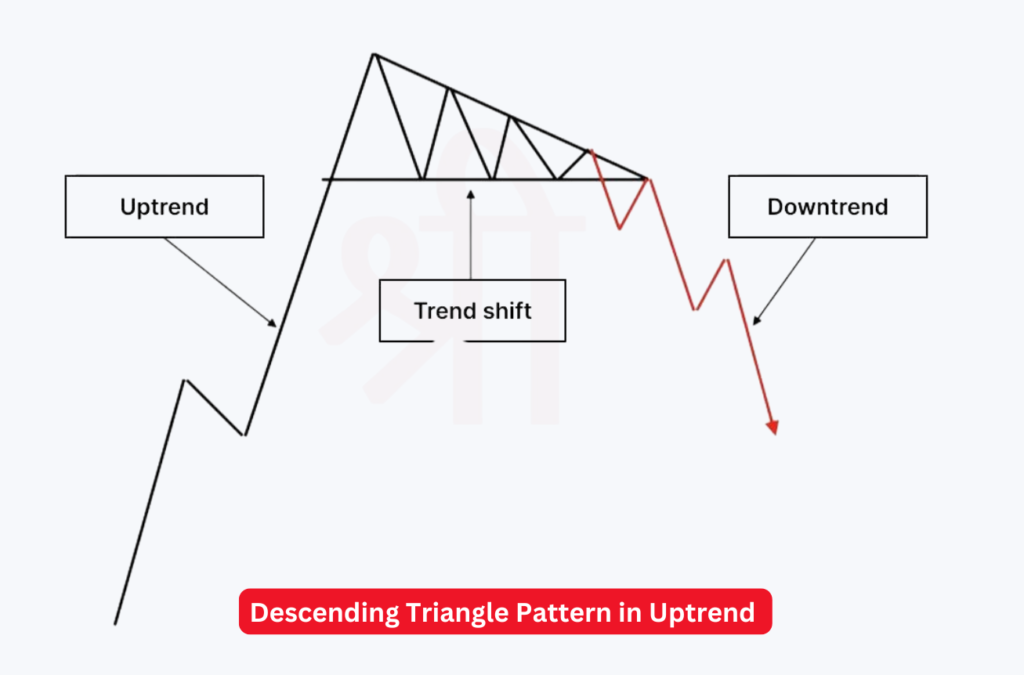

While this pattern is generally associated with downtrends, it can also appear during uptrends, though with different implications. Here’s a practical breakdown of how it functions in each scenario:

Traders widely use the Descending Triangle Breakout Strategy to capitalize on a potential downward price movement once a breakout occurs. This strategy is especially effective when volume and price action align to indicate a strong bearish signal.

Here’s a step-by-step approach to applying this breakout strategy:

Once the breakout is confirmed, the Measuring Technique can project a target price for the trade. Here’s how it’s done:

Example Calculation

Imagine a stock with a horizontal support level at ₹100 and the highest point at ₹120:

This gives the trader a projected price of ₹80, helping set clear profit targets based on the pattern’s movement.

Combining additional technical tools with the descending triangle pattern can strengthen a trader’s confidence in anticipating breakouts. Below are two popular strategies that use Heikin Ashi and Moving Averages alongside descending triangles.

Using Heikin Ashi Charts with descending triangles can make trend identification clearer. Heikin Ashi candlesticks are unique as they smooth price action, making trends easier to spot and reducing “noise.”

This combination is especially helpful for short-term trading, as Heikin Ashi charts offer a clearer trend without the usual price fluctuations.

Using Moving Averages with descending triangles pattern can enhance breakout predictions by adding an extra layer of confirmation:

Both descending and ascending triangle patterns are widely recognized chart formations traders use to identify potential trend reversals or continuations. While they share similarities in structure, they convey opposite market sentiments. Here’s a comparison to help understand the differences and trading implications of each:

| Feature | Descending Triangle | Ascending Triangle |

|---|---|---|

| Trend Direction | Typically appears in a downtrend (bearish) | Usually forms in an uptrend (bullish) |

| Top Line (Resistance/Trendline) | Descending, connecting lower highs | Horizontal, connecting equal highs |

| Bottom Line (Support/Trendline) | Horizontal, representing consistent support | Ascending, representing increasing support |

| Market Sentiment | Indicates selling pressure; sellers control the market | Shows buying pressure; buyers dominate the market |

| Expected Breakout | Breakout below the horizontal support signals a downtrend | Breakout above horizontal resistance suggests an uptrend |

| Trading Strategy | Short/sell position upon confirmed breakout downward | Long/buy position upon confirmed breakout upward |

These triangle patterns help traders align their strategies with market sentiment, allowing them to anticipate potential breakout directions.

The best timeframe to trade a descending triangle pattern depends on your trading goals and strategy. For day traders and short-term trades, hourly or 15-minute charts may work well as they can capture quick movements around breakouts. Swing traders or those holding positions longer might prefer daily or weekly charts, which can help identify more sustained price movements and avoid smaller, less reliable fluctuations. Confirming breakouts with volume and monitoring the pattern closely to avoid false signals is essential, whichever time frame you choose.

Pros:

Cons:

The descending triangle pattern is a valuable tool for predicting potential bearish breakouts and helping traders spot continuation patterns. However, it’s essential to confirm breakouts with volume analysis and avoid making hasty decisions based on initial signals. By carefully combining descending triangles with other technical indicators, traders can make more informed moves and set realistic targets.

A descending triangle is a bearish chart pattern that forms when the price creates lower highs while maintaining a horizontal support level. It indicates that selling pressure is gradually increasing, and traders watch for a potential breakout below the support line to signal a downtrend continuation.

The descending triangle pattern is generally considered bearish. It suggests that sellers are gaining control, and a breakout below the support level signals the potential for further downward movement in the market.

A descending triangle is a bearish pattern where the upper trendline slopes downward, and the lower trendline is horizontal. In contrast, an ascending triangle is typically bullish, with the lower trendline sloping upwards, indicating increasing buying pressure.

While the descending triangle is typically a bearish pattern, it can sometimes lead to bullish outcomes in rare cases. If the price breaks above the descending trendline rather than below the support, it may indicate a bullish reversal, though this is less common.

The descending triangle reflects growing selling pressure, as lower highs indicate that sellers are willing to accept decreasing prices. The support level shows buyers’ attempts to hold up the price, but a breakout below this level often signals that sellers have gained control.

Disclaimer: This article is intended for educational purposes only. Please note that the data related to the mentioned companies may change over time. The referenced securities are provided as examples and should not be considered recommendations.