TCS Buyback 2023:

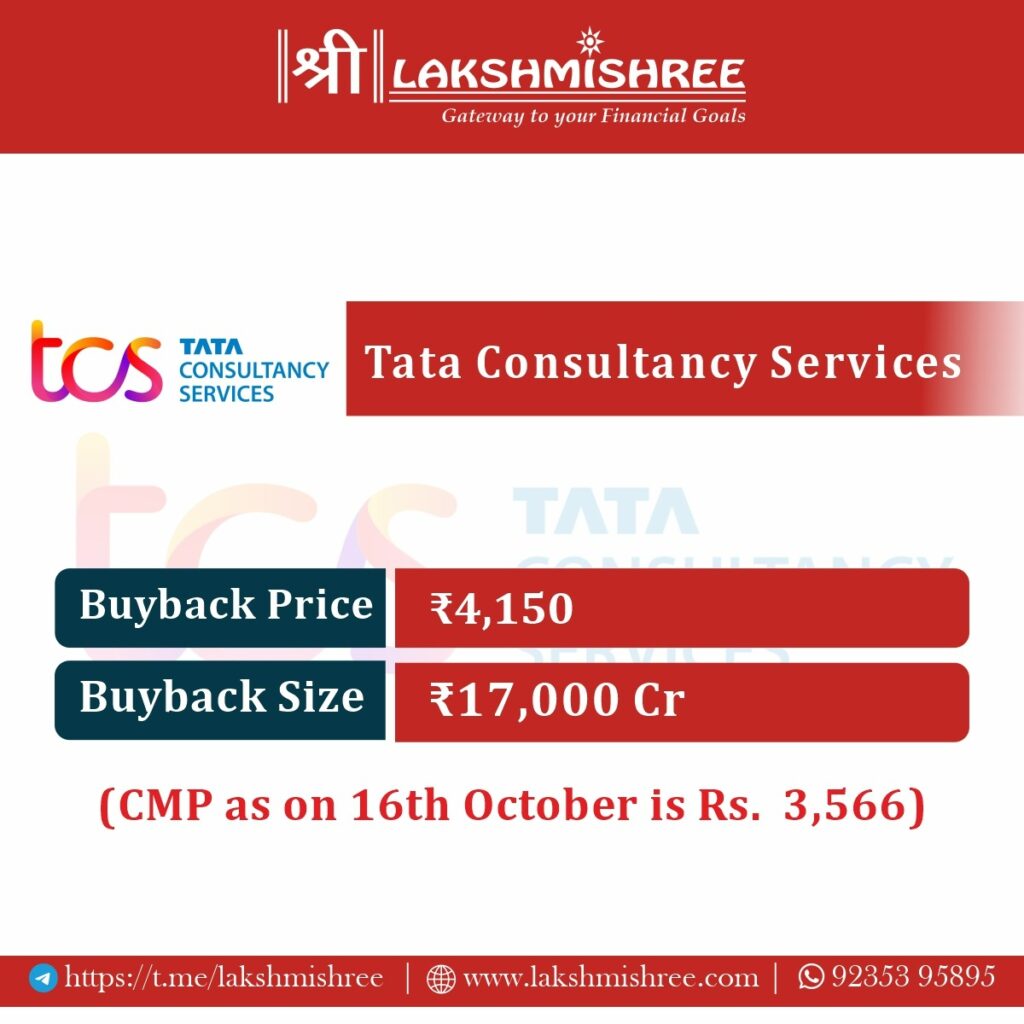

Tata Consultancy Services (TCS), India's leading IT giant, has announced a massive share buyback program of up to Rs 17,000 crore at a price of Rs 4,150 per share through a tender offer. This colossal opportunity comes on the heels of a board meeting that reviewed the company's stellar second-quarter results, likely influencing the decision. This blog post will delve into what this buyback means, its benefits, and how you can participate.

Sharе buyback, also known as stock buyback, occurs when a company dеcidеs to purchasе its sharеs from thе opеn markеt. Through share buyback, a company buys back some of its shares in public—this rеducеs thе total numbеr of sharеs availablе for trading. Companiеs often do this for various reasons, such as increasing the value of their stock or using еxcеss cash еffеctivеly. By rеpurchasing sharеs, a company can incrеasе its еarnings pеr sharе (EPS) and potеntially incrеasе thе stock markеt valuе, bеnеfiting еxisting sharеholdеrs.

Here are the essential details you need to know:

| Buyback Type: | Tender Offer |

| Buyback Offer Amount: | ₹ 17,000 Cr |

| Date of Board Meeting approving the proposal: | Oct 11, 2023 |

| Date of Public Announcement: | Oct 11, 2023 |

| Buyback Offer Size: | 1.12% |

| Buyback Number of Shares: | 4,09,63,855 |

| Buyback Price: | ₹ 4,150 Per Equity Share |

If you're a TCS shareholder or planning to become one, this buyback is a golden opportunity. You can sell your shares at a premium price of Rs 4,150, making a neat profit compared to the current market price.

Ready to make a profit? Buy TCS shares now through Lakshmishree Investment.

Eligibility: To be eligible for the buyback, you should own shares of Tata Consultancy Services Limited either in Demat or physical form as of the record date, which is yet to be updated.

Tender Shares: Once you have the shares in your Demat account, you can participate in the buyback process. The buyback window will open on a date that will be announced soon. You can tender your shares through your broker on the NSE or BSE.

Payment and Return: On another date to be announced, the payment for the accepted shares will be processed. Any shares not accepted in the buyback will be returned to your Demat account.

The TCS buyback is an excellent opportunity for both existing shareholders and new investors. Whether you're looking to make a quick profit or planning a long-term investment, now is the time to act.

The record date will be announced soon. Stay tuned!

Absolutely, it's a great time to enter the market and benefit from the buyback.

It's simple! Just click here to open an account and follow the steps.